This version of the form is not currently in use and is provided for reference only. Download this version of

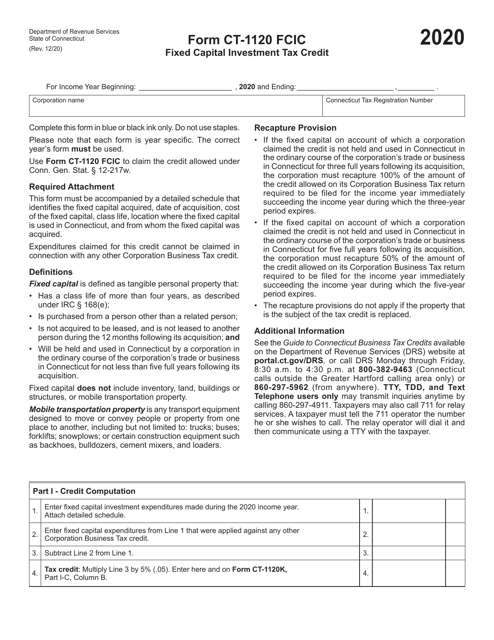

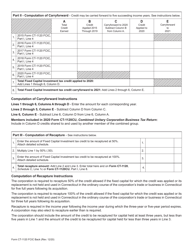

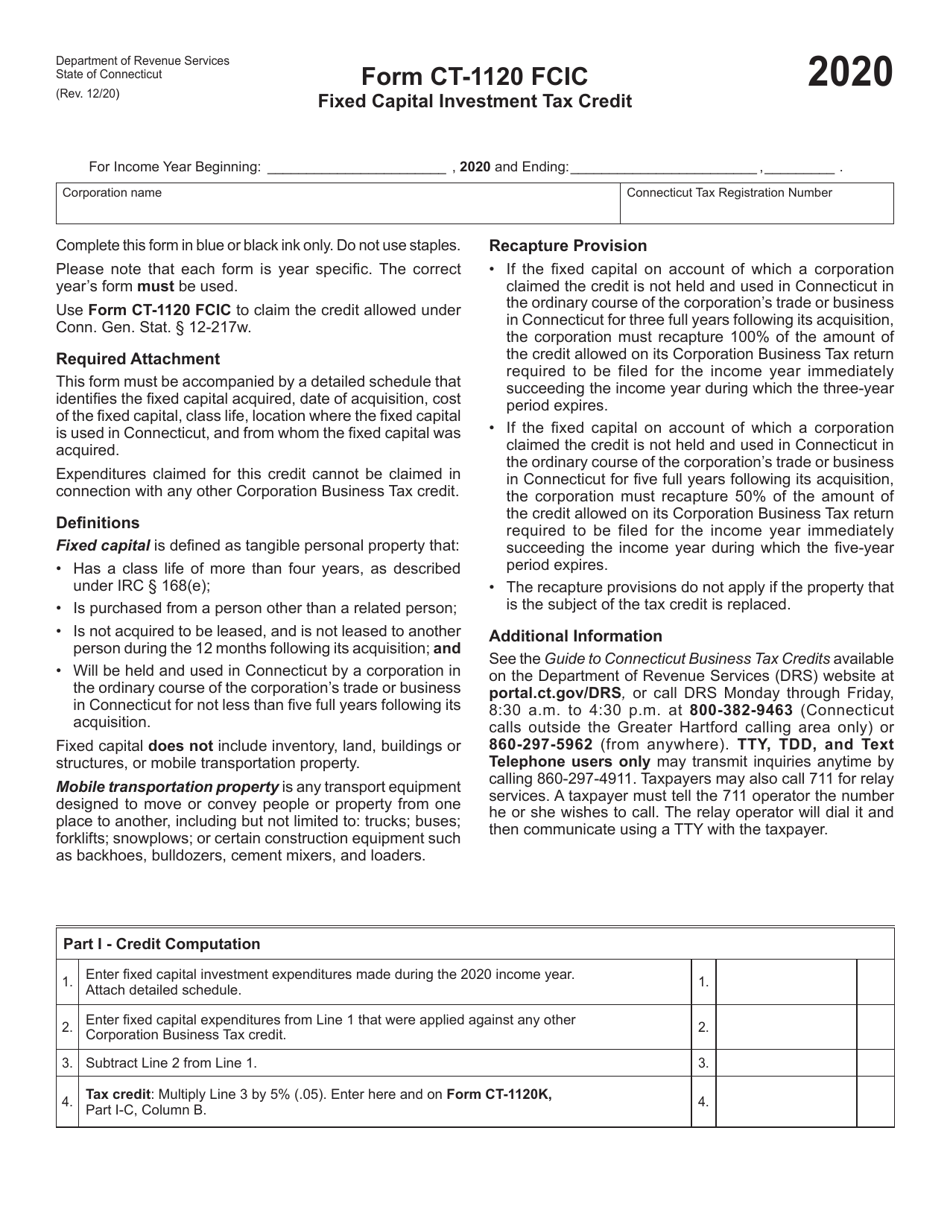

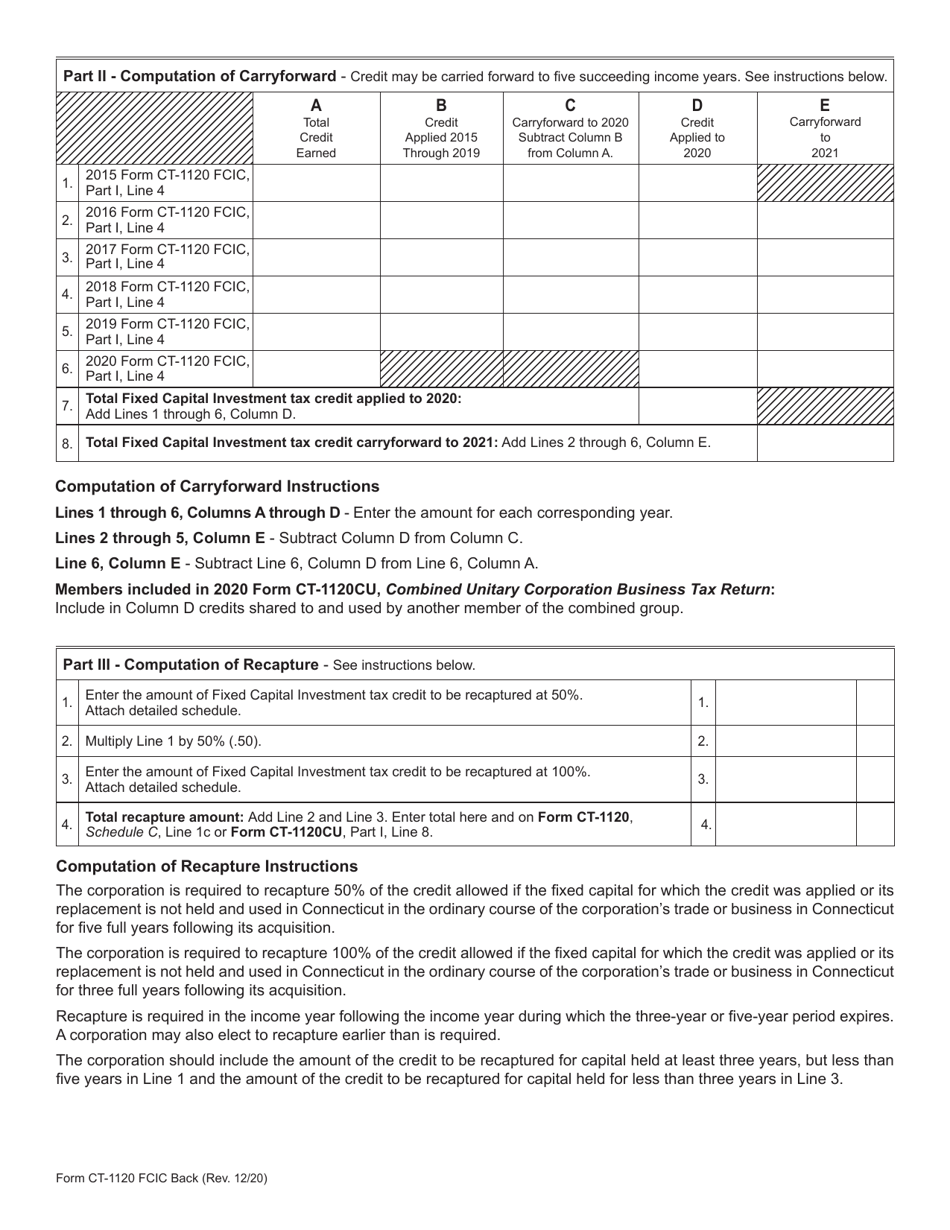

Form CT-1120 FCIC

for the current year.

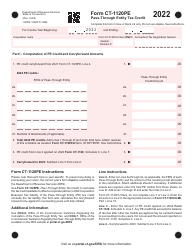

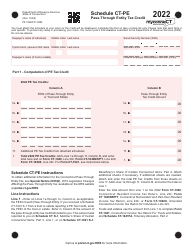

Form CT-1120 FCIC Fixed Capital Investment Tax Credit - Connecticut

What Is Form CT-1120 FCIC?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120 FCIC?

A: Form CT-1120 FCIC is a tax form in Connecticut used to claim the Fixed Capital Investment Tax Credit.

Q: What is the Fixed Capital Investment Tax Credit?

A: The Fixed Capital Investment Tax Credit is a tax credit in Connecticut that allows businesses to receive a credit against their state corporate income tax for eligible capital investments.

Q: Who is eligible for the Fixed Capital Investment Tax Credit?

A: Businesses that make eligible capital investments in Connecticut are generally eligible for the Fixed Capital Investment Tax Credit.

Q: What types of investments qualify for the Fixed Capital Investment Tax Credit?

A: Eligible investments for the Fixed Capital Investment Tax Credit include tangible personal property, buildings, and infrastructure that are used for business purposes.

Q: How much is the Fixed Capital Investment Tax Credit worth?

A: The Fixed Capital Investment Tax Credit is generally equal to 5% of the eligible capital investment made by a business.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120 FCIC by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.