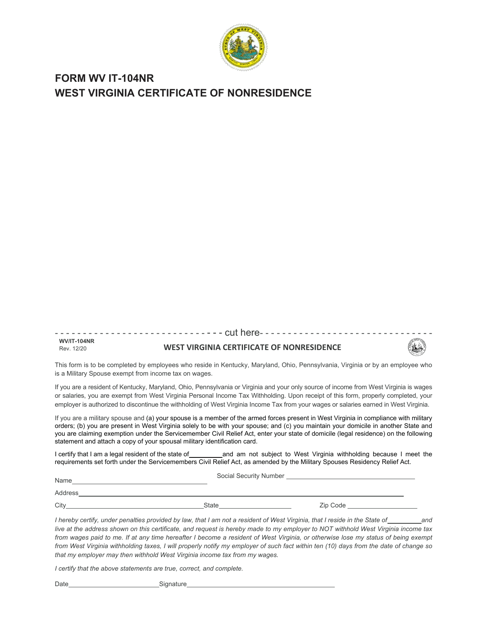

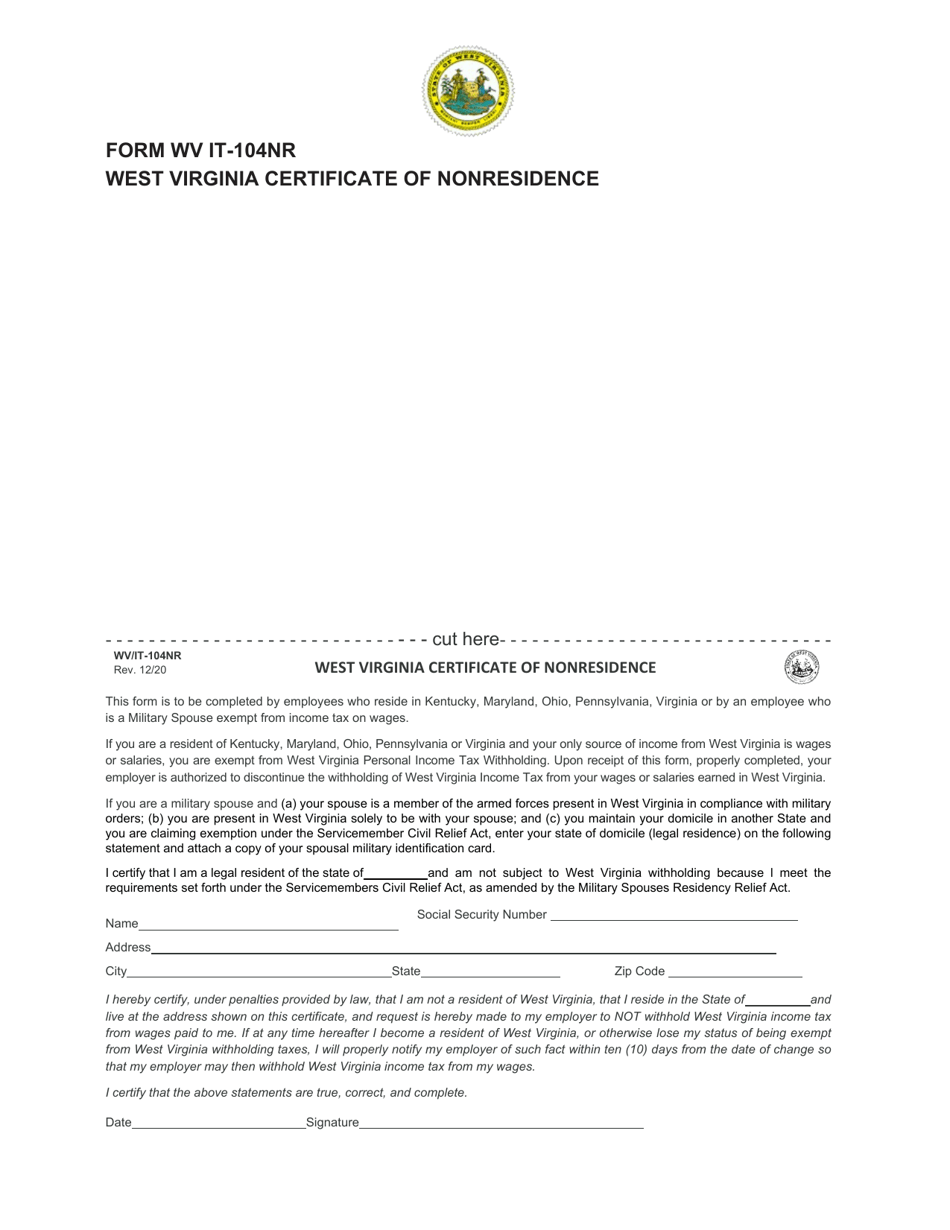

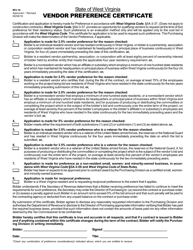

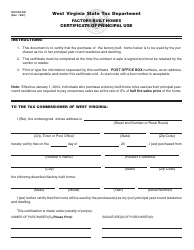

Form WV / IT-104NR West Virginia Certificate of Nonresidence - West Virginia

What Is Form WV/IT-104NR?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the WV/IT-104NR form?

A: The WV/IT-104NR form is the West Virginia Certificate of Nonresidence.

Q: Who can use the WV/IT-104NR form?

A: The WV/IT-104NR form can be used by individuals who are not residents of West Virginia, but have income from West Virginia sources.

Q: What is the purpose of the WV/IT-104NR form?

A: The purpose of the WV/IT-104NR form is to certify nonresidency and claim exemption from West Virginia income tax.

Q: When should I file the WV/IT-104NR form?

A: You should file the WV/IT-104NR form at the same time you file your West Virginia personal income tax return.

Q: Do I need to include any supporting documents with the WV/IT-104NR form?

A: Yes, you must include a copy of your federal income tax return and any other supporting documents that may be required.

Q: Can I e-file the WV/IT-104NR form?

A: No, the WV/IT-104NR form cannot be e-filed. It must be filed by mail or in person.

Q: What happens if I don't file the WV/IT-104NR form?

A: If you don't file the WV/IT-104NR form, you may be subject to West Virginia income tax on your income from West Virginia sources.

Q: Can I use the WV/IT-104NR form if I am a resident of West Virginia?

A: No, the WV/IT-104NR form is only for individuals who are not residents of West Virginia.

Q: What should I do if I have additional questions about the WV/IT-104NR form?

A: If you have additional questions about the WV/IT-104NR form, you should contact the West Virginia Department of Revenue for assistance.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/IT-104NR by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.