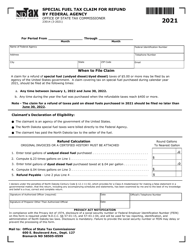

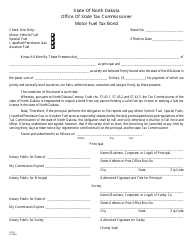

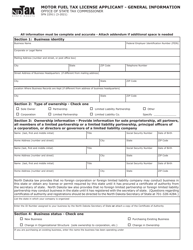

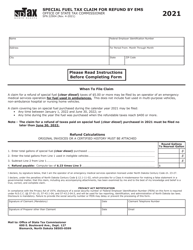

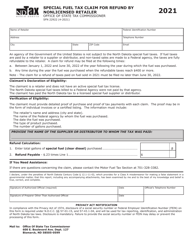

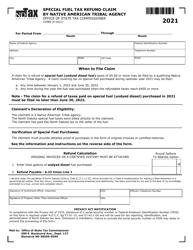

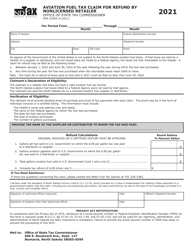

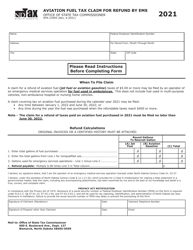

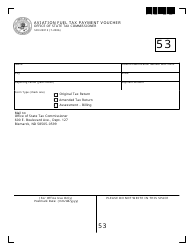

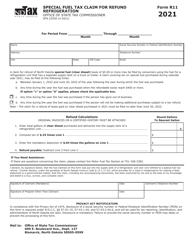

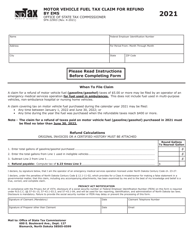

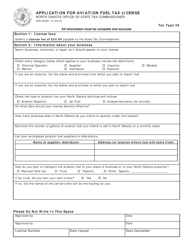

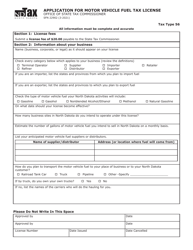

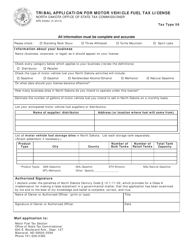

Form SFN23014 Special Fuel Tax Claim for Refund by Federal Agency - North Dakota

What Is Form SFN23014?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN23014?

A: Form SFN23014 is the Special Fuel Tax Claim for Refund by Federal Agency form in North Dakota.

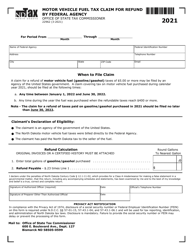

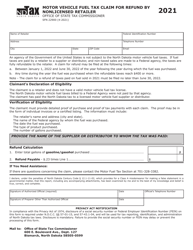

Q: Who can use Form SFN23014?

A: Federal agencies can use Form SFN23014 to claim a refund on special fuel tax in North Dakota.

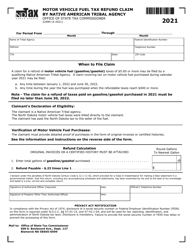

Q: What is special fuel tax?

A: Special fuel tax is a tax imposed on certain types of fuel, such as diesel and aviation fuel.

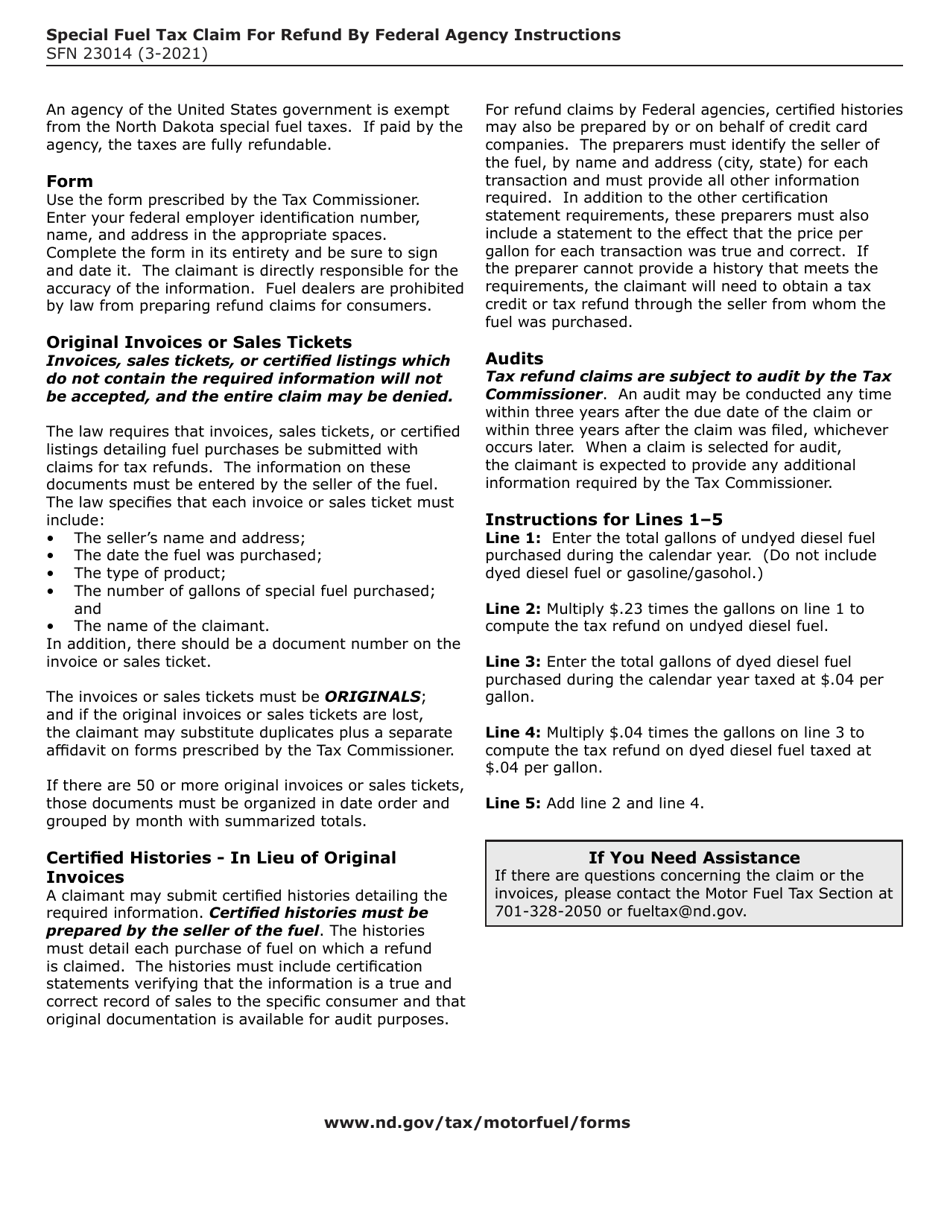

Q: How do I claim a refund using Form SFN23014?

A: To claim a refund, federal agencies need to complete Form SFN23014 and submit it to the North Dakota Tax Department.

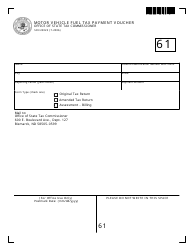

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN23014 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.