This version of the form is not currently in use and is provided for reference only. Download this version of

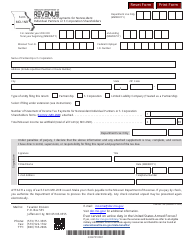

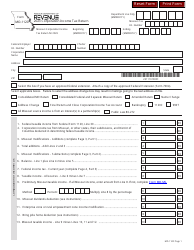

Form MO-MSS

for the current year.

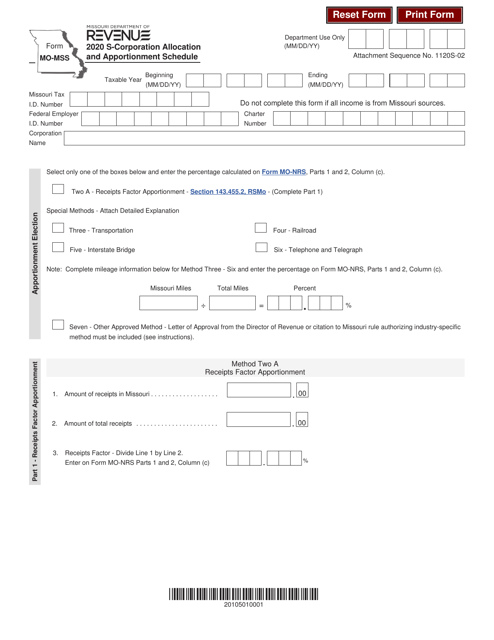

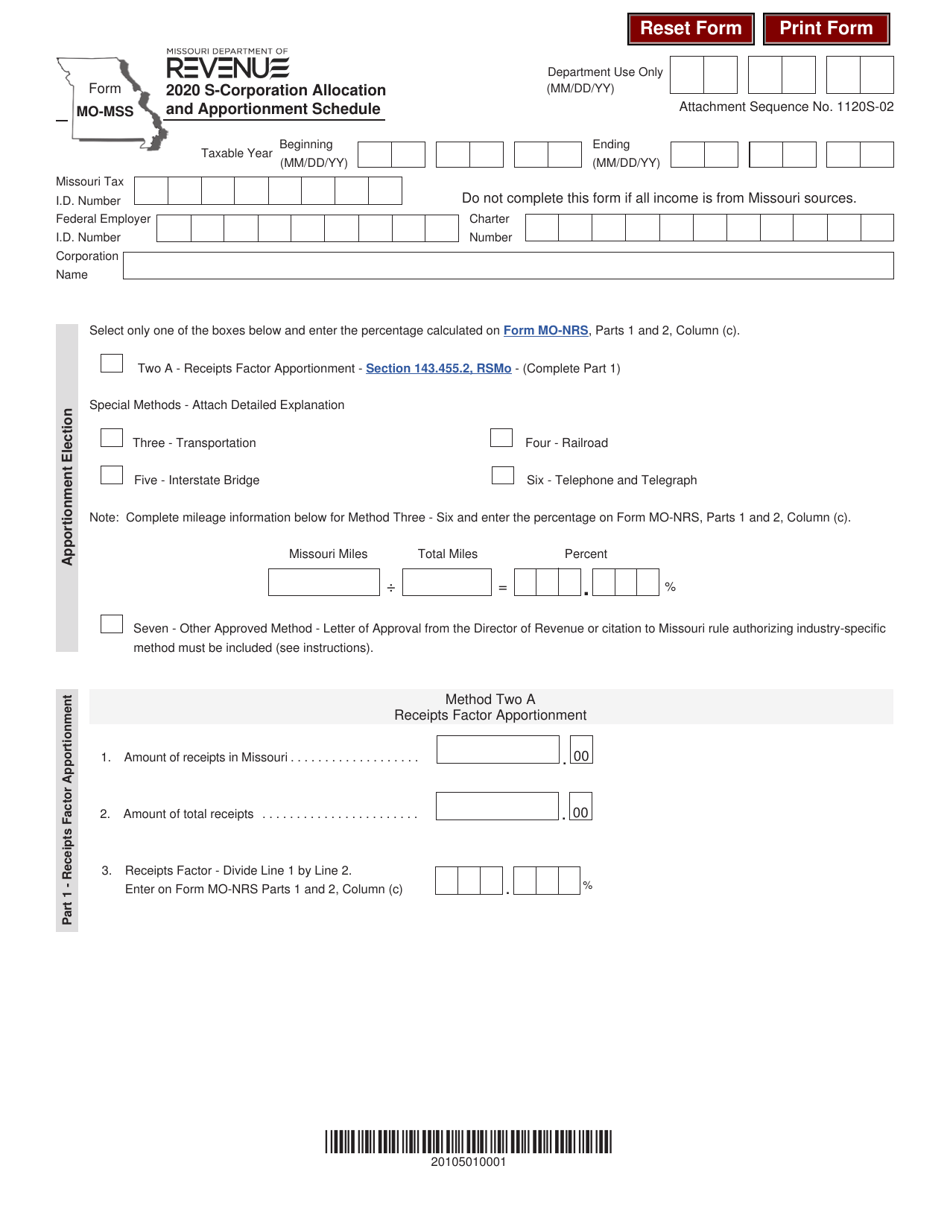

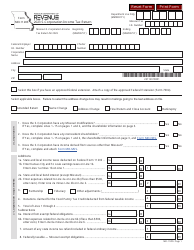

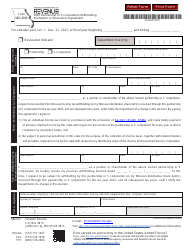

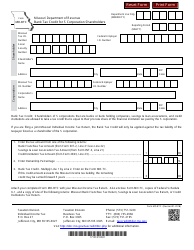

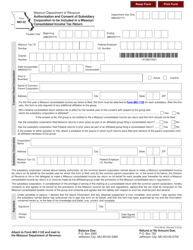

Form MO-MSS S-Corporation Allocation and Apportionment Schedule - Missouri

What Is Form MO-MSS?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

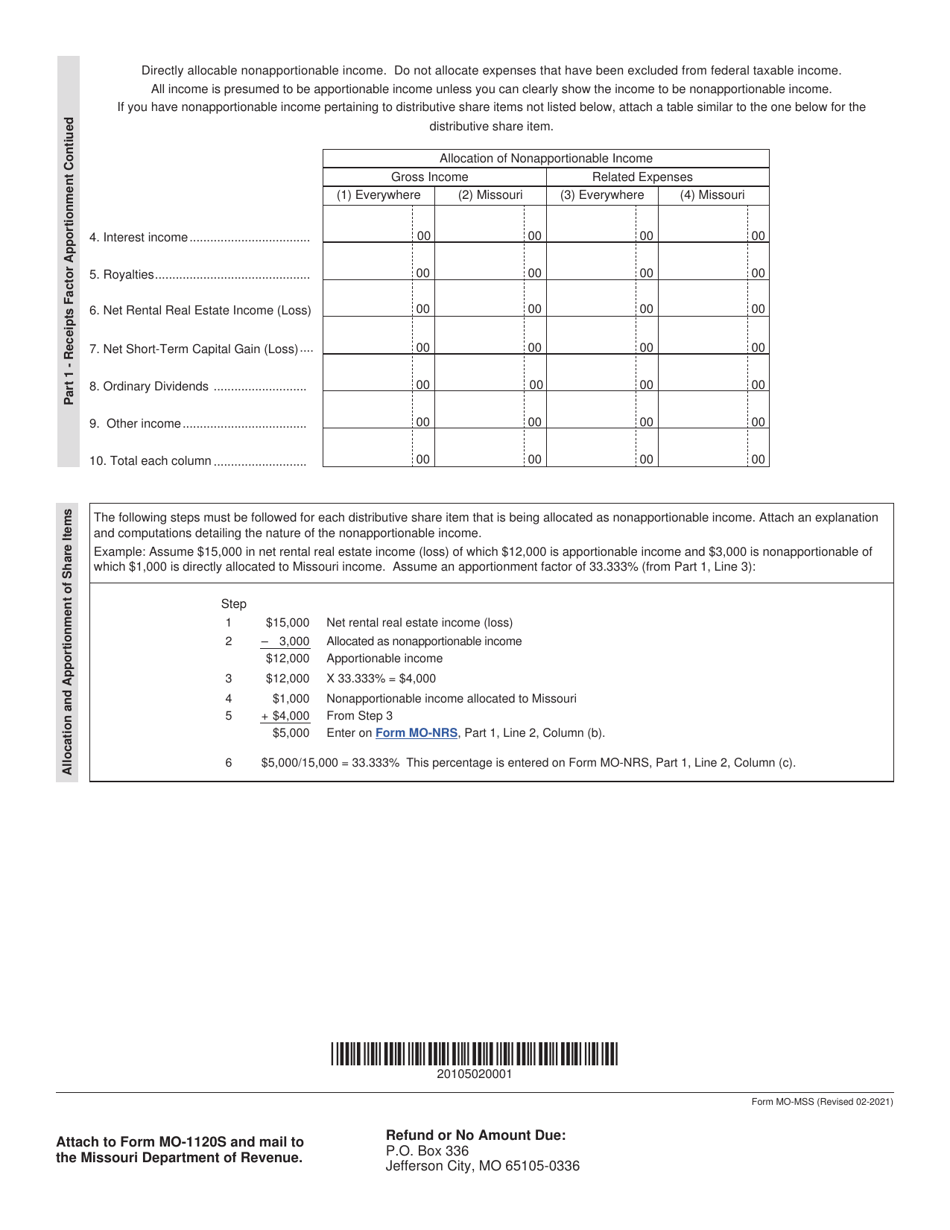

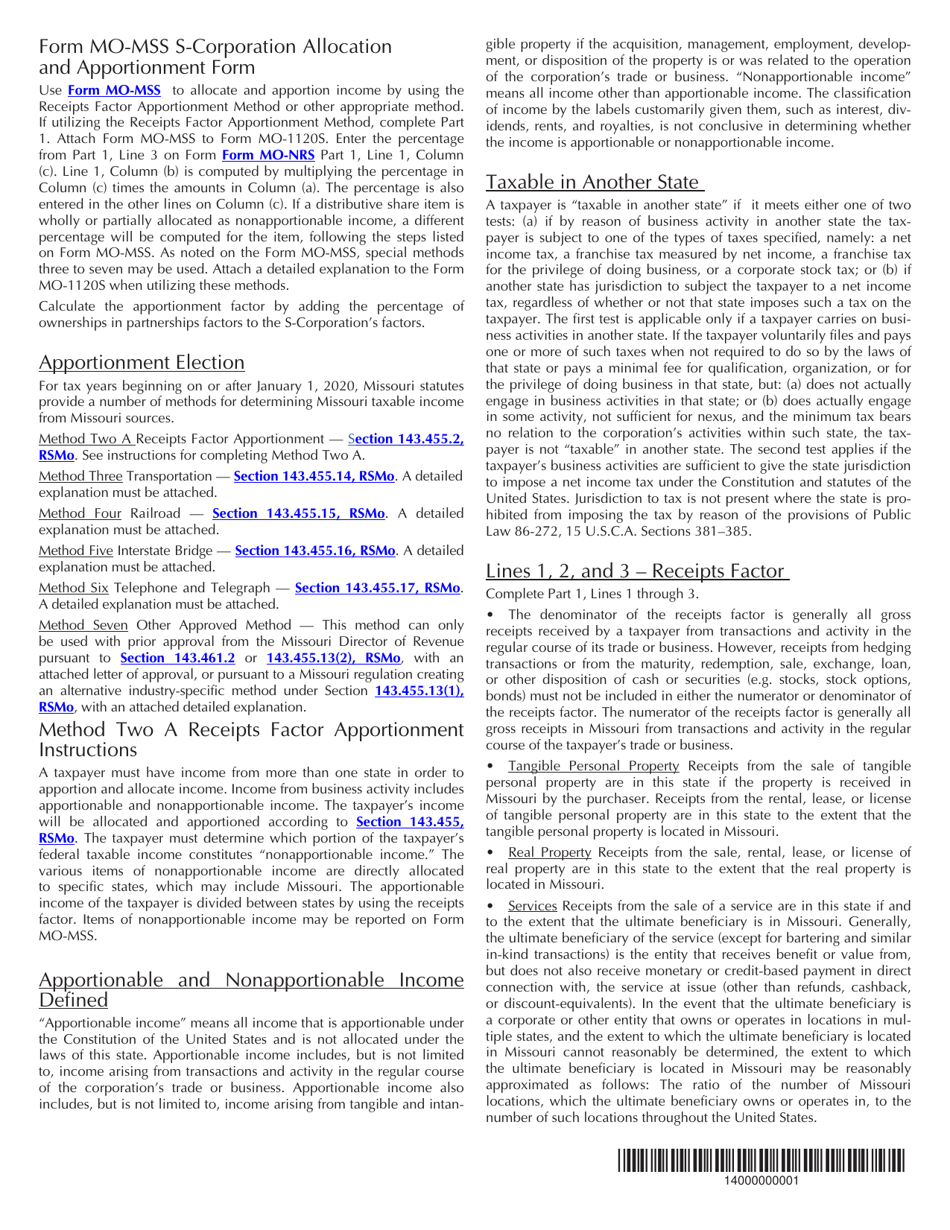

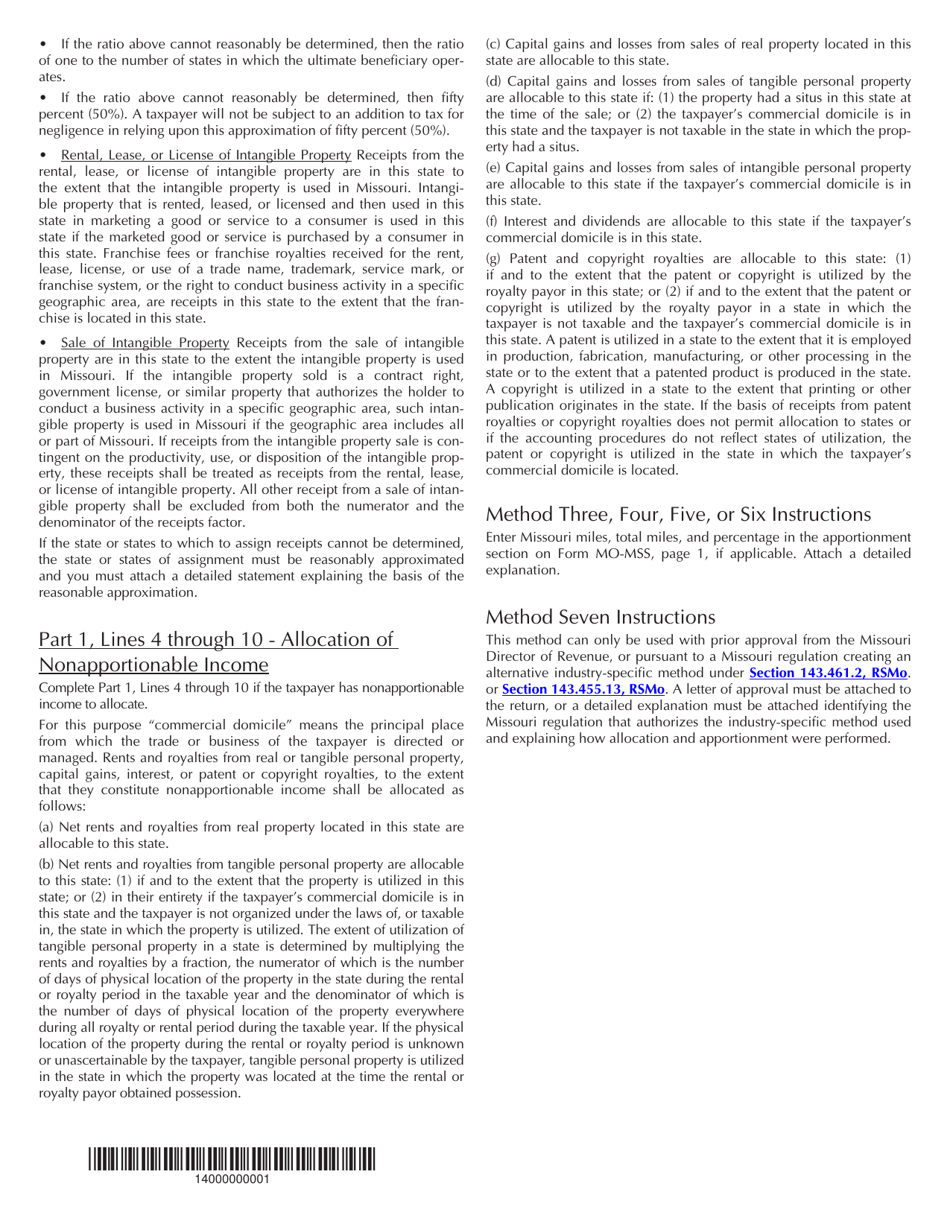

Q: What is the Form MO-MSS S-Corporation Allocation and Apportionment Schedule?

A: The Form MO-MSS S-Corporation Allocation and Apportionment Schedule is a document that S-Corporations in Missouri use to report their income allocation and apportionment for tax purposes.

Q: Who needs to file Form MO-MSS?

A: S-Corporations that are doing business in Missouri and have income to report and allocate and apportion for tax purposes need to file Form MO-MSS.

Q: What is the purpose of Form MO-MSS?

A: The purpose of Form MO-MSS is to determine the portion of the S-Corporation's income that is attributable to Missouri and to determine the proper apportionment of that income.

Q: When is Form MO-MSS due?

A: Form MO-MSS is due on the same date as the S-Corporation's federal income tax return, which is typically March 15th.

Q: What information do I need to file Form MO-MSS?

A: To file Form MO-MSS, you'll need the S-Corporation's federal income tax return, as well as information about the S-Corporation's income allocation and apportionment.

Q: Are there any penalties for not filing Form MO-MSS?

A: Yes, there are penalties for failure to file Form MO-MSS, including late filing penalties and interest on any unpaid tax amounts.

Q: What do I do with Form MO-MSS after filing?

A: After filing Form MO-MSS, you should keep a copy of the form for your records and provide a copy to your tax preparer, if applicable.

Q: Can I amend Form MO-MSS if I make a mistake?

A: Yes, if you make a mistake on Form MO-MSS, you can file an amended version of the form to correct the error.

Form Details:

- Released on February 1, 2021;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-MSS by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.