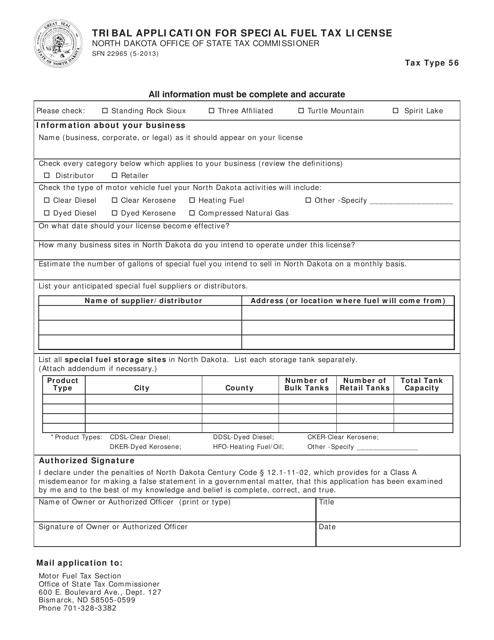

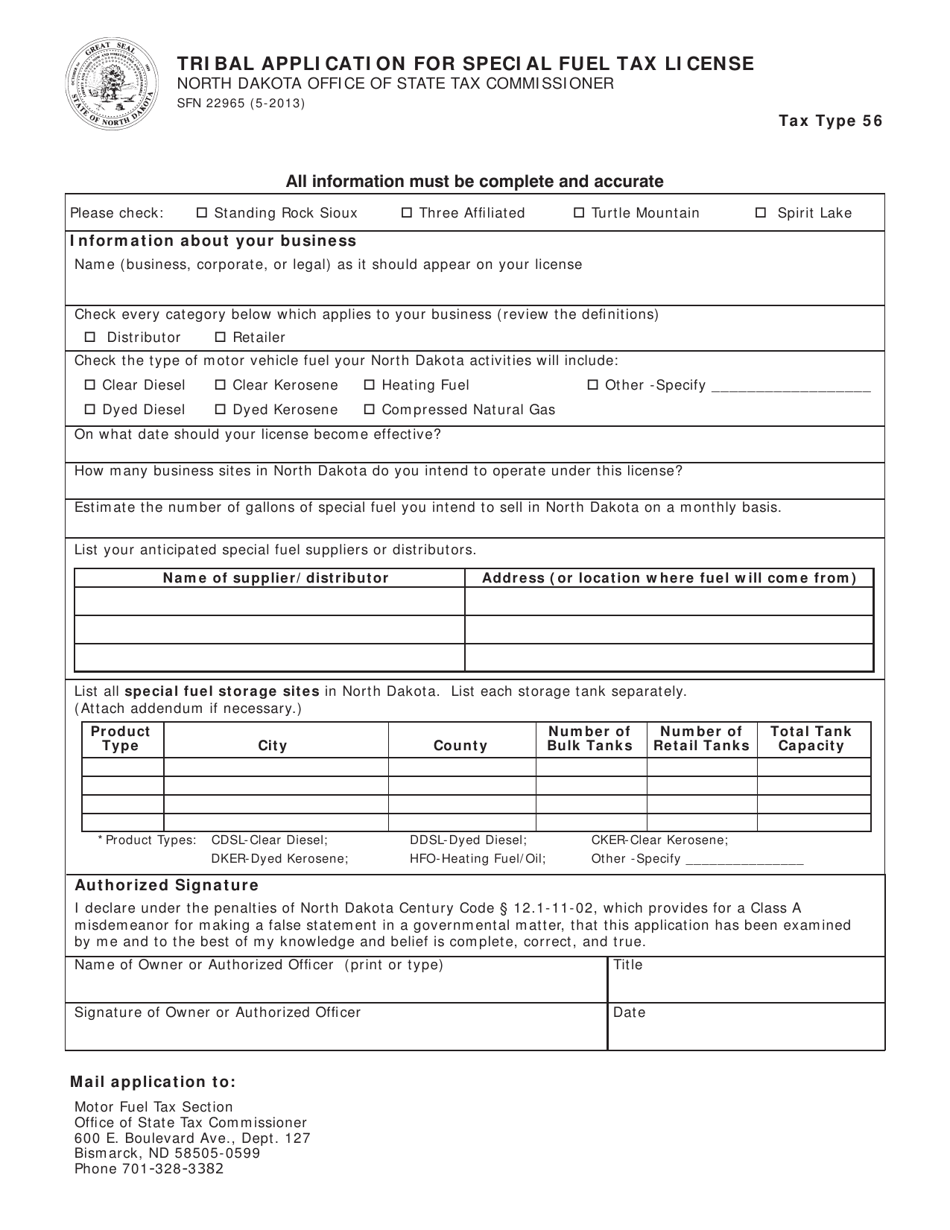

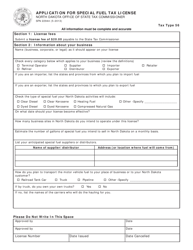

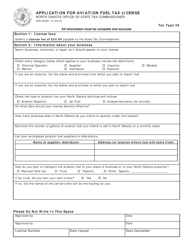

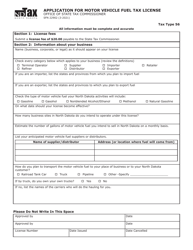

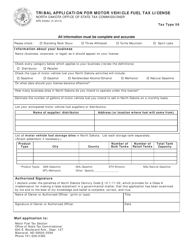

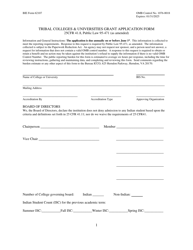

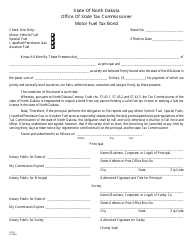

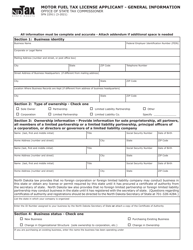

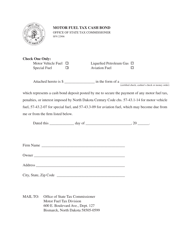

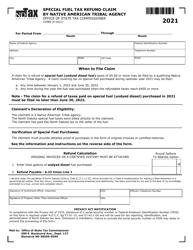

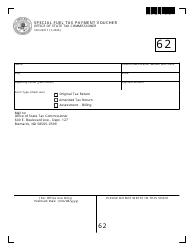

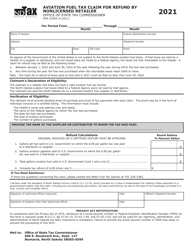

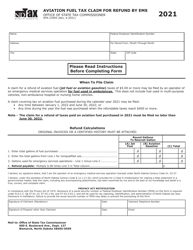

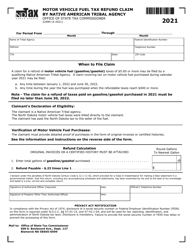

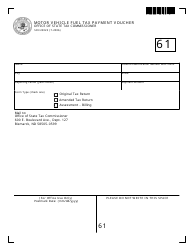

Form SFN22965 Tribal Application for Special Fuel Tax License - North Dakota

What Is Form SFN22965?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN22965?

A: Form SFN22965 is the Tribal Application for Special Fuel Tax License in North Dakota.

Q: Who needs to fill out Form SFN22965?

A: Any individual or business operating on tribal lands in North Dakota who sells special fuel is required to fill out this form.

Q: What is special fuel?

A: Special fuel refers to fuel that is not gasoline or diesel, such as biodiesel or propane.

Q: What information do I need to provide on Form SFN22965?

A: You will need to provide general business information, fuel sales information, and tribal enrollment documentation.

Q: Is there a fee for submitting Form SFN22965?

A: Yes, there is a $25 fee for submitting the form.

Q: Are there any additional requirements for obtaining a special fuel tax license?

A: Yes, you may need to obtain a separate tribal license or permit depending on the tribal policies.

Q: How long does it take to process Form SFN22965?

A: Processing times may vary, but it typically takes a few weeks to receive your special fuel tax license.

Q: What happens if I fail to fill out Form SFN22965?

A: Failure to submit the form may result in penalties or legal consequences for selling special fuel on tribal lands in North Dakota without a license.

Form Details:

- Released on May 1, 2013;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN22965 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.