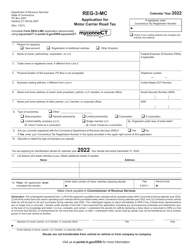

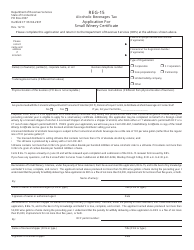

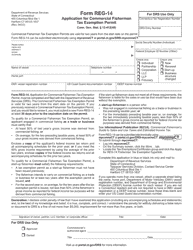

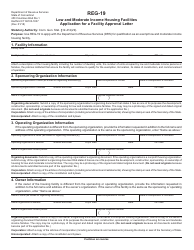

This version of the form is not currently in use and is provided for reference only. Download this version of

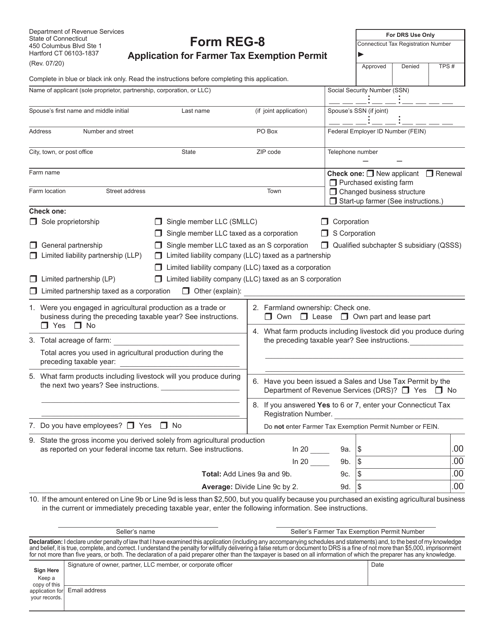

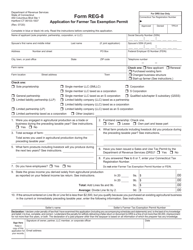

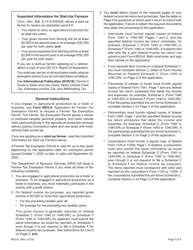

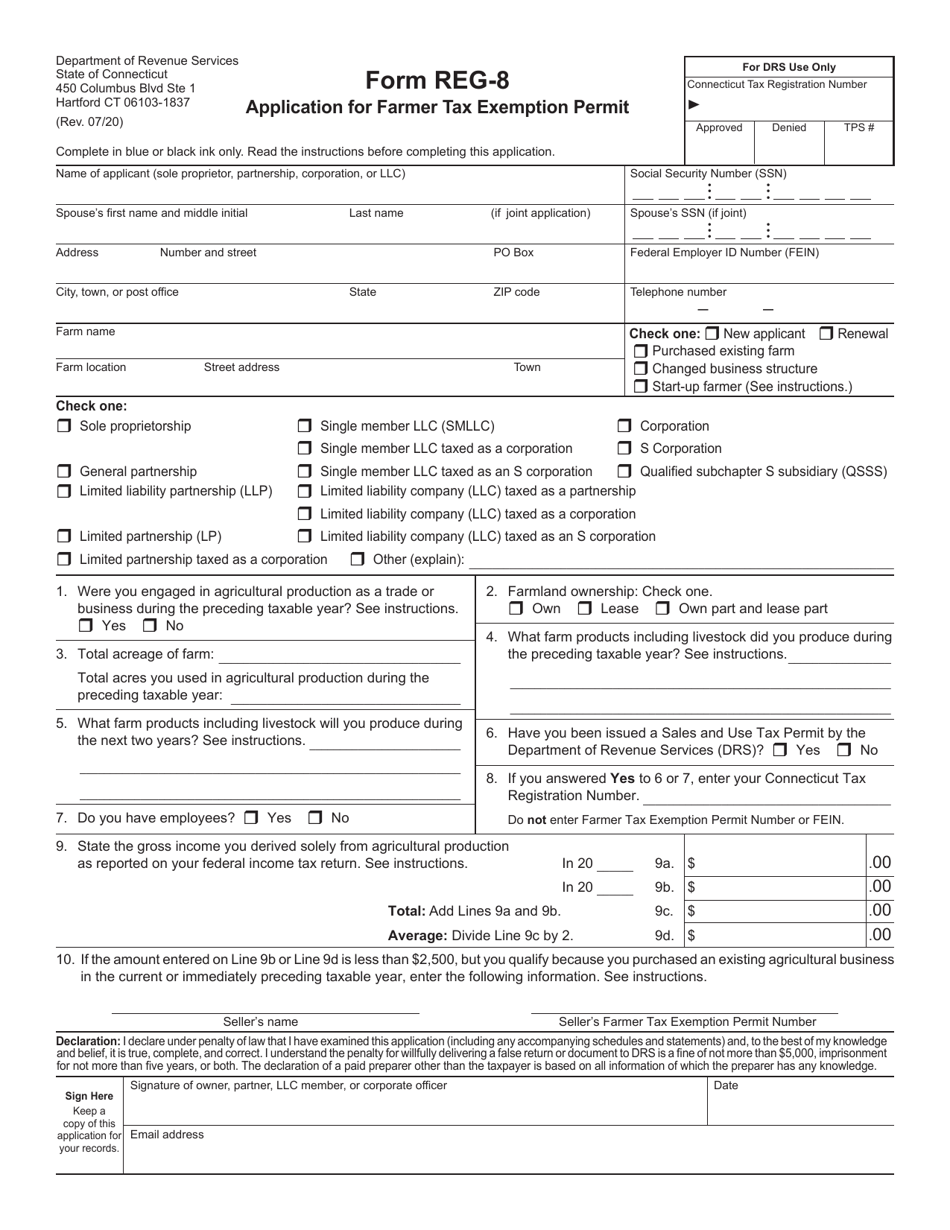

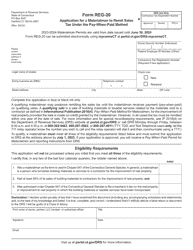

Form REG-8

for the current year.

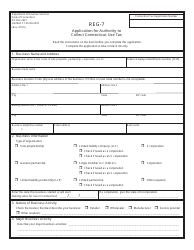

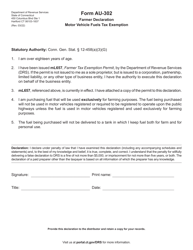

Form REG-8 Application for Farmer Tax Exemption Permit - Connecticut

What Is Form REG-8?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is REG-8?

A: REG-8 is the application for Farmer Tax Exemption Permit in Connecticut.

Q: Who needs to file REG-8?

A: Farmers in Connecticut who wish to claim tax exemption need to file REG-8.

Q: What is the purpose of REG-8?

A: The purpose of REG-8 is to apply for the Farmer Tax Exemption Permit.

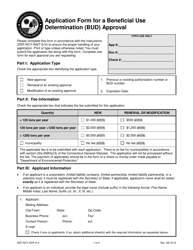

Q: Is there a fee to file REG-8?

A: No, there is no fee to file REG-8.

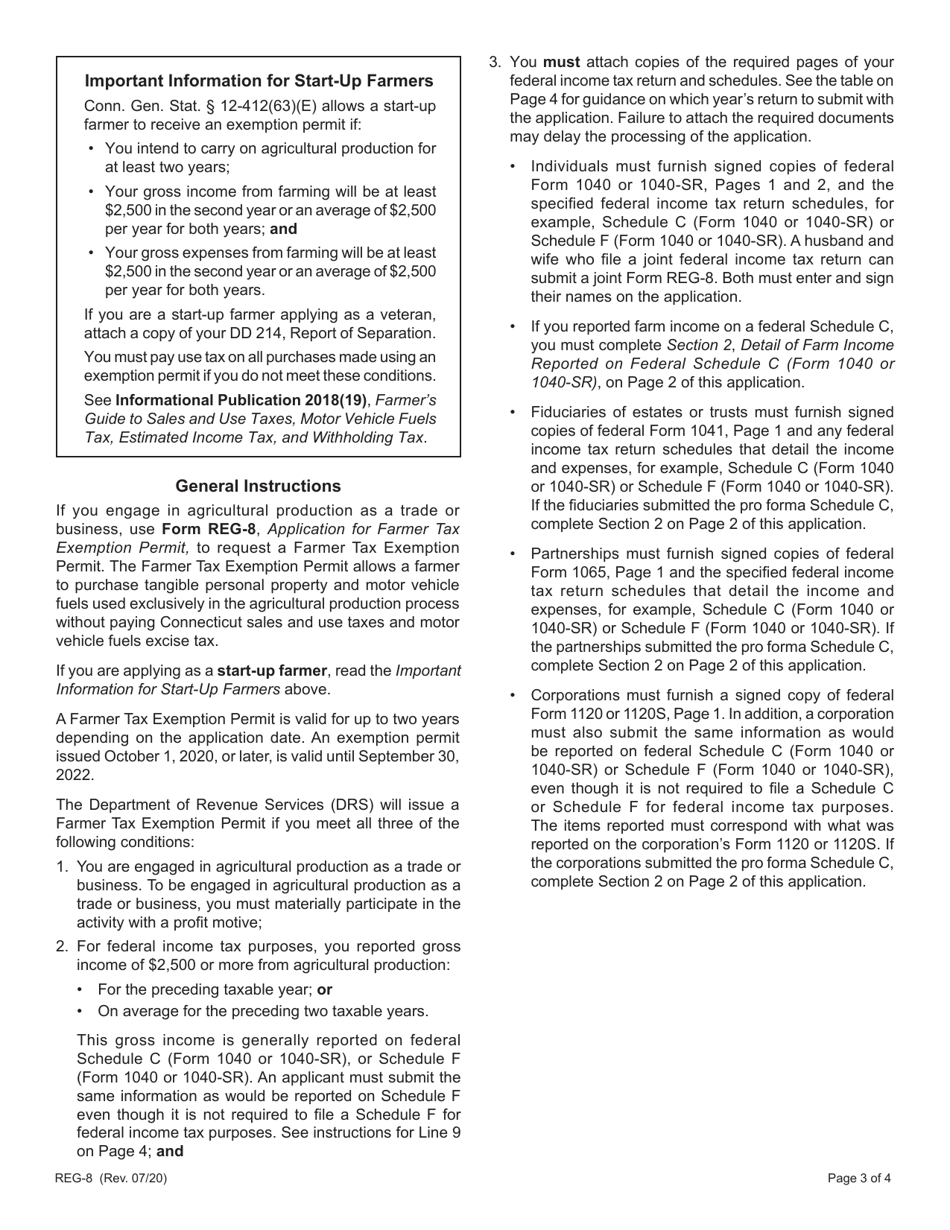

Q: Are there eligibility requirements for the Farmer Tax Exemption Permit?

A: Yes, there are eligibility requirements such as being actively engaged in farming and meeting certain income thresholds.

Q: What are the benefits of the Farmer Tax Exemption Permit?

A: The Farmer Tax Exemption Permit provides exemption from certain sales and use taxes on qualifying farm purchases.

Q: How often do I need to renew the Farmer Tax Exemption Permit?

A: The Farmer Tax Exemption Permit needs to be renewed every five years.

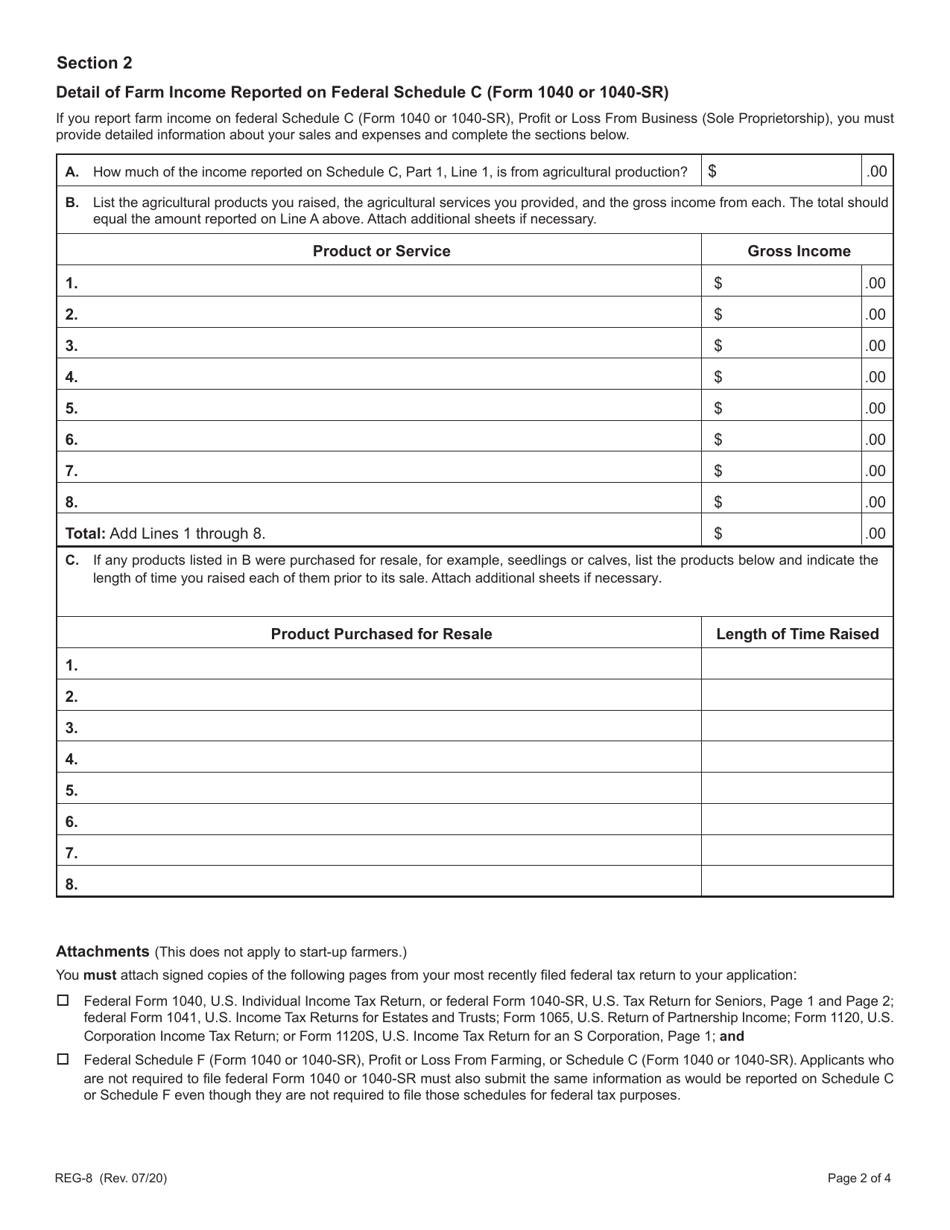

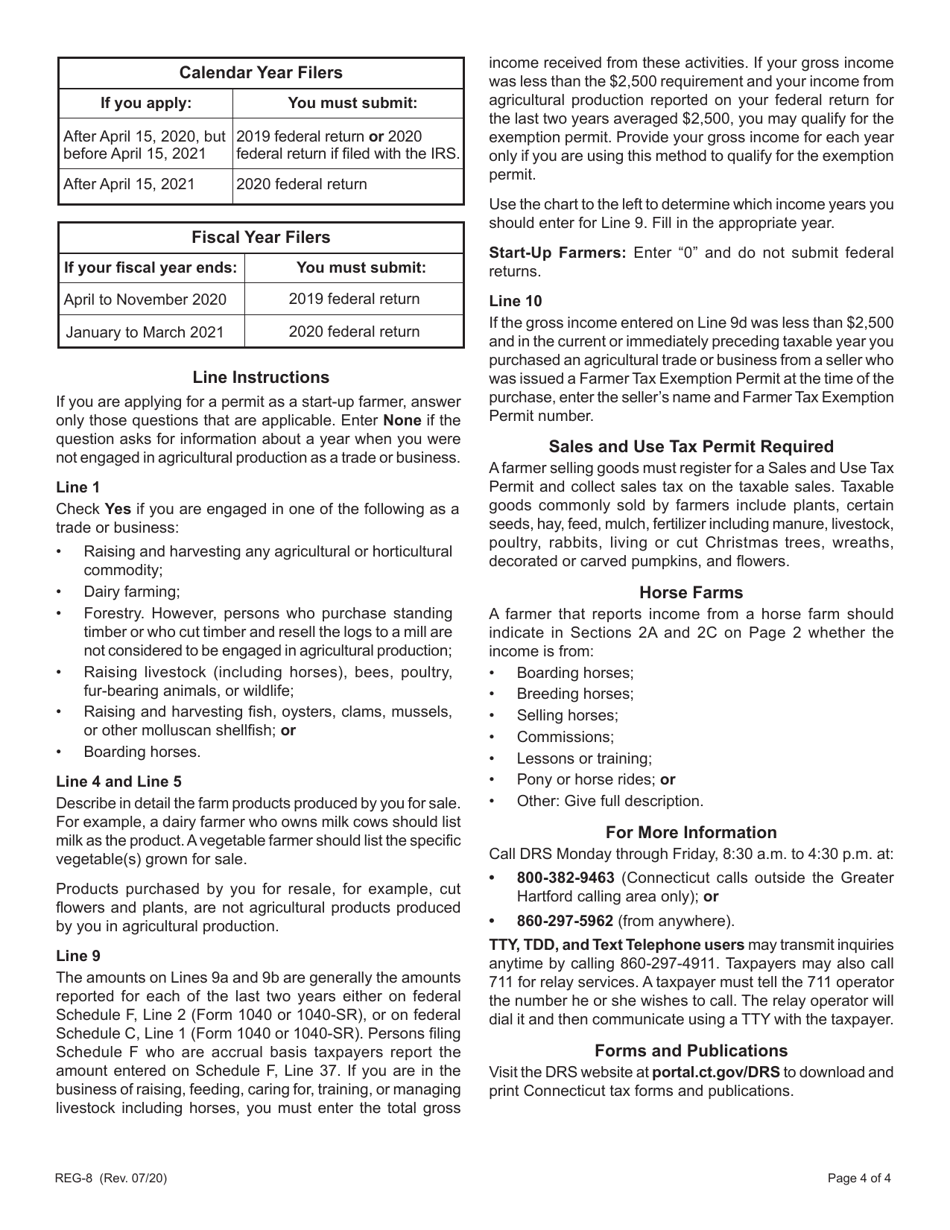

Q: Are there any additional forms or documentation required with REG-8?

A: Yes, you may need to submit additional forms and documentation depending on your specific situation. Consult the REG-8 instructions for more information.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REG-8 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.