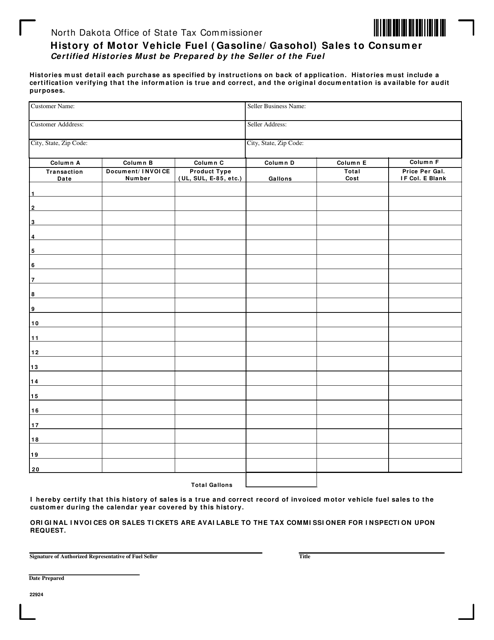

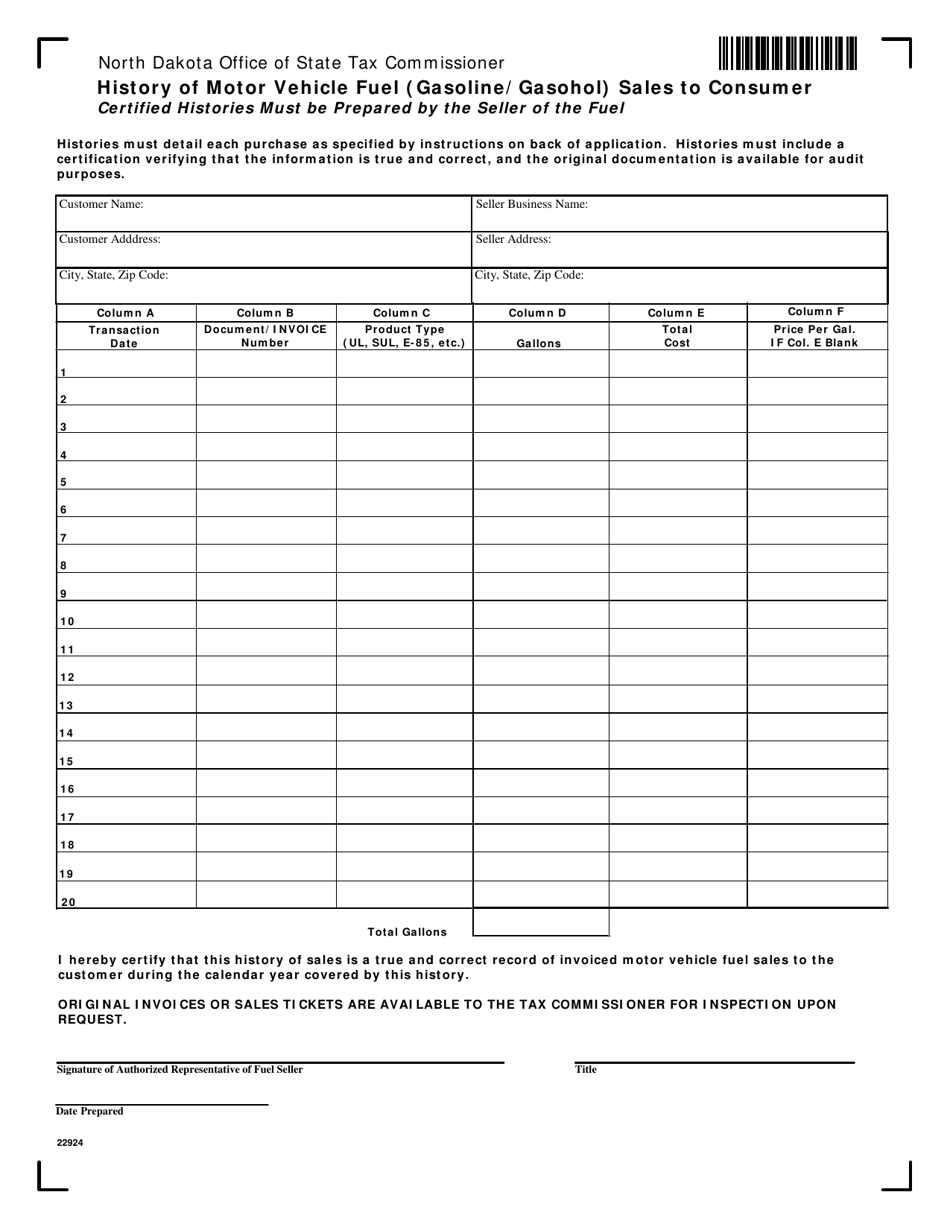

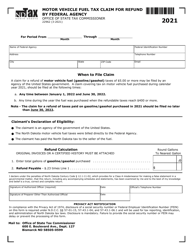

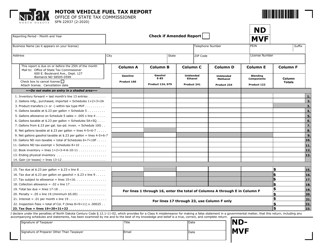

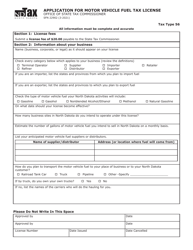

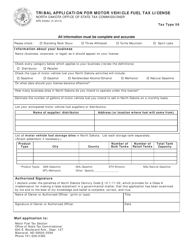

Form 22924 History of Motor Vehicle Fuel (Gasoline / Gasohol) Sales to Consumer - North Dakota

What Is Form 22924?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 22924?

A: Form 22924 is a document that records the history of motor vehicle fuel (gasoline/gasohol) sales to consumers in North Dakota.

Q: Who is required to file Form 22924?

A: Retailers who sell motor vehicle fuel (gasoline/gasohol) to consumers in North Dakota are required to file Form 22924.

Q: What information is included in Form 22924?

A: Form 22924 includes information such as the gallons of motor vehicle fuel sold, the date of sale, the selling price, and the buyer's name and address.

Q: Why is Form 22924 important?

A: Form 22924 is important for tracking and reporting motor vehicle fuel sales in North Dakota. It helps ensure compliance with tax regulations and provides data for revenue collection.

Q: How often is Form 22924 filed?

A: Form 22924 is typically filed on a monthly basis. Retailers must submit the form by the 25th day of the month following the reporting period.

Q: Are there any penalties for not filing Form 22924?

A: Yes, there may be penalties for retailers who fail to file Form 22924 or provide false or incomplete information. It's important to comply with the filing requirements.

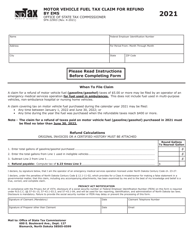

Form Details:

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 22924 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.