This version of the form is not currently in use and is provided for reference only. Download this version of

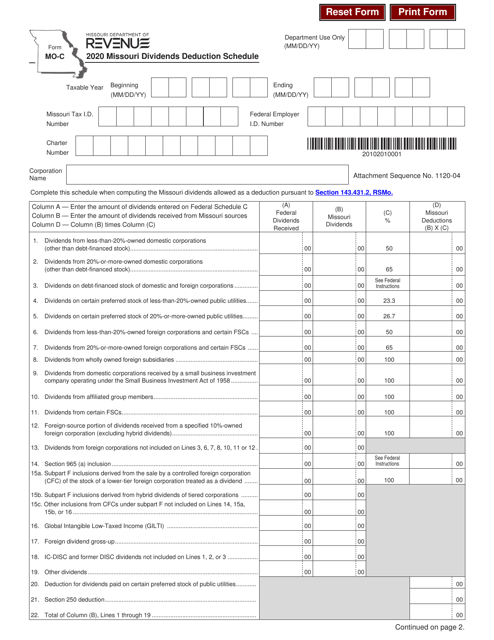

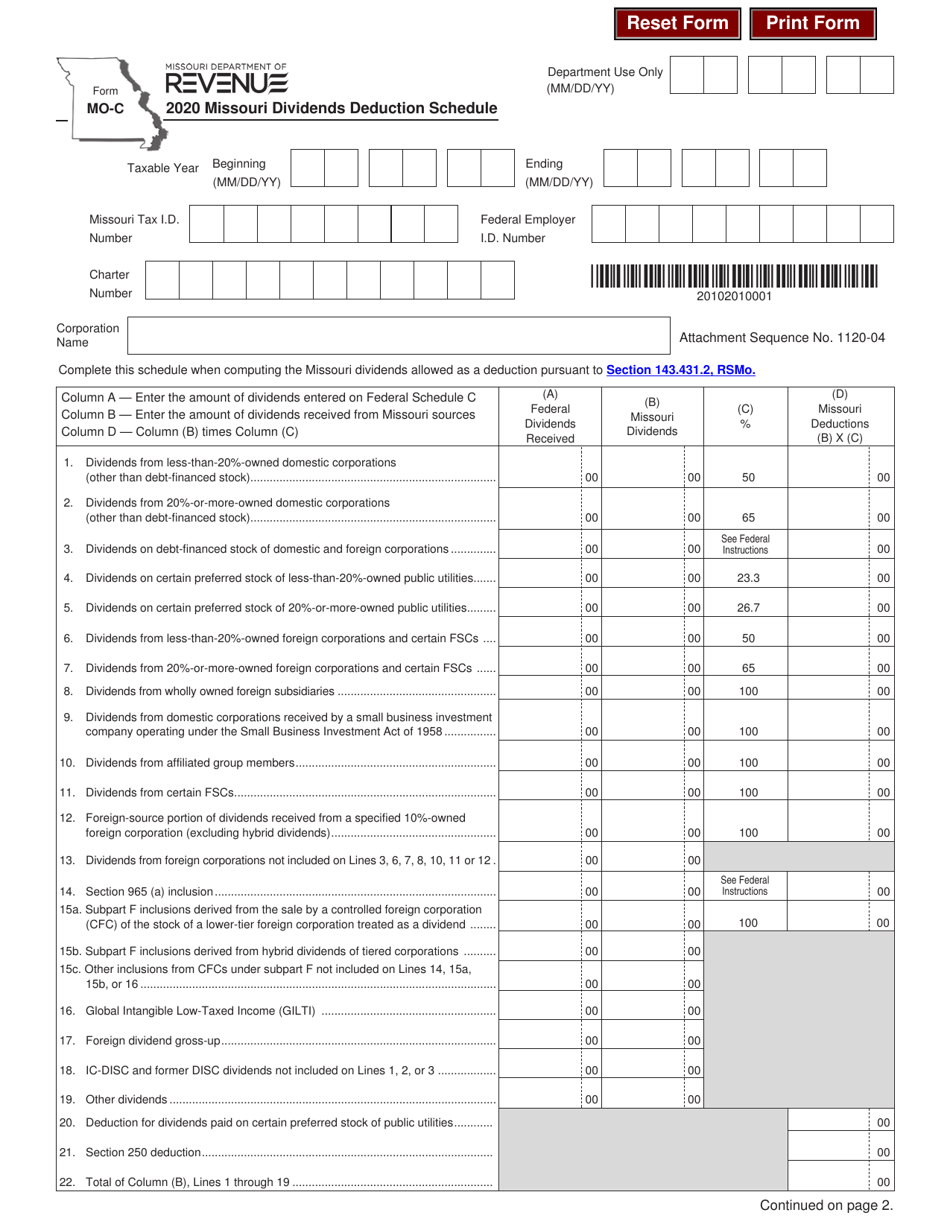

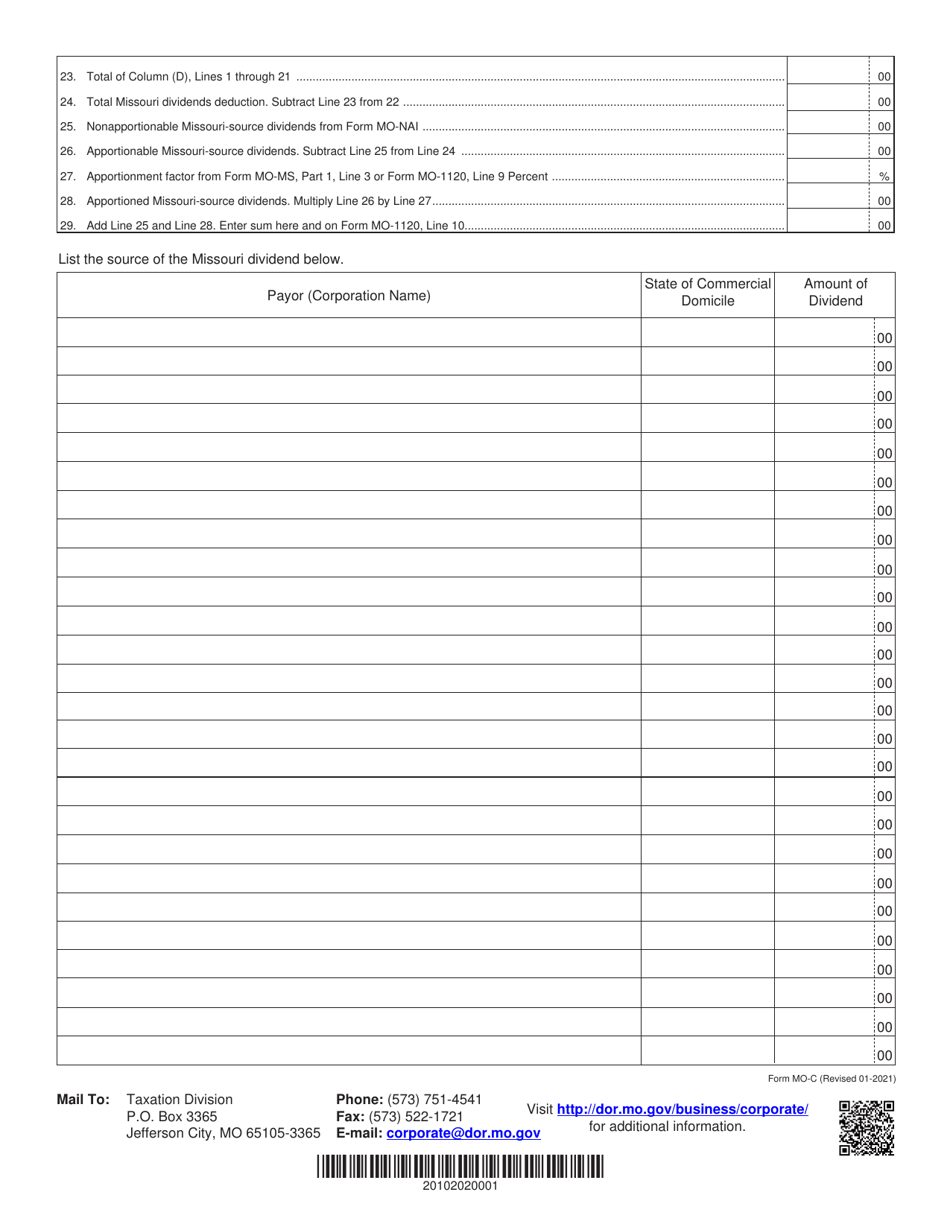

Form MO-C

for the current year.

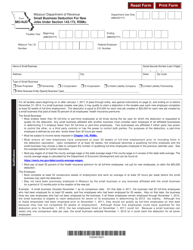

Form MO-C Missouri Dividends Deduction Schedule - Missouri

What Is Form MO-C?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

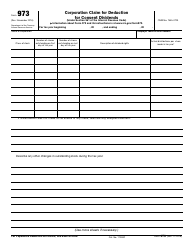

Q: What is Form MO-C?

A: Form MO-C is the Missouri Dividends Deduction Schedule.

Q: What is the purpose of Form MO-C?

A: The purpose of Form MO-C is to report dividends deductions on your Missouri state tax return.

Q: Who needs to file Form MO-C?

A: You need to file Form MO-C if you claimed a deduction for dividends on your federal tax return and are also claiming a similar deduction on your Missouri state tax return.

Q: What information do I need to complete Form MO-C?

A: To complete Form MO-C, you will need information about your dividends and any deductions you are claiming.

Q: When is the deadline for filing Form MO-C?

A: The deadline for filing Form MO-C is the same as the deadline for filing your Missouri state income tax return, which is typically April 15th.

Q: Can I e-file Form MO-C?

A: Yes, you can e-file Form MO-C using approved software or through a tax professional.

Q: What should I do with Form MO-C once I have completed it?

A: Once you have completed Form MO-C, you should attach it to your Missouri state tax return.

Q: Is there a fee for filing Form MO-C?

A: There is no fee for filing Form MO-C.

Q: What if I made a mistake on Form MO-C?

A: If you made a mistake on Form MO-C, you can file an amended return using Form MO-1040X.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-C by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.