This version of the form is not currently in use and is provided for reference only. Download this version of

Form MO-5090

for the current year.

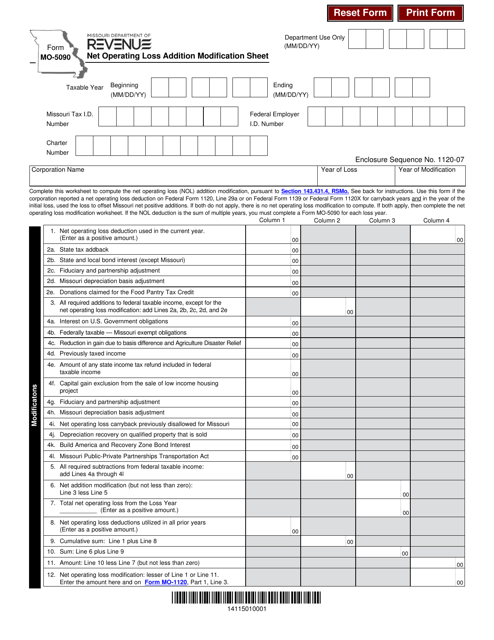

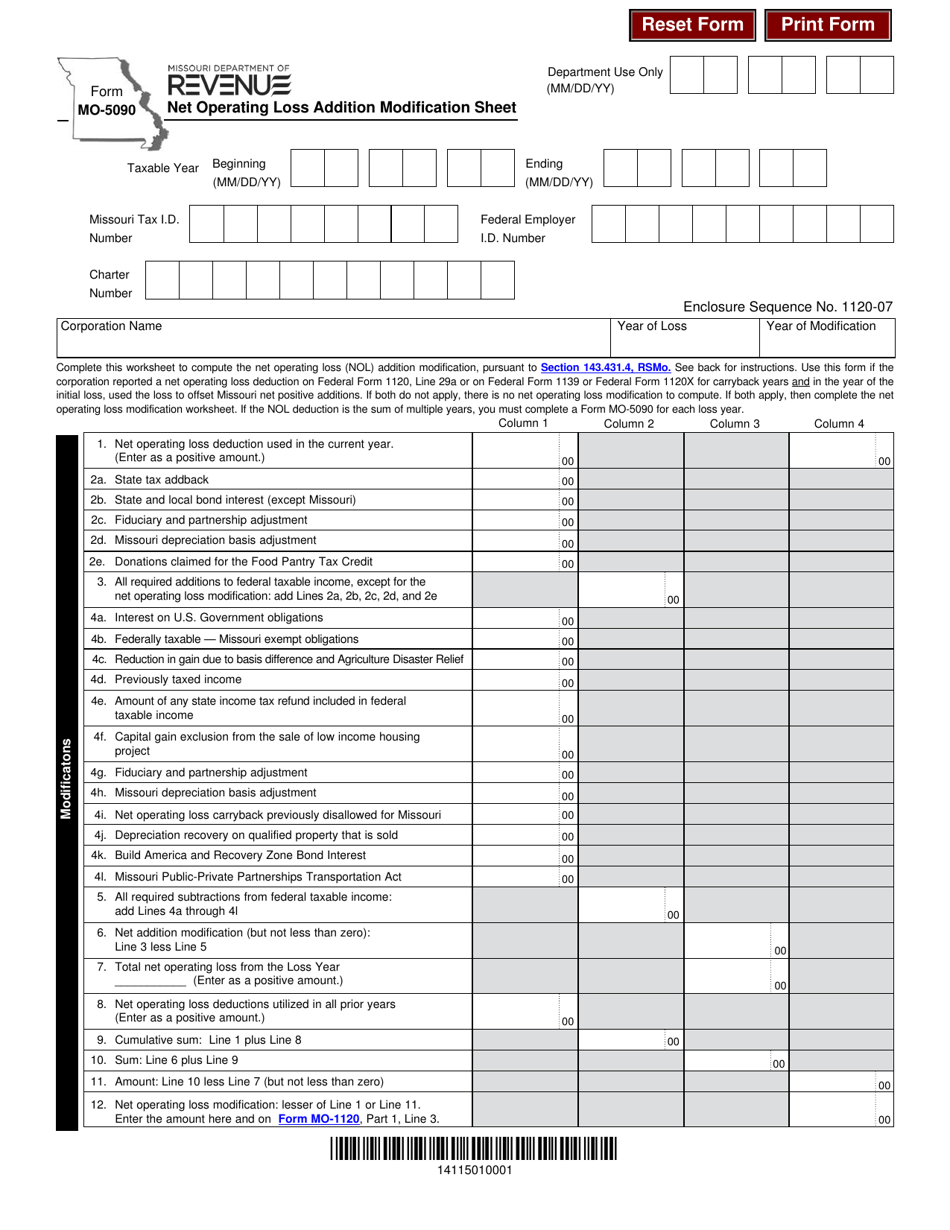

Form MO-5090 Net Operating Loss Addition Modification Sheet - Missouri

What Is Form MO-5090?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

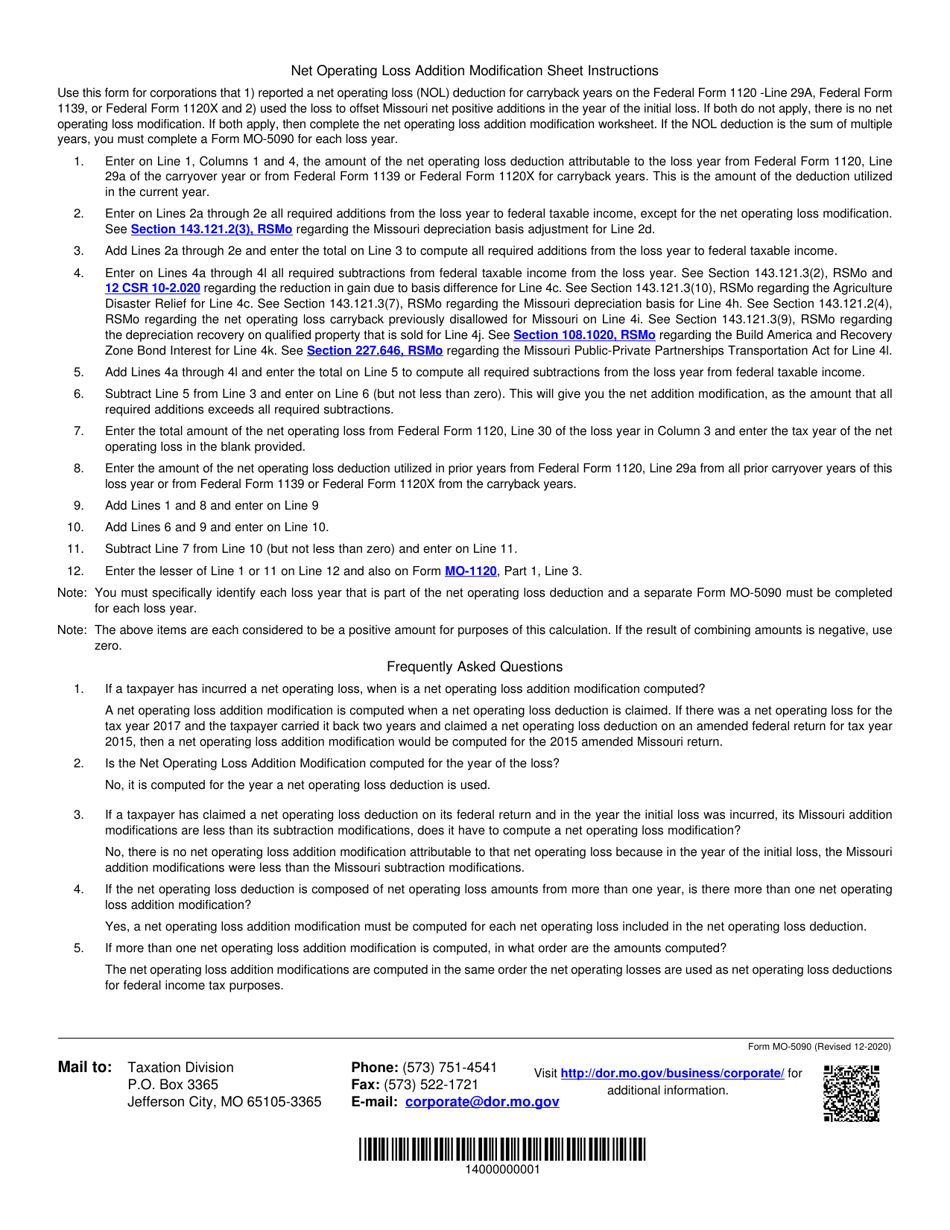

Q: What is Form MO-5090?

A: Form MO-5090 is the Net Operating Loss Addition Modification Sheet for the state of Missouri.

Q: What is a net operating loss?

A: A net operating loss is when a business's total expenses exceed its total income for a particular tax year.

Q: Why do I need to fill out Form MO-5090?

A: You need to fill out Form MO-5090 to report any net operating losses that you are adding back to your Missouri taxable income.

Q: When is Form MO-5090 due?

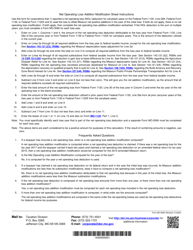

A: The due date for Form MO-5090 varies depending on the tax year. Please refer to the instructions on the form or check with the Missouri Department of Revenue for the specific due date.

Q: Are there any penalties for not filing Form MO-5090?

A: Failure to file Form MO-5090 or including incorrect information may result in penalties and interest charges.

Q: Can I e-file Form MO-5090?

A: Yes, you can e-file Form MO-5090 if you are required to file it.

Q: Do I need to attach any supporting documents with Form MO-5090?

A: You may need to attach supporting documents, such as federal tax forms or schedules, depending on your specific situation. Please refer to the instructions on the form.

Q: Can I amend Form MO-5090 if I made a mistake?

A: Yes, you can amend Form MO-5090 if you made a mistake. You would need to file an amended return with the Missouri Department of Revenue.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-5090 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.