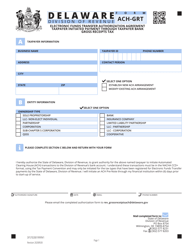

Instructions for Form ACH-WHC Electronic Funds Transfer Authorization Agreement - Taxpayer Initiated Payment Through Taxpayer Bank Withholding, Corporate Tentative, & S-Corporation Estimated - Delaware

This document contains official instructions for Form ACH-WHC , Electronic Authorization Agreement - Taxpayer Initiated Payment Through Taxpayer Bank Withholding, Corporate Tentative, & S-Corporation Estimated - a form released and collected by the Delaware Department of Finance - Division of Revenue. An up-to-date fillable Form ACH-WHC is available for download through this link.

FAQ

Q: What is Form ACH-WHC?

A: Form ACH-WHC is an Electronic Funds Transfer Authorization Agreement.

Q: What is the purpose of Form ACH-WHC?

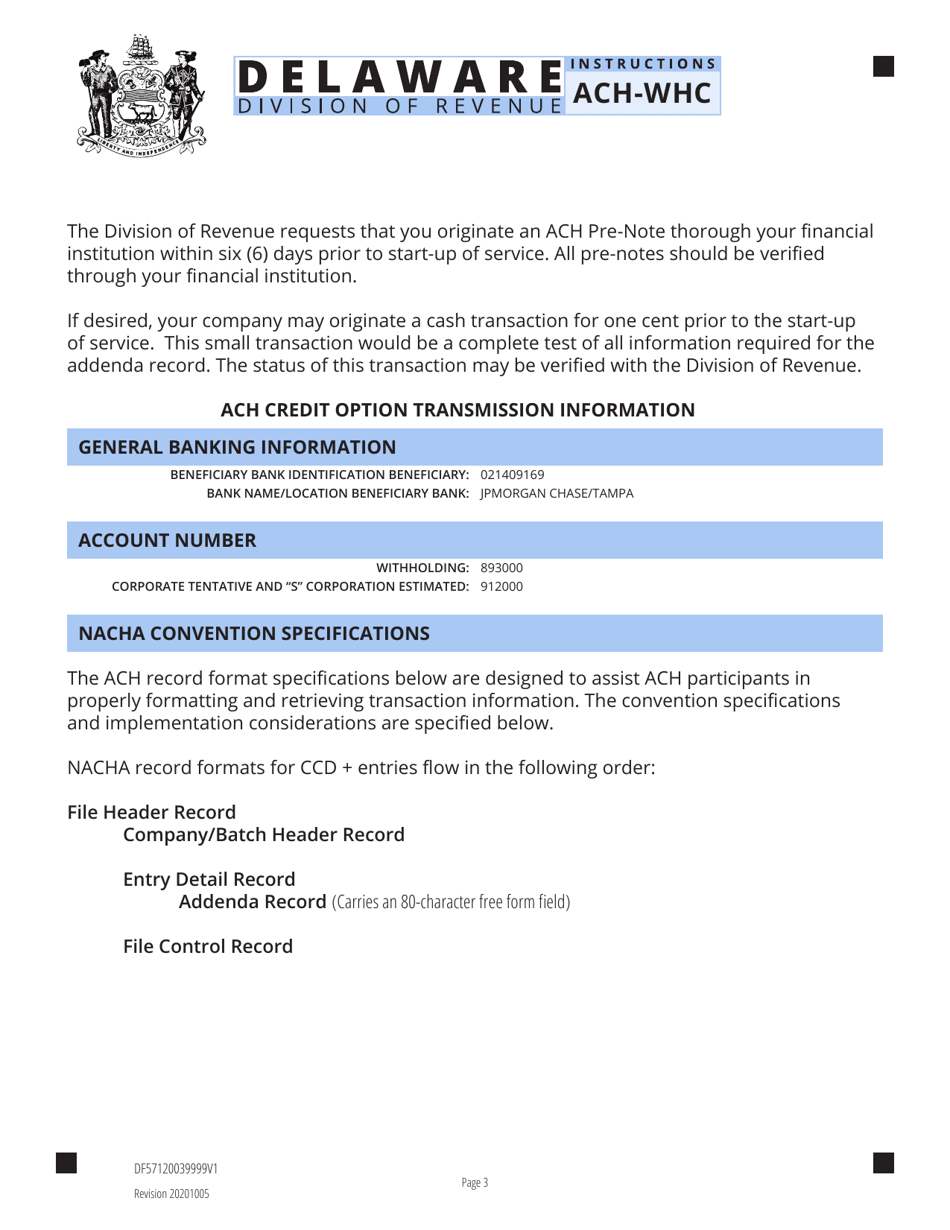

A: The purpose of Form ACH-WHC is to authorize the taxpayer to make electronic funds transfers for Taxpayer Initiated Payment Through Taxpayer Bank Withholding, Corporate Tentative, & S-Corporation Estimated payments.

Q: Who should use Form ACH-WHC?

A: Taxpayers who want to make electronic funds transfers for Taxpayer Initiated Payment Through Taxpayer Bank Withholding, Corporate Tentative, & S-Corporation Estimated payments in Delaware should use Form ACH-WHC.

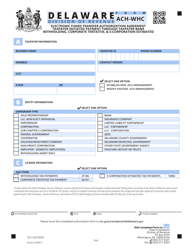

Q: What information is required on Form ACH-WHC?

A: Form ACH-WHC requires the taxpayer's name, address, taxpayer identification number, bank name and address, bank routing number, bank account number, and the type of payment.

Q: How should I submit Form ACH-WHC?

A: Form ACH-WHC can be submitted by mail or fax to the Delaware Division of Revenue.

Q: Is there a fee to use Form ACH-WHC?

A: No, there is no fee to use Form ACH-WHC.

Q: Can I cancel or modify my authorization on Form ACH-WHC?

A: Yes, you can cancel or modify your authorization on Form ACH-WHC by submitting a new form or contacting the Delaware Division of Revenue.

Q: Are there any penalties for unauthorized or insufficient funds transfers?

A: Yes, there may be penalties for unauthorized or insufficient funds transfers.

Q: Who should I contact for more information about Form ACH-WHC?

A: For more information about Form ACH-WHC, you should contact the Delaware Division of Revenue.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Delaware Department of Finance - Division of Revenue.