This version of the form is not currently in use and is provided for reference only. Download this version of

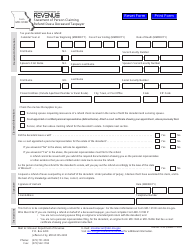

Form MO-NRS

for the current year.

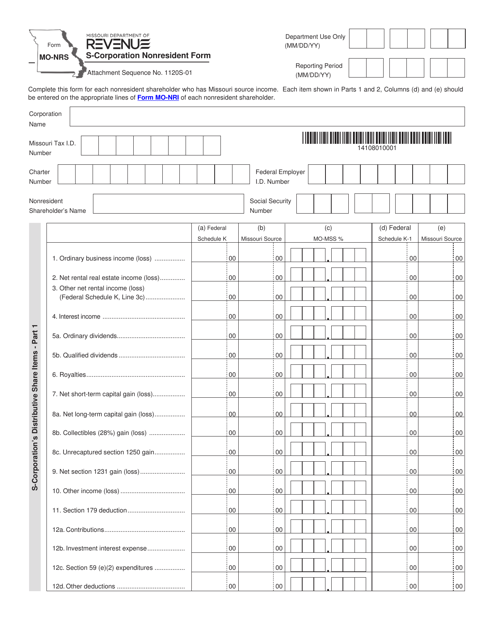

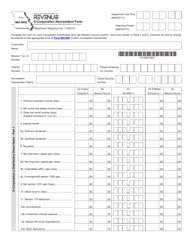

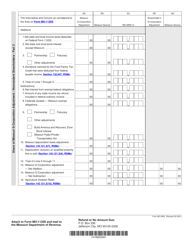

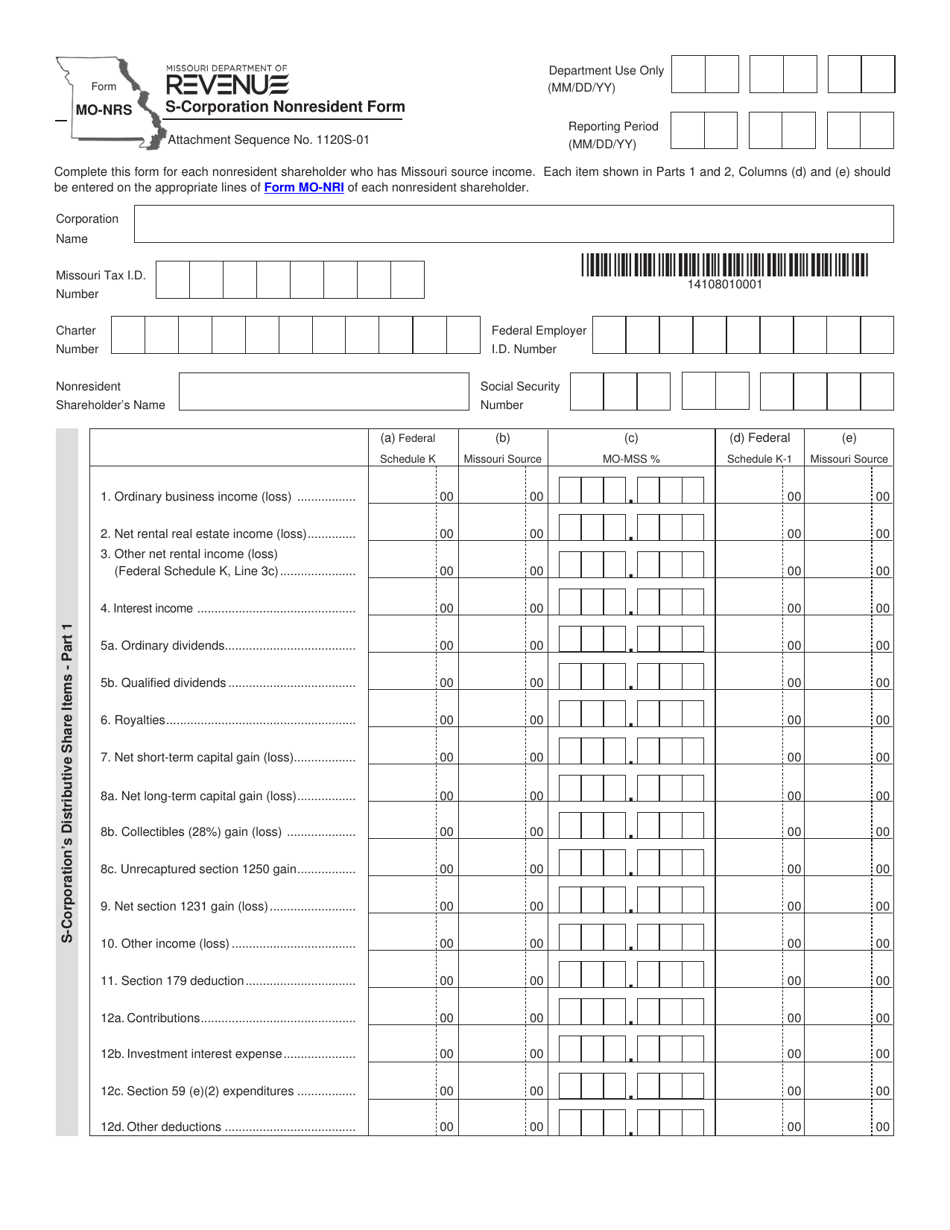

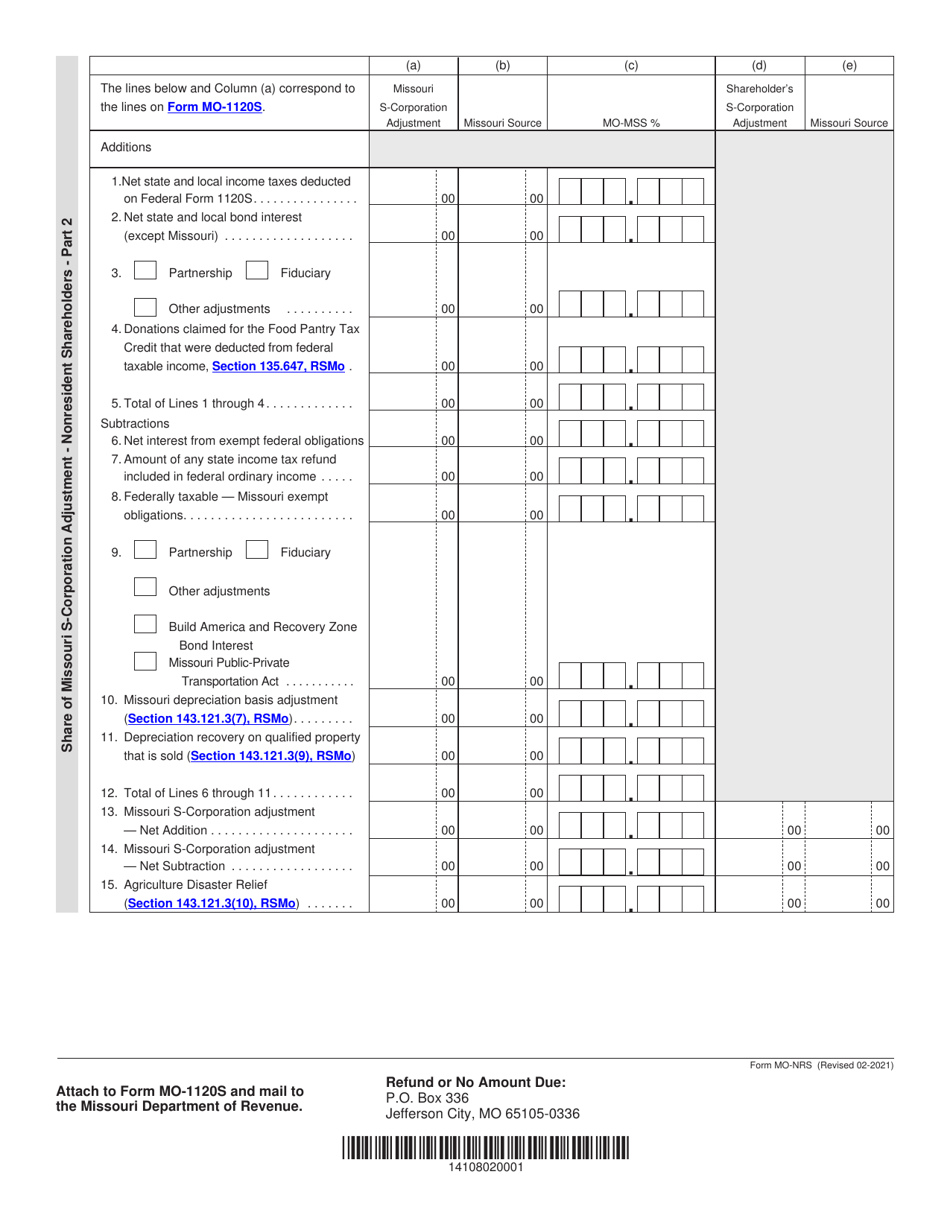

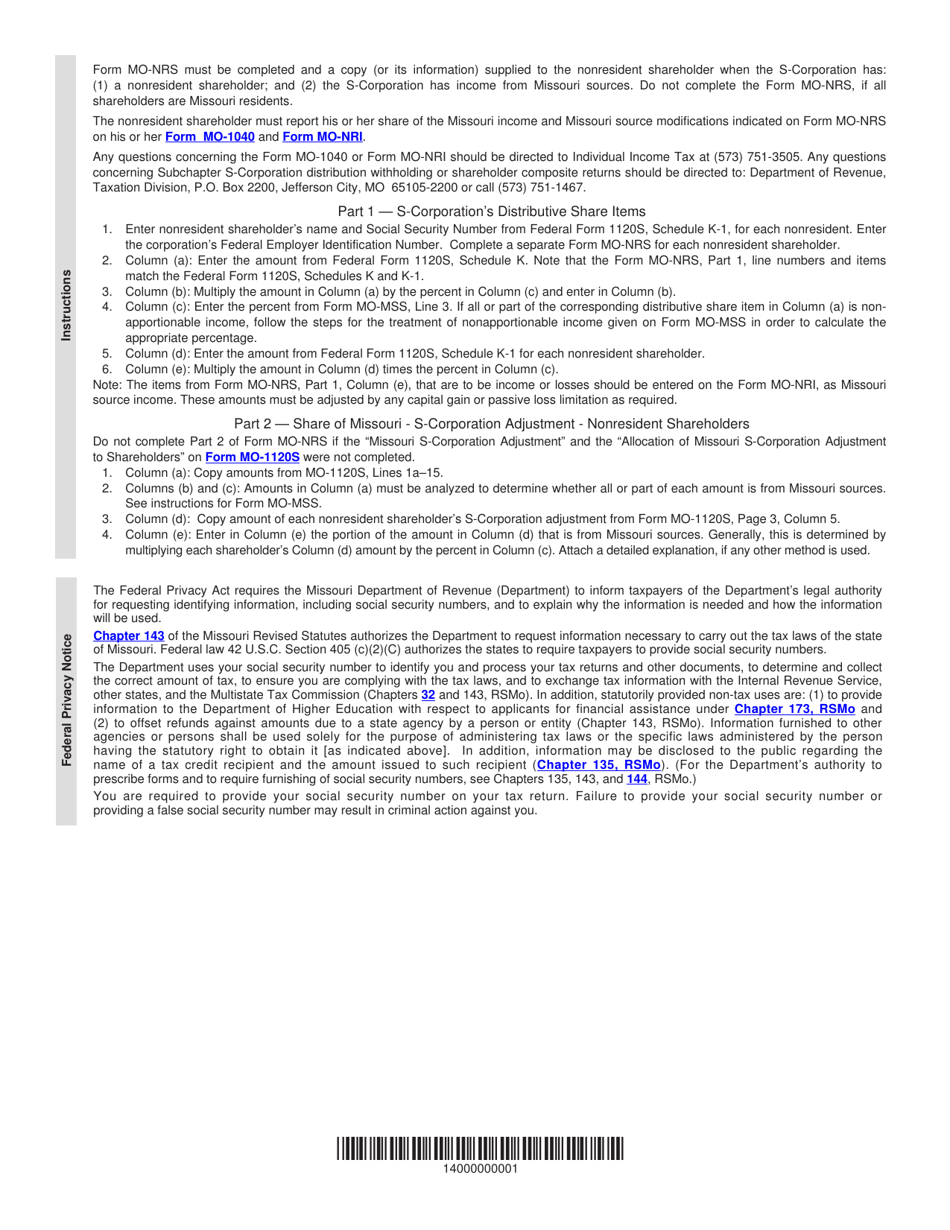

Form MO-NRS S-Corporation Nonresident Form - Missouri

What Is Form MO-NRS?

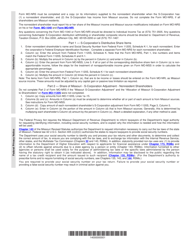

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the MO-NRS S-Corporation Nonresident Form?

A: The MO-NRS S-Corporation Nonresident Form is a form required by the state of Missouri for S-Corporations that have nonresident shareholders.

Q: Who needs to file the MO-NRS S-Corporation Nonresident Form?

A: S-Corporations in Missouri with nonresident shareholders need to file the MO-NRS S-Corporation Nonresident Form.

Q: What is the purpose of the MO-NRS S-Corporation Nonresident Form?

A: The purpose of the MO-NRS S-Corporation Nonresident Form is to report the income and deductions of nonresident shareholders of a S-Corporation in Missouri.

Q: When is the deadline to file the MO-NRS S-Corporation Nonresident Form?

A: The deadline to file the MO-NRS S-Corporation Nonresident Form is the same as the deadline for filing the S-Corporation's federal tax return, which is typically March 15th.

Q: What happens if the MO-NRS S-Corporation Nonresident Form is not filed?

A: If the MO-NRS S-Corporation Nonresident Form is not filed, the S-Corporation may be subject to penalties and interest on any unpaid taxes.

Form Details:

- Released on February 1, 2021;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-NRS by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.