This version of the form is not currently in use and is provided for reference only. Download this version of

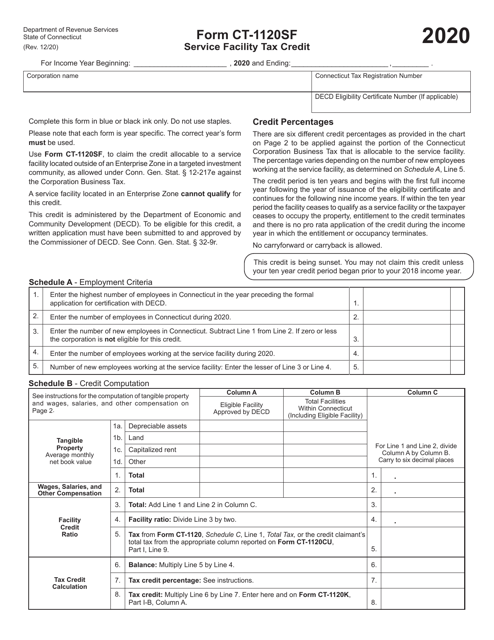

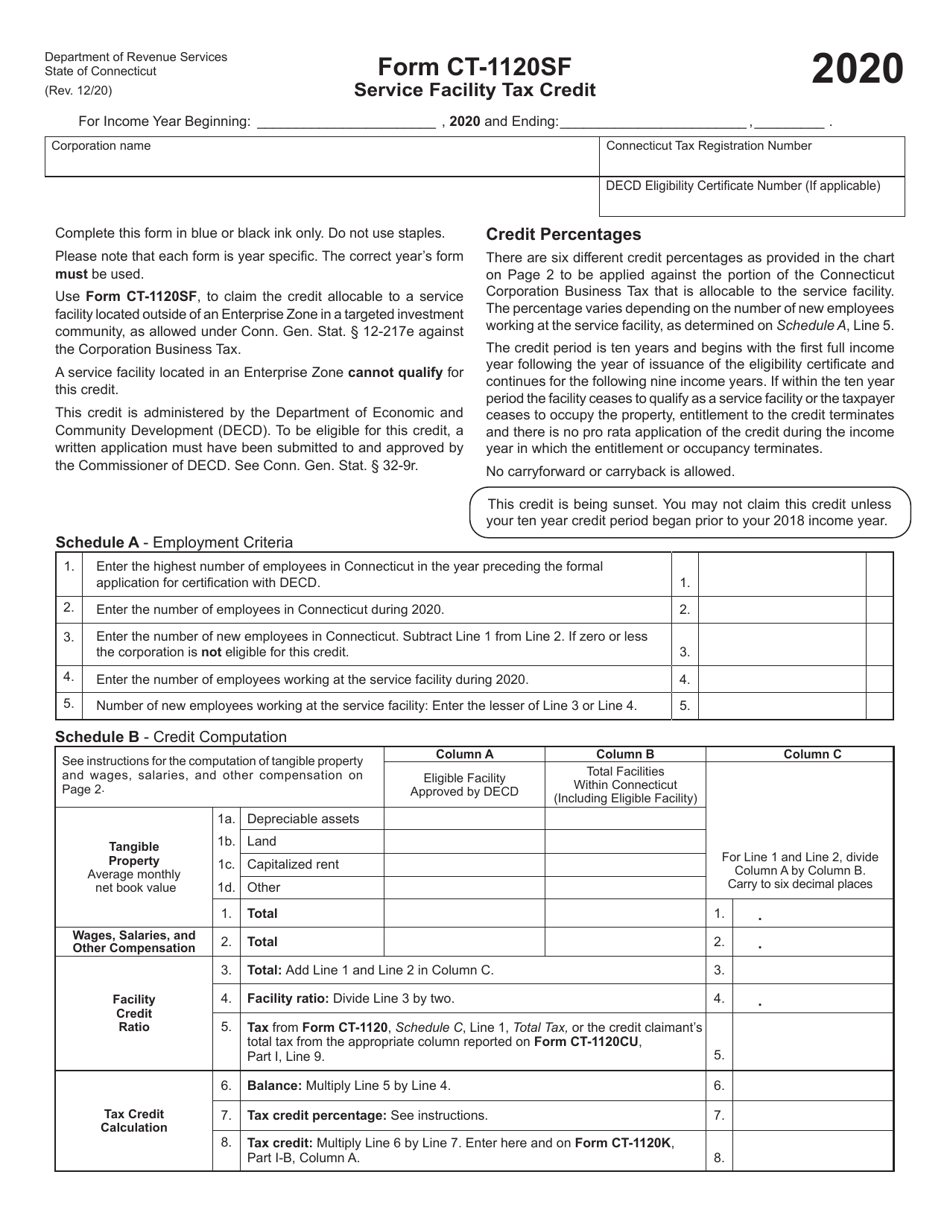

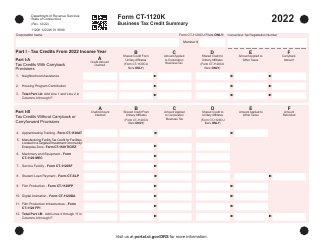

Form CT-1120SF

for the current year.

Form CT-1120SF Service Facility Tax Credit - Connecticut

What Is Form CT-1120SF?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120SF?

A: Form CT-1120SF is a tax form used by Connecticut businesses to claim the Service Facility Tax Credit.

Q: Who can use Form CT-1120SF?

A: Connecticut businesses that meet the eligibility criteria can use Form CT-1120SF.

Q: What is the Service Facility Tax Credit?

A: The Service Facility Tax Credit is a tax credit available to businesses in Connecticut that provide certain services.

Q: What services are eligible for the Service Facility Tax Credit?

A: The specific services eligible for the Service Facility Tax Credit are defined by Connecticut law. It is recommended to refer to the official form instructions or consult with a tax professional for specific details.

Q: How can I claim the Service Facility Tax Credit?

A: To claim the Service Facility Tax Credit, businesses must complete Form CT-1120SF and include it with their Connecticut state tax return.

Q: Are there any deadlines for filing Form CT-1120SF?

A: The deadlines for filing Form CT-1120SF may vary depending on the tax year and other factors. It is recommended to check the official instructions or consult with a tax professional for the specific deadlines.

Q: What other documents or information do I need to complete Form CT-1120SF?

A: In addition to the basic business information, you may need to provide information related to the specific services eligible for the Service Facility Tax Credit. Consult the official form instructions or a tax professional for details.

Q: Can I claim the Service Facility Tax Credit if I am not a Connecticut business?

A: No, the Service Facility Tax Credit is specific to businesses located in Connecticut. Businesses in other states would not be eligible.

Q: What are the potential benefits of claiming the Service Facility Tax Credit?

A: Claiming the Service Facility Tax Credit can reduce a business's tax liability and potentially result in tax savings.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120SF by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.