This version of the form is not currently in use and is provided for reference only. Download this version of

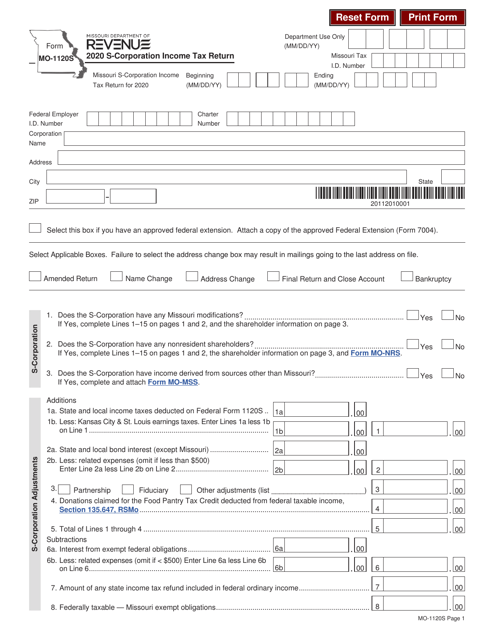

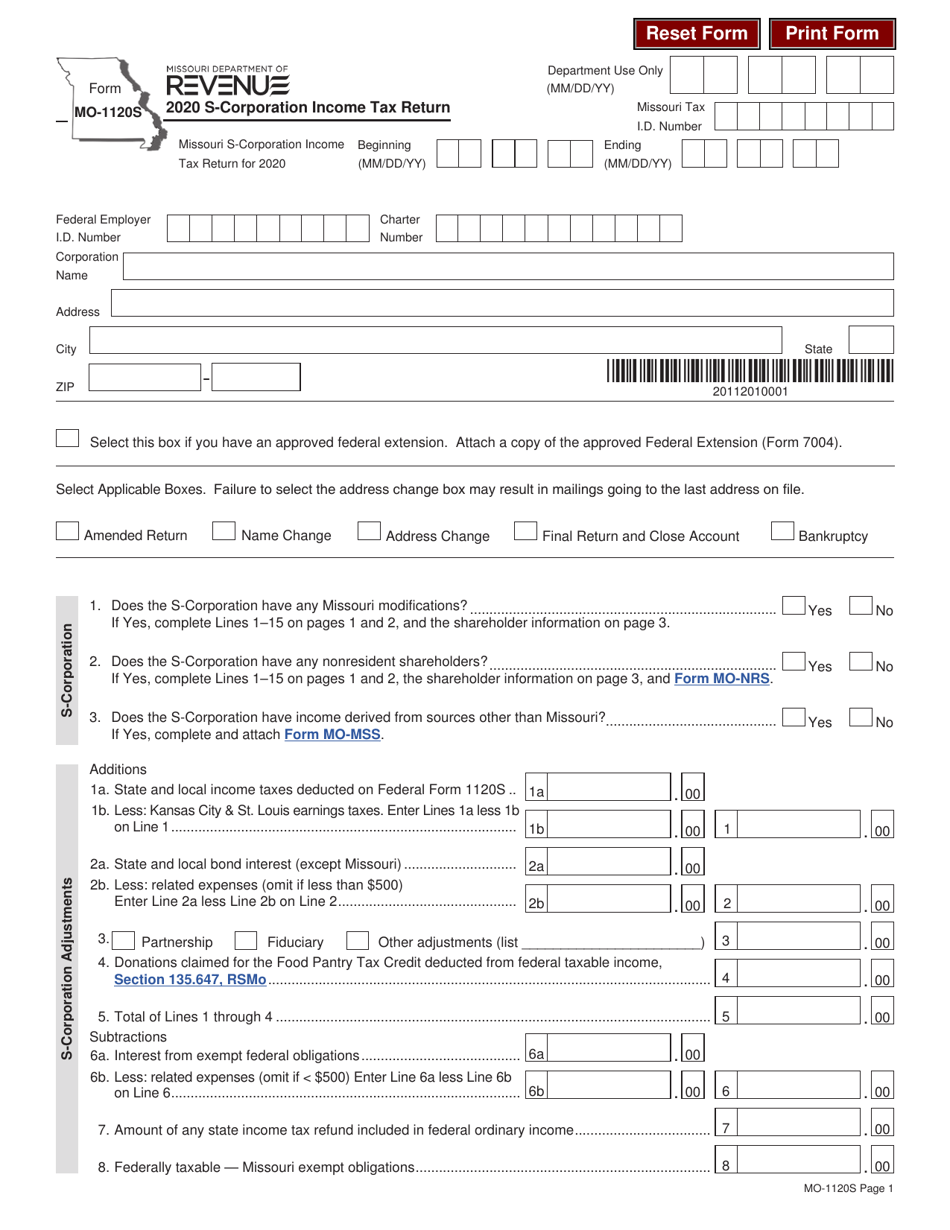

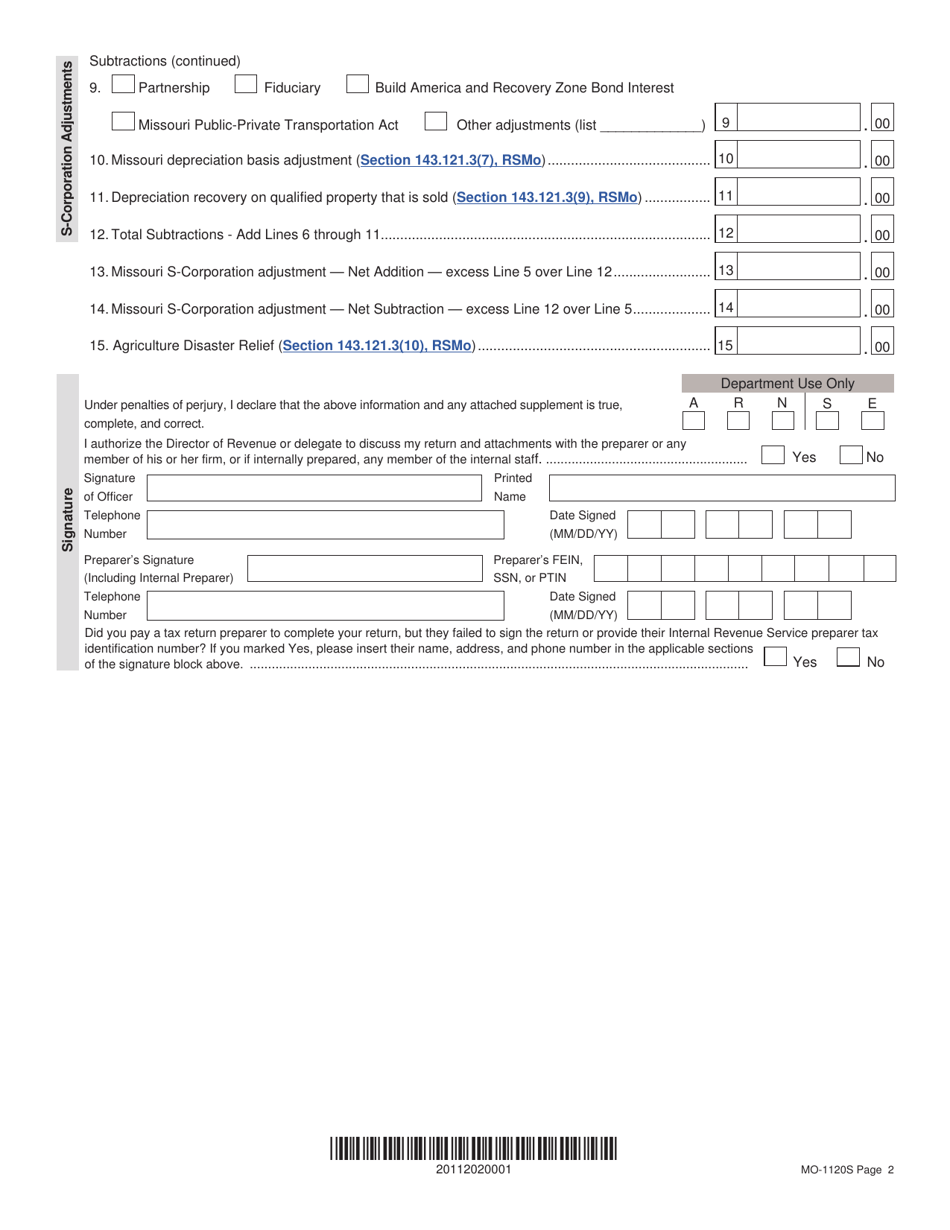

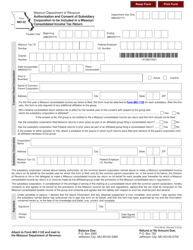

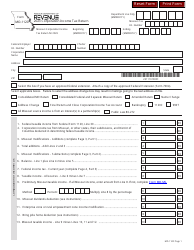

Form MO-1120S

for the current year.

Form MO-1120S S-Corporation Income Tax Return - Missouri

What Is Form MO-1120S?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-1120S?

A: Form MO-1120S is the S-Corporation Income Tax Return form for the state of Missouri.

Q: Who needs to file Form MO-1120S?

A: S-Corporations in Missouri need to file Form MO-1120S.

Q: What is the purpose of Form MO-1120S?

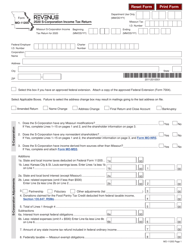

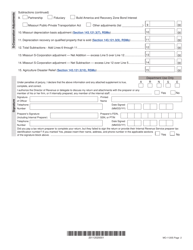

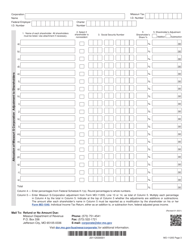

A: Form MO-1120S is used to report the income, deductions, and credits of S-Corporations in Missouri.

Q: What are the deadlines for filing Form MO-1120S?

A: The deadline for filing Form MO-1120S is generally the same as the federal deadline, which is the 15th day of the 3rd month after the end of the tax year.

Q: Are there any penalties for late filing of Form MO-1120S?

A: Yes, there may be penalties for late filing of Form MO-1120S. It is important to file the return and pay any taxes owed on time to avoid these penalties.

Q: Can I e-file Form MO-1120S?

A: Yes, you can e-file Form MO-1120S. Missouri accepts electronic filing for this form.

Q: Do I need to attach any documents to Form MO-1120S?

A: You may need to attach certain supporting documents, such as Schedule K-1s, to Form MO-1120S. Be sure to read the instructions for the form to determine what documents need to be attached.

Q: What do I do if I have questions about Form MO-1120S?

A: If you have questions about Form MO-1120S, you can contact the Missouri Department of Revenue or consult a tax professional for guidance.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-1120S by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.