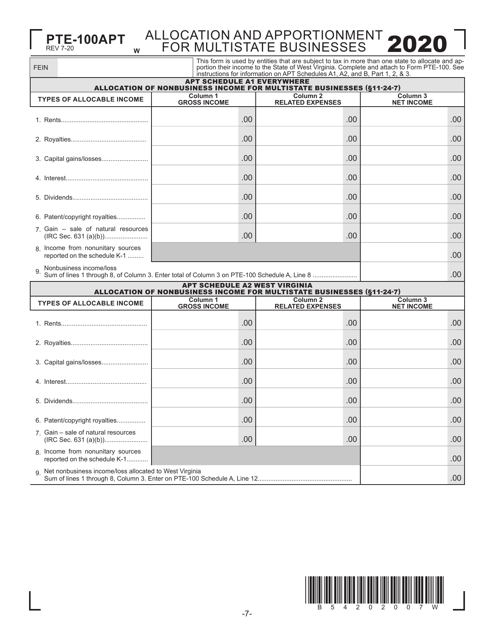

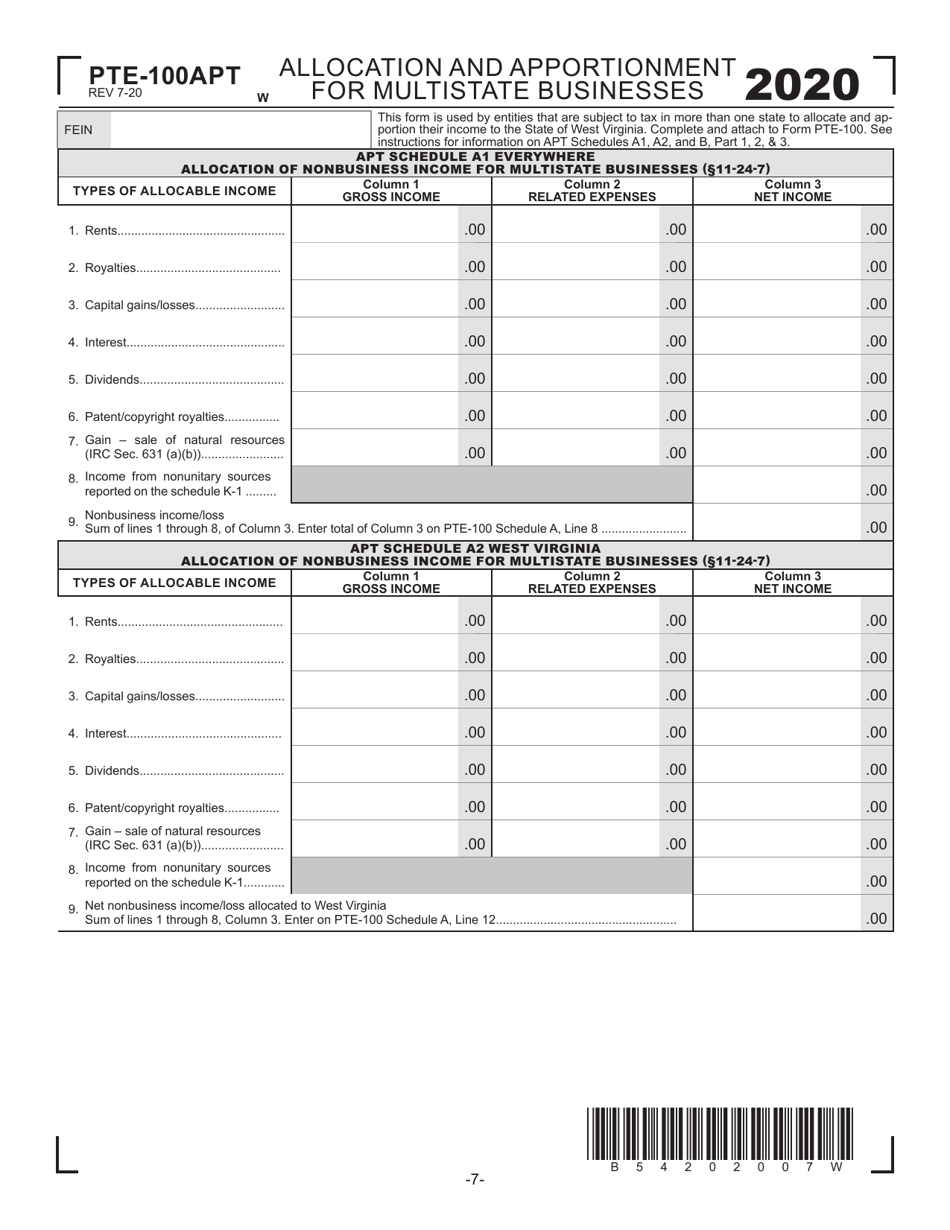

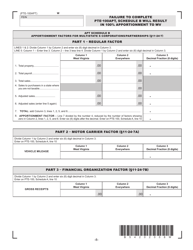

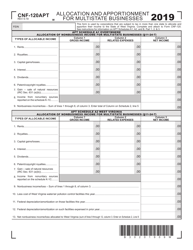

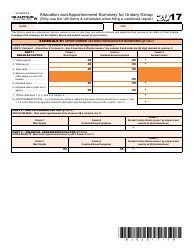

Form PTE-100APT Schedule A Allocation and Apportionment for Multistate Businesses - West Virginia

What Is Form PTE-100APT Schedule A?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PTE-100APT?

A: Form PTE-100APT is the form used for the Allocation and Apportionment for Multistate Businesses in West Virginia.

Q: Who needs to file Form PTE-100APT?

A: Multistate businesses operating in West Virginia need to file Form PTE-100APT.

Q: What is the purpose of Form PTE-100APT?

A: The purpose of Form PTE-100APT is to allocate and apportion income for multistate businesses in accordance with West Virginia tax laws.

Q: What is Schedule A?

A: Schedule A is a part of Form PTE-100APT that is used for reporting the allocation and apportionment of income.

Q: What are the requirements for filing Form PTE-100APT?

A: The requirements for filing Form PTE-100APT include having a multistate business operating in West Virginia and meeting the filing deadlines set by the West Virginia tax authorities.

Q: Is Form PTE-100APT specific to West Virginia?

A: Yes, Form PTE-100APT is specific to West Virginia and is used for reporting the allocation and apportionment of income for multistate businesses in the state.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PTE-100APT Schedule A by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.