This version of the form is not currently in use and is provided for reference only. Download this version of

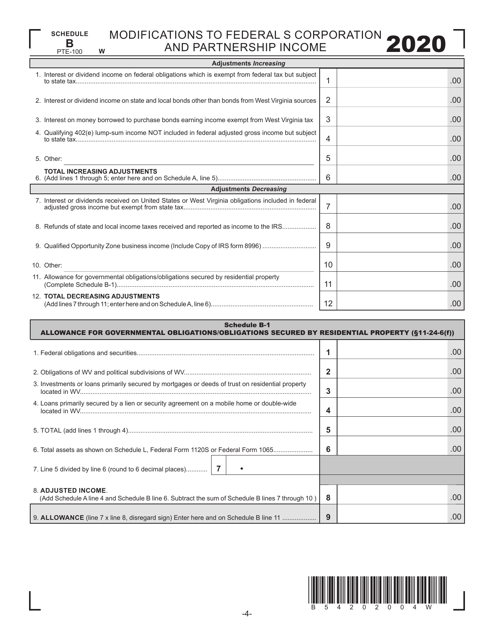

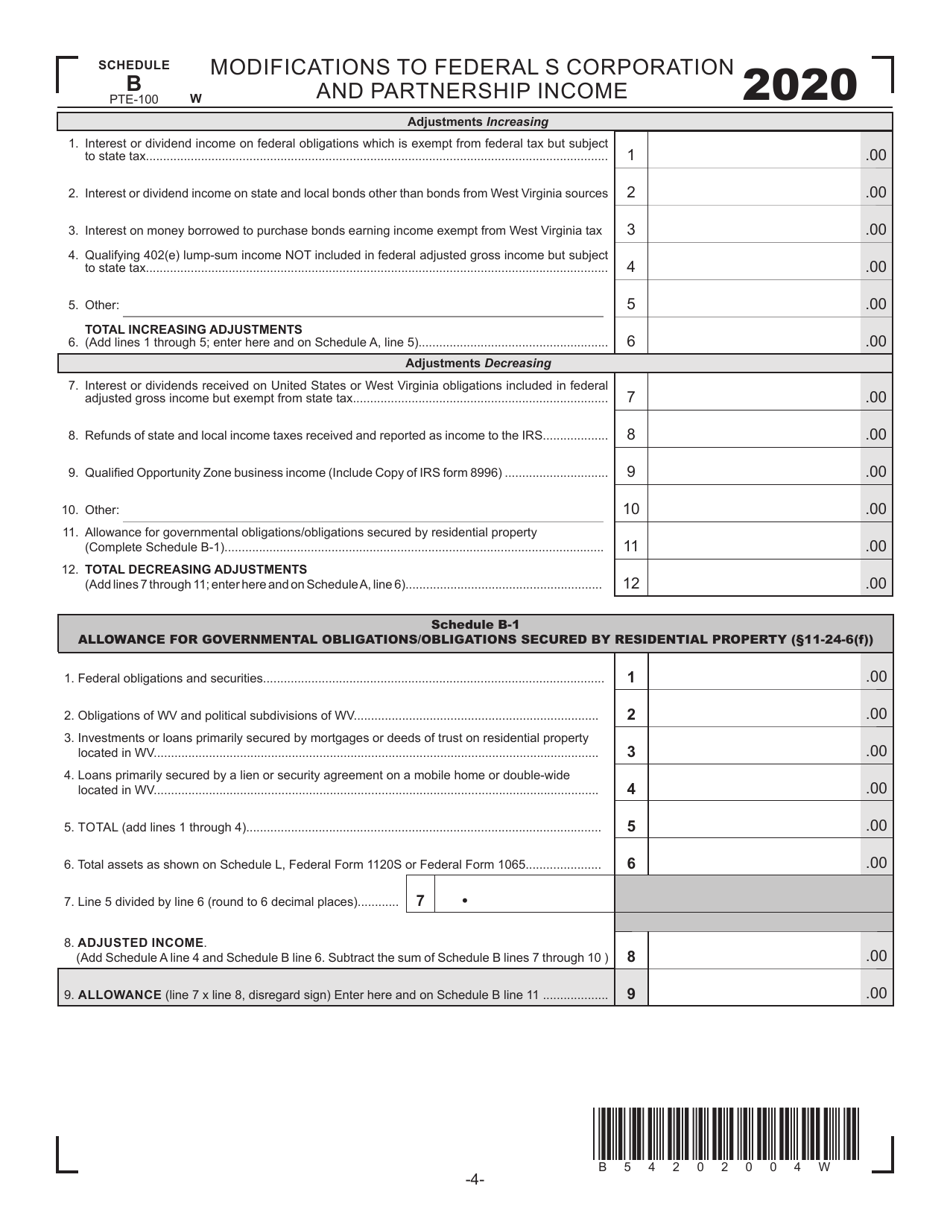

Form PTE-100 Schedule B

for the current year.

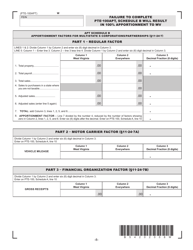

Form PTE-100 Schedule B Modifications to Federal S Corporation and Partnership Income - West Virginia

What Is Form PTE-100 Schedule B?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia.The document is a supplement to Form PTE-100, West Virginia Income Tax Return S Corporation & Partnership (Pass-Through Entity). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PTE-100 Schedule B?

A: Form PTE-100 Schedule B is a tax form used in West Virginia to report modifications to Federal S Corporation and Partnership Income.

Q: Who needs to file Form PTE-100 Schedule B?

A: Individuals or entities that are S Corporations or partnerships and have modifications to their federal income need to file Form PTE-100 Schedule B in West Virginia.

Q: What are modifications to federal income?

A: Modifications to federal income are adjustments that need to be made to the S Corporation or partnership income to calculate the correct state tax liability.

Q: What information is required on Form PTE-100 Schedule B?

A: Form PTE-100 Schedule B requires the taxpayer to provide details of the modifications made to their federal income.

Q: Is Form PTE-100 Schedule B only for businesses in West Virginia?

A: Yes, Form PTE-100 Schedule B is specifically for businesses in West Virginia to report modifications to their federal S Corporation or partnership income.

Q: When is the deadline to file Form PTE-100 Schedule B?

A: The deadline to file Form PTE-100 Schedule B in West Virginia is the same as the deadline for filing the state income tax return, which is generally April 15th.

Q: Do I need to include a copy of my federal tax return with Form PTE-100 Schedule B?

A: No, you do not need to include a copy of your federal tax return with Form PTE-100 Schedule B. However, you may need to provide supporting documentation for the modifications made to your federal income.

Q: What happens if I don't file Form PTE-100 Schedule B?

A: If you fail to file Form PTE-100 Schedule B when required, you may be subject to penalties and interest on any unpaid taxes.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PTE-100 Schedule B by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.