This version of the form is not currently in use and is provided for reference only. Download this version of

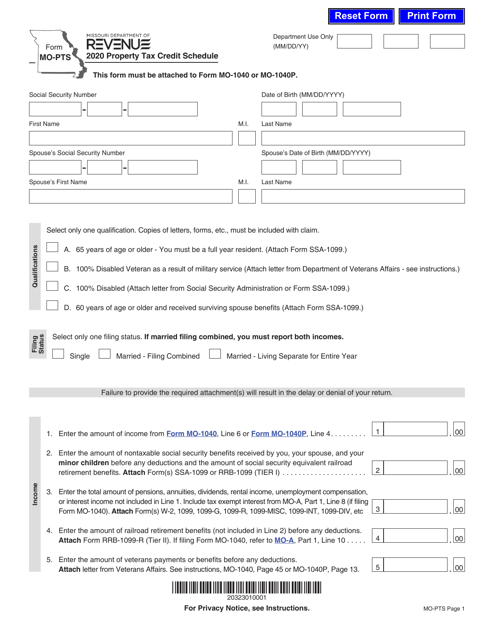

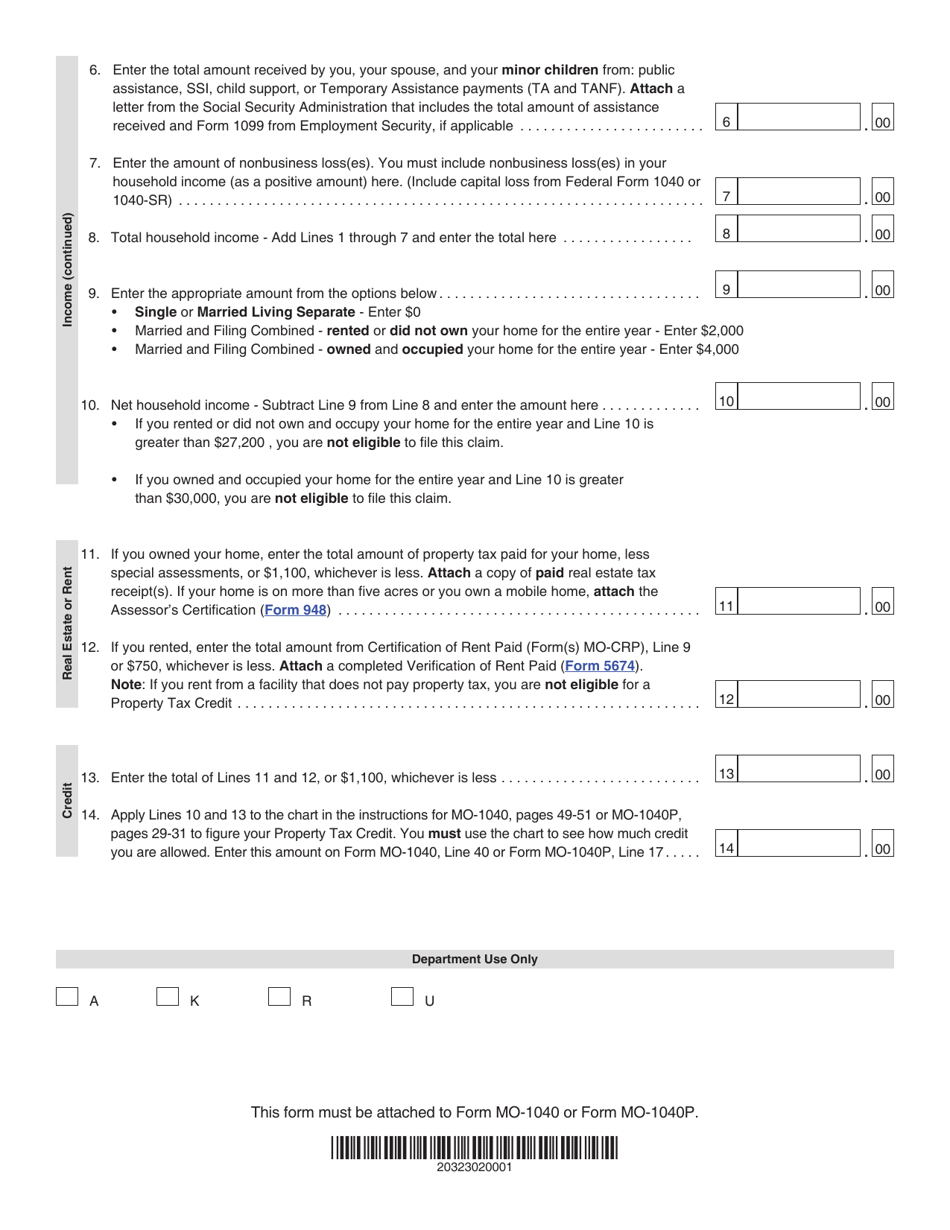

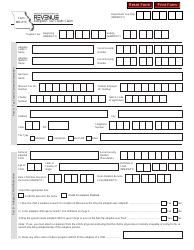

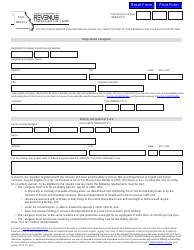

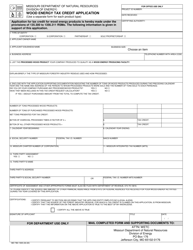

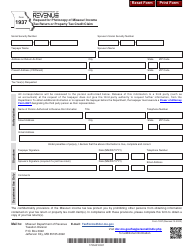

Form MO-PTS

for the current year.

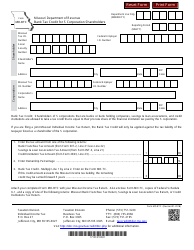

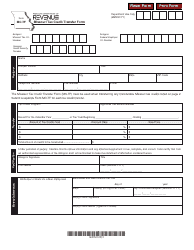

Form MO-PTS Property Tax Credit Schedule - Missouri

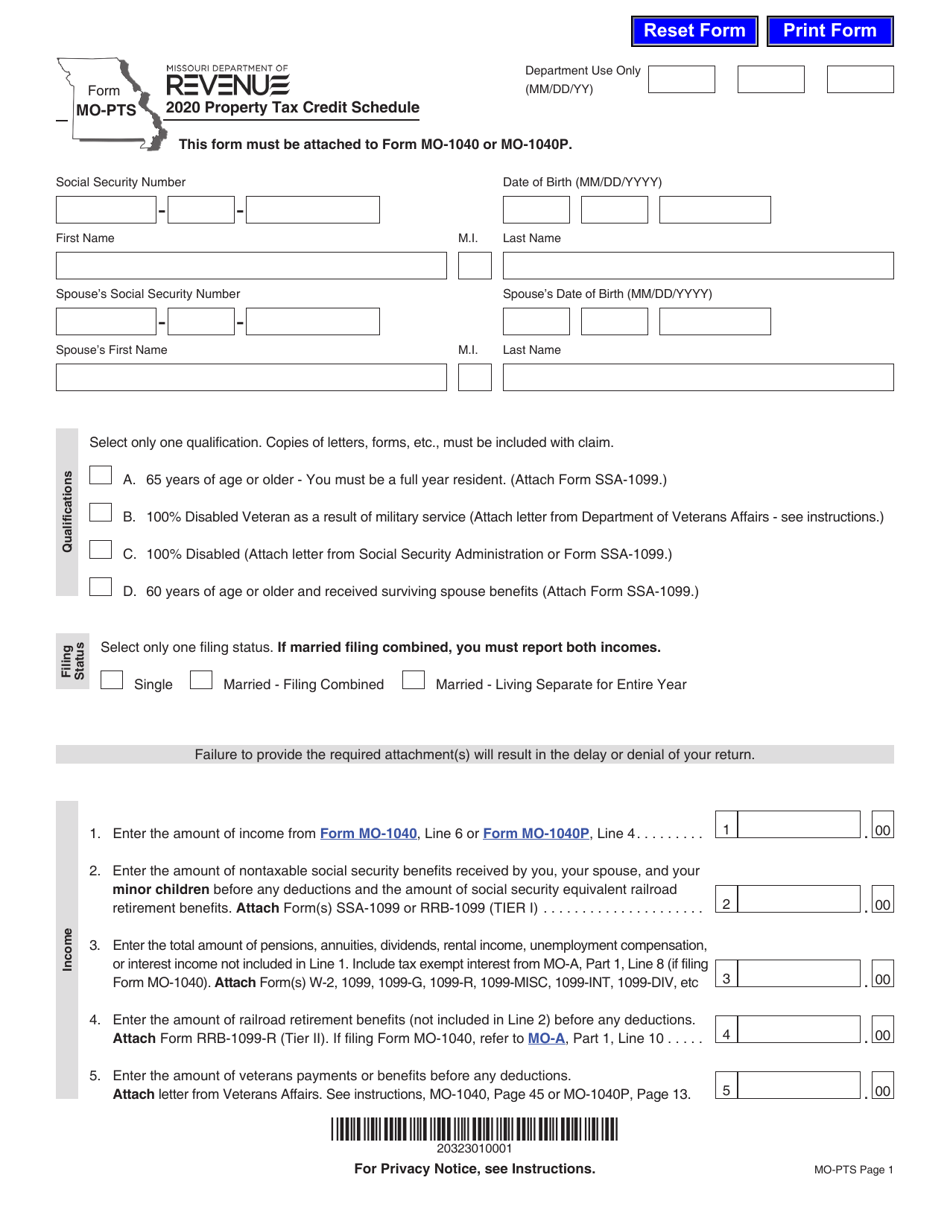

What Is Form MO-PTS?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-PTS?

A: Form MO-PTS is the Property Tax Credit Schedule for the state of Missouri.

Q: What is the purpose of Form MO-PTS?

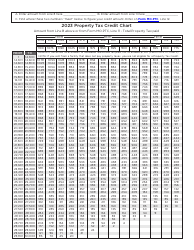

A: The purpose of Form MO-PTS is to calculate and claim the property tax credit for eligible taxpayers in Missouri.

Q: Who needs to file Form MO-PTS?

A: Residents of Missouri who meet certain eligibility criteria and want to claim the property tax credit need to file Form MO-PTS.

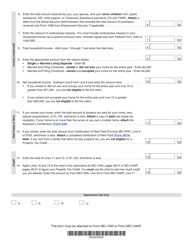

Q: What information is required to complete Form MO-PTS?

A: To complete Form MO-PTS, you will need information about your household income, property taxes paid, and the number of individuals in your household.

Q: When is the deadline to file Form MO-PTS?

A: The deadline to file Form MO-PTS is April 15th of each year.

Q: Is there a fee to file Form MO-PTS?

A: No, there is no fee to file Form MO-PTS.

Q: What happens after I file Form MO-PTS?

A: After you file Form MO-PTS, the Missouri Department of Revenue will review your application and notify you of the amount of property tax credit you are eligible to receive.

Q: Can I amend my Form MO-PTS if I made a mistake?

A: Yes, you can amend your Form MO-PTS if you made a mistake. You will need to file an amended form with the correct information.

Form Details:

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-PTS by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.