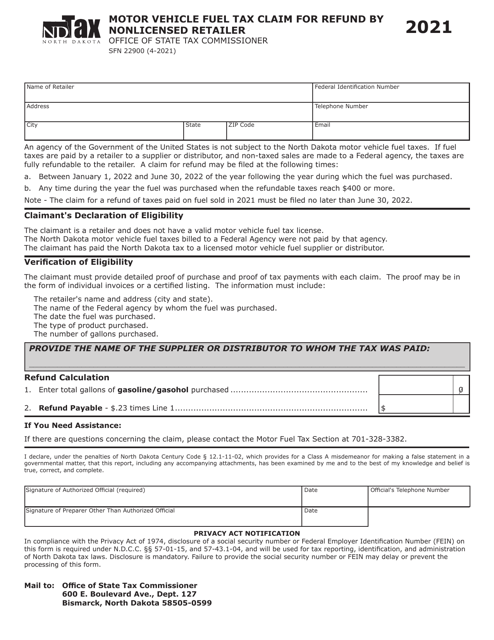

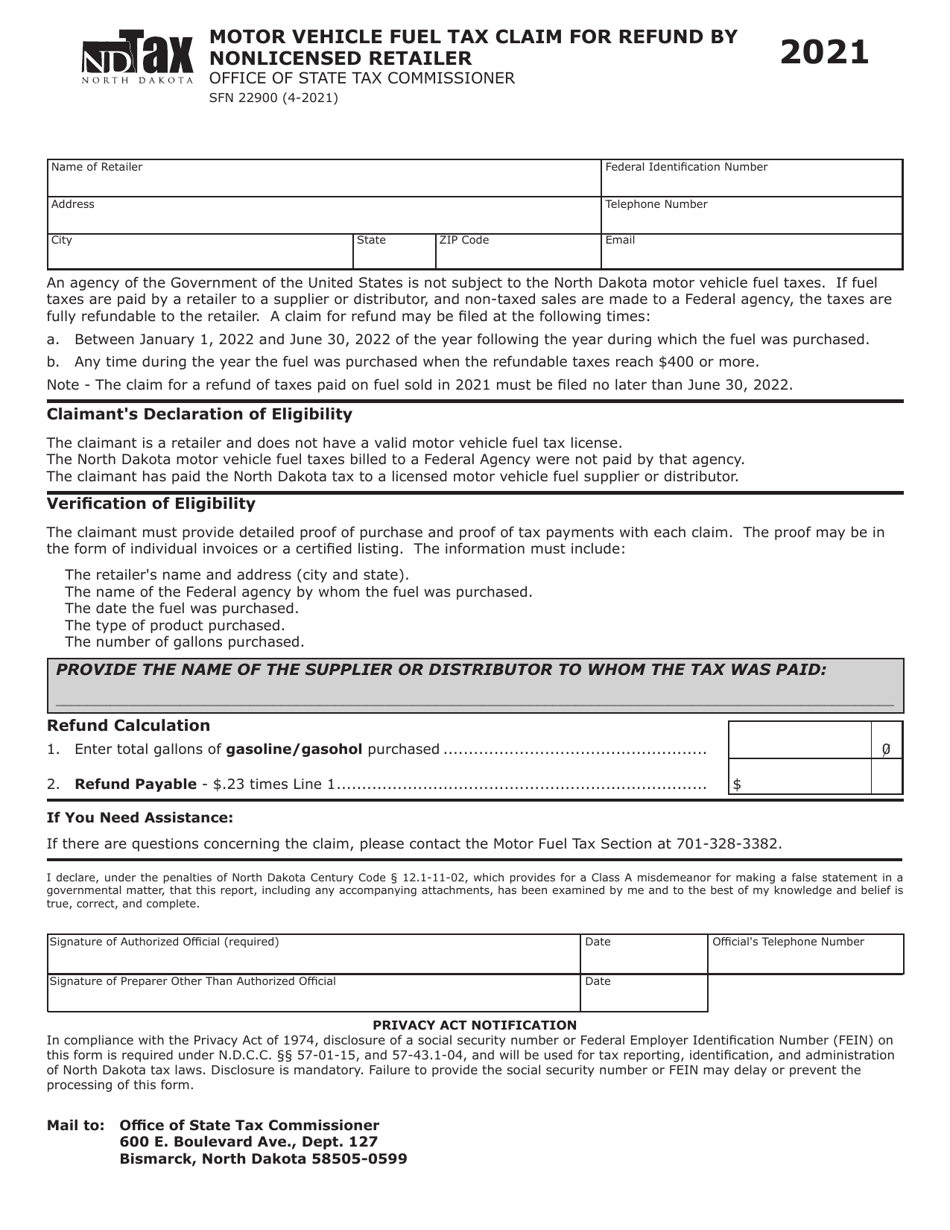

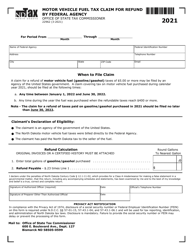

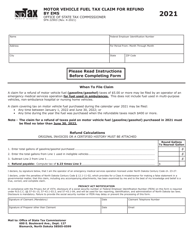

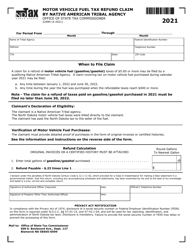

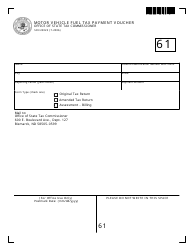

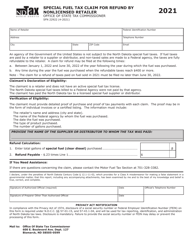

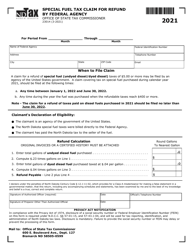

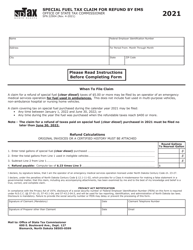

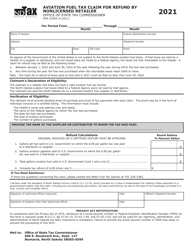

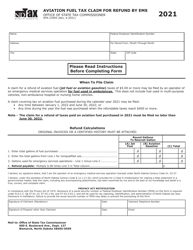

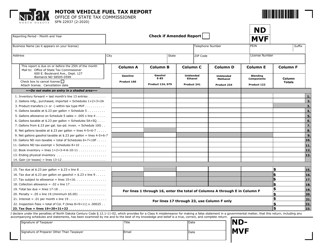

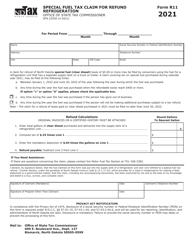

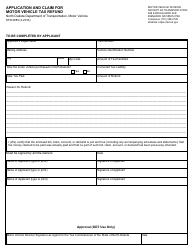

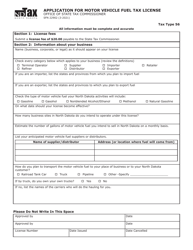

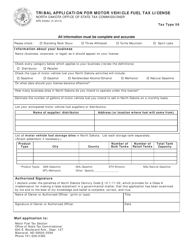

Form SFN22900 Motor Vehicle Fuel Tax Claim for Refund by Nonlicensed Retailer - North Dakota

What Is Form SFN22900?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN22900?

A: Form SFN22900 is a Motor Vehicle Fuel Tax Claim for Refund by Nonlicensed Retailer form in North Dakota.

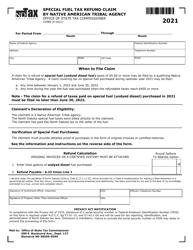

Q: Who can use Form SFN22900?

A: Form SFN22900 can be used by nonlicensed retailers in North Dakota to claim a refund for motor vehicle fuel tax paid.

Q: What is the purpose of Form SFN22900?

A: The purpose of Form SFN22900 is to allow nonlicensed retailers in North Dakota to request a refund of motor vehicle fuel tax.

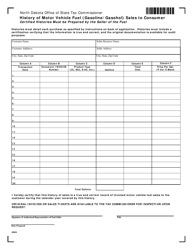

Q: How do I fill out Form SFN22900?

A: You must provide your business information, details of the fuel purchases, and any supporting documentation requested on Form SFN22900.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN22900 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.