This version of the form is not currently in use and is provided for reference only. Download this version of

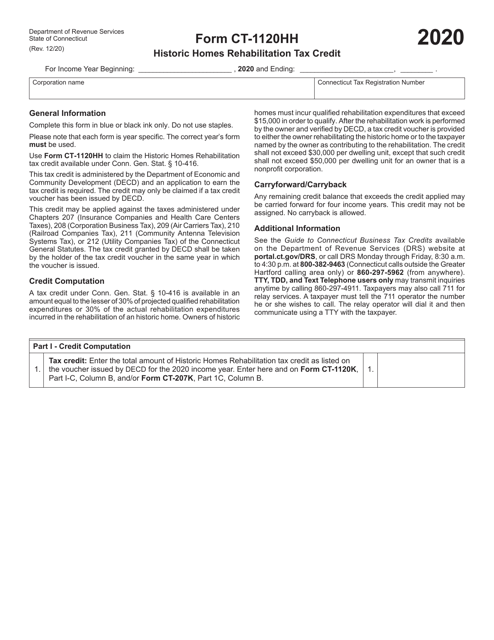

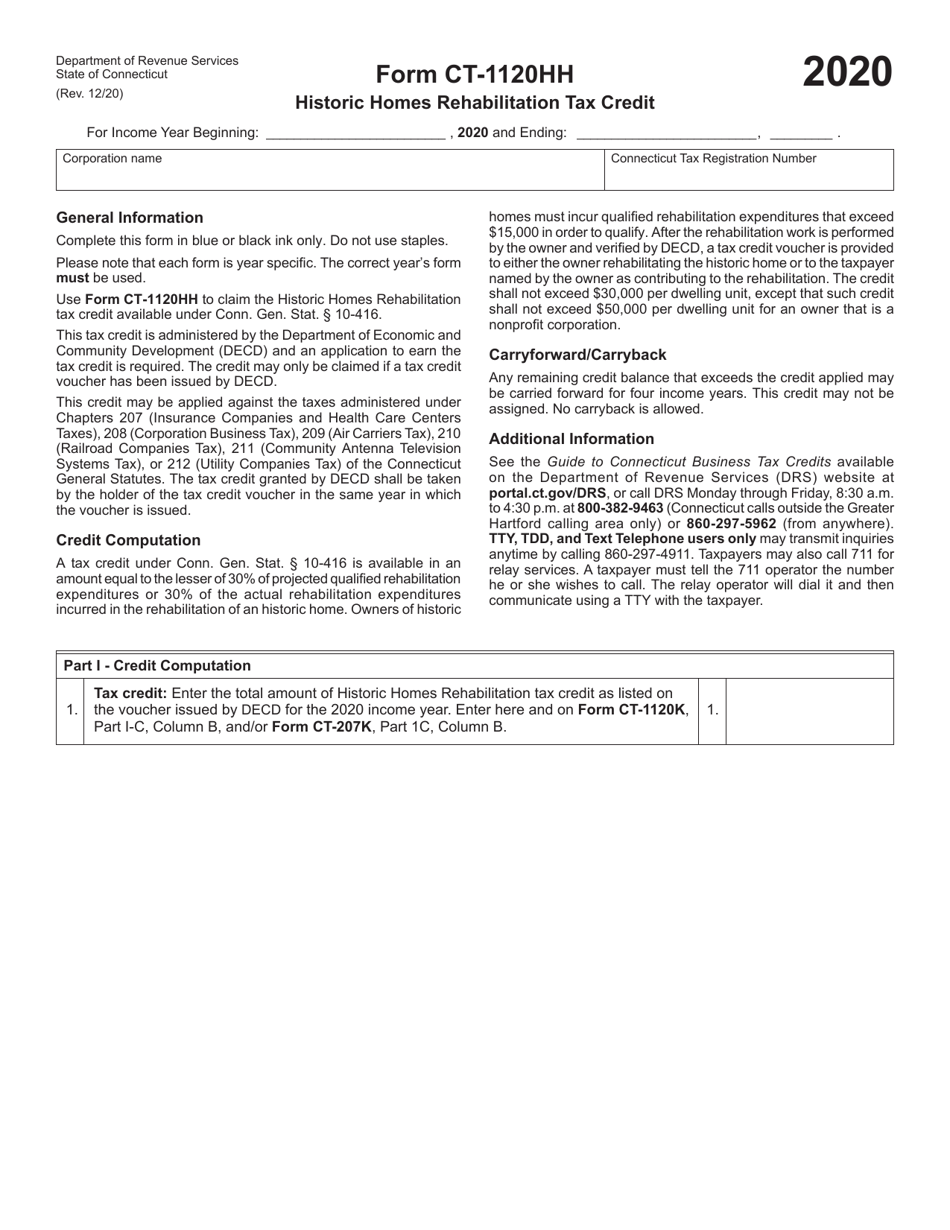

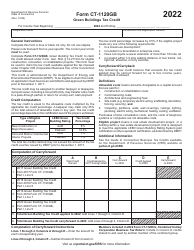

Form CT-1120HH

for the current year.

Form CT-1120HH Historic Homes Rehabilitation Tax Credit - Connecticut

What Is Form CT-1120HH?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120HH?

A: Form CT-1120HH is the Historic Homes Rehabilitation Tax Credit form in Connecticut.

Q: What is the purpose of Form CT-1120HH?

A: The purpose of Form CT-1120HH is to claim a tax credit for the rehabilitation of historic homes.

Q: Who is eligible to file Form CT-1120HH?

A: Owners of historic homes in Connecticut who have completed eligible rehabilitation work may be eligible to file Form CT-1120HH.

Q: What expenses are eligible for the Historic Homes Rehabilitation Tax Credit?

A: Expenses related to the rehabilitation of the historic home, such as labor, materials, and professional fees, may be eligible for the tax credit.

Q: How much is the Historic Homes Rehabilitation Tax Credit in Connecticut?

A: The tax credit is equal to 30% of the eligible expenses, up to a maximum of $30,000 per historic home.

Q: Is there a deadline to file Form CT-1120HH?

A: Yes, the deadline to file Form CT-1120HH is typically the same as the deadline for filing the corresponding state income tax return.

Q: Are there any additional requirements for the Historic Homes Rehabilitation Tax Credit?

A: Yes, there are additional requirements, such as obtaining approval from the Connecticut Historic Preservation Office and complying with the Secretary of the Interior's Standards for Rehabilitation.

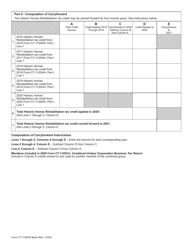

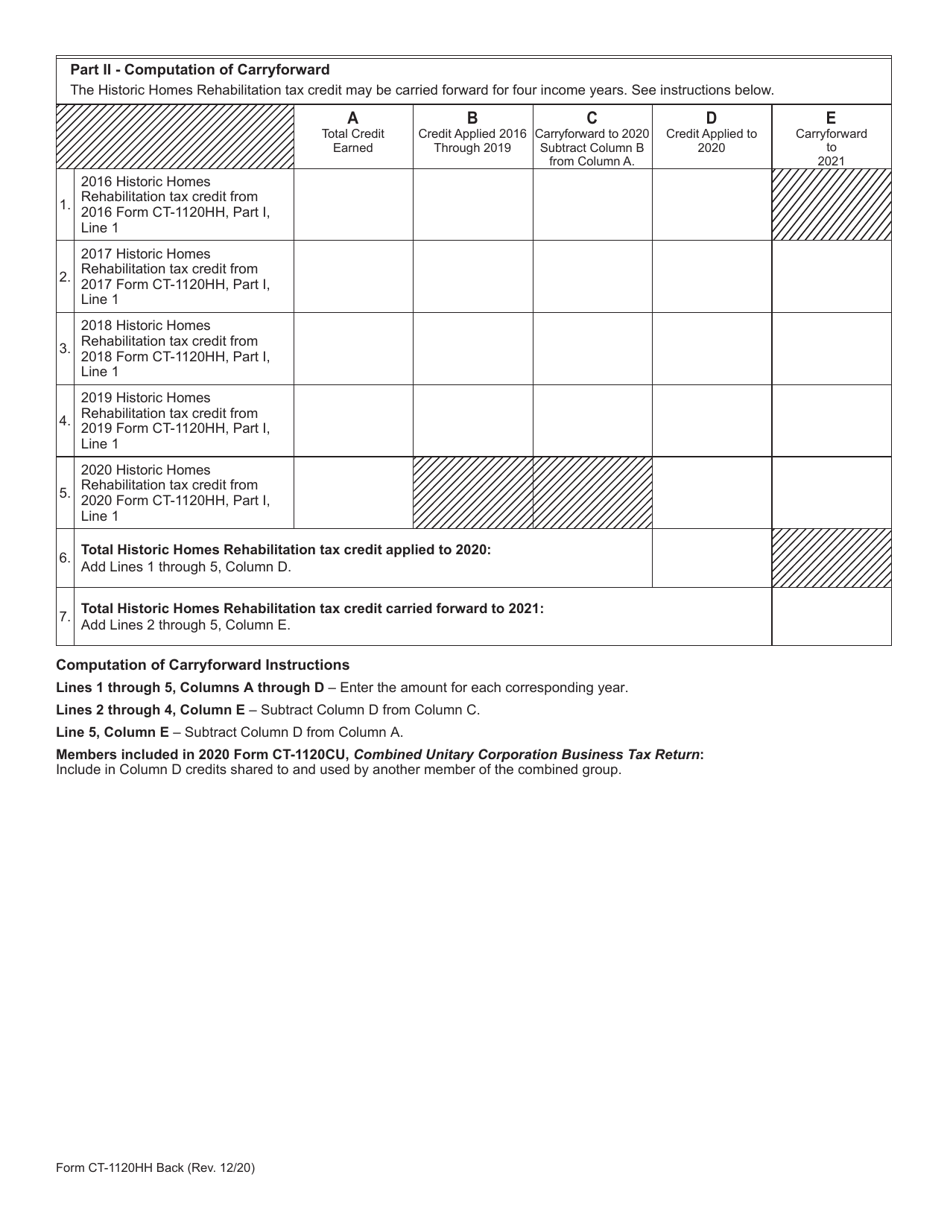

Q: Can the Historic Homes Rehabilitation Tax Credit be carried forward or transferred?

A: No, the tax credit cannot be carried forward or transferred to another individual or tax year.

Q: What documents should be included when filing Form CT-1120HH?

A: When filing Form CT-1120HH, include detailed receipts, invoices, and other documentation that support the eligibility of the expenses claimed for the tax credit.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120HH by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.