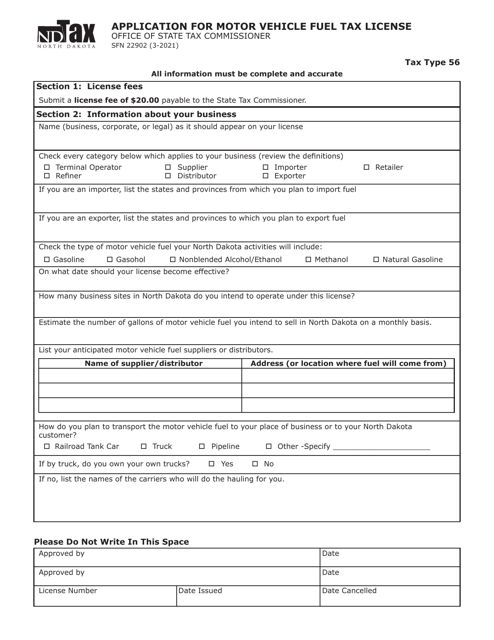

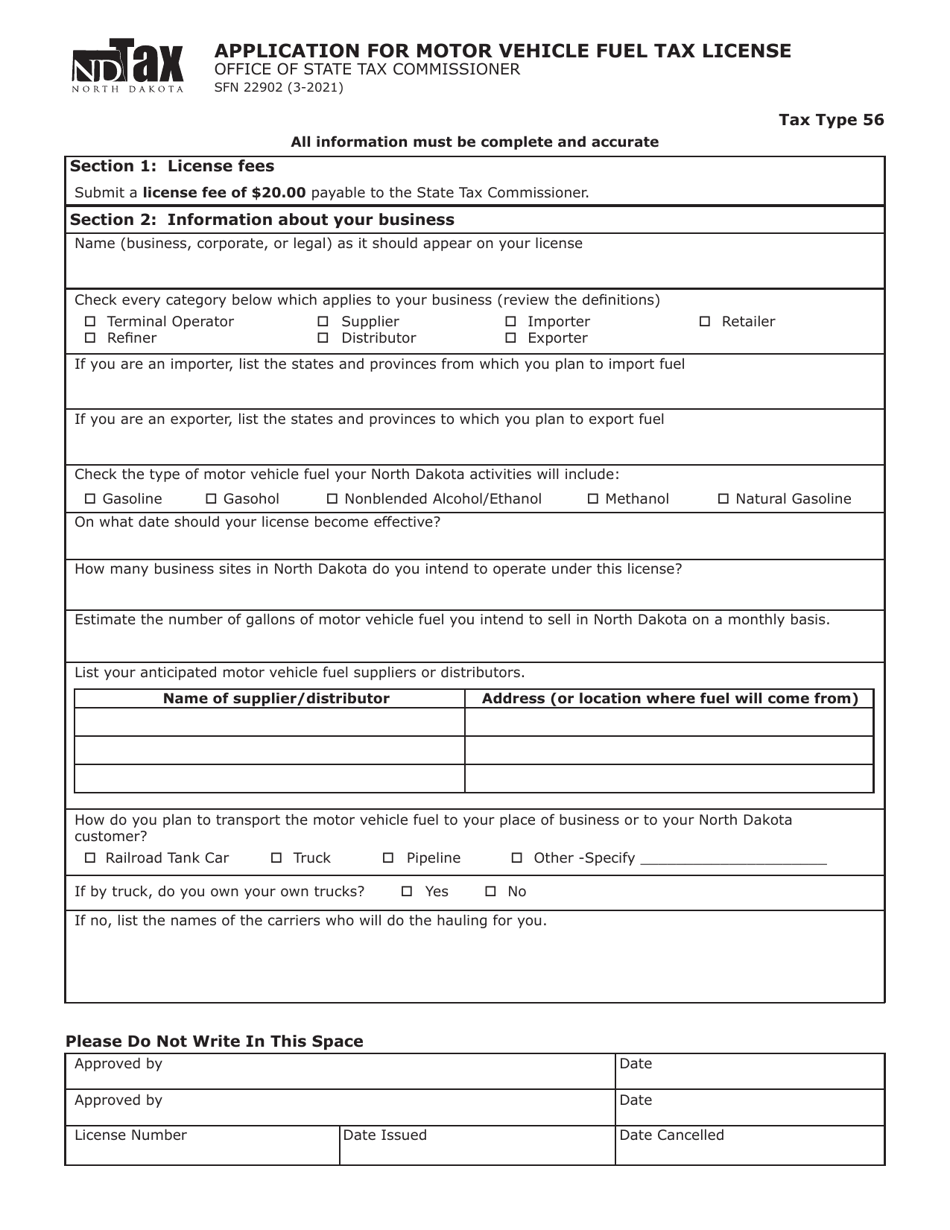

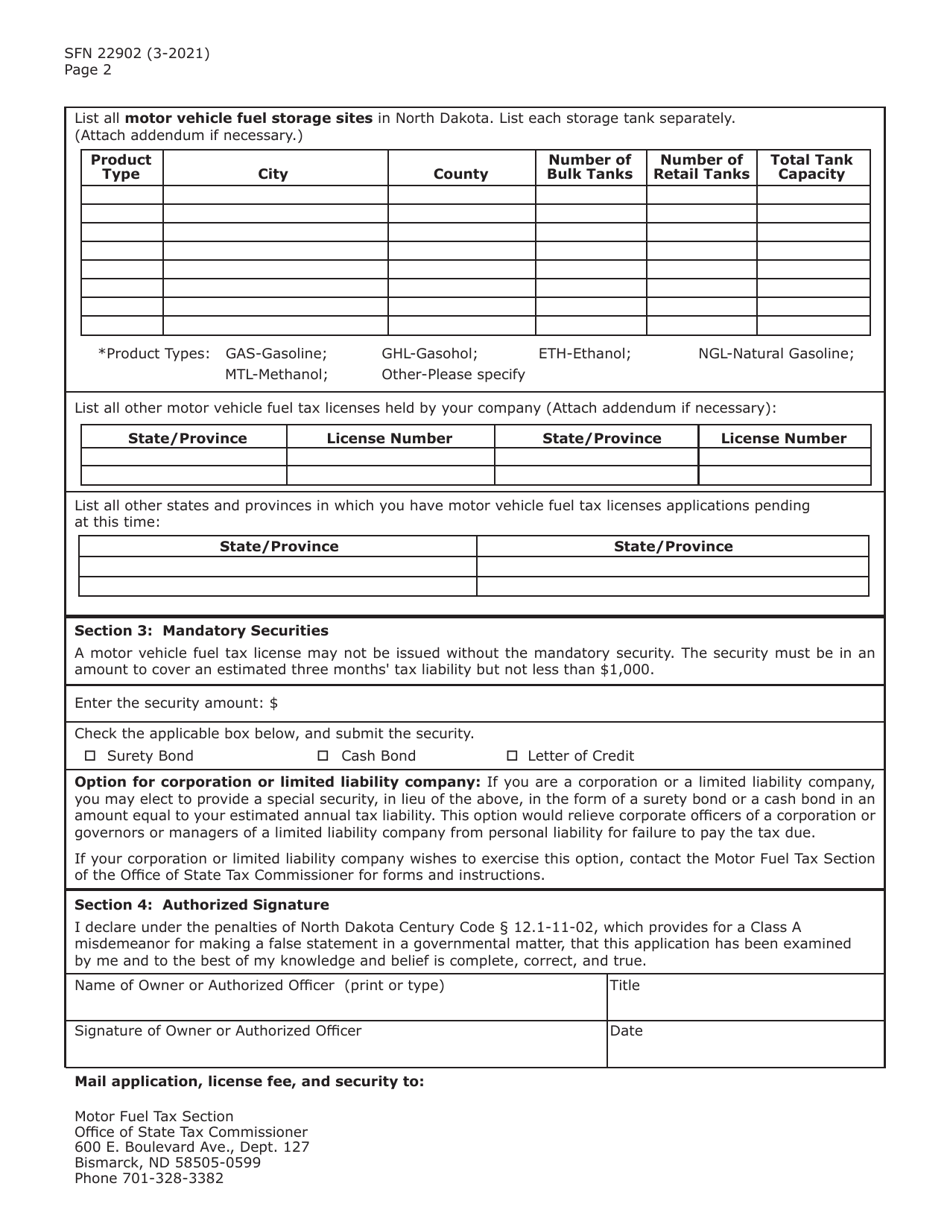

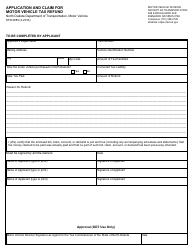

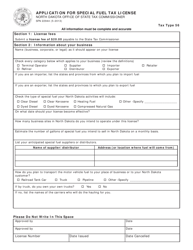

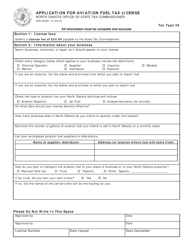

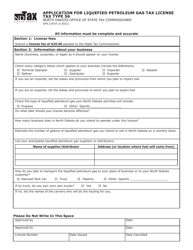

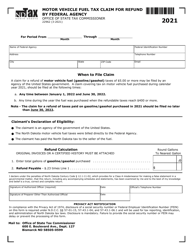

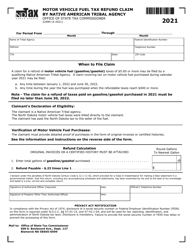

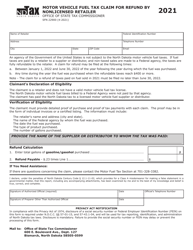

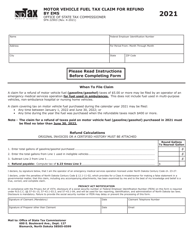

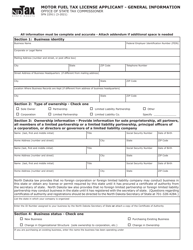

Form SFN22902 Application for Motor Vehicle Fuel Tax License - North Dakota

What Is Form SFN22902?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN22902?

A: Form SFN22902 is the application for a Motor Vehicle Fuel Tax License in North Dakota.

Q: Why do I need a Motor Vehicle Fuel Tax License?

A: You need a Motor Vehicle Fuel Tax License in North Dakota if you will be selling or using motor vehicle fuel in the state.

Q: Who needs to fill out Form SFN22902?

A: Anyone who wants to apply for a Motor Vehicle Fuel Tax License in North Dakota needs to fill out Form SFN22902.

Q: What information do I need to provide on Form SFN22902?

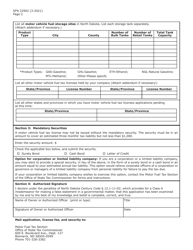

A: You will need to provide your personal and business information, including your name, address, and federal employer identification number, as well as information about the motor vehicle fuel you will be selling or using.

Q: Are there any fees associated with the Motor Vehicle Fuel Tax License?

A: Yes, there is a $30 fee for the Motor Vehicle Fuel Tax License in North Dakota.

Q: How long does it take to process the application?

A: The processing time for the application can vary, but it typically takes a few weeks to receive your Motor Vehicle Fuel Tax License.

Q: What should I do if I have questions about the application process?

A: If you have questions about the application process, you can contact the North Dakota Office of State Tax Commissioner for assistance.

Form Details:

- Released on March 1, 2021;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN22902 by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.