This version of the form is not currently in use and is provided for reference only. Download this version of

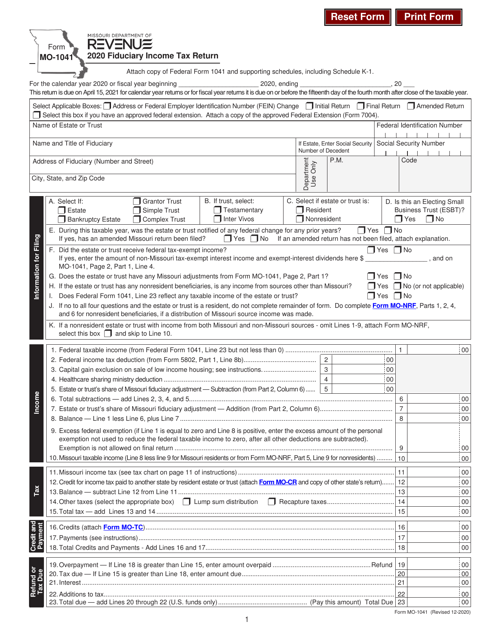

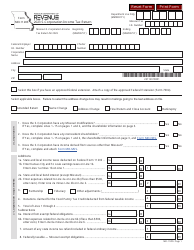

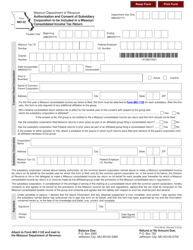

Form MO-1041

for the current year.

Form MO-1041 Fiduciary Income Tax Return - Missouri

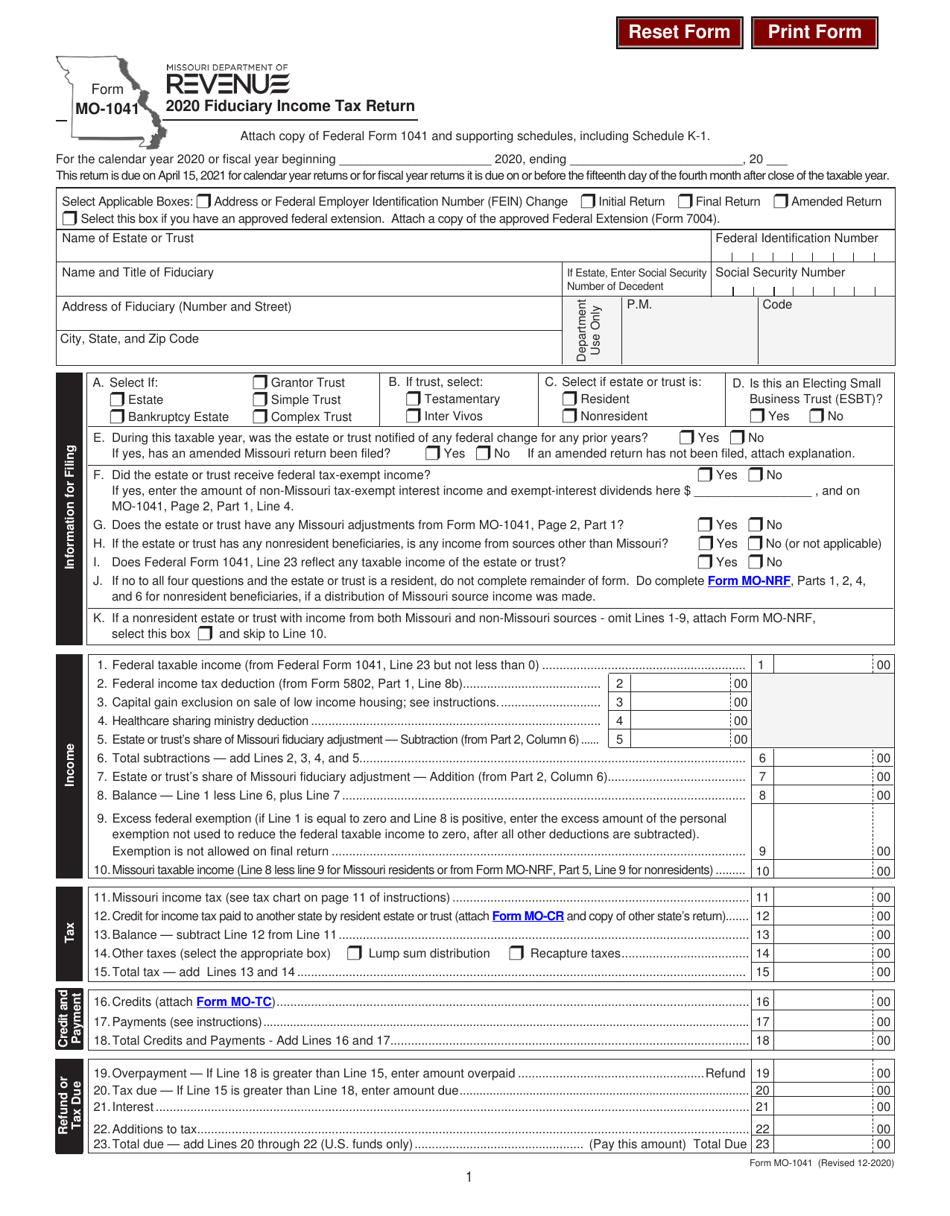

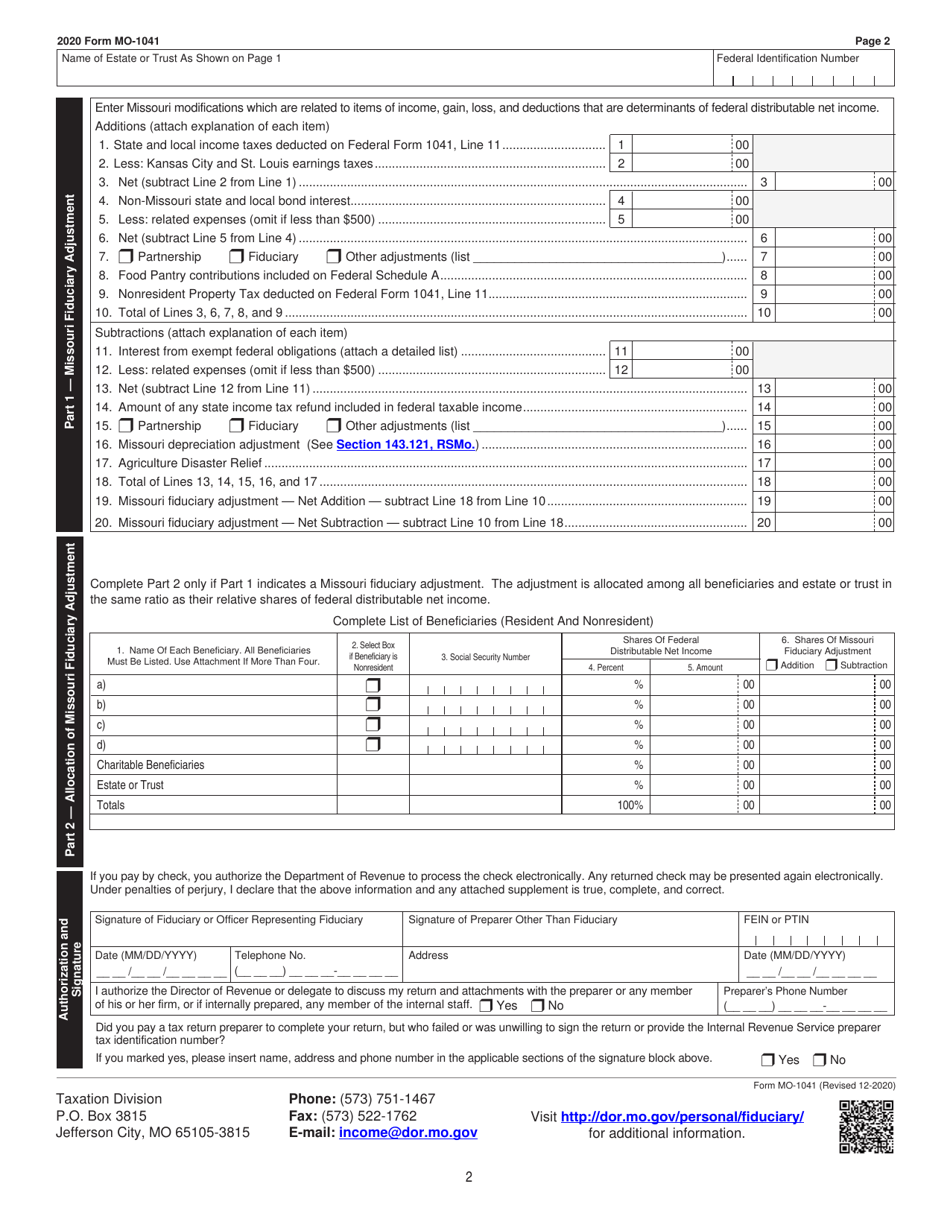

What Is Form MO-1041?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-1041?

A: Form MO-1041 is the Fiduciary Income Tax Return for the state of Missouri.

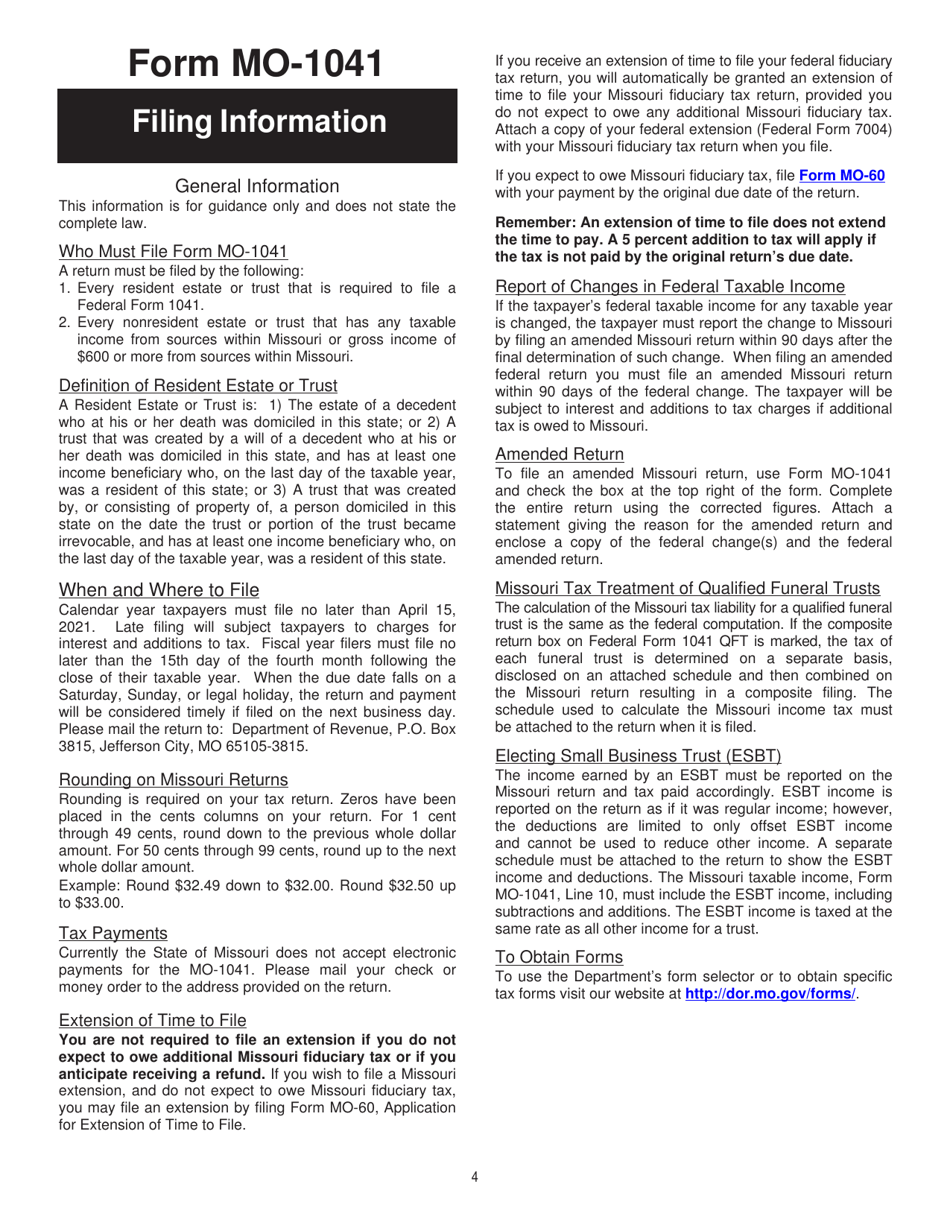

Q: Who should file Form MO-1041?

A: Form MO-1041 should be filed by fiduciaries who are responsible for filing income tax returns on behalf of estates or trusts in Missouri.

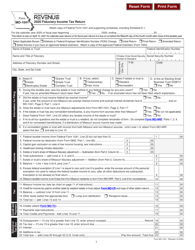

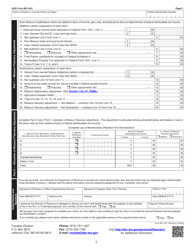

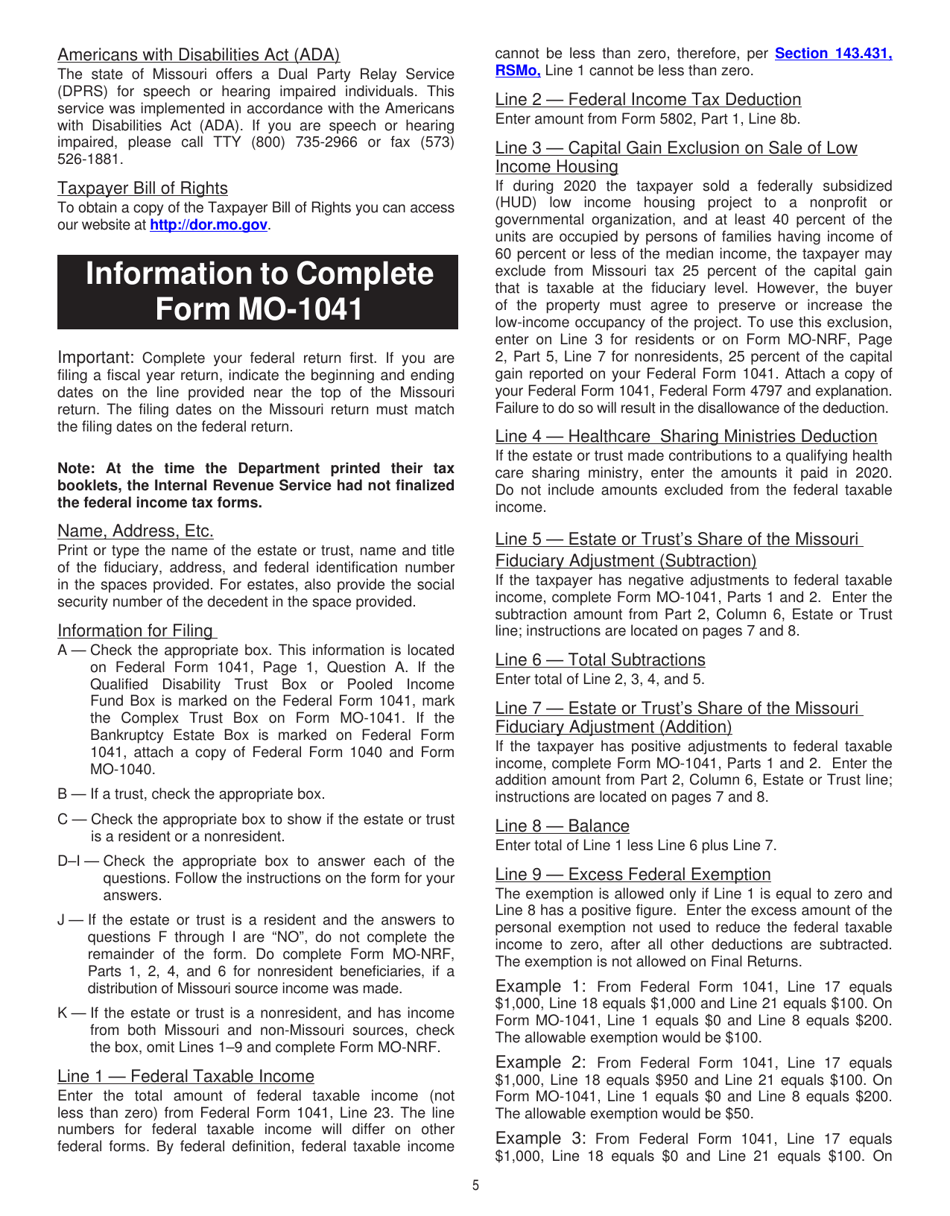

Q: What information is required on Form MO-1041?

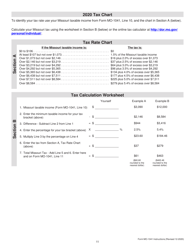

A: Form MO-1041 requires detailed information about the income, deductions, and credits of the estate or trust, as well as information about the beneficiaries.

Q: When is Form MO-1041 due?

A: Form MO-1041 is due on the 15th day of the fourth month following the close of the tax year, which is generally April 15th for calendar year filers.

Q: Are there any special considerations when filing Form MO-1041?

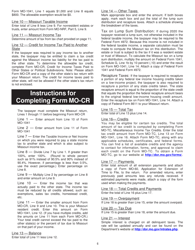

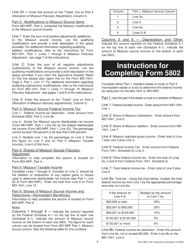

A: Yes, fiduciaries must pay estimated taxes throughout the year and may need to provide additional documentation, such as Schedule MO-A, if claiming certain deductions or credits.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-1041 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.