This version of the form is not currently in use and is provided for reference only. Download this version of

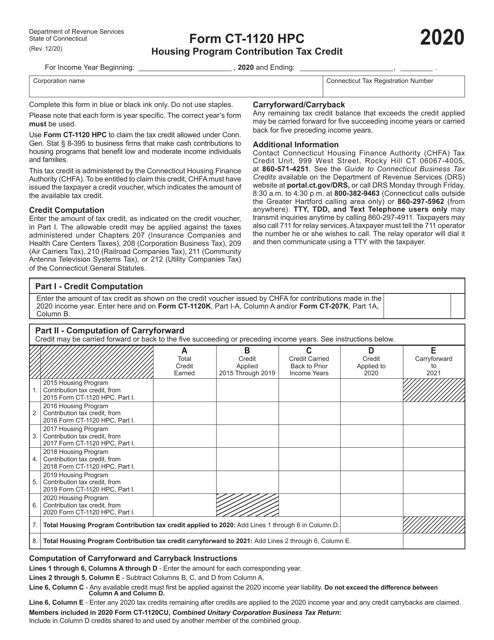

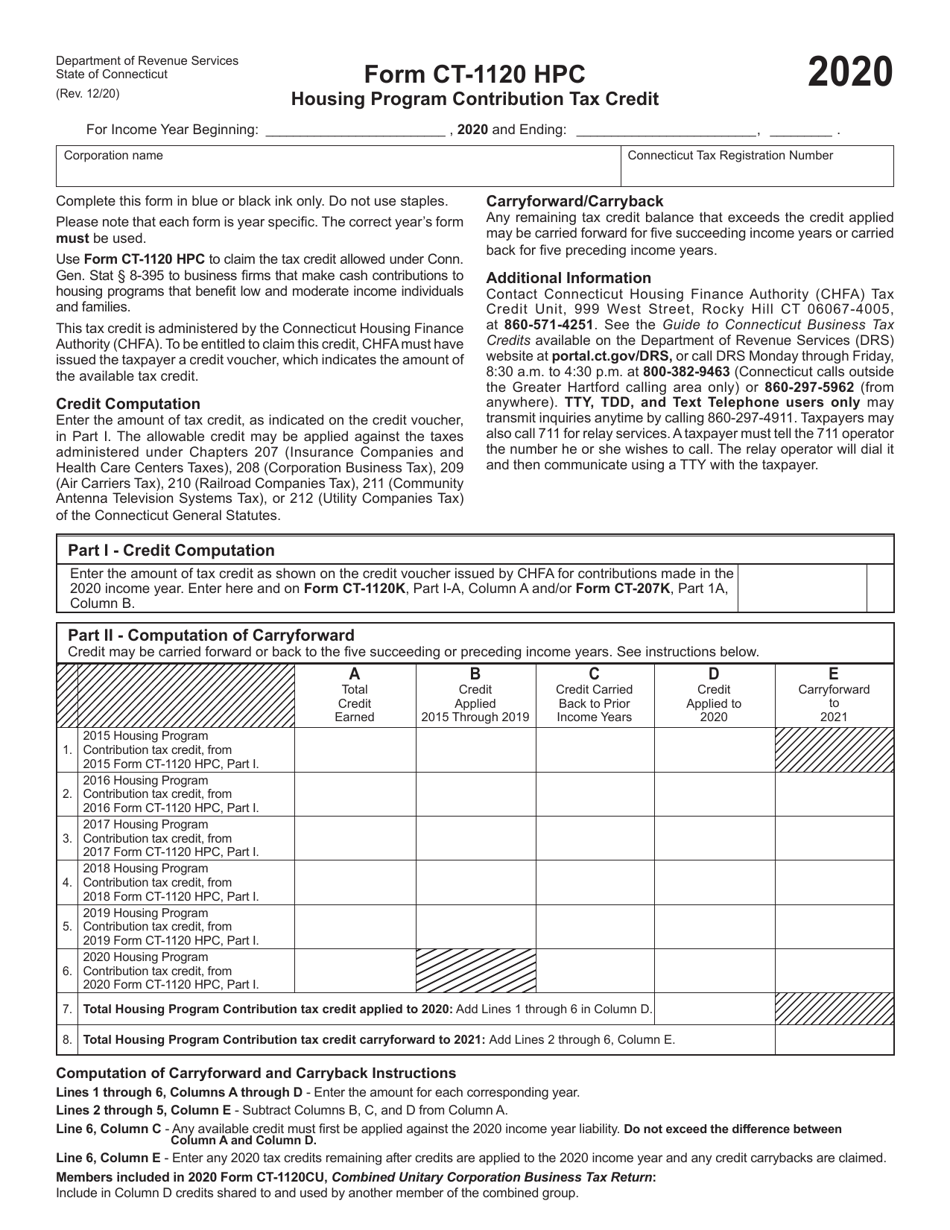

Form CT-1120 HPC

for the current year.

Form CT-1120 HPC Housing Program Contribution Tax Credit - Connecticut

What Is Form CT-1120 HPC?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120 HPC?

A: Form CT-1120 HPC is a tax form used in Connecticut.

Q: What is the HPC Housing Program Contribution Tax Credit?

A: The HPC Housing Program Contribution Tax Credit is a tax credit in Connecticut for eligible contributions made to affordable housing programs.

Q: Who is eligible for the HPC Housing Program Contribution Tax Credit?

A: Eligible taxpayers are businesses and individual taxpayers who make qualifying contributions to affordable housing programs in Connecticut.

Q: How much is the tax credit?

A: The tax credit is equal to 100% of the eligible contributions made to qualifying affordable housing programs.

Q: How do I claim the tax credit?

A: To claim the tax credit, you must complete Form CT-1120 HPC and attach it to your Connecticut tax return.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120 HPC by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.