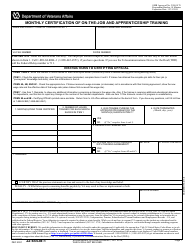

This version of the form is not currently in use and is provided for reference only. Download this version of

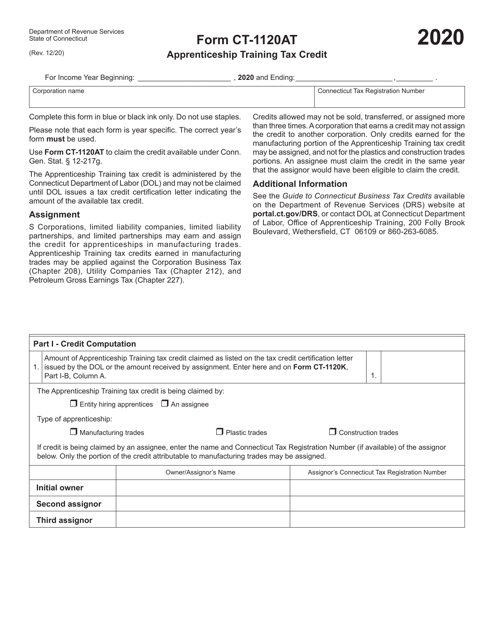

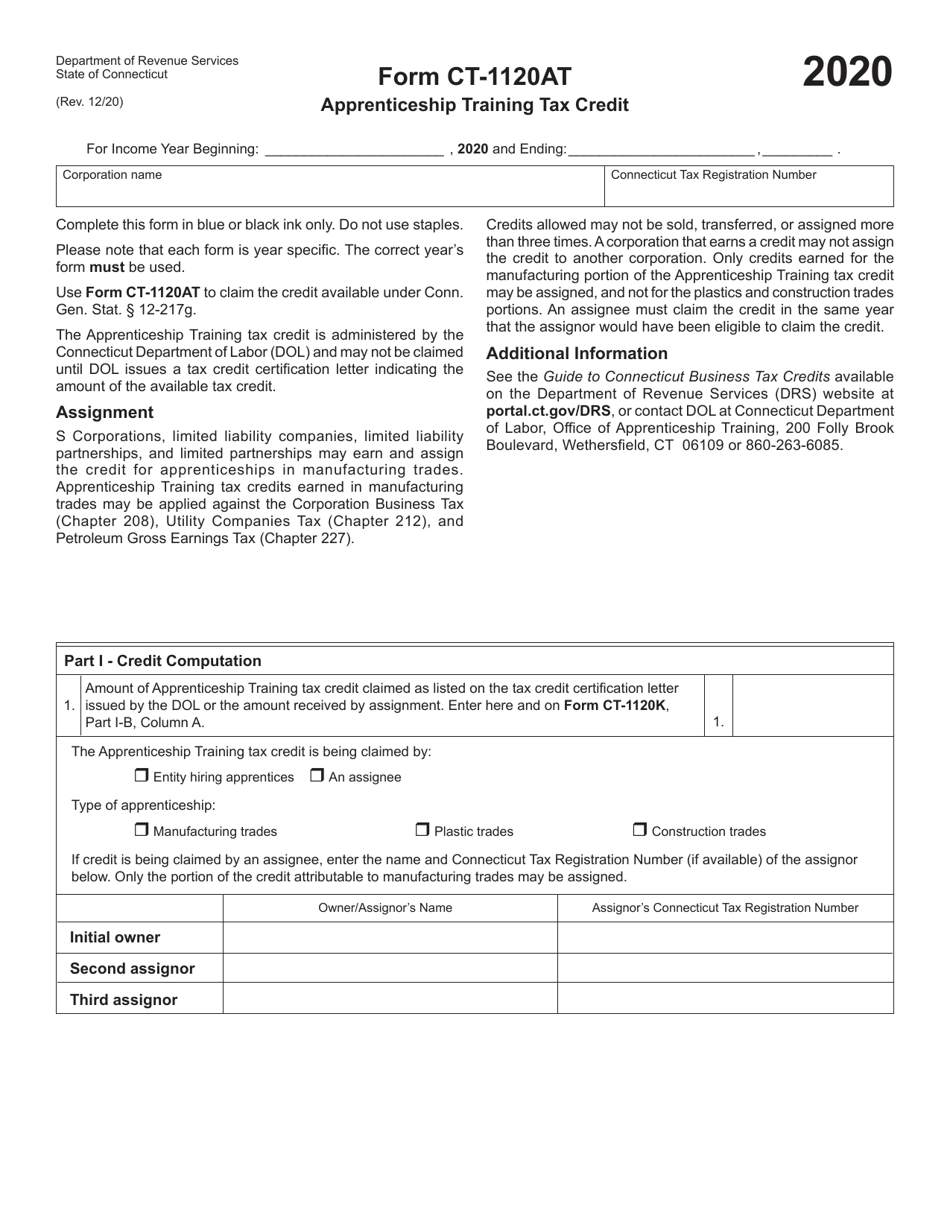

Form CT-1120AT

for the current year.

Form CT-1120AT Apprenticeship Training Tax Credit - Connecticut

What Is Form CT-1120AT?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-1120AT?

A: Form CT-1120AT is the Apprenticeship Training Tax Credit form specifically for Connecticut.

Q: What is the purpose of Form CT-1120AT?

A: Form CT-1120AT is used to claim the Apprenticeship Training Tax Credit in Connecticut.

Q: What is the Apprenticeship Training Tax Credit?

A: The Apprenticeship Training Tax Credit is a tax credit provided by the state of Connecticut to businesses that hire eligible apprentices.

Q: Who is eligible for the Apprenticeship Training Tax Credit?

A: Businesses in Connecticut that hire eligible apprentices are eligible for the tax credit.

Q: How much is the Apprenticeship Training Tax Credit?

A: The amount of the tax credit depends on various factors and is determined by the Connecticut Department of Labor.

Q: How can I claim the Apprenticeship Training Tax Credit?

A: To claim the tax credit, businesses must complete and file Form CT-1120AT with the Connecticut Department of Revenue Services.

Q: Is there a deadline for filing Form CT-1120AT?

A: Yes, Form CT-1120AT must be filed on or before the due date of the business's Connecticut corporation business tax return.

Q: Are there any other requirements or documentation needed to claim the Apprenticeship Training Tax Credit?

A: Yes, businesses must provide documentation and meet certain requirements as outlined by the Connecticut Department of Labor.

Q: Can the Apprenticeship Training Tax Credit be carried forward or refunded?

A: No, the tax credit cannot be carried forward or refunded, and any unused credit cannot be carried over to future years.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-1120AT by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.