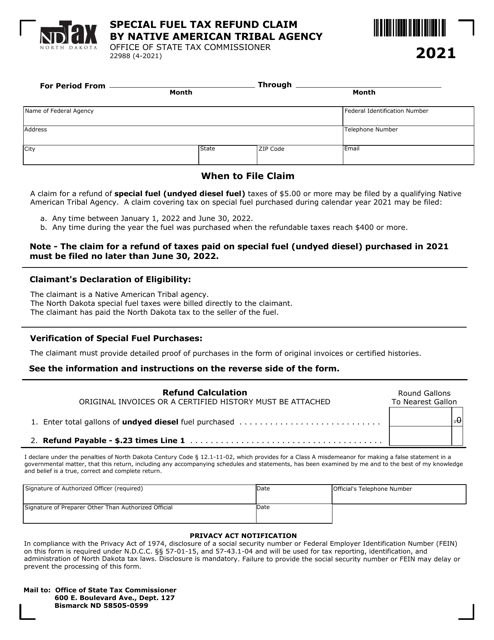

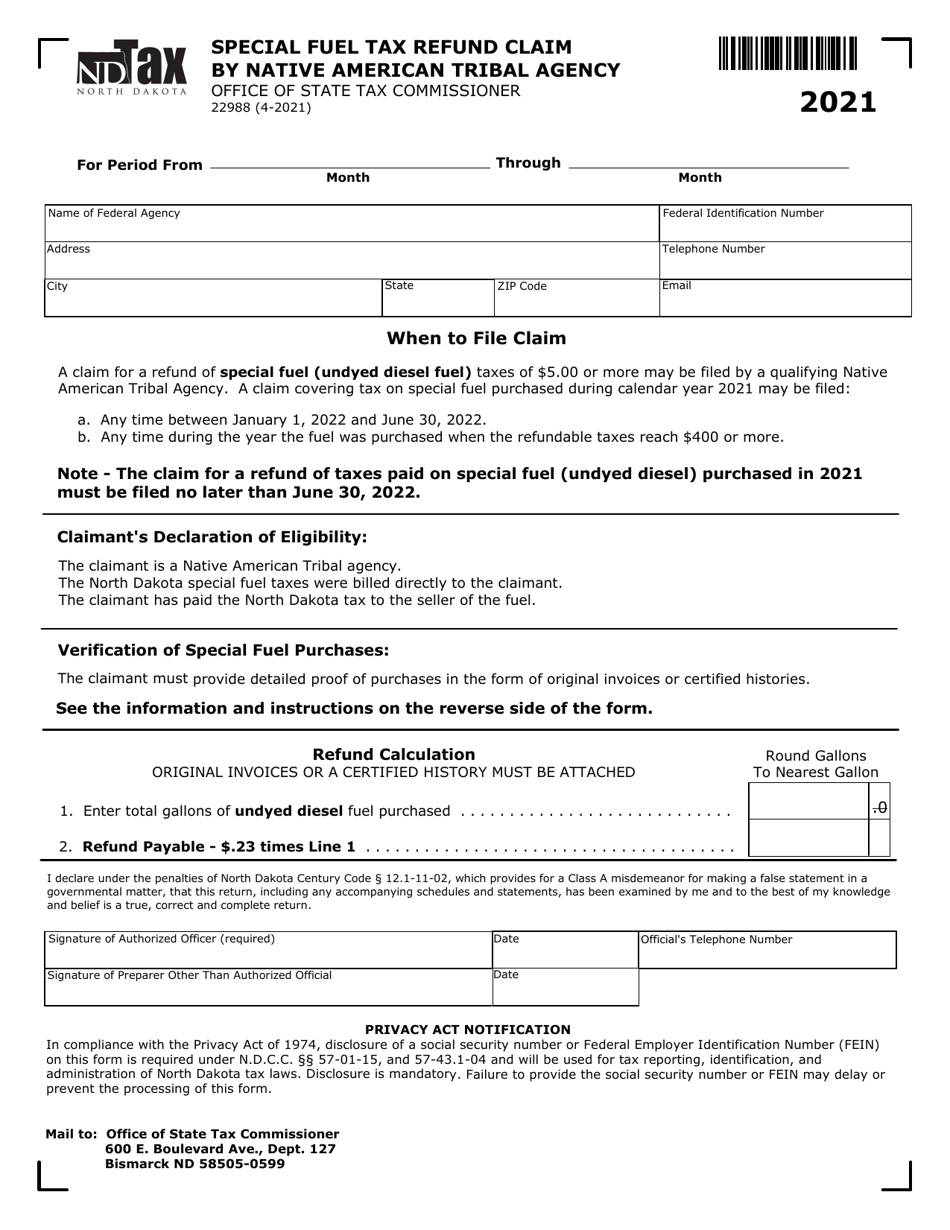

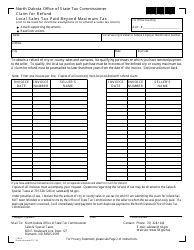

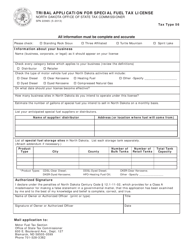

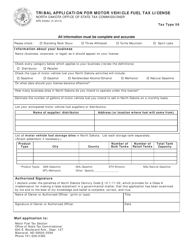

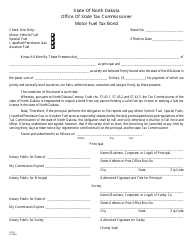

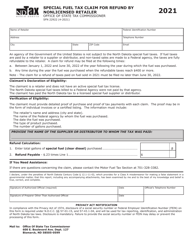

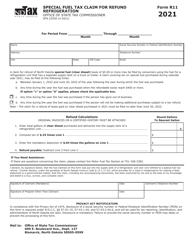

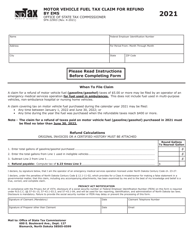

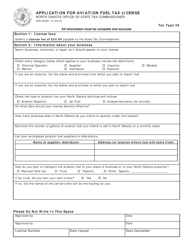

Form SFN22988 Special Fuel Tax Refund Claim by Native American Tribal Agency - North Dakota

What Is Form SFN22988?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

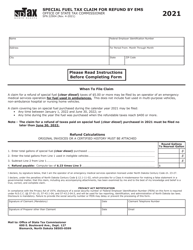

Q: What is Form SFN22988?

A: Form SFN22988 is the Special Fuel Tax Refund Claim by Native American Tribal Agency - North Dakota.

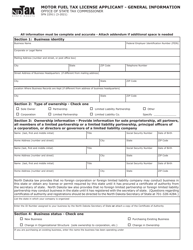

Q: Who can use Form SFN22988?

A: Native American Tribal Agencies in North Dakota can use Form SFN22988 to claim a refund of special fuel tax.

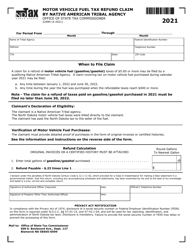

Q: What is special fuel tax?

A: Special fuel tax is a tax imposed on certain fuels that are used in motor vehicles and equipment.

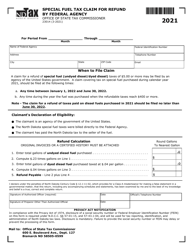

Q: What fuels are eligible for a refund?

A: Diesel fuel, fuel alcohol, and fuel blends containing fuel alcohol are eligible for a refund.

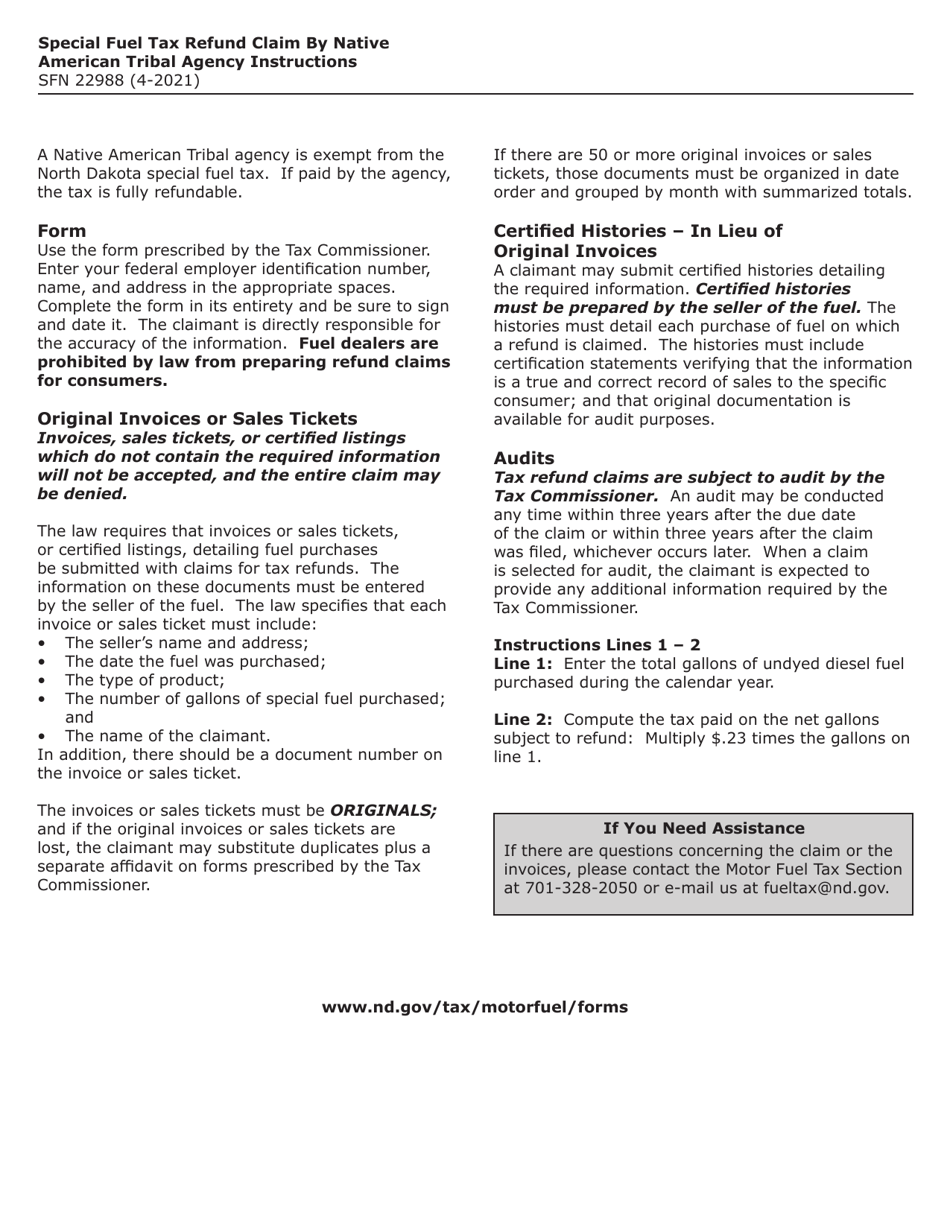

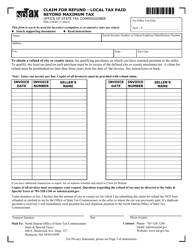

Q: What are the requirements for claiming a refund?

A: The Native American Tribal Agency must be registered with the North Dakota Office of State Tax Commissioner and must provide documentation to support the claim.

Q: How often can a refund be claimed?

A: Refunds can be claimed on a monthly, quarterly, or annual basis.

Q: Is there a deadline for filing the refund claim?

A: Yes, the refund claim must be filed within 3 years from the date the fuel was purchased.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

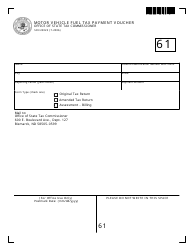

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN22988 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.