This version of the form is not currently in use and is provided for reference only. Download this version of

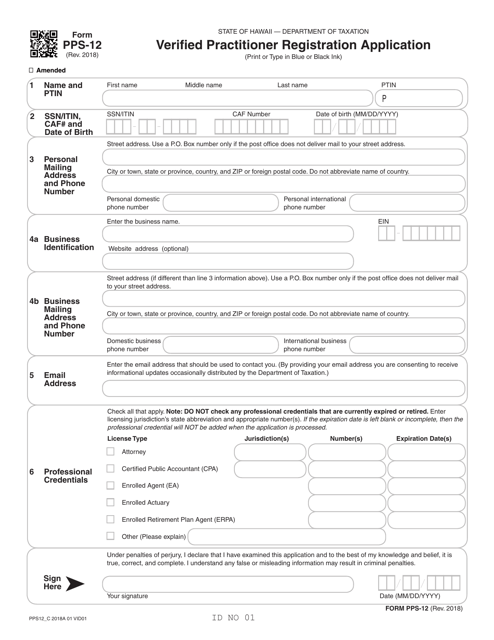

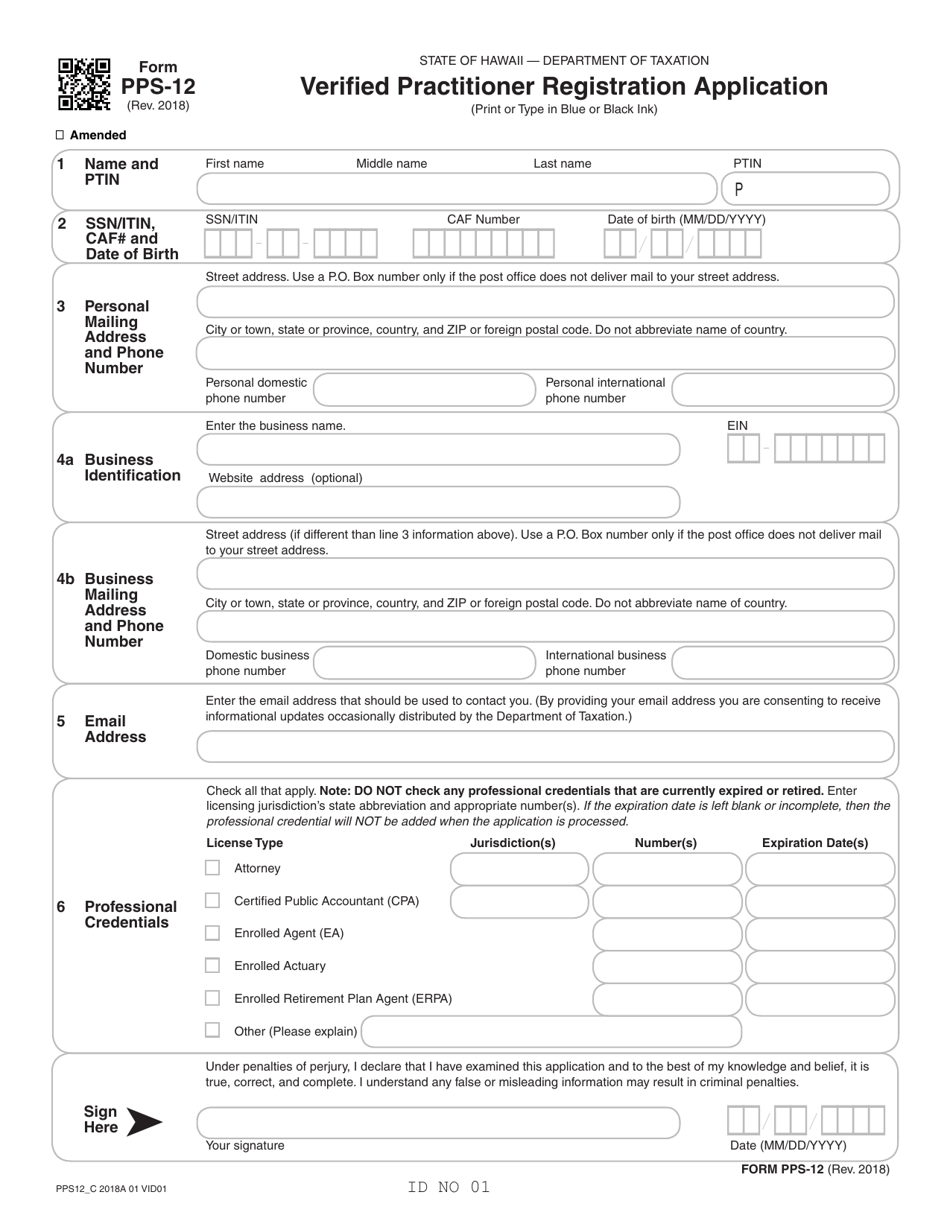

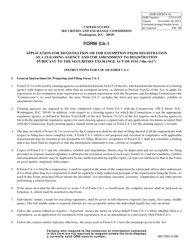

Form PPS-12

for the current year.

Form PPS-12 Verified Practitioner Registration Application - Hawaii

What Is Form PPS-12?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PPS-12?

A: Form PPS-12 is the Verified Practitioner Registration Application for the state of Hawaii.

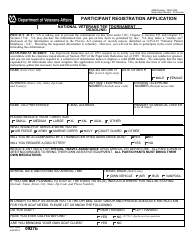

Q: Who is this form for?

A: This form is for individuals who want to apply for Verified Practitioner Registration in Hawaii.

Q: What is Verified Practitioner Registration?

A: Verified Practitioner Registration is a process by which individuals can become registered to practice in a specific profession.

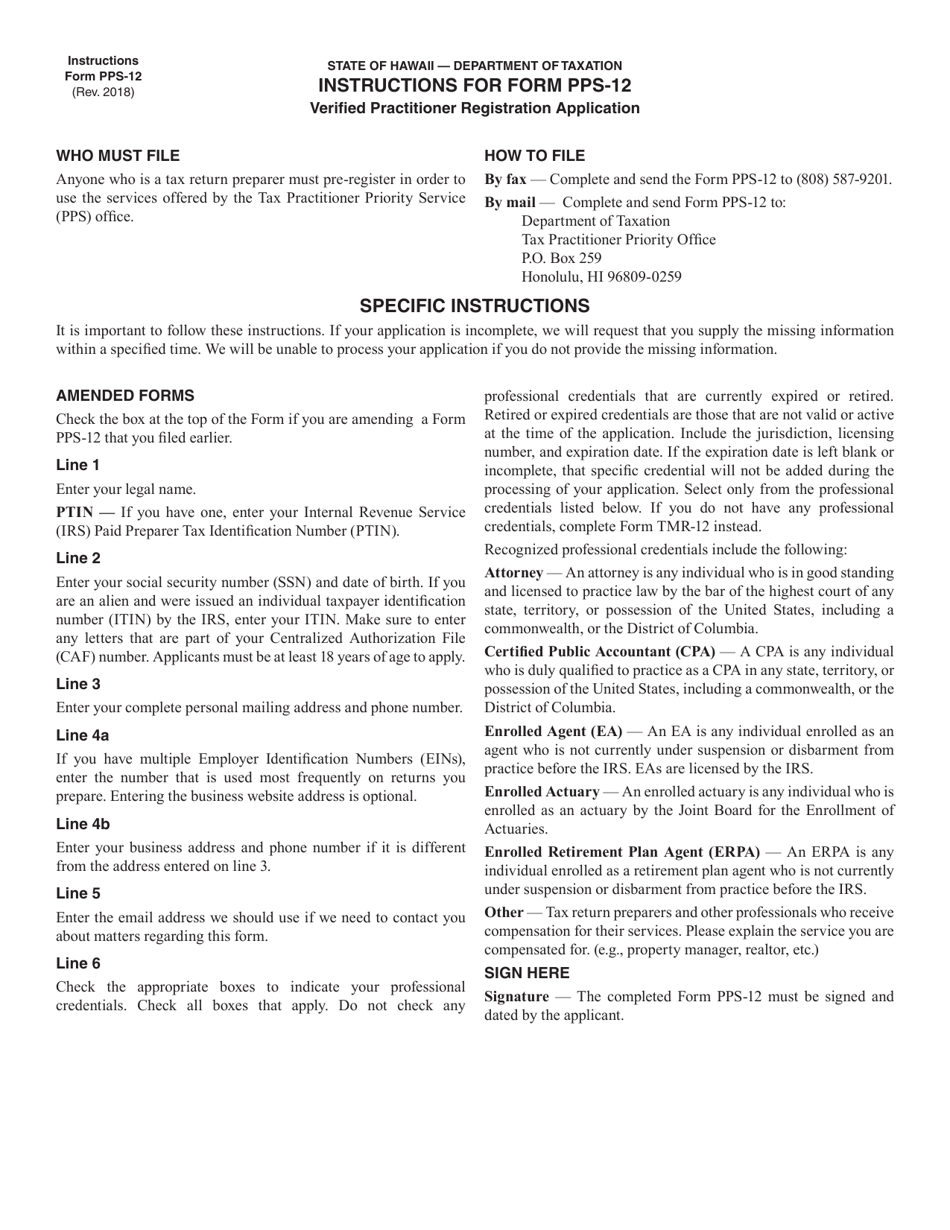

Q: How do I fill out this form?

A: You need to provide personal and professional information, including your name, contact details, and details of your professional qualifications.

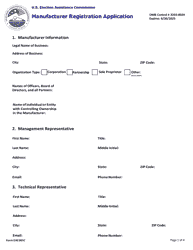

Q: Are there any fees associated with this application?

A: Yes, there is a fee for submitting the Verified Practitioner Registration Application.

Q: How long does it take to process this application?

A: The processing time for the Verified Practitioner Registration Application may vary. It is best to check with the licensing authority for more information.

Q: What happens after I submit this form?

A: After you submit the Form PPS-12, your application will be reviewed, and if approved, you will receive your Verified Practitioner Registration.

Q: Can I practice in Hawaii without Verified Practitioner Registration?

A: No, you need Verified Practitioner Registration to practice in Hawaii legally.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PPS-12 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.