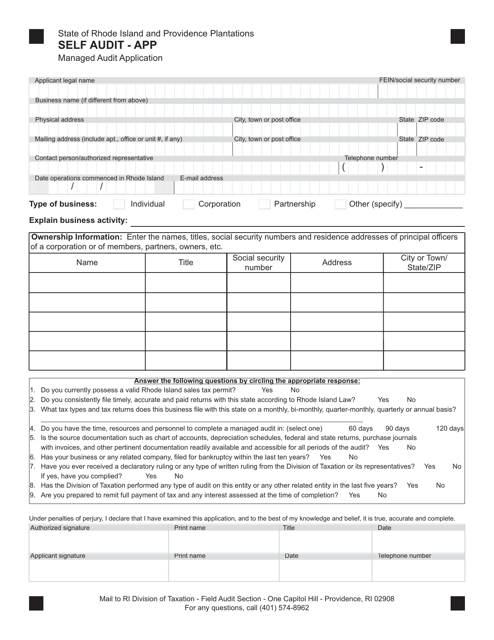

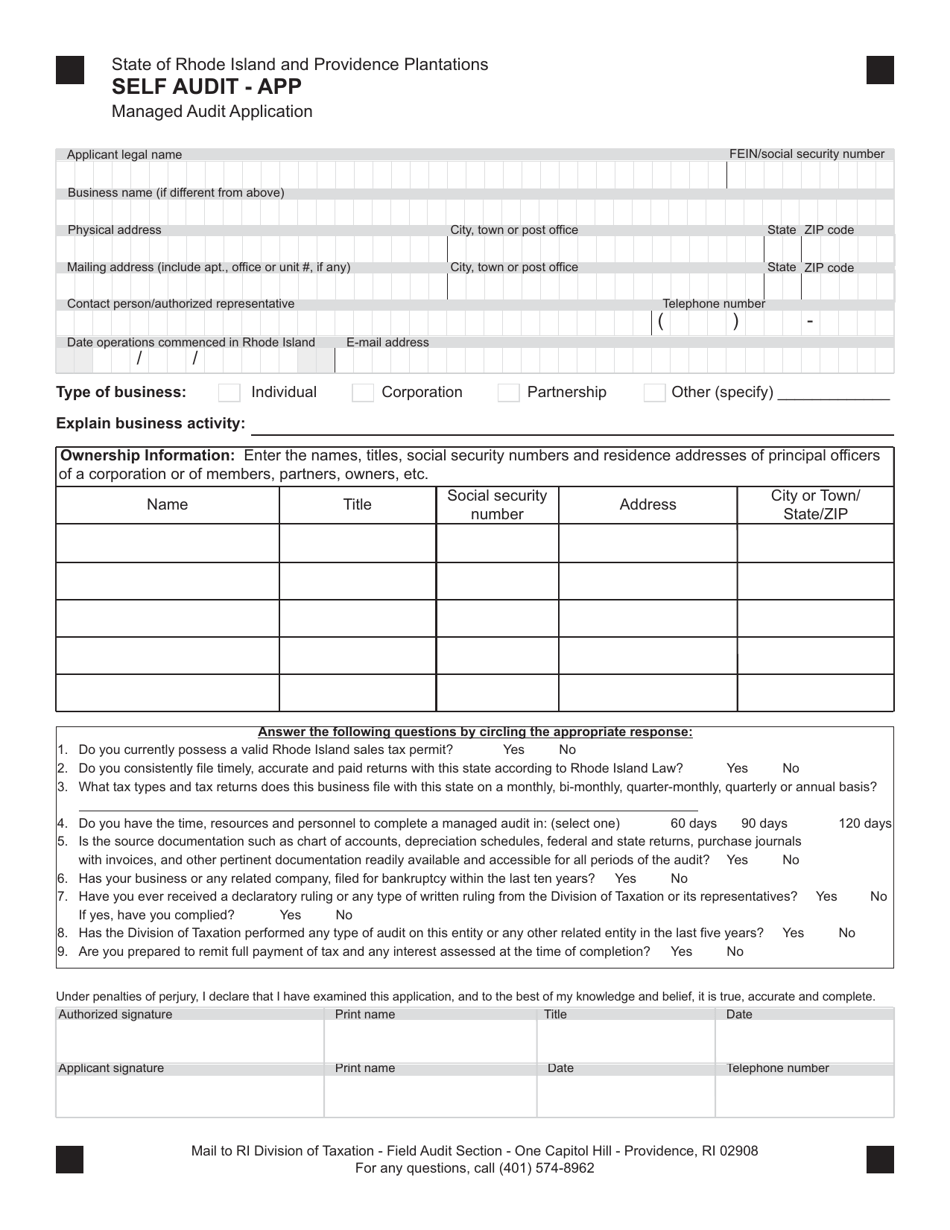

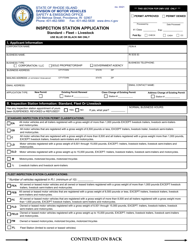

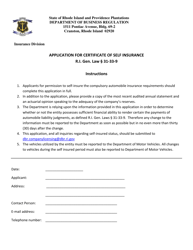

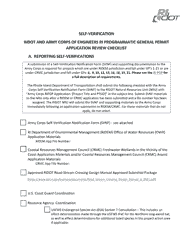

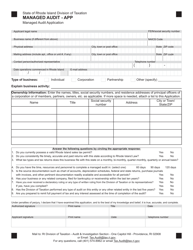

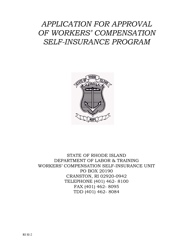

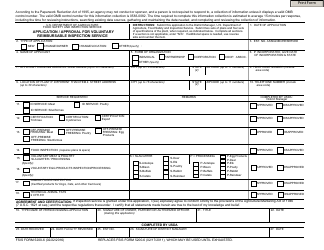

Self-audit - Application Form - Rhode Island

Self-audit - Application Form is a legal document that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island.

FAQ

Q: What is a self-audit?

A: A self-audit is a process where individuals review their own application form to ensure accuracy and completeness.

Q: Why do I need to do a self-audit?

A: Doing a self-audit helps to avoid any errors or omissions in your application form, which could lead to delays or rejections.

Q: What should I review during a self-audit?

A: During a self-audit, you should review all sections of your application form, including personal information, employment history, education, and any supporting documents.

Q: How can I perform a self-audit?

A: To perform a self-audit, carefully review each section of your application form, double-check all information for accuracy, and ensure that you have provided all the required documents.

Q: What should I do if I find errors or omissions during the self-audit?

A: If you find errors or omissions during the self-audit, correct them immediately and make necessary updates to your application form.

Q: Can I seek assistance during the self-audit process?

A: Yes, you can seek assistance from professionals or friends/family members who are familiar with the application process to review your form.

Q: Is a self-audit mandatory for all applications?

A: A self-audit is not mandatory, but it is highly recommended to ensure the accuracy and completeness of your application form.

Q: What are the consequences of not performing a self-audit?

A: Not performing a self-audit may result in errors or omissions in your application form, which could lead to delays in processing or rejection of your application.

Q: Can I make changes to my application form after submitting it?

A: In most cases, once you submit your application form, you cannot make changes. It is important to review it thoroughly before submitting.

Q: What should I do if I need to make changes after submitting my application form?

A: If you need to make changes after submitting your application form, contact the relevant authority or organization to inquire about the process for updating or correcting your information.

Form Details:

- The latest edition currently provided by the Rhode Island Department of Revenue - Division of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.