This version of the form is not currently in use and is provided for reference only. Download this version of

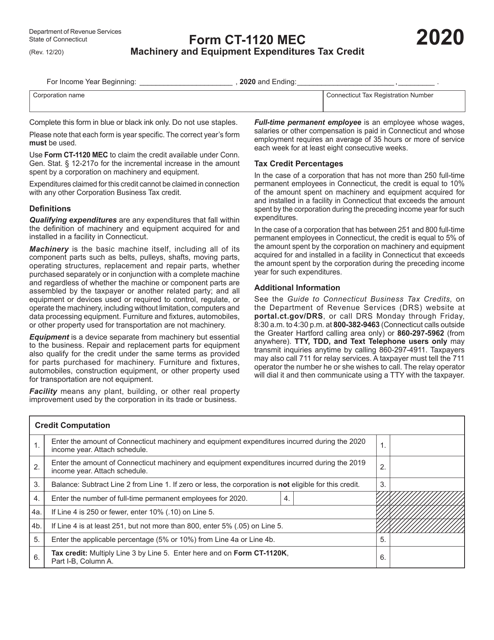

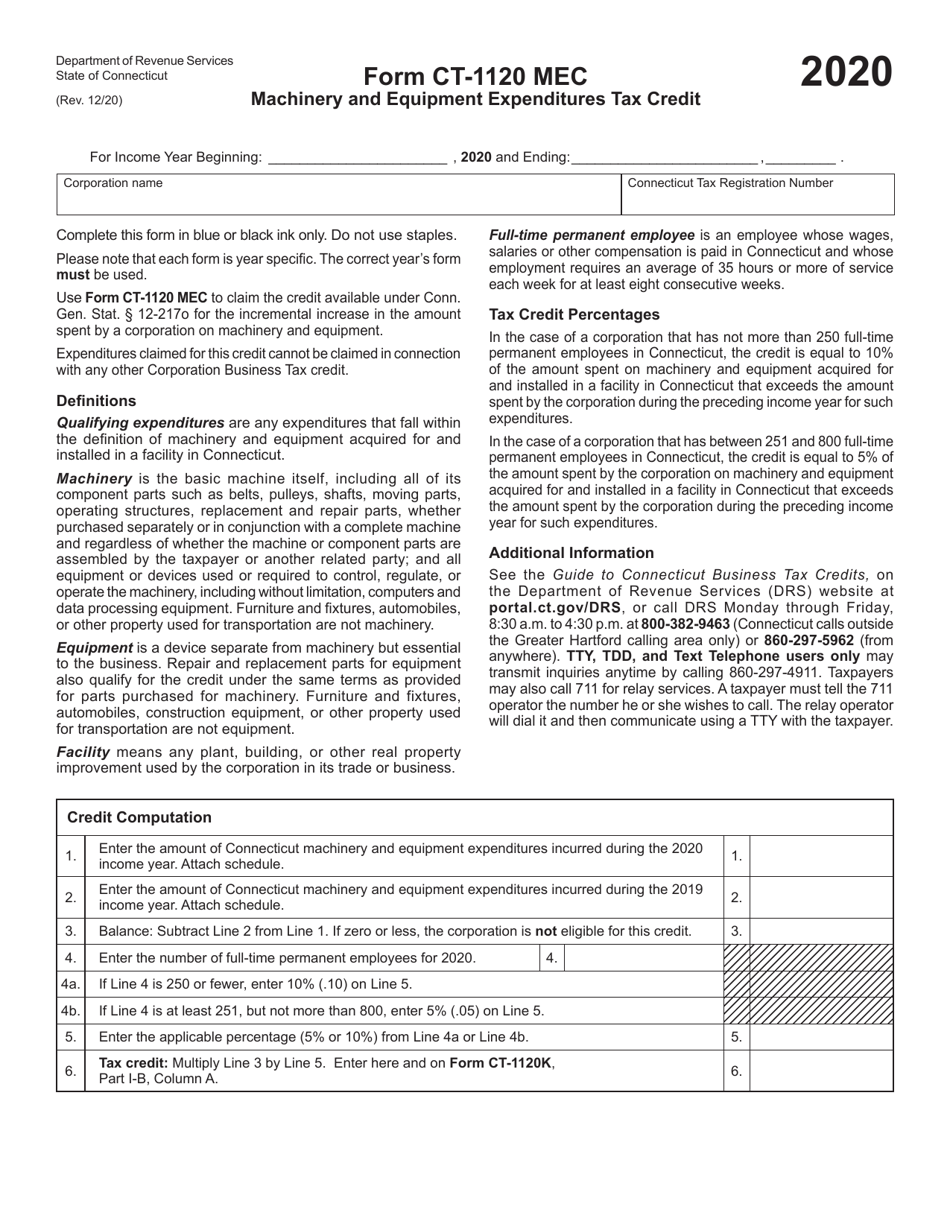

Form CT-1120 MEC

for the current year.

Form CT-1120 MEC Machinery and Equipment Expenditures Tax Credit - Connecticut

What Is Form CT-1120 MEC?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120 MEC?

A: Form CT-1120 MEC is a tax form used in Connecticut to claim the Machinery and Equipment Expenditures Tax Credit.

Q: What is the Machinery and Equipment Expenditures Tax Credit?

A: The Machinery and Equipment Expenditures Tax Credit is a tax credit in Connecticut that allows businesses to deduct a portion of the cost of qualifying machinery and equipment purchases from their state corporate income tax.

Q: Who is eligible to claim the tax credit?

A: Corporations that purchase qualifying machinery and equipment for use in Connecticut are eligible to claim the tax credit.

Q: What expenses qualify for the tax credit?

A: Expenses for the purchase of qualifying machinery and equipment for use in Connecticut qualify for the tax credit.

Q: How much is the tax credit?

A: The tax credit is equal to 10% of the eligible expenditures.

Q: Is there a limit on the amount of the tax credit?

A: Yes, the maximum tax credit that can be claimed is $1 million per taxable year.

Q: How do I claim the tax credit?

A: To claim the tax credit, businesses must complete and file Form CT-1120 MEC with their Connecticut corporate income tax return.

Q: Is there a deadline to claim the tax credit?

A: Yes, the tax credit must be claimed on or before the due date of the Connecticut corporate income tax return for the taxable year in which the eligible expenditures were made.

Q: Are there any other requirements to claim the tax credit?

A: Yes, businesses must meet certain job creation and capital investment requirements to be eligible for the tax credit.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120 MEC by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.