This version of the form is not currently in use and is provided for reference only. Download this version of

Form 5835

for the current year.

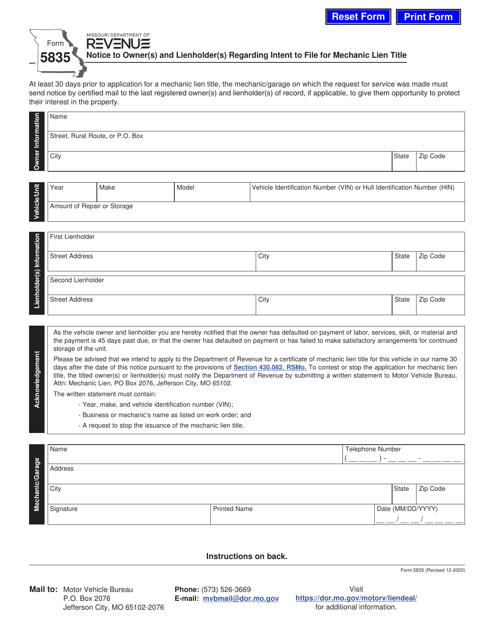

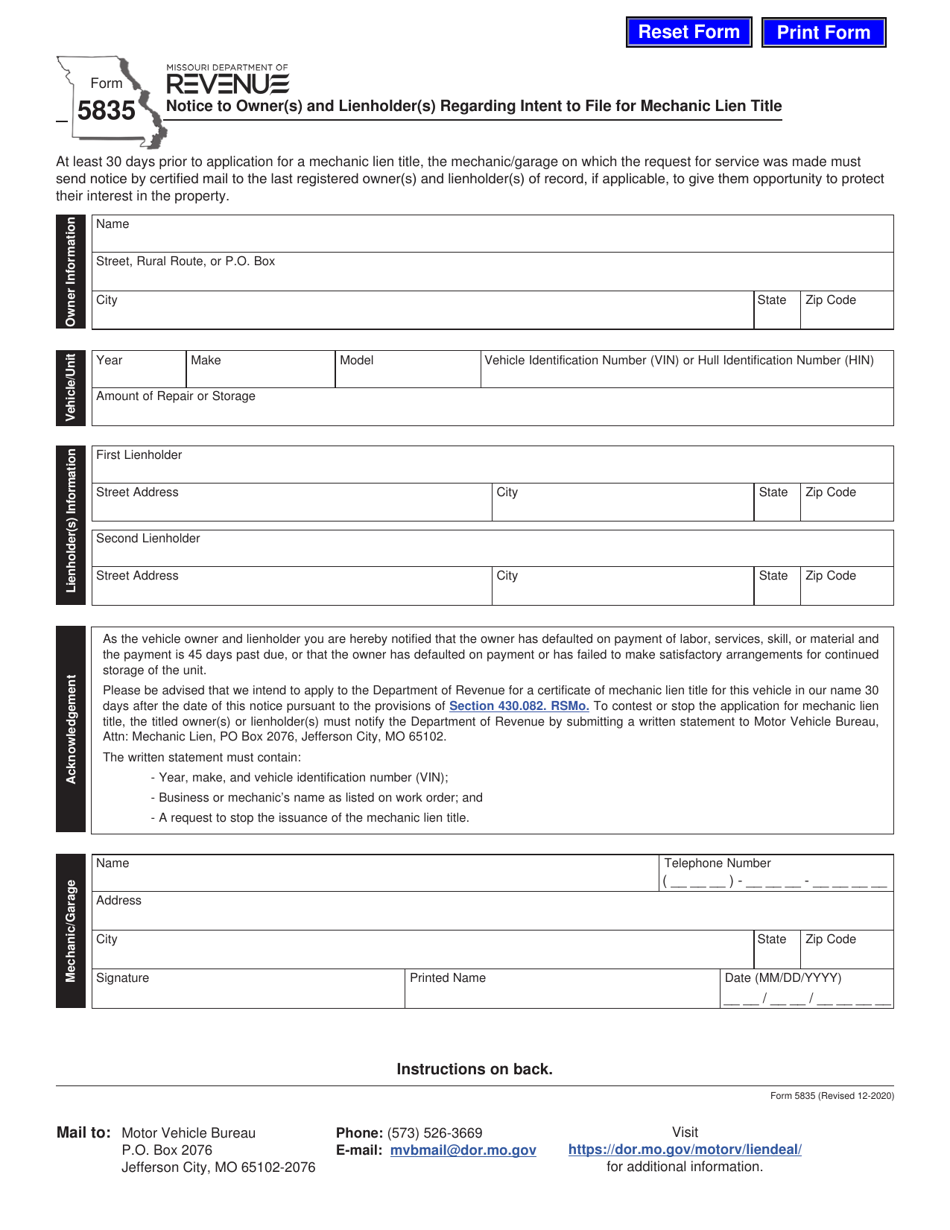

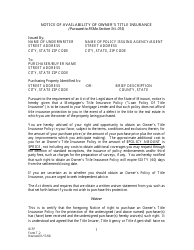

Form 5835 Notice to Owner(S) and Lienholder(S) Regarding Intent to File for Mechanic Lien Title - Missouri

What Is Form 5835?

This is a legal form that was released by the Missouri Department of Revenue - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

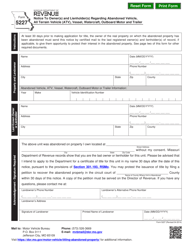

Q: What is Form 5835?

A: Form 5835 is a Notice to Owner(s) and Lienholder(s) regarding the intent to file for a mechanic lien title in Missouri.

Q: Who is required to file Form 5835?

A: Contractors, suppliers, or other parties who have provided labor, materials, or services for a construction project in Missouri and wish to assert their right to file a mechanic lien may be required to file Form 5835.

Q: What is the purpose of Form 5835?

A: The purpose of Form 5835 is to provide notice to the property owner(s) and lienholder(s) of the intention to file for a mechanic lien title in Missouri.

Q: What information is required on Form 5835?

A: Form 5835 requires information such as the name and address of the person giving notice, the project location, the description of the labor, materials, or services provided, and the amount claimed.

Q: When should Form 5835 be filed?

A: Form 5835 should be filed before or within 10 days after the completion of the improvement to the property, as specified by Missouri law.

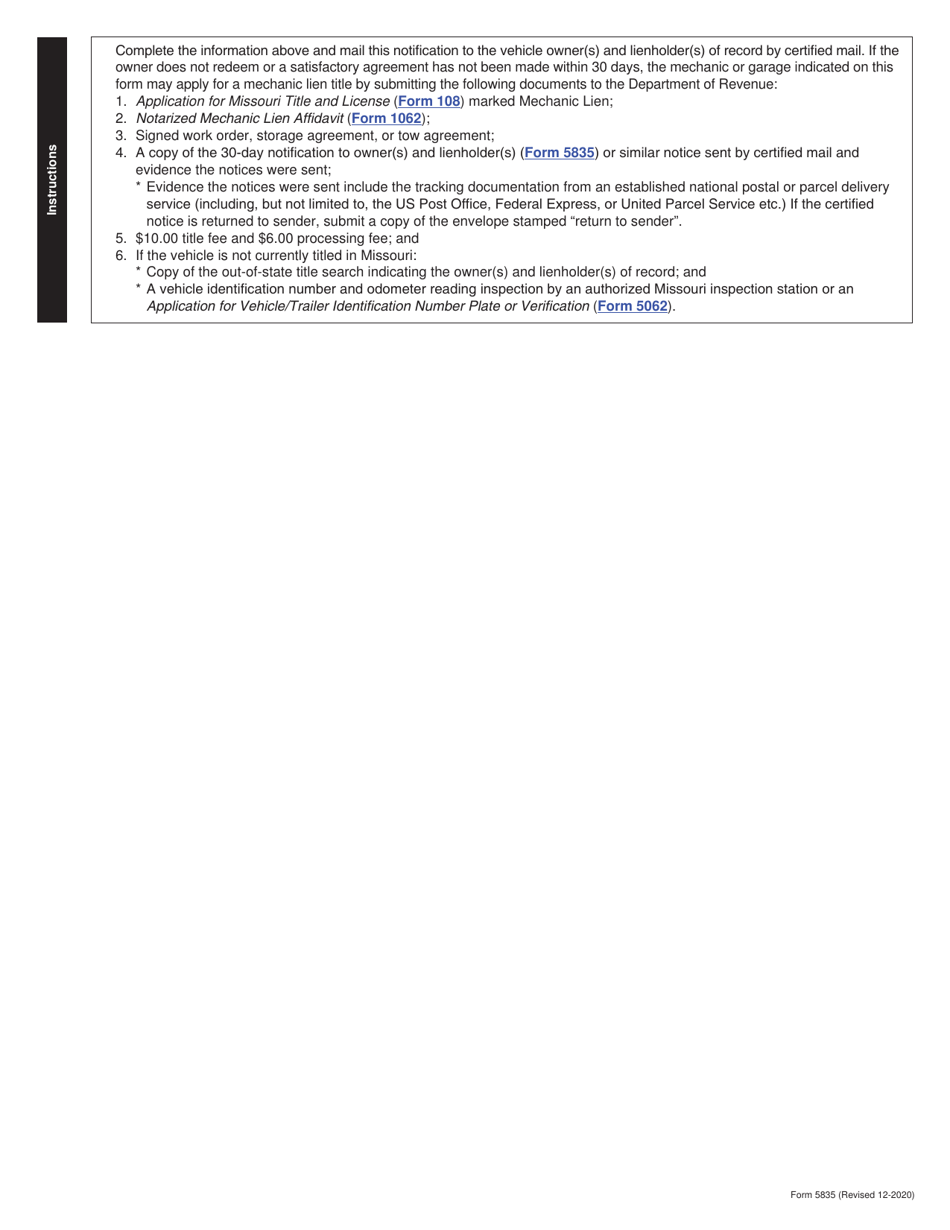

Q: What happens after filing Form 5835?

A: After filing Form 5835, the person giving notice may proceed with filing a mechanic lien against the property if they are not paid for the labor, materials, or services provided.

Q: Is it necessary to file Form 5835 to file a mechanic lien in Missouri?

A: In Missouri, it is not always necessary to file Form 5835 in order to file a mechanic lien. However, providing notice to the property owner(s) and lienholder(s) through Form 5835 can help protect your rights.

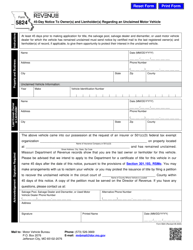

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the Missouri Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5835 by clicking the link below or browse more documents and templates provided by the Missouri Department of Revenue.