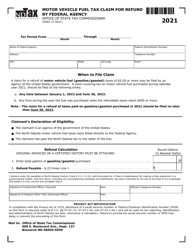

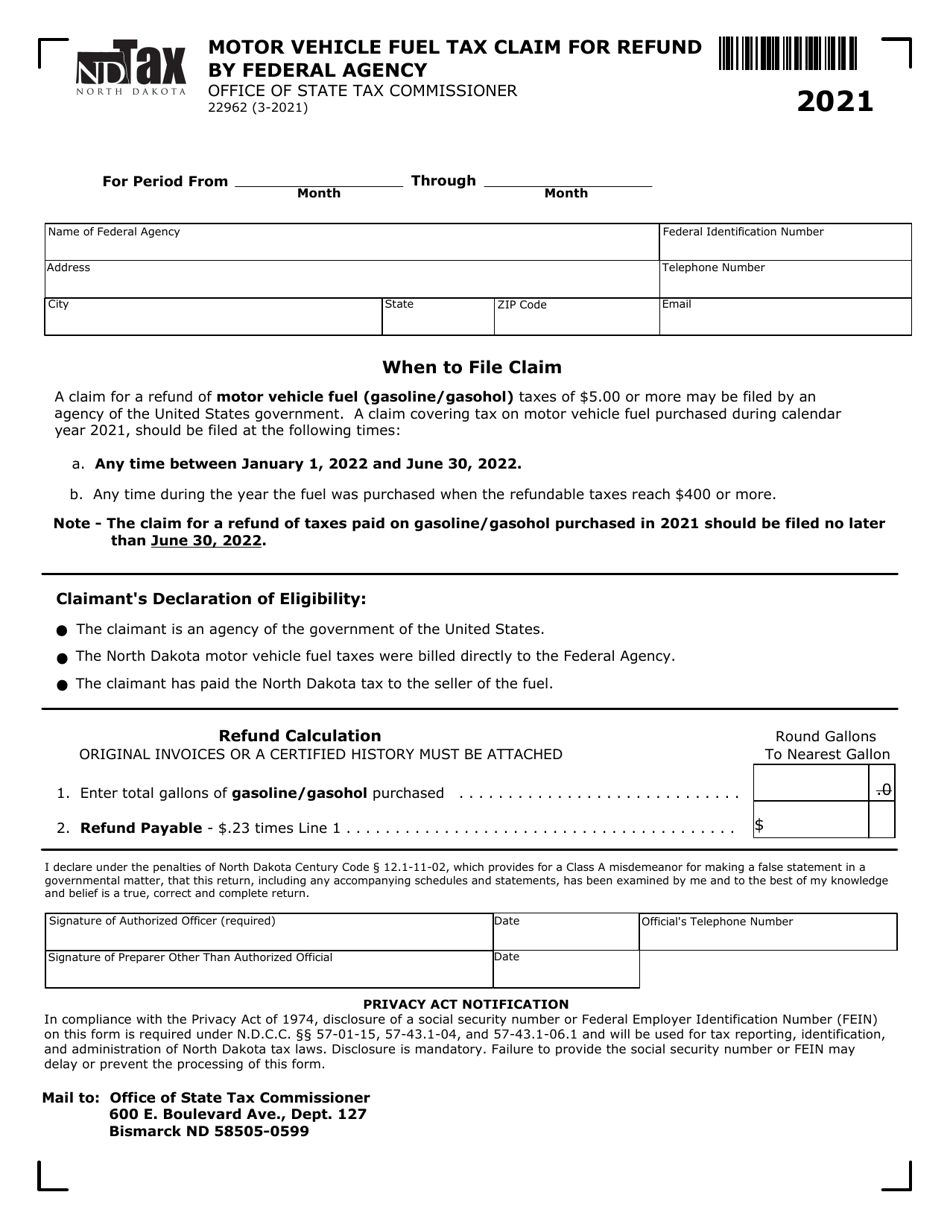

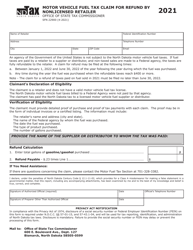

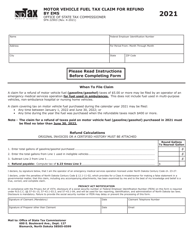

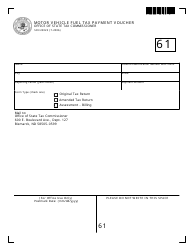

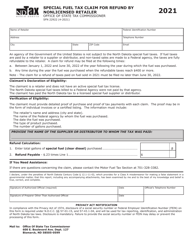

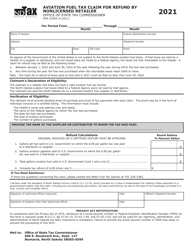

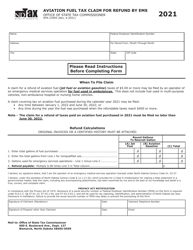

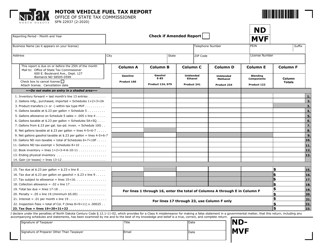

Form SFN22962 Motor Vehicle Fuel Tax Claim for Refund by Federal Agency - North Dakota

What Is Form SFN22962?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form SFN22962?

A: Form SFN22962 is the Motor Vehicle Fuel Tax Claim for Refund by Federal Agency specifically for North Dakota.

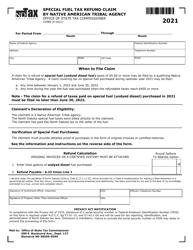

Q: Who can use form SFN22962?

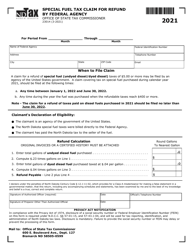

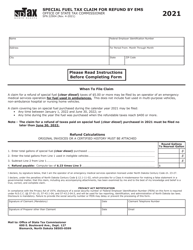

A: Form SFN22962 can be used by federal agencies in North Dakota to claim a refund of motor vehicle fuel tax.

Q: What is the purpose of form SFN22962?

A: The purpose of form SFN22962 is for federal agencies to apply for a refund of motor vehicle fuel tax paid in North Dakota.

Q: Is form SFN22962 specific to North Dakota?

A: Yes, form SFN22962 is specific to North Dakota and cannot be used for claiming refunds in other states.

Q: Are there any eligibility criteria to use form SFN22962?

A: Yes, only federal agencies operating in North Dakota are eligible to use form SFN22962.

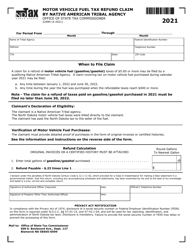

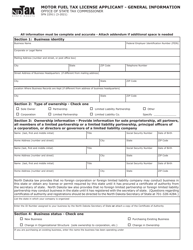

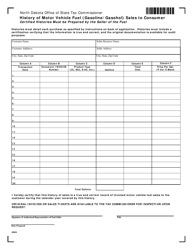

Q: What information is required on form SFN22962?

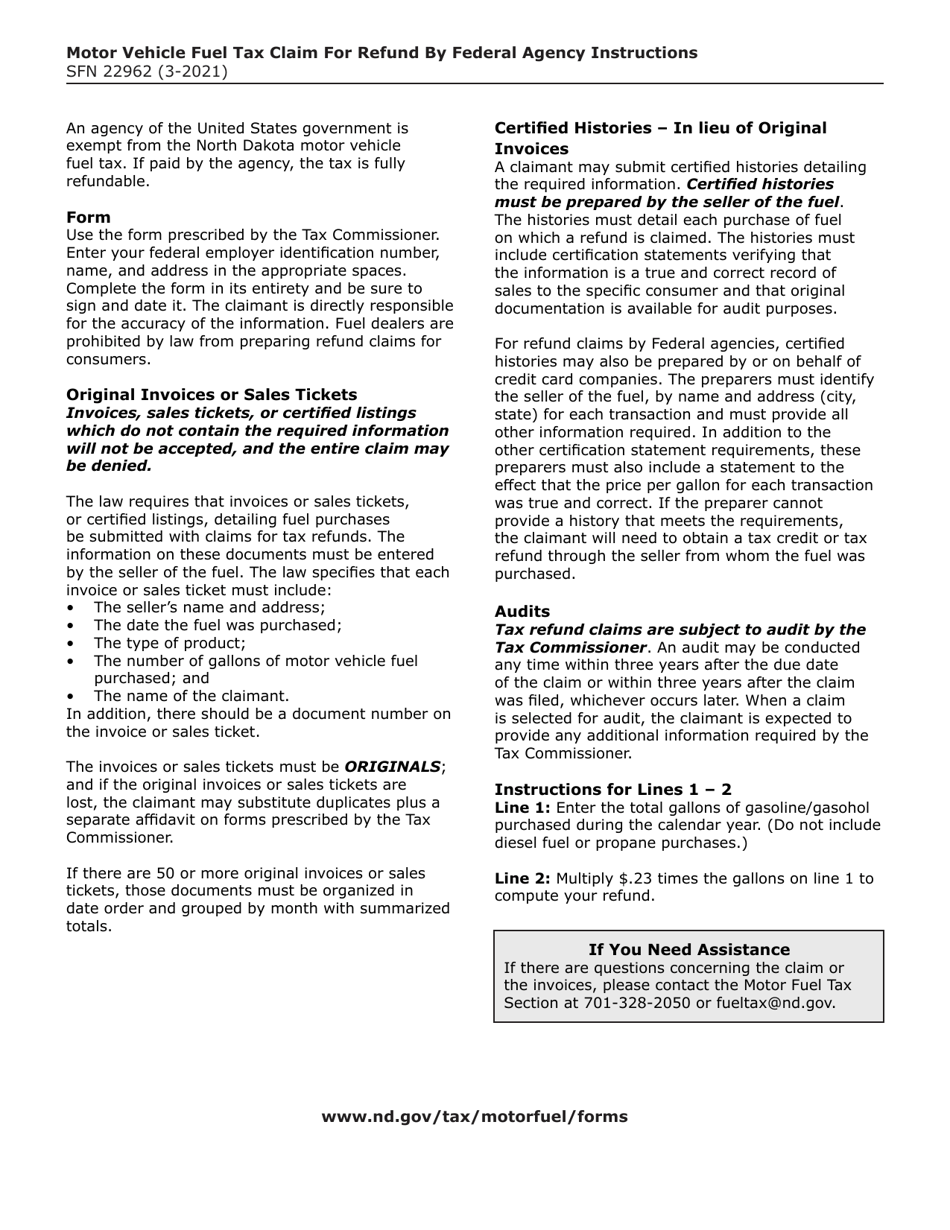

A: Form SFN22962 requires information such as the federal agency name, address, fuel purchase details, and supporting documentation.

Q: How long does it take to process a claim on form SFN22962?

A: The processing time for claims made on form SFN22962 may vary, and it is recommended to contact the North Dakota Office of State Tax Commissioner for specific timelines.

Q: Are there any deadlines to submit form SFN22962?

A: Yes, form SFN22962 should be filed within six months after the last day of the month in which the fuel was used.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN22962 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.