This version of the form is not currently in use and is provided for reference only. Download this version of

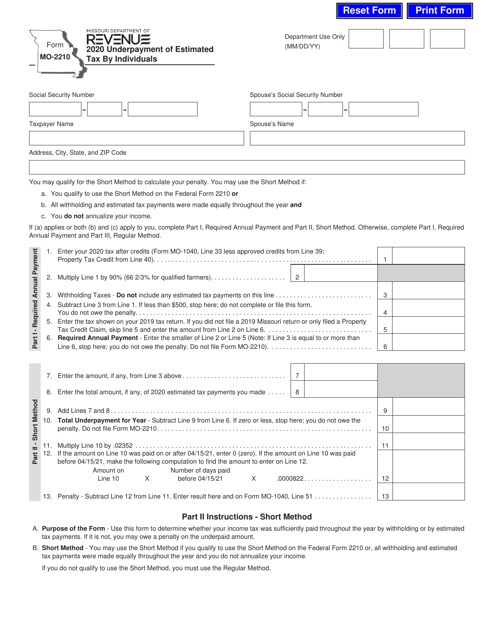

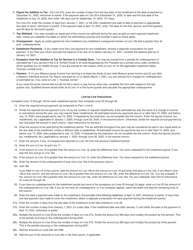

Form MO-2210

for the current year.

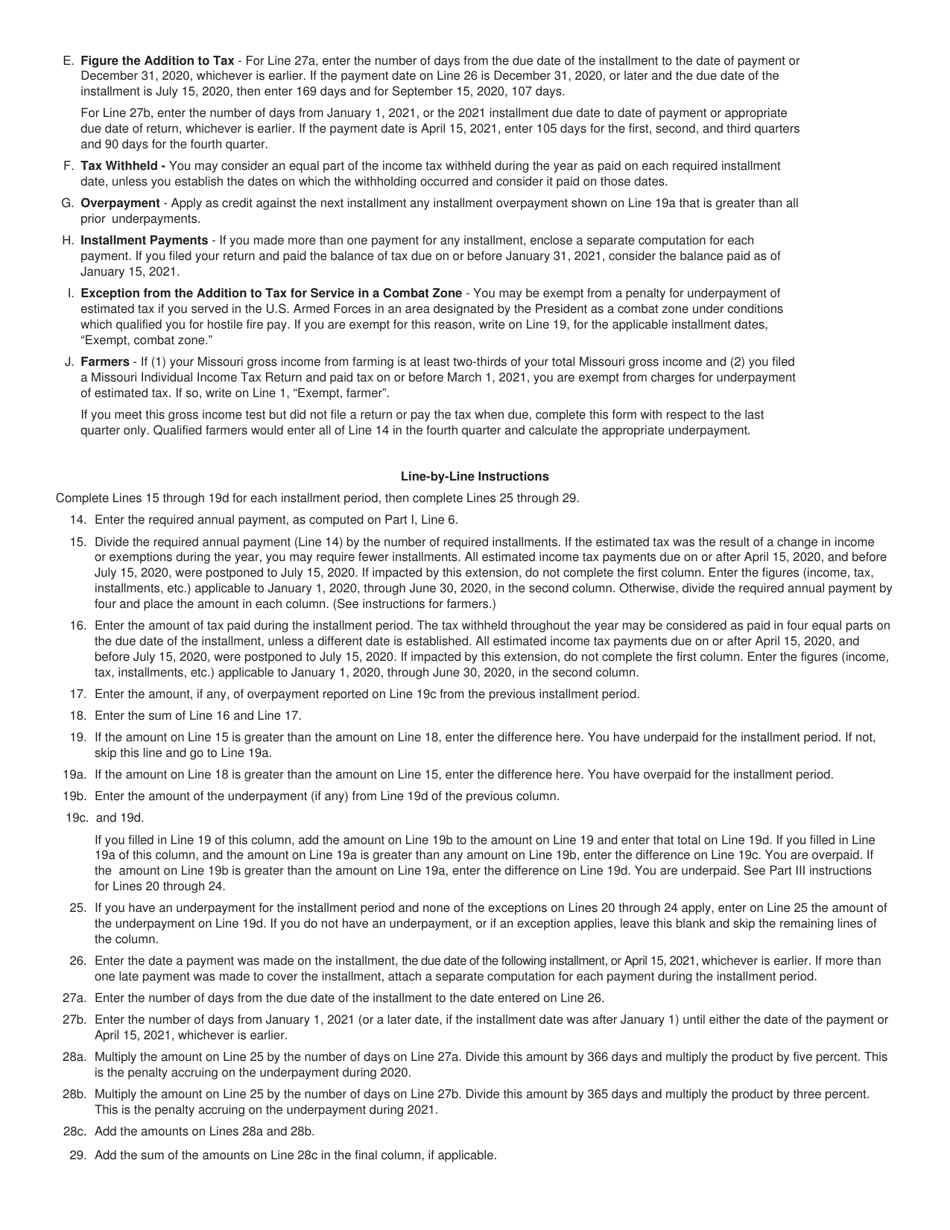

Form MO-2210 Underpayment of Estimated Tax by Individuals - Missouri

What Is Form MO-2210?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form MO-2210?

A: Form MO-2210 is a tax form used by individuals in Missouri to calculate and report any underpayment of estimated tax.

Q: Who needs to file Form MO-2210?

A: Any individual in Missouri who has underpaid their estimated tax for the tax year needs to file Form MO-2210.

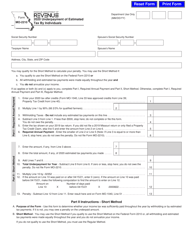

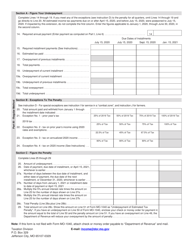

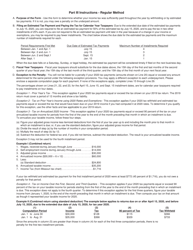

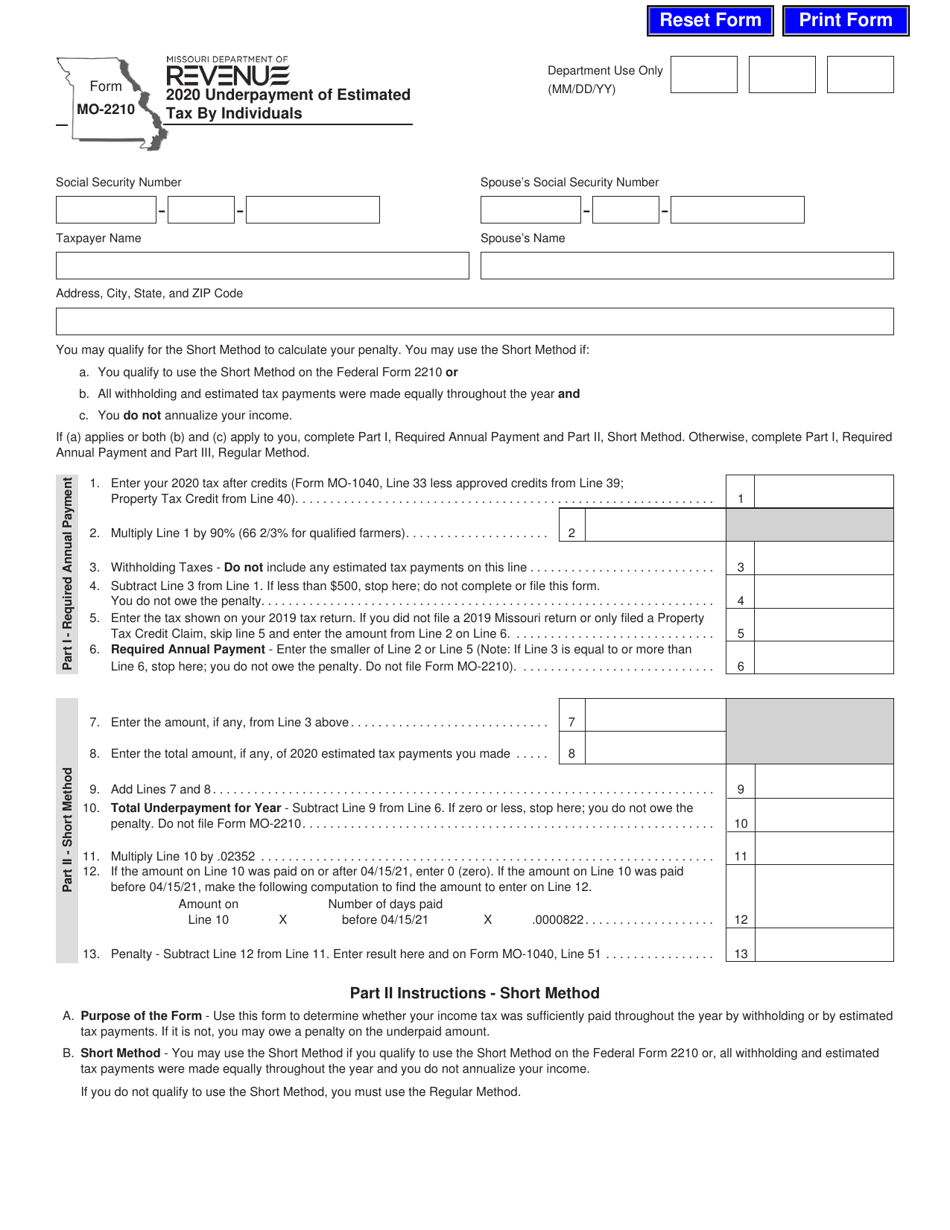

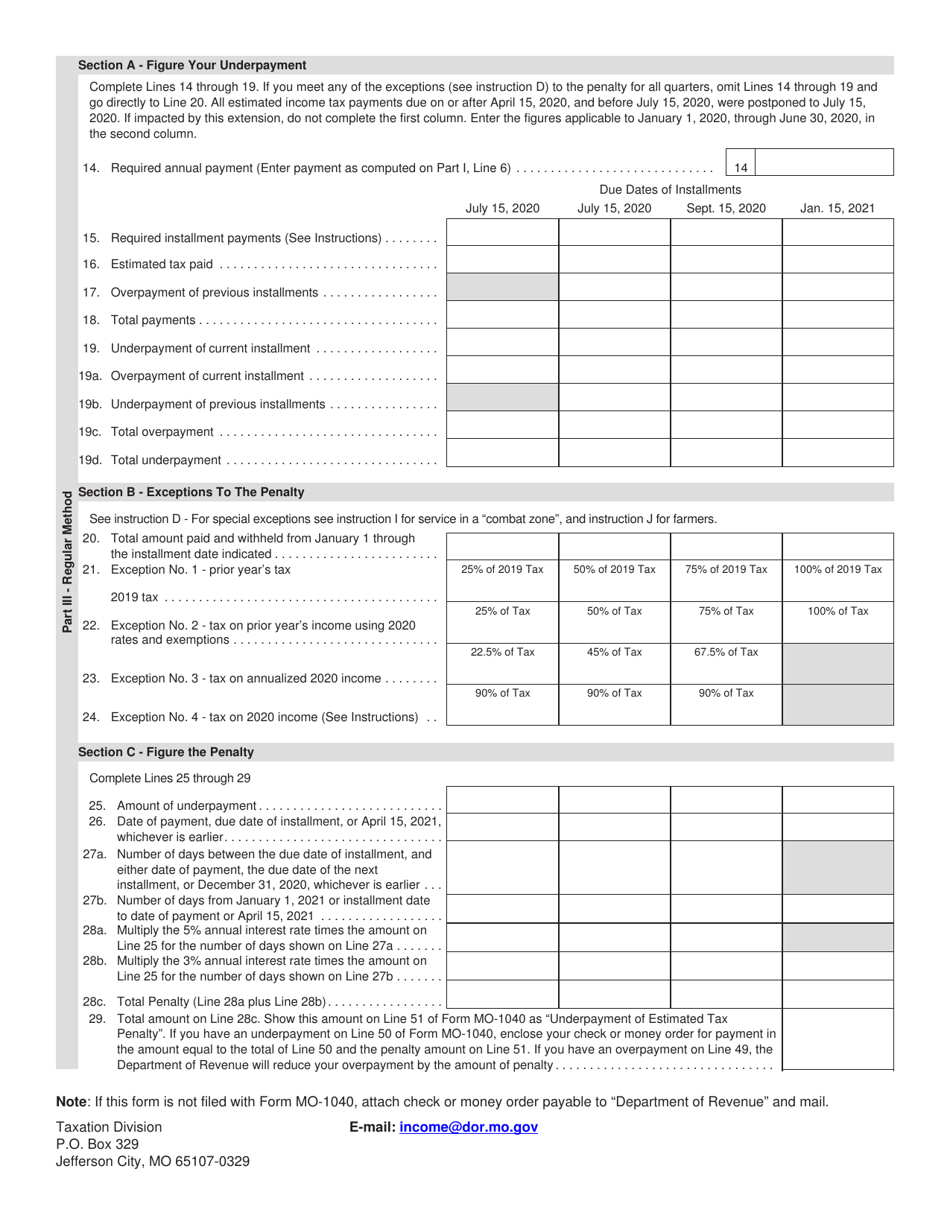

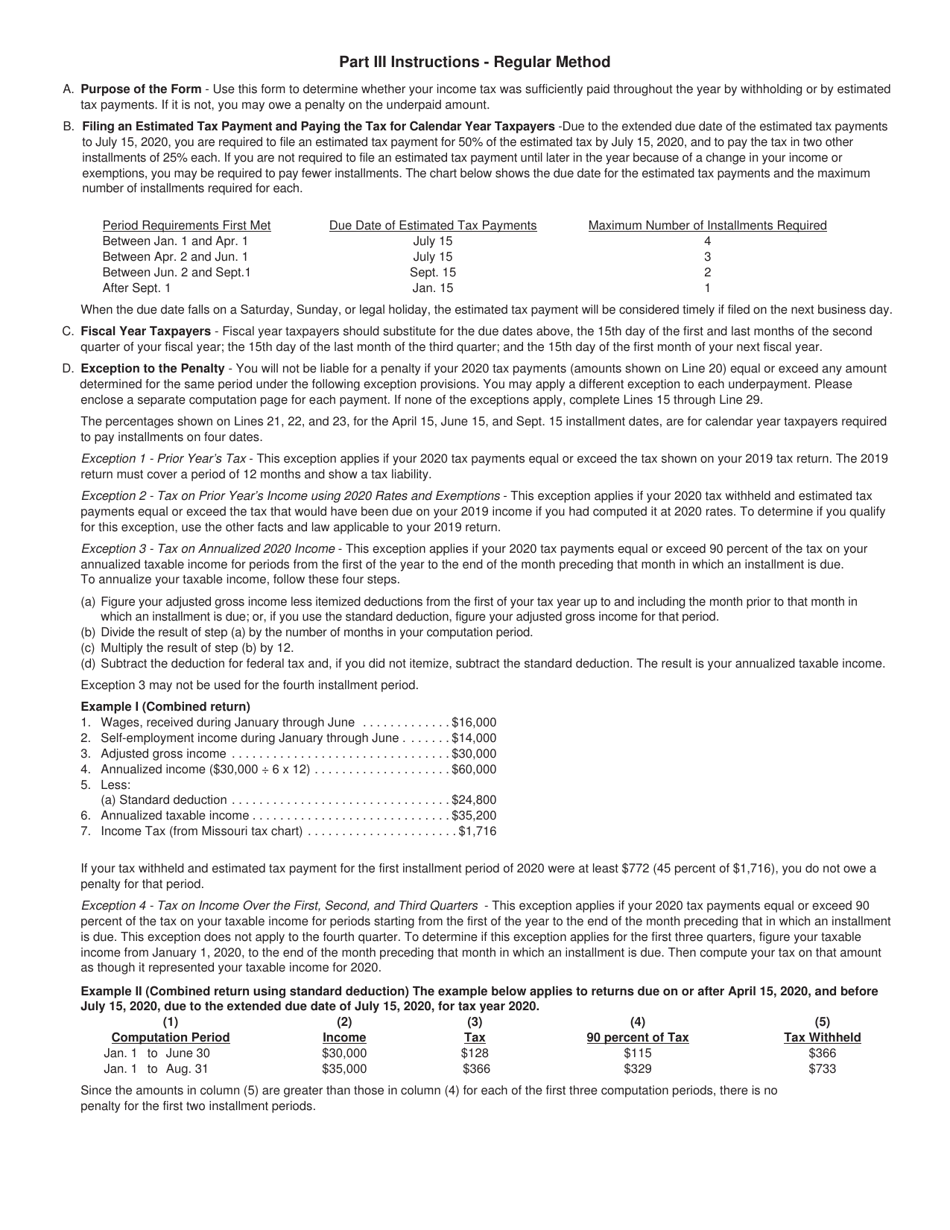

Q: How do I calculate the underpayment penalty?

A: The underpayment penalty is calculated using the percentage set by the Missouri Department of Revenue. The form provides instructions on how to calculate the penalty.

Q: When is Form MO-2210 due?

A: Form MO-2210 is due on the same day as your Missouri individual income tax return, which is usually April 15th.

Q: Can I file Form MO-2210 electronically?

A: Yes, you can file Form MO-2210 electronically if you are filing your individual income tax return electronically.

Form Details:

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-2210 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.