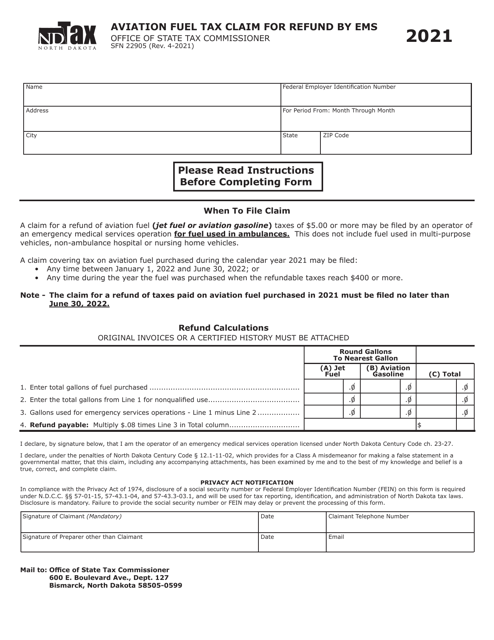

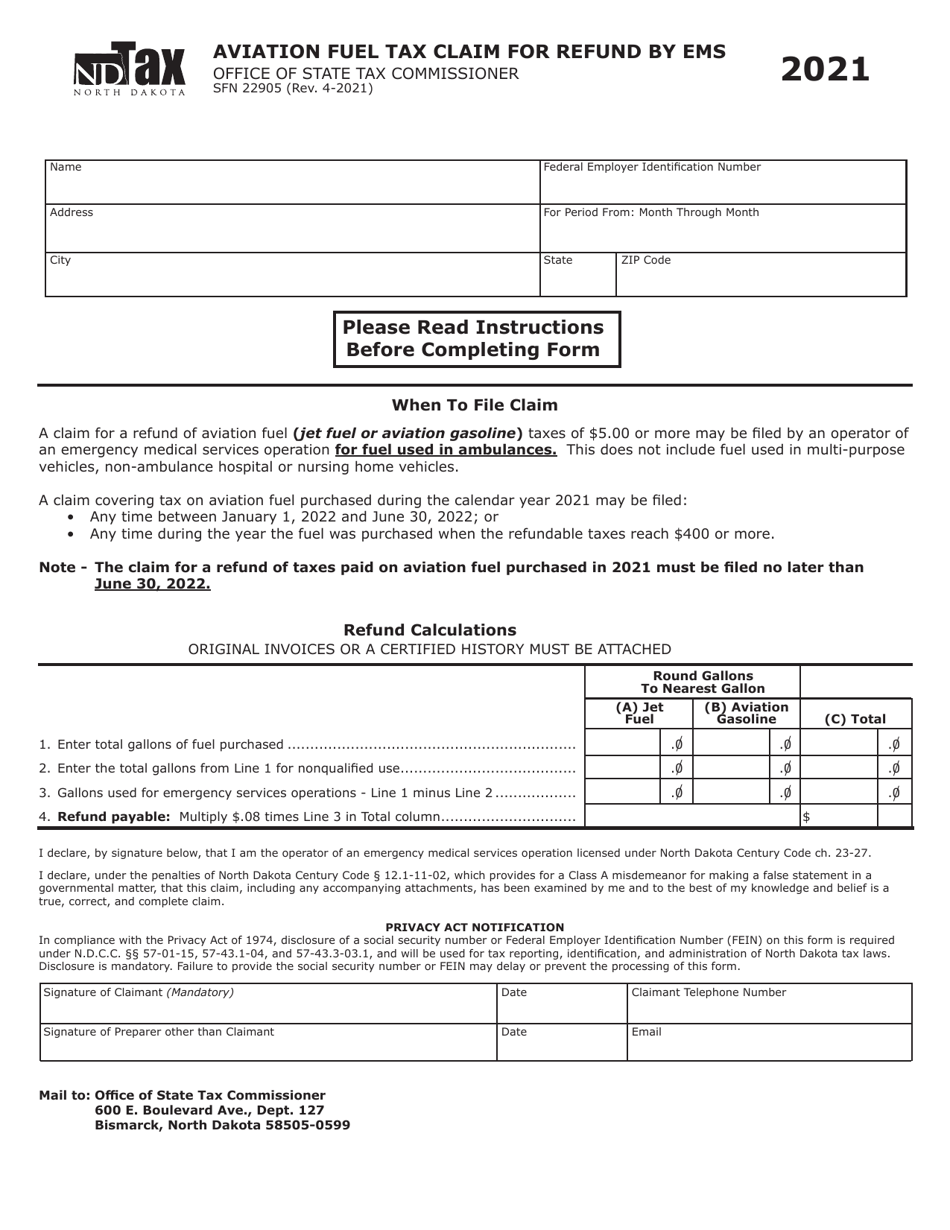

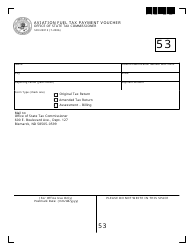

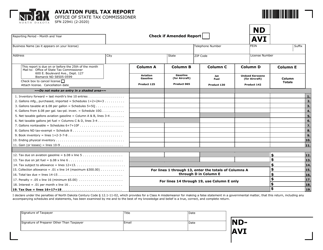

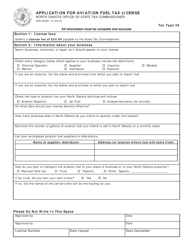

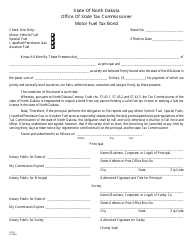

Form SFN22905 Aviation Fuel Tax Claim for Refund by Ems - North Dakota

What Is Form SFN22905?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

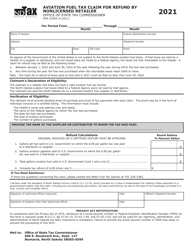

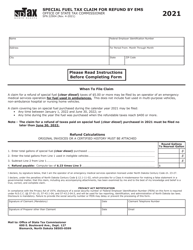

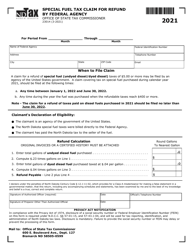

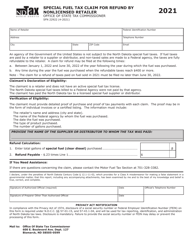

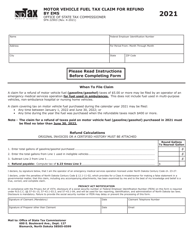

Q: Who can file Form SFN22905?

A: Any person or business who has paid aviation fuel taxes in North Dakota can file Form SFN22905.

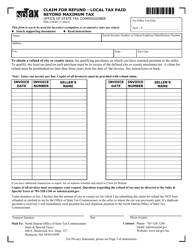

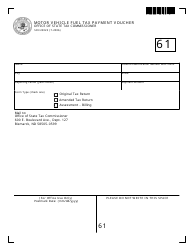

Q: What is Form SFN22905 used for?

A: Form SFN22905 is used to claim a refund for aviation fuel taxes paid in North Dakota.

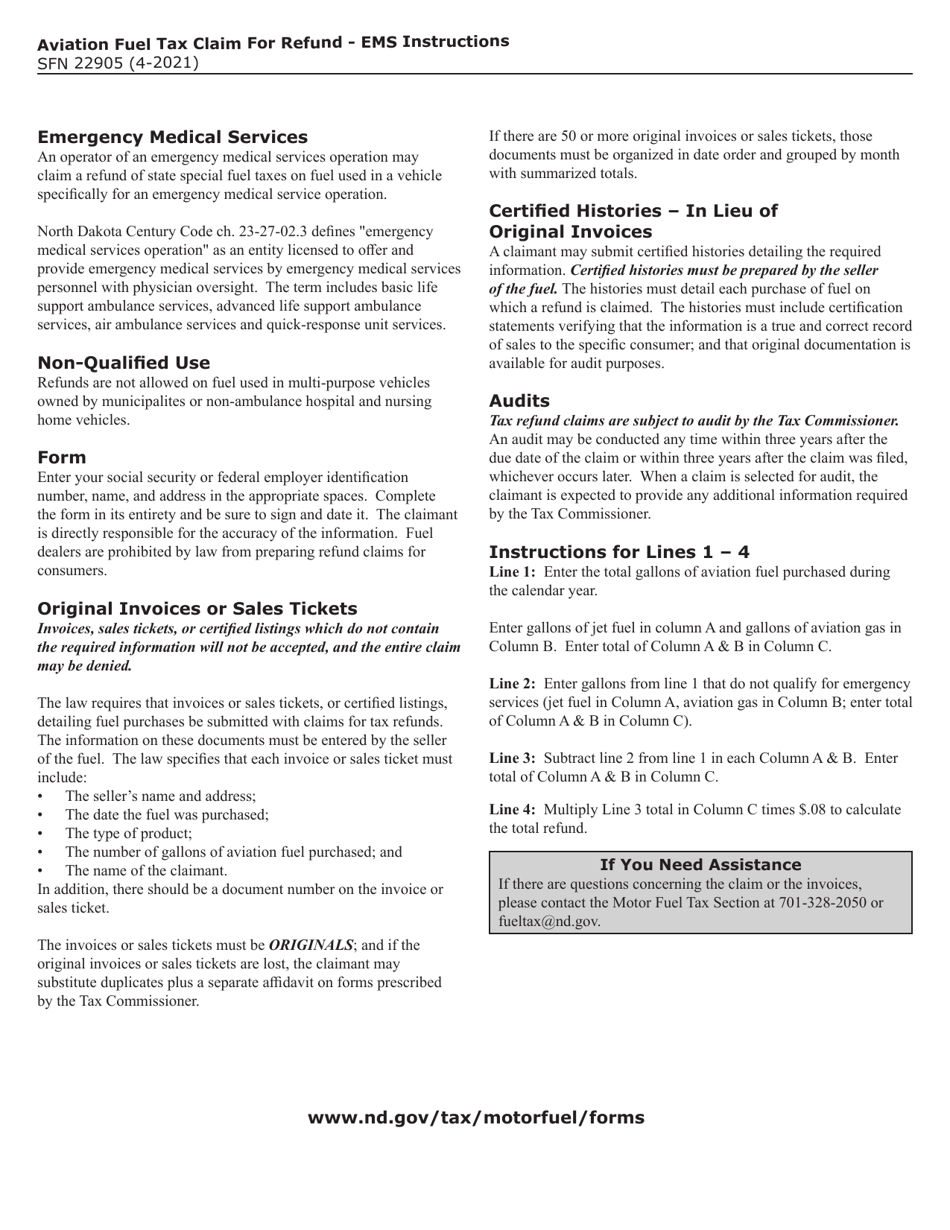

Q: What supporting documents do I need to include with Form SFN22905?

A: You need to include copies of all fuel invoices and proof of payment with Form SFN22905.

Q: What is the deadline for filing Form SFN22905?

A: Form SFN22905 must be filed within 3 years from the date the tax was paid.

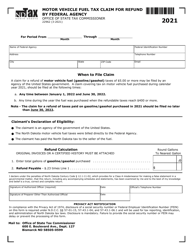

Q: How long does it take to receive a refund after filing Form SFN22905?

A: It typically takes 4 to 6 weeks to process and issue the refund after filing Form SFN22905.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN22905 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.