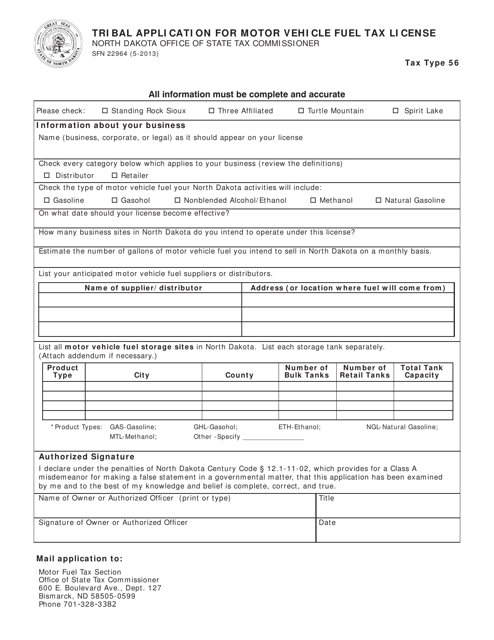

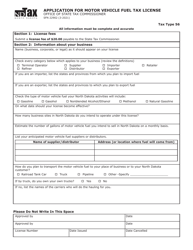

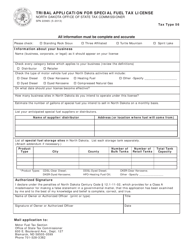

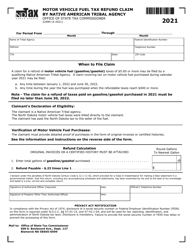

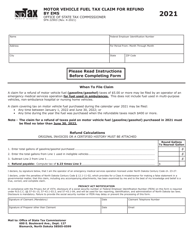

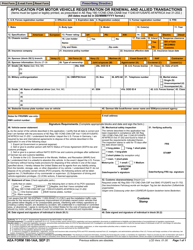

Form SFN22964 Tribal Application for Motor Vehicle Fuel Tax License - North Dakota

What Is Form SFN22964?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

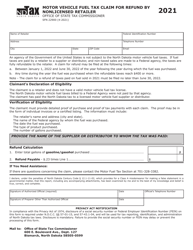

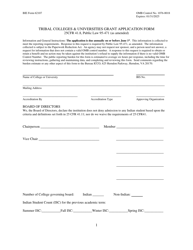

Q: What is SFN22964?

A: SFN22964 is the form used to apply for a tribal motor vehicle fuel tax license in North Dakota.

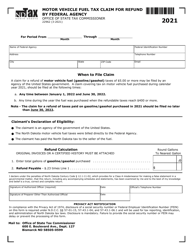

Q: Who needs to fill out SFN22964?

A: Any individual or business who is a member or enrolled in a federally recognized tribe and engaged in the importation or distribution of motor vehicle fuel in tribal trust lands in North Dakota needs to fill out SFN22964.

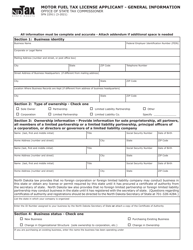

Q: What information is required on SFN22964?

A: SFN22964 requires information about the applicant, including their name, tribal affiliation, address, and business activities.

Q: Are there any fees associated with SFN22964?

A: Yes, there is a $25 application fee for a tribal motor vehicle fuel tax license in North Dakota.

Q: How long does it take to process SFN22964?

A: The processing time for SFN22964 is typically 2-4 weeks.

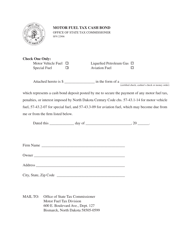

Q: Are there any additional requirements for obtaining a tribal motor vehicle fuel tax license?

A: Yes, additional requirements may include providing bonding or proof of financial responsibility, maintaining records, and filing tax returns.

Form Details:

- Released on May 1, 2013;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN22964 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.