This version of the form is not currently in use and is provided for reference only. Download this version of

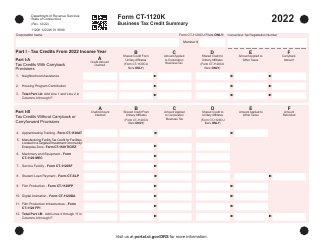

Form CT-1120HP

for the current year.

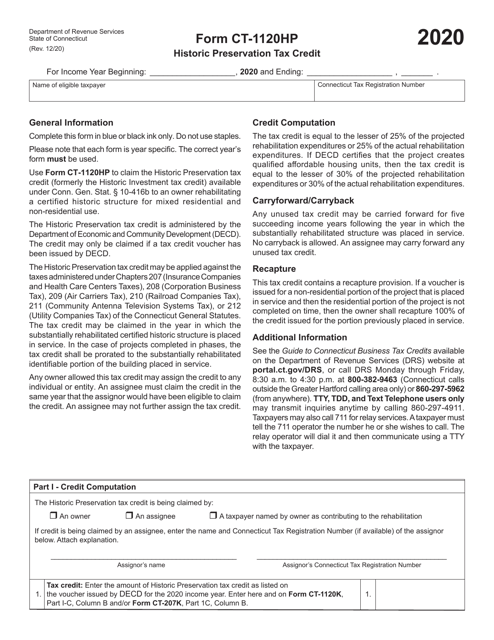

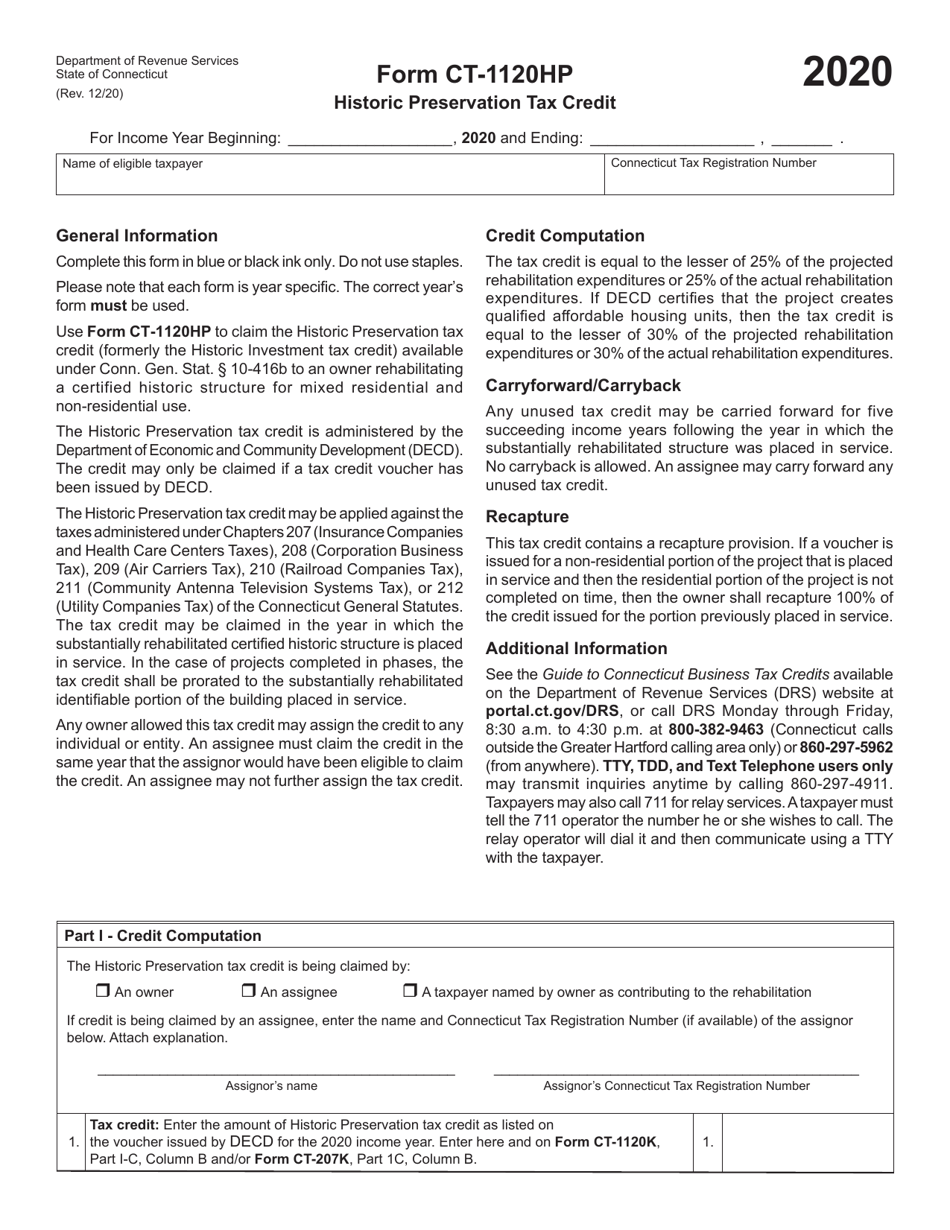

Form CT-1120HP Historic Preservation Tax Credit - Connecticut

What Is Form CT-1120HP?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120HP?

A: Form CT-1120HP is the Historic Preservation Tax Credit form for businesses in Connecticut.

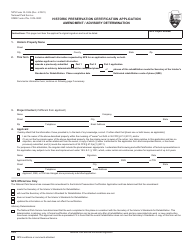

Q: Who is eligible to use Form CT-1120HP?

A: Businesses in Connecticut that have incurred eligible expenses for the preservation and rehabilitation of historic buildings may be eligible to use Form CT-1120HP.

Q: What is the purpose of Form CT-1120HP?

A: Form CT-1120HP is used to calculate and claim the Historic Preservation Tax Credit for businesses in Connecticut.

Q: What expenses can be claimed on Form CT-1120HP?

A: Expenses related to the preservation and rehabilitation of historic buildings, including qualified rehabilitation expenses and state-certified rehabilitation expenditures, can be claimed on Form CT-1120HP.

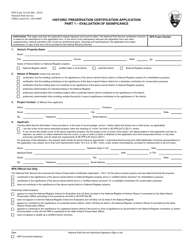

Q: How is the Historic Preservation Tax Credit calculated?

A: The Historic Preservation Tax Credit is calculated based on a percentage of eligible expenses incurred for the preservation and rehabilitation of historic buildings.

Q: How can businesses claim the Historic Preservation Tax Credit?

A: Businesses can claim the Historic Preservation Tax Credit by completing and filing Form CT-1120HP with the Connecticut Department of Revenue Services.

Q: Are there any deadlines for filing Form CT-1120HP?

A: Yes, Form CT-1120HP must be filed on or before the due date for filing the corresponding business tax return (Form CT-1120) for the taxable year in which the expenses were incurred.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120HP by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.