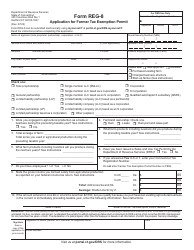

This version of the form is not currently in use and is provided for reference only. Download this version of

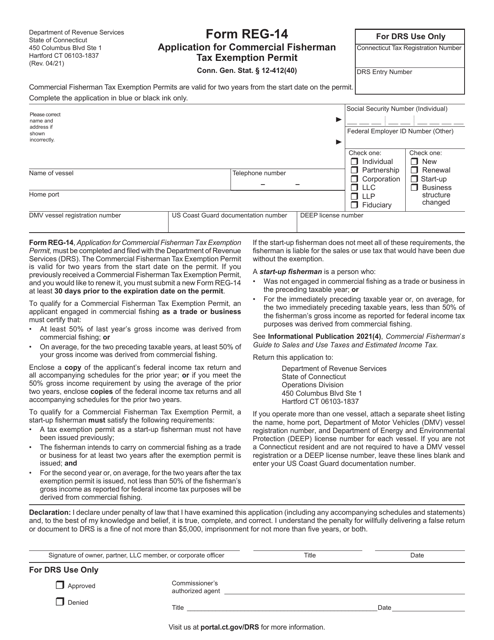

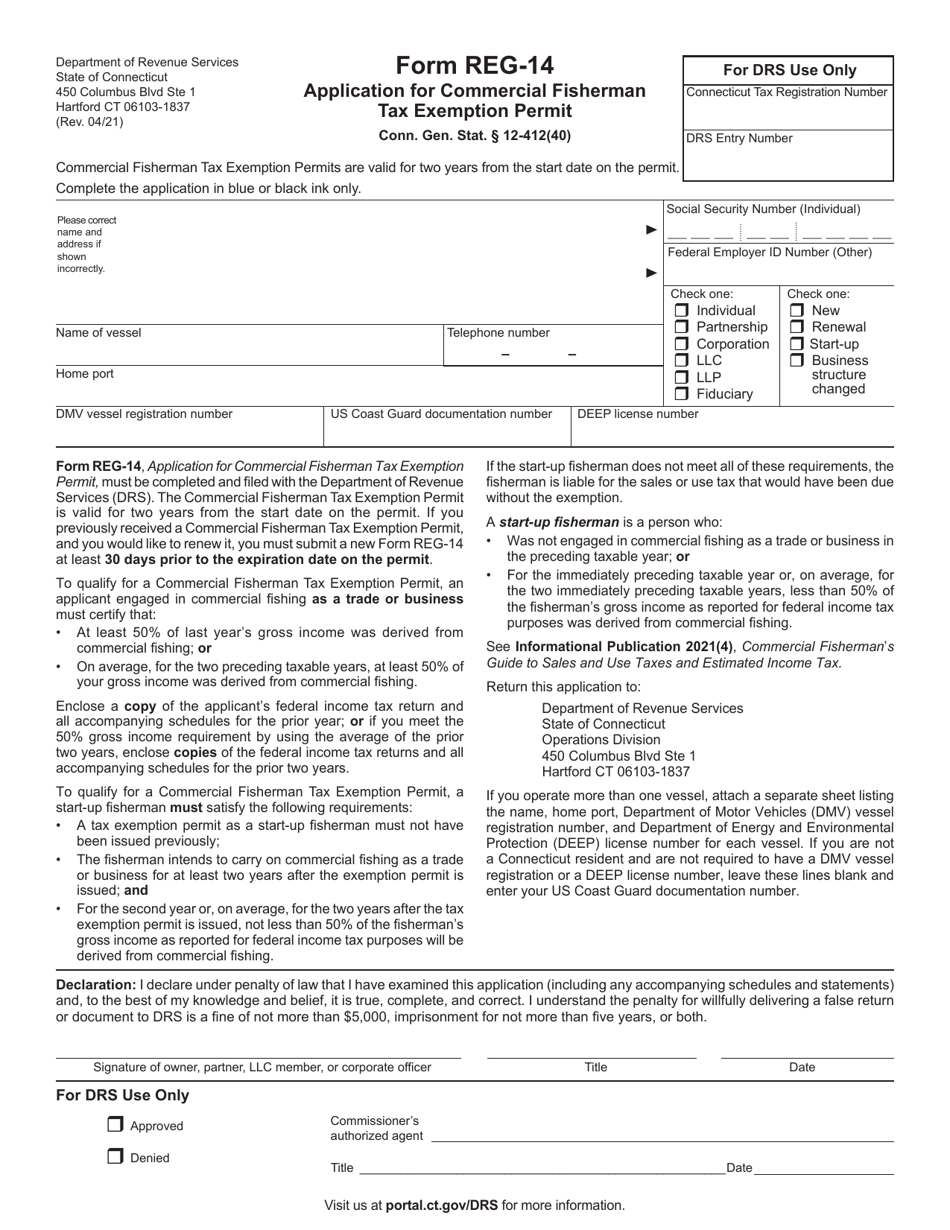

Form REG-14

for the current year.

Form REG-14 Application for Commercial Fisherman Tax Exemption Permit - Connecticut

What Is Form REG-14?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REG-14?

A: Form REG-14 is the application for a Commercial Fisherman Tax Exemption Permit in Connecticut.

Q: Who needs to complete Form REG-14?

A: Commercial fishermen in Connecticut who want to apply for a tax exemption permit need to complete Form REG-14.

Q: What is the purpose of the Commercial Fisherman Tax Exemption Permit?

A: The Commercial Fisherman Tax Exemption Permit allows eligible fishermen to purchase fuel and supplies without paying sales tax in Connecticut.

Q: Is there a fee for obtaining a Commercial Fisherman Tax Exemption Permit?

A: Yes, there is a fee for obtaining a Commercial Fisherman Tax Exemption Permit. The fee amount can be found on the Form REG-14 instructions.

Q: What supporting documents should be submitted with Form REG-14?

A: Applicants for a Commercial Fisherman Tax Exemption Permit should submit copies of their current state-issued commercial fishing license and boat registration.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REG-14 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.