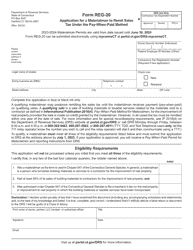

This version of the form is not currently in use and is provided for reference only. Download this version of

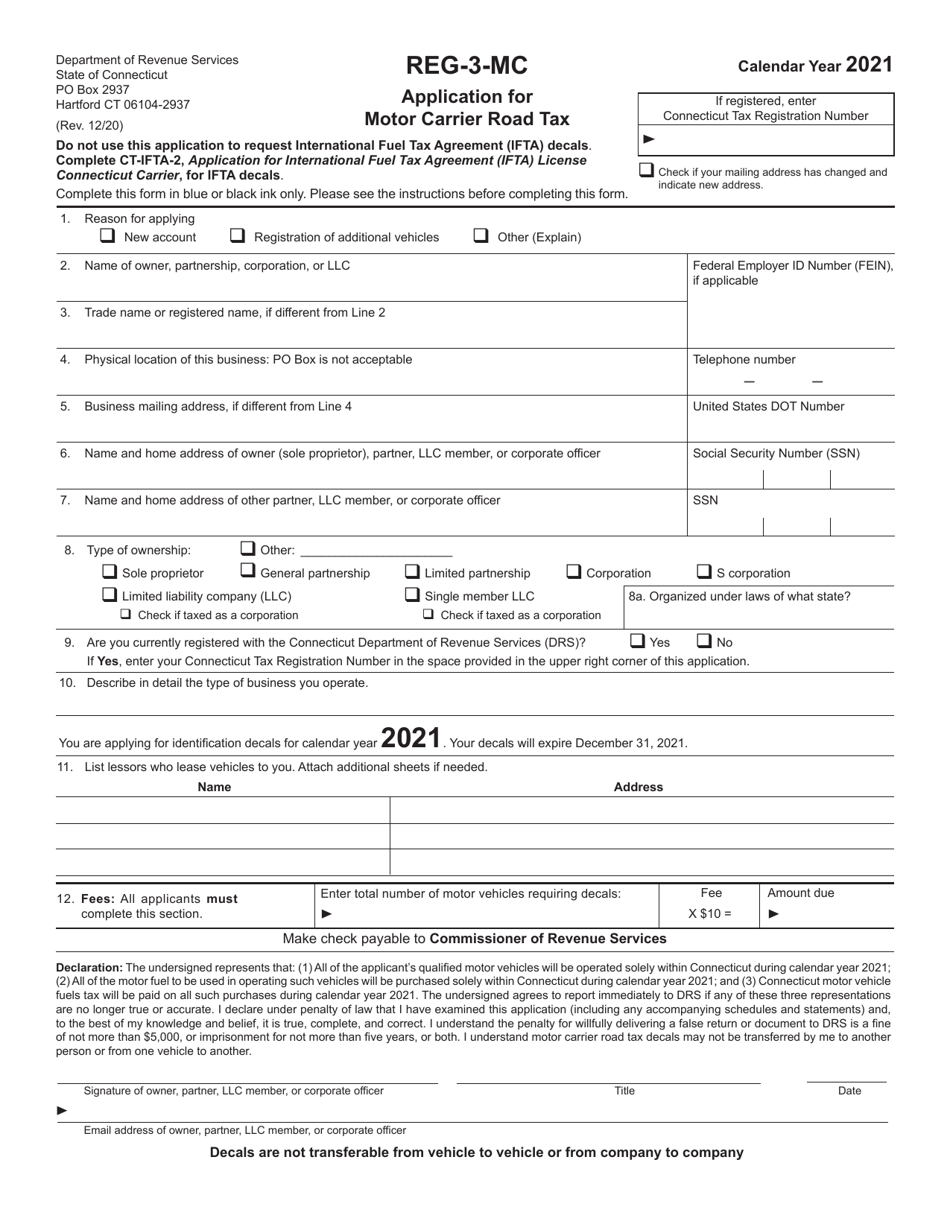

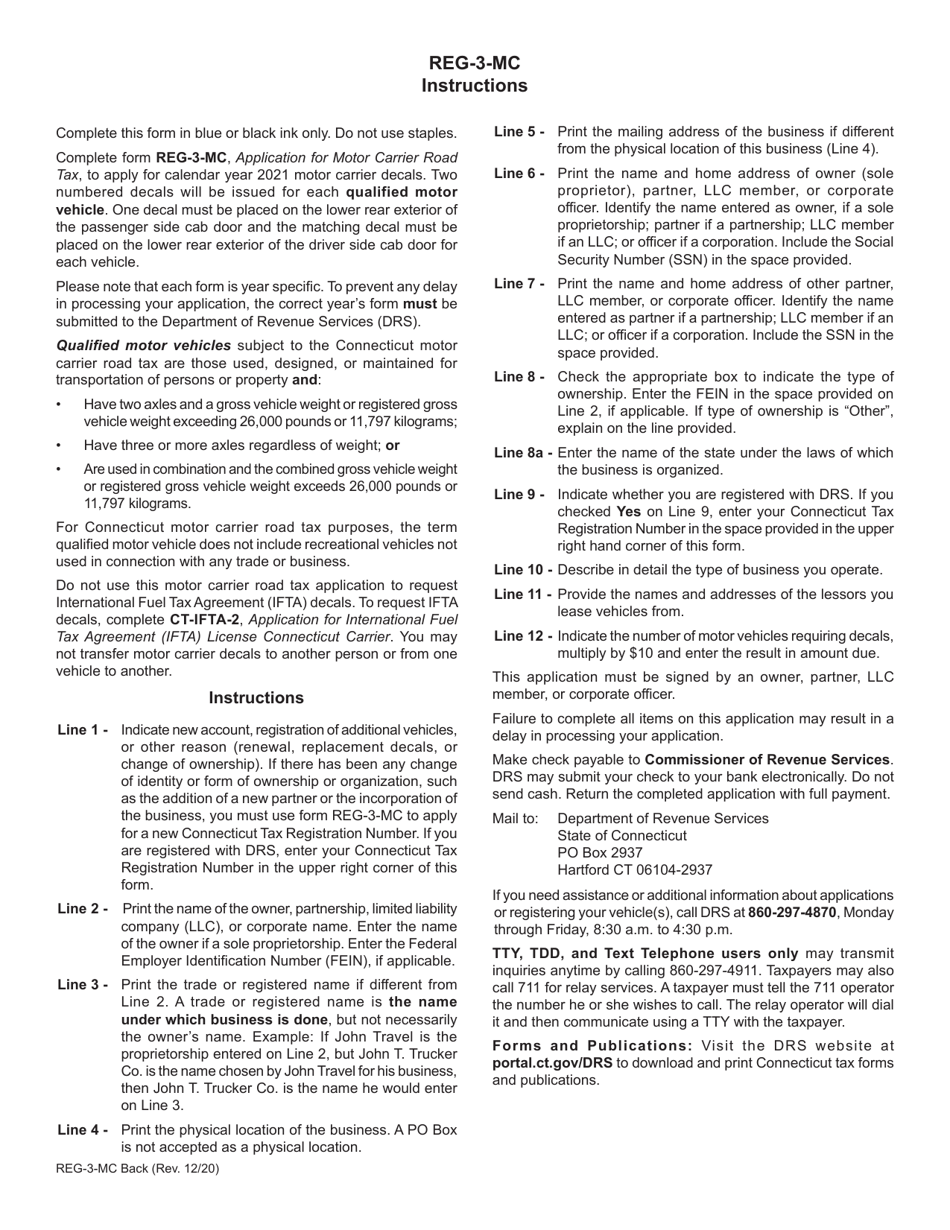

Form REG-3-MC

for the current year.

Form REG-3-MC Application for Motor Carrier Road Tax - Connecticut

What Is Form REG-3-MC?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REG-3-MC?

A: Form REG-3-MC is the application for Motor Carrier Road Tax in Connecticut.

Q: Who needs to file Form REG-3-MC?

A: Motor carriers operating in Connecticut need to file Form REG-3-MC.

Q: What is the purpose of the Motor Carrier Road Tax?

A: The Motor Carrier Road Tax is used to fund transportation infrastructure and maintenance in Connecticut.

Q: How can I submit Form REG-3-MC?

A: You can submit Form REG-3-MC by mail or electronically through the Connecticut Department of Revenue Services e-services portal.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REG-3-MC by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.