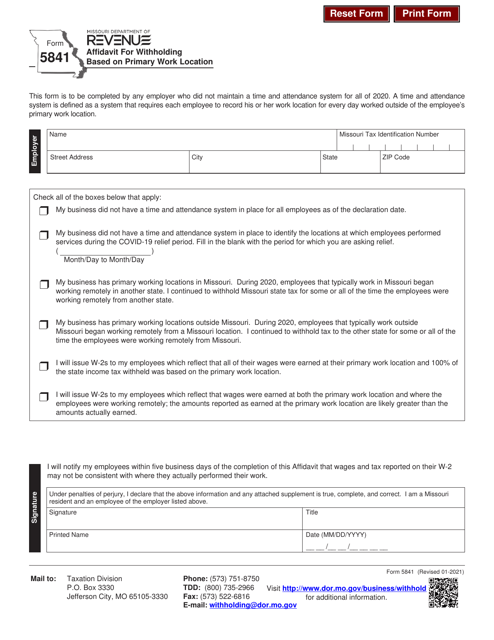

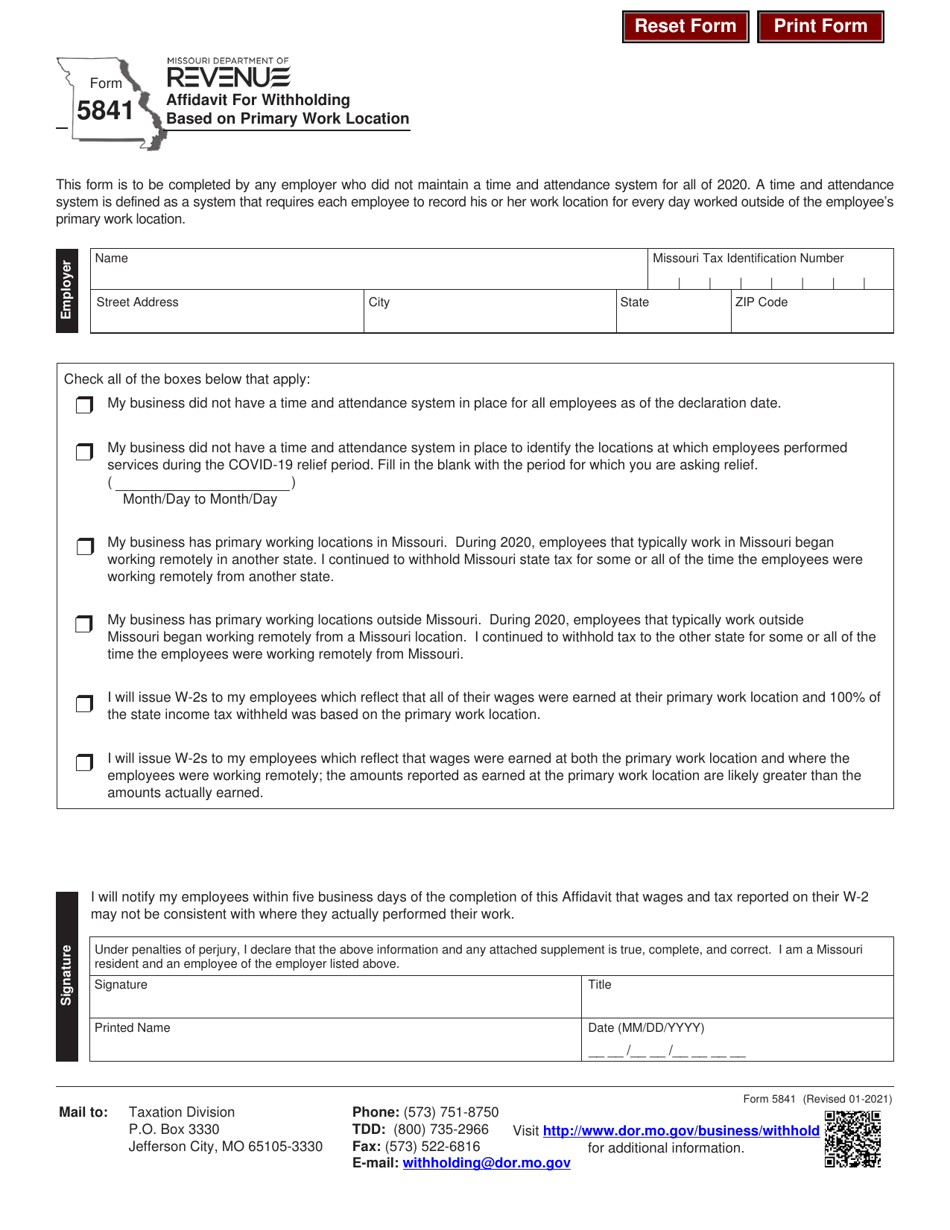

Form 5841 Affidavit for Withholding Based on Primary Work Location - Missouri

What Is Form 5841?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5841?

A: Form 5841 is an affidavit for withholding based on primary work location in Missouri.

Q: Who needs to fill out Form 5841?

A: Employees who work in Missouri and want to have their withholding taxes based on their primary work location.

Q: Why would someone need to fill out Form 5841?

A: To ensure that their taxes are withheld based on their primary work location in Missouri.

Q: How do I fill out Form 5841?

A: You need to provide your personal information, employer information, and indicate your primary work location.

Q: What should I do with completed Form 5841?

A: You should submit the form to your employer for them to adjust your withholding taxes accordingly.

Q: Are there any fees associated with Form 5841?

A: No, there are no fees associated with Form 5841.

Q: Can I change my primary work location on Form 5841?

A: Yes, you can change your primary work location by filling out a new Form 5841 if your work location changes.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5841 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.