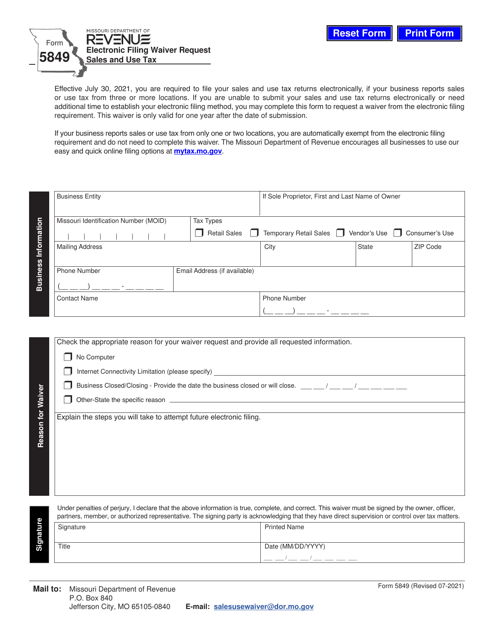

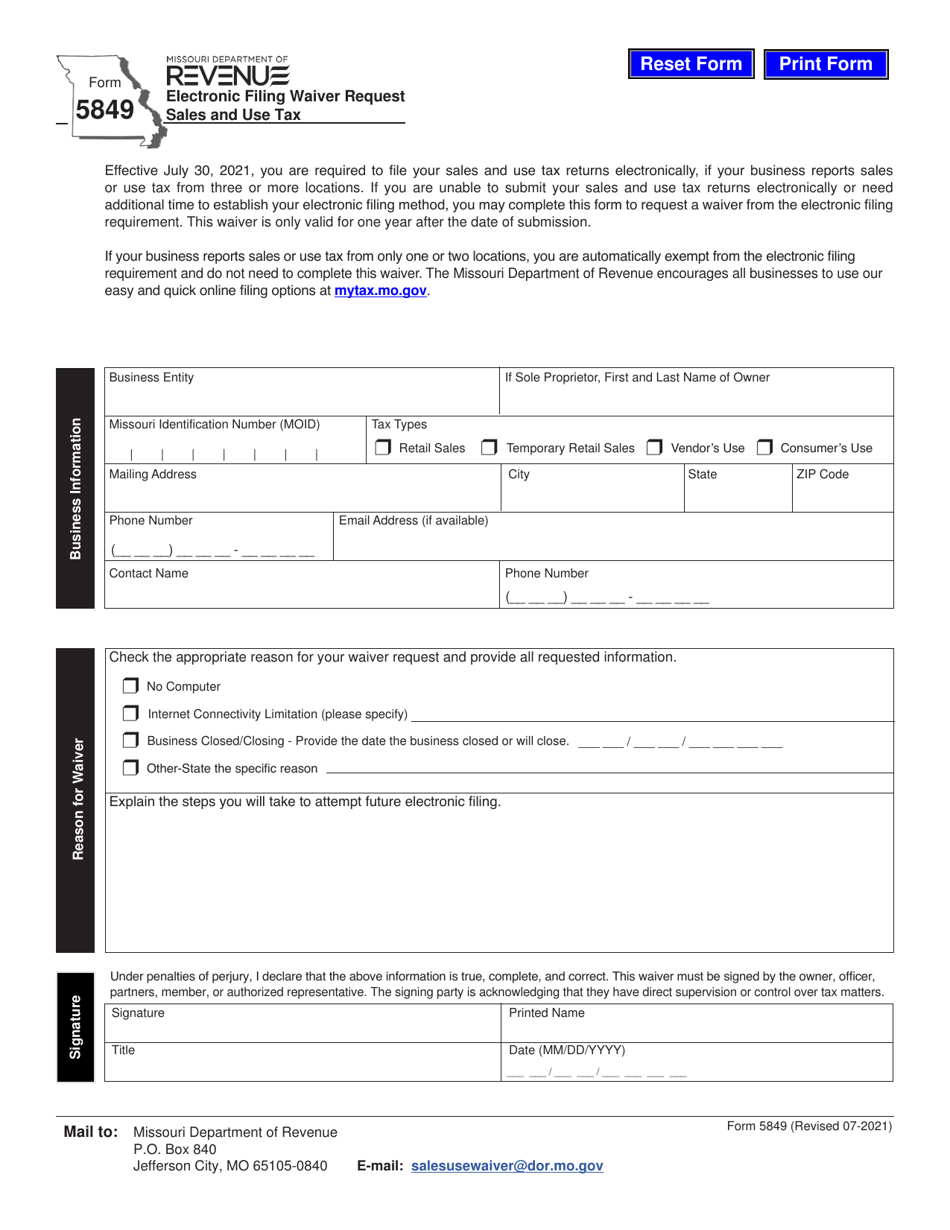

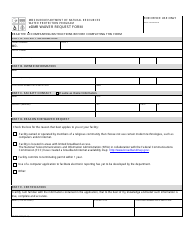

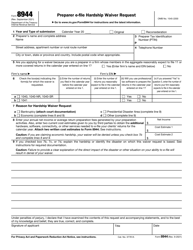

Form 5849 Electronic Filing Waiver Request Sales and Use Tax - Missouri

What Is Form 5849?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5849?

A: Form 5849 is a waiver request forelectronic filing of sales and use tax in Missouri.

Q: Who needs to file Form 5849?

A: Anyone who wants to request a waiver from electronically filing sales and use tax in Missouri.

Q: Why would someone request a waiver from electronic filing?

A: Some individuals or businesses may have a valid reason for not being able to file sales and use tax electronically, such as technical limitations or other extenuating circumstances.

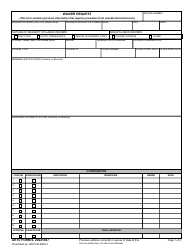

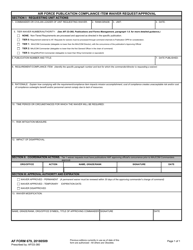

Q: What information is required on Form 5849?

A: Form 5849 requires information such as the taxpayer's name, address, contact information, and a justification for the waiver request.

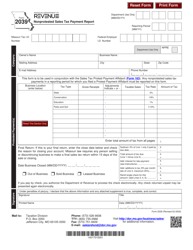

Q: Is there a deadline for submitting Form 5849?

A: Yes, Form 5849 must be submitted by the due date for filing the sales and use tax return.

Q: Will my waiver request always be granted?

A: The Missouri Department of Revenue will review each waiver request on a case-by-case basis and determine whether or not to grant the waiver based on the information provided.

Q: What happens if my waiver request is denied?

A: If your waiver request is denied, you will be required to file your sales and use tax electronically.

Q: Is there a fee for submitting Form 5849?

A: No, there is no fee for submitting Form 5849.

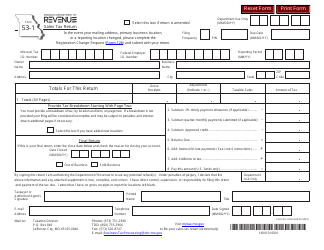

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5849 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.