This version of the form is not currently in use and is provided for reference only. Download this version of

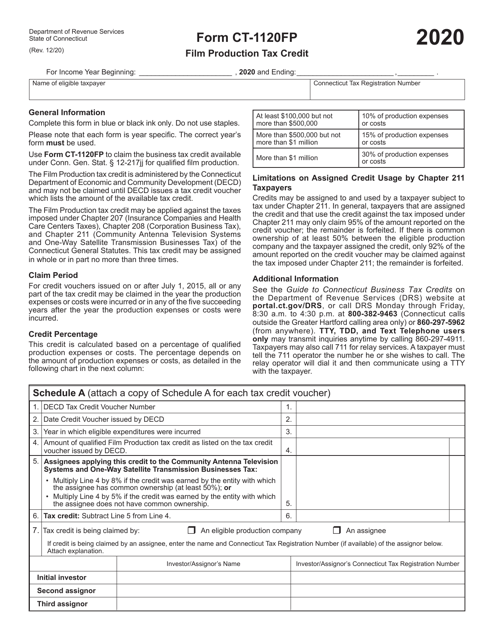

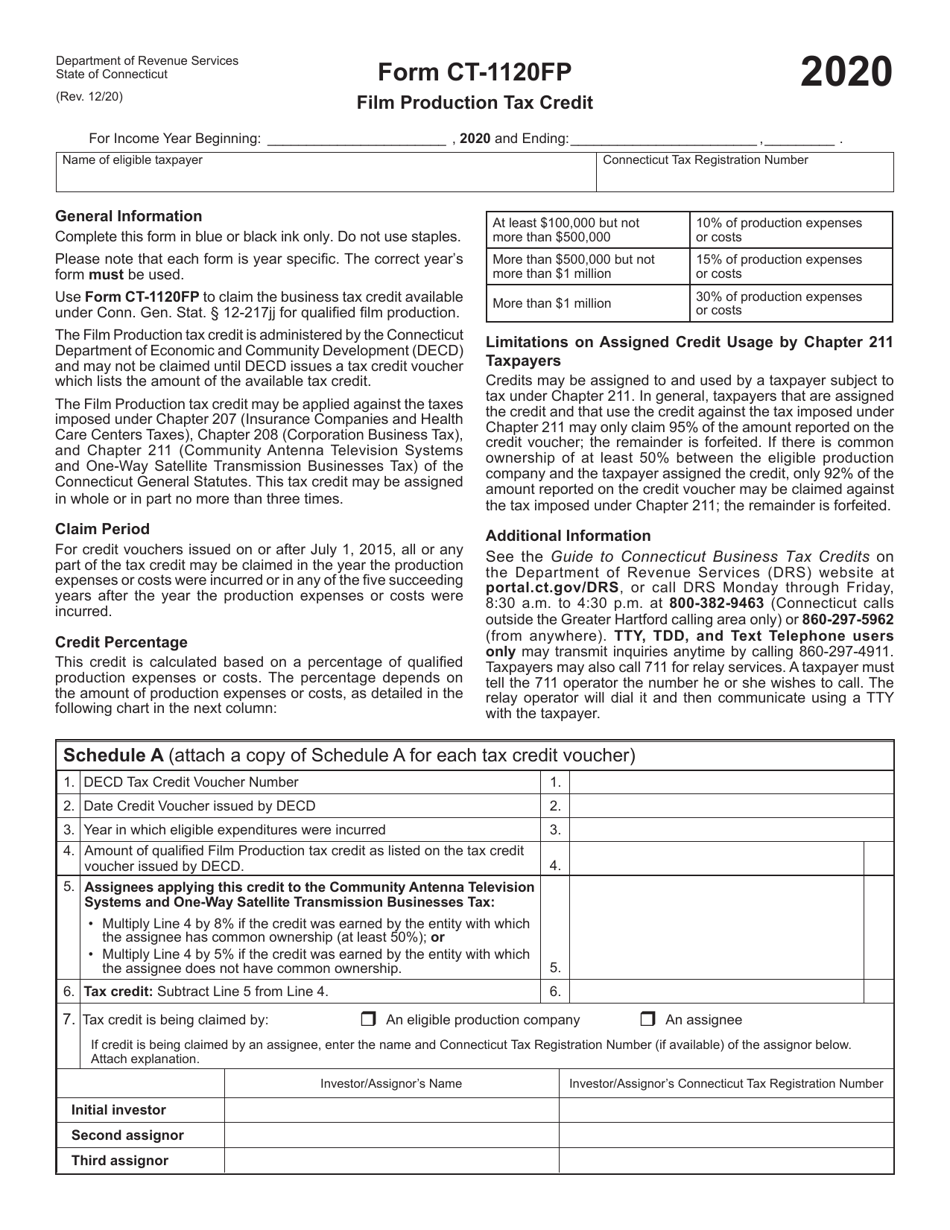

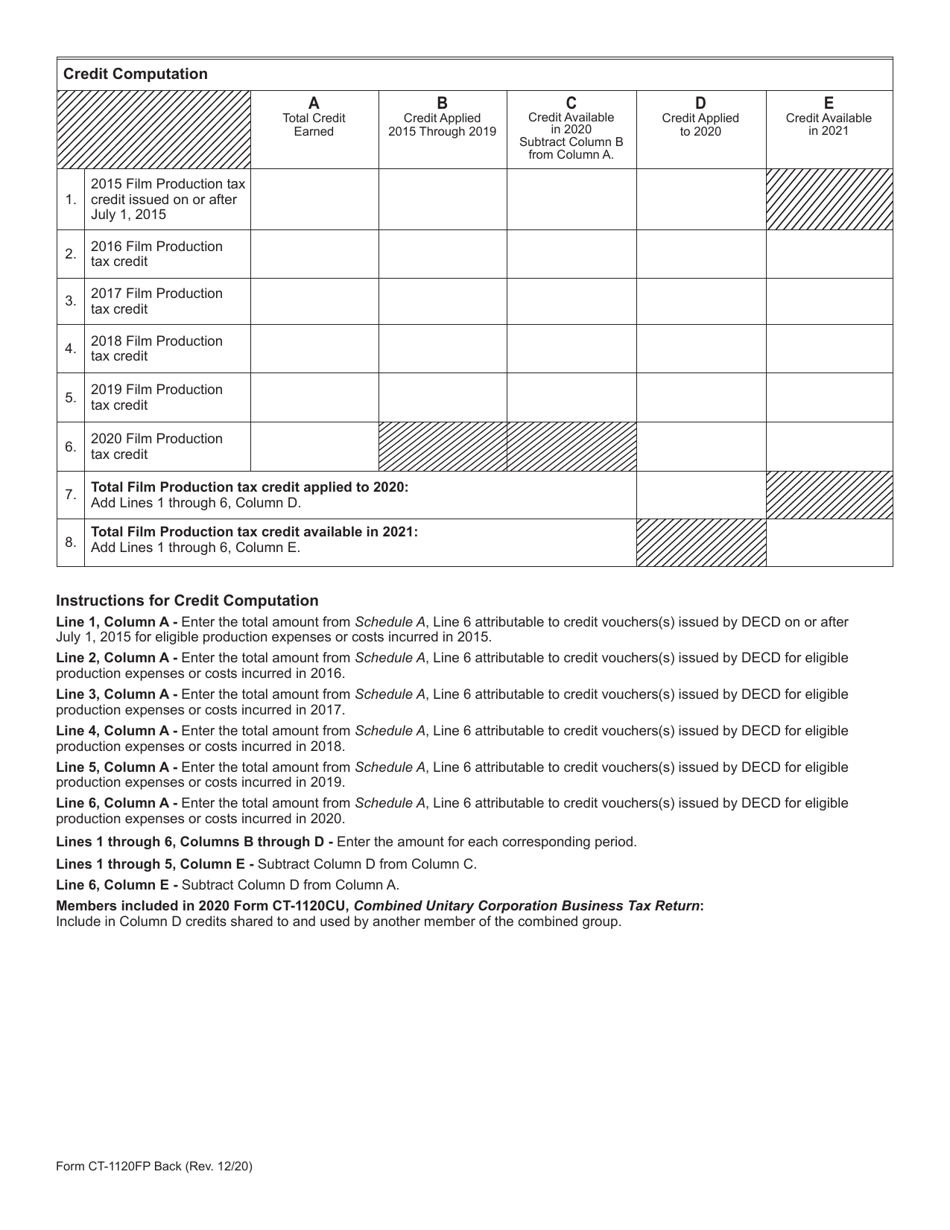

Form CT-1120FP

for the current year.

Form CT-1120FP Film Production Tax Credit - Connecticut

What Is Form CT-1120FP?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120FP?

A: Form CT-1120FP is the tax form used to claim the Film ProductionTax Credit in Connecticut.

Q: What is the Film Production Tax Credit?

A: The Film Production Tax Credit is a credit that encourages film and digital media production companies to choose Connecticut as their filming location.

Q: Who is eligible to claim the Film Production Tax Credit?

A: Film and digital media production companies that meet certain criteria are eligible to claim the credit.

Q: How do I fill out Form CT-1120FP?

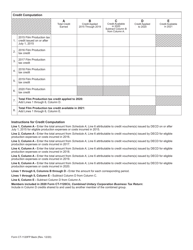

A: You should carefully review the instructions provided with the form and enter the required information, including details about the film production and the expenses incurred.

Q: What expenses can I claim on Form CT-1120FP?

A: You can claim various expenses related to the film production, such as wages, fees, and costs for goods and services used in Connecticut.

Q: When should I file Form CT-1120FP?

A: The form should be filed annually by the due date of the corporation's tax return, including extensions.

Q: Are there any credits or deductions similar to the Film Production Tax Credit in other states?

A: Yes, some other states offer similar incentives to attract film and digital media production companies.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120FP by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.