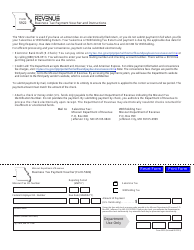

This version of the form is not currently in use and is provided for reference only. Download this version of

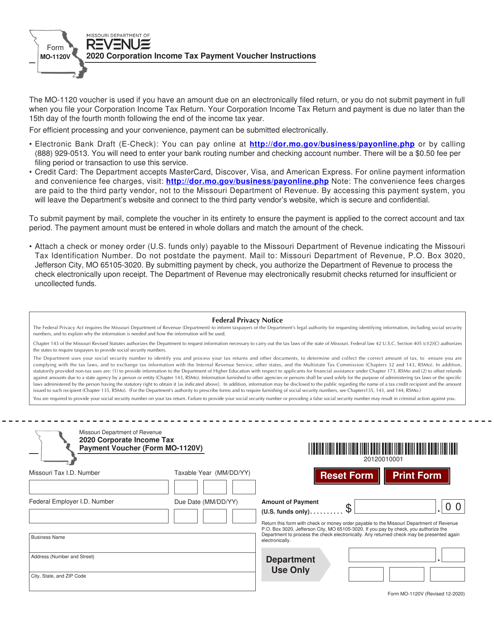

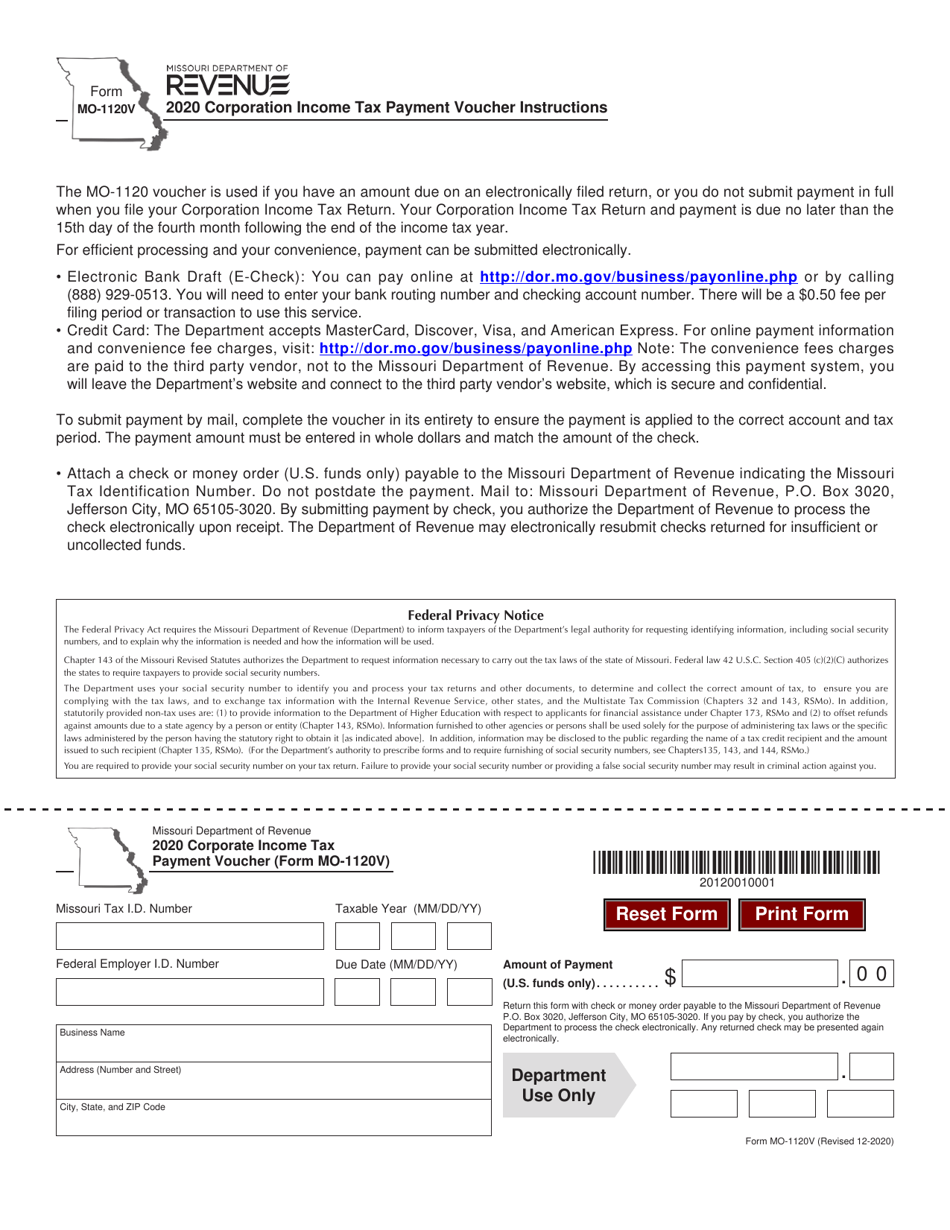

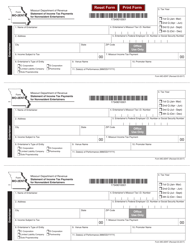

Form MO-1120V

for the current year.

Form MO-1120V Corporate Income Tax Payment Voucher - Missouri

What Is Form MO-1120V?

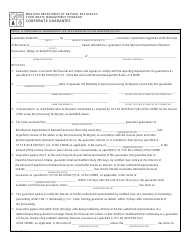

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MO-1120V?

A: Form MO-1120V is the Corporate Income Tax Payment Voucher for the state of Missouri.

Q: What is it used for?

A: Form MO-1120V is used to submit payment for corporate incometax liability in Missouri.

Q: Who needs to file Form MO-1120V?

A: Corporations that owe income tax to the state of Missouri must file Form MO-1120V.

Q: Is Form MO-1120V accompanied by any other forms?

A: Form MO-1120V is usually filed together with Form MO-1120, the Missouri Corporation Income Tax Return.

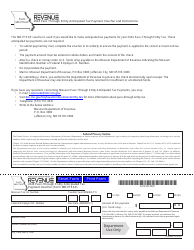

Q: What should I do if I cannot pay the full amount owed?

A: If you are unable to pay the full amount owed, you should still file Form MO-1120V and pay as much as possible. Contact the Missouri Department of Revenue for further assistance.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MO-1120V by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.