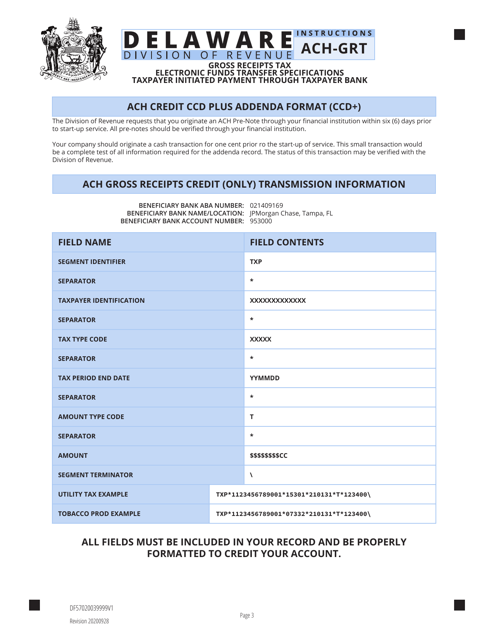

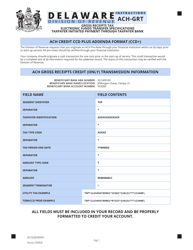

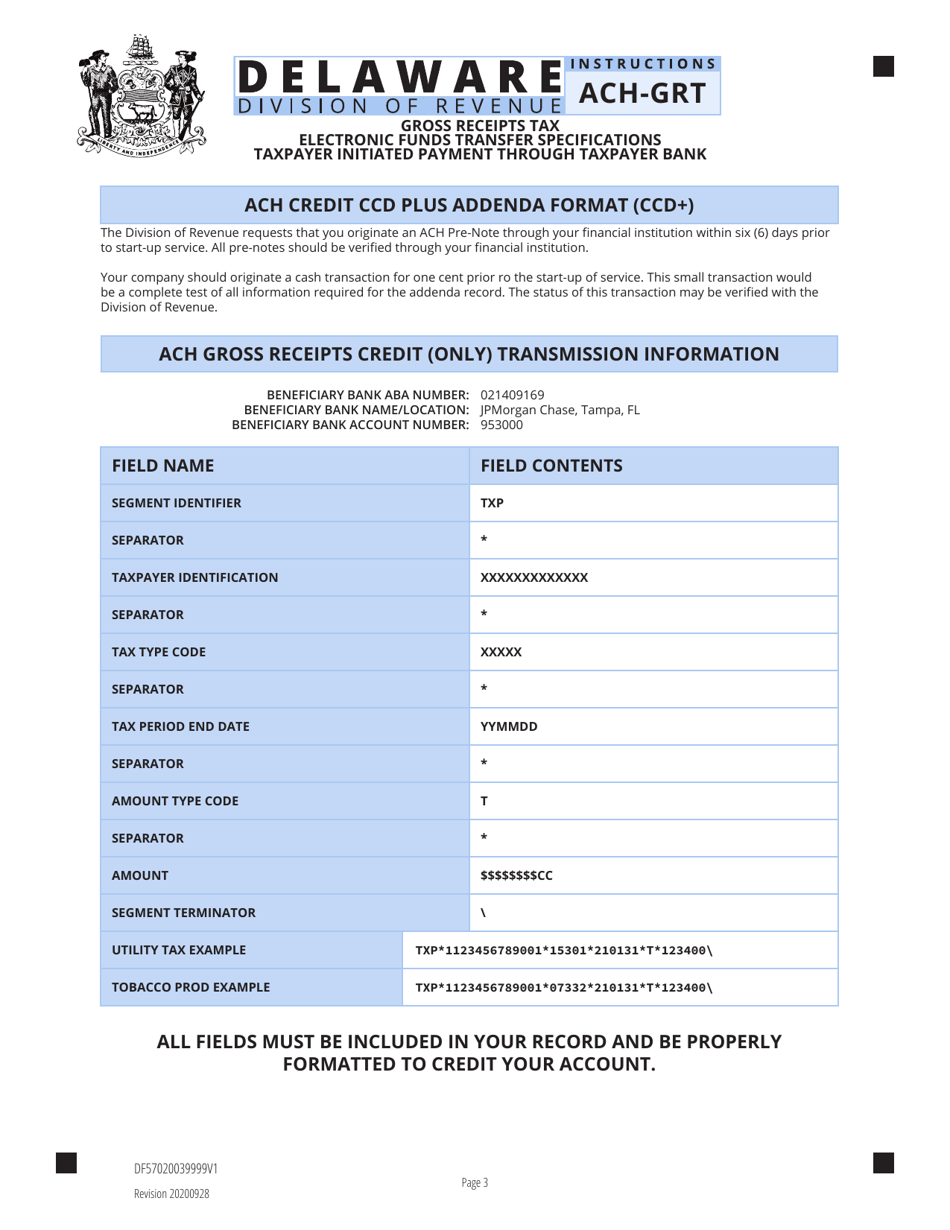

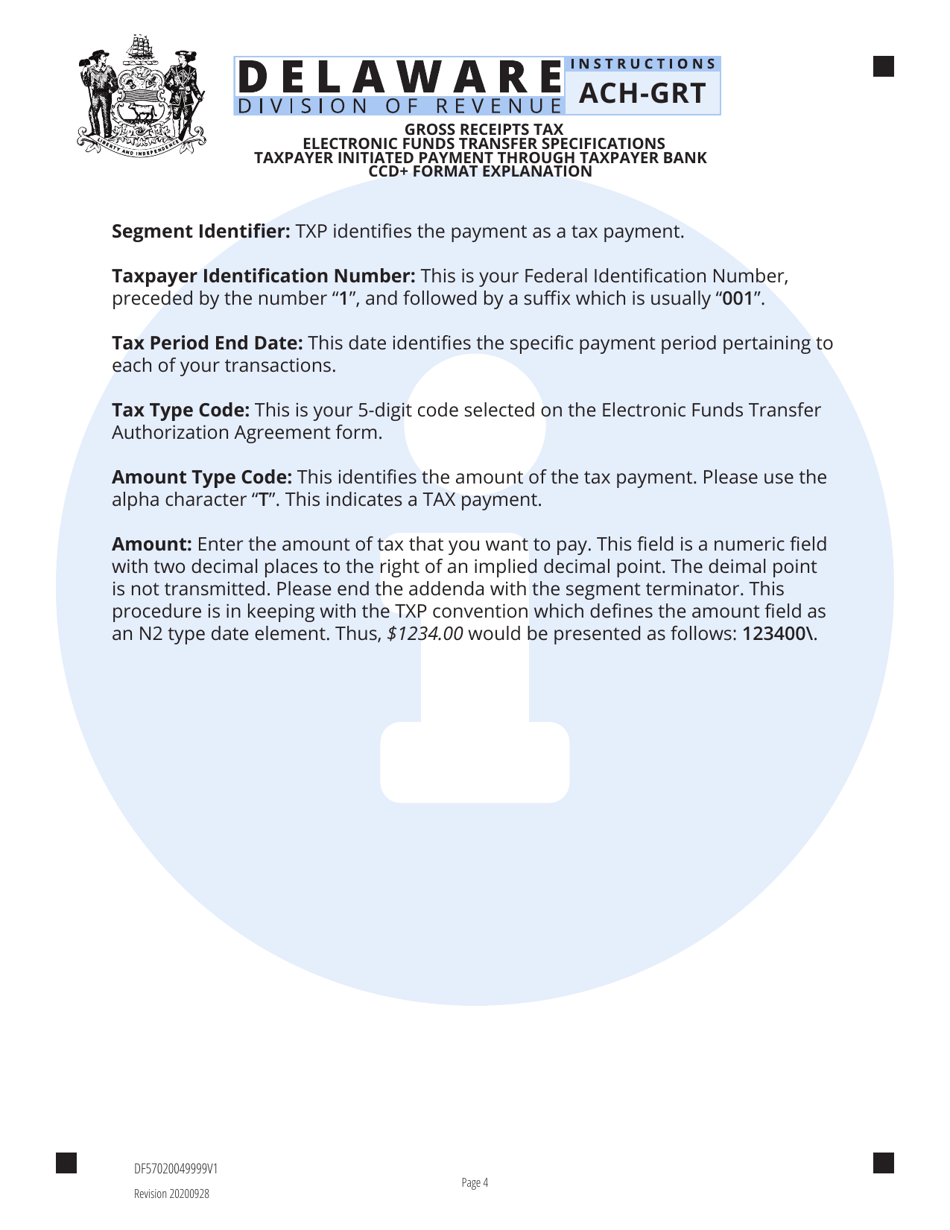

Instructions for Form ACH-GRT Electronic Funds Transfer Authorization Agreement - Taxpayer Initiated Payment Through Taxpayer Bank - Gross Receipts Tax - Delaware

This document contains official instructions for Form ACH-GRT , Electronic Gross Receipts Tax - a form released and collected by the Delaware Department of Finance - Division of Revenue. An up-to-date fillable Form ACH-GRT is available for download through this link.

FAQ

Q: What is Form ACH-GRT?

A: Form ACH-GRT is an authorization agreement for electronic funds transfer.

Q: What is the purpose of Form ACH-GRT?

A: The purpose of Form ACH-GRT is to authorize electronic payment of Gross Receipts Tax in Delaware.

Q: Who can use Form ACH-GRT?

A: Taxpayers who are required to pay Gross Receipts Tax in Delaware can use Form ACH-GRT.

Q: What type of payment does Form ACH-GRT authorize?

A: Form ACH-GRT authorizes taxpayer-initiated electronic funds transfer for Gross Receipts Tax.

Q: Can I use Form ACH-GRT for other types of taxes?

A: No, Form ACH-GRT is specifically for Gross Receipts Tax payments in Delaware.

Q: Is there a fee for using Form ACH-GRT?

A: There is no fee for using Form ACH-GRT.

Q: Can I cancel or change my electronic payment authorization?

A: Yes, you can cancel or change your electronic payment authorization by submitting a written request to the Delaware Division of Revenue.

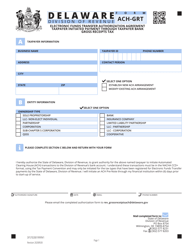

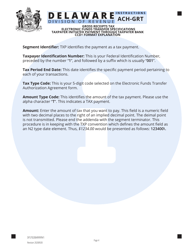

Q: What information is required to complete Form ACH-GRT?

A: To complete Form ACH-GRT, you will need to provide your taxpayer identification number, bank account information, and authorization signature.

Q: When should I submit Form ACH-GRT?

A: You should submit Form ACH-GRT at least 7 days before your Gross Receipts Tax payment is due.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Delaware Department of Finance - Division of Revenue.