This version of the form is not currently in use and is provided for reference only. Download this version of

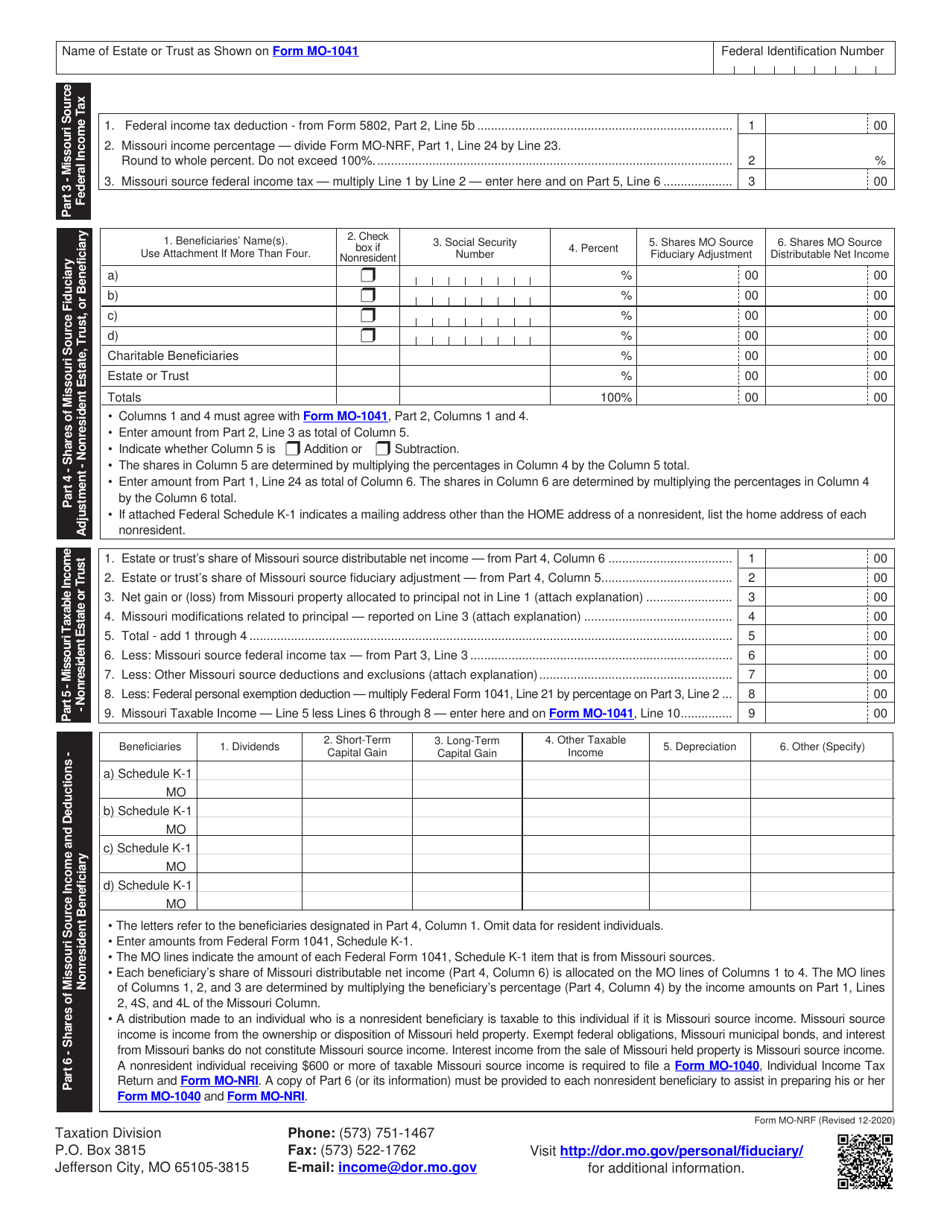

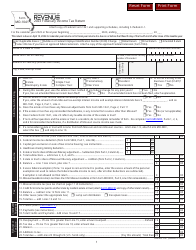

Form MO-NRF

for the current year.

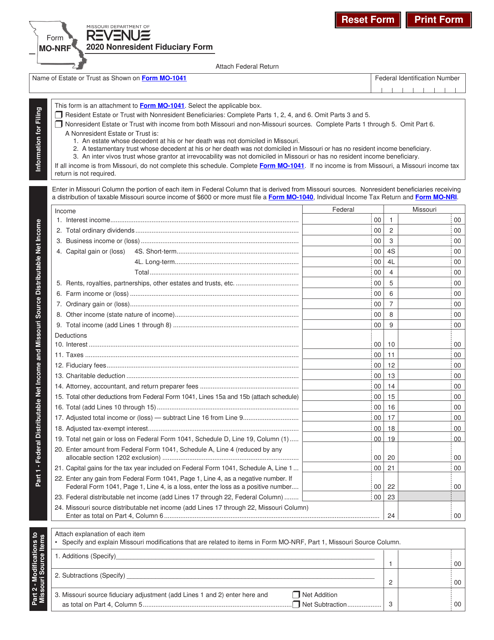

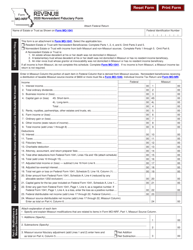

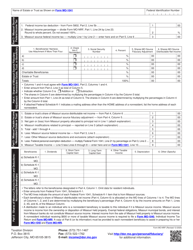

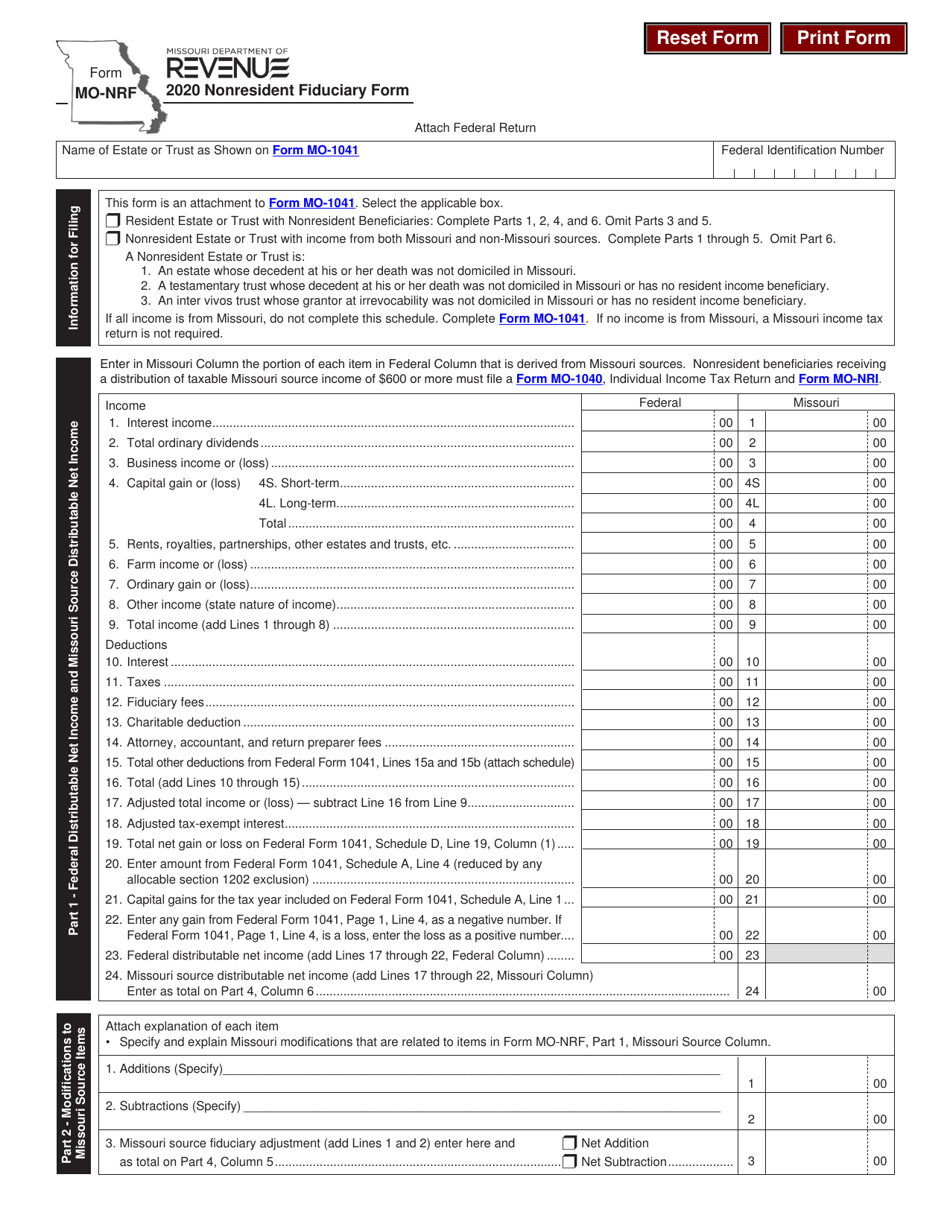

Form MO-NRF Nonresident Fiduciary Form - Missouri

What Is Form MO-NRF?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MO-NRF Nonresident Fiduciary Form?

A: The MO-NRF Nonresident Fiduciary Form is a tax form used by nonresident fiduciaries to report income from Missouri sources.

Q: Who needs to file the MO-NRF Nonresident Fiduciary Form?

A: Nonresident fiduciaries who have income from Missouri sources need to file this form.

Q: What is considered income from Missouri sources?

A: Income from Missouri sources includes income from real or tangible personal property in Missouri, income from a business, profession, or occupation carried out in Missouri, and income from any other activity in Missouri.

Q: What is the deadline for filing the MO-NRF Nonresident Fiduciary Form?

A: The form must be filed on or before April 15th of the following year.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing. It is important to file the form on time to avoid penalties and interest charges.

Q: Can I e-file the MO-NRF Nonresident Fiduciary Form?

A: No, the form must be filed on paper and mailed to the Missouri Department of Revenue.

Q: Do I need to include any supporting documents with the form?

A: Yes, you should include copies of federal Form 1041 and all schedules, as well as any other supporting documents.

Q: Is there a separate form for claiming a refund?

A: No, you can use the MO-NRF Nonresident Fiduciary Form to claim a refund if you have overpaid your taxes.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-NRF by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.