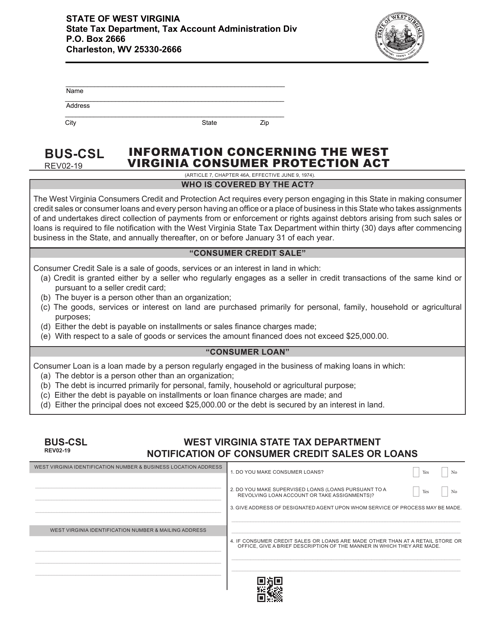

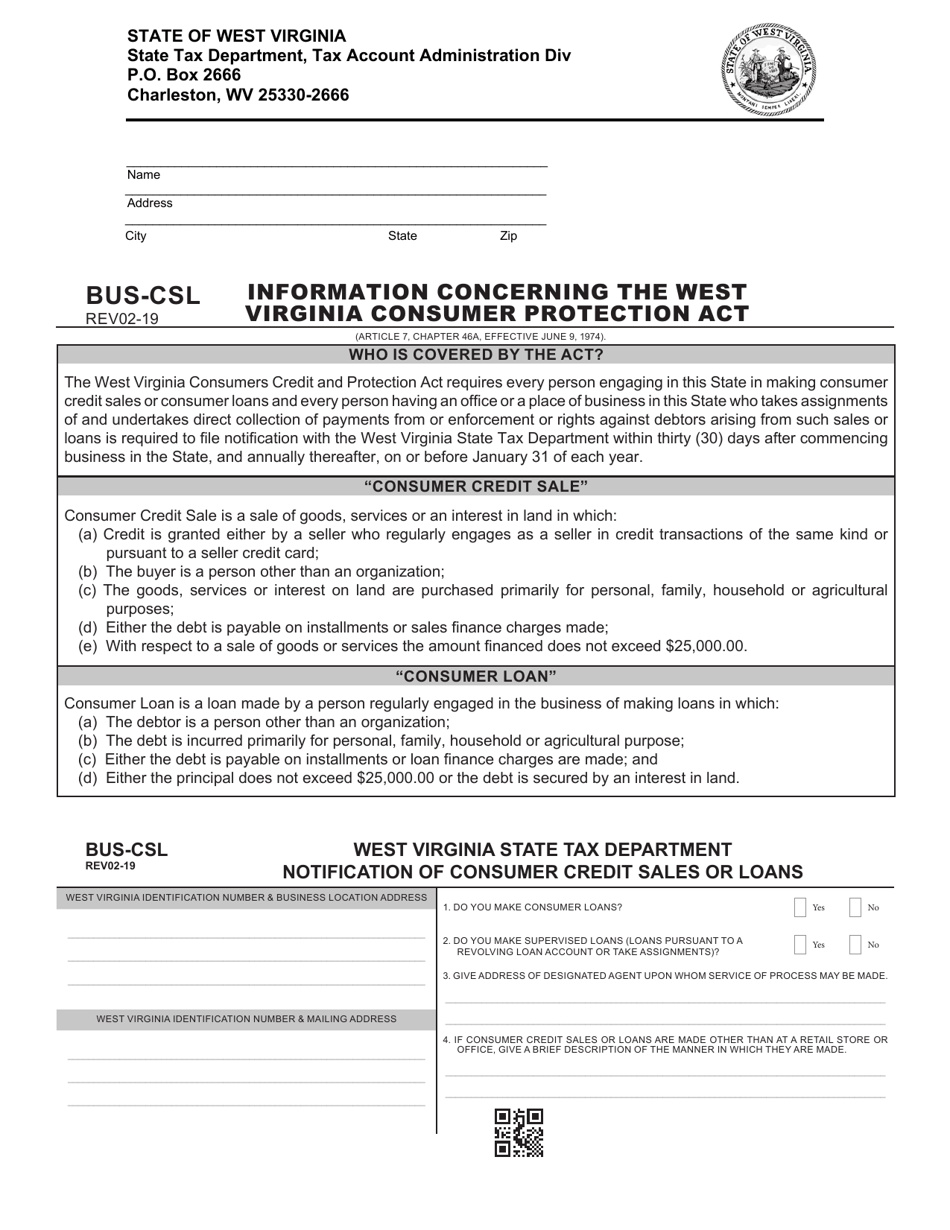

Form BUS-CSL Information Concerning the West Virginia Consumer Protection Act - West Virginia

What Is Form BUS-CSL?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

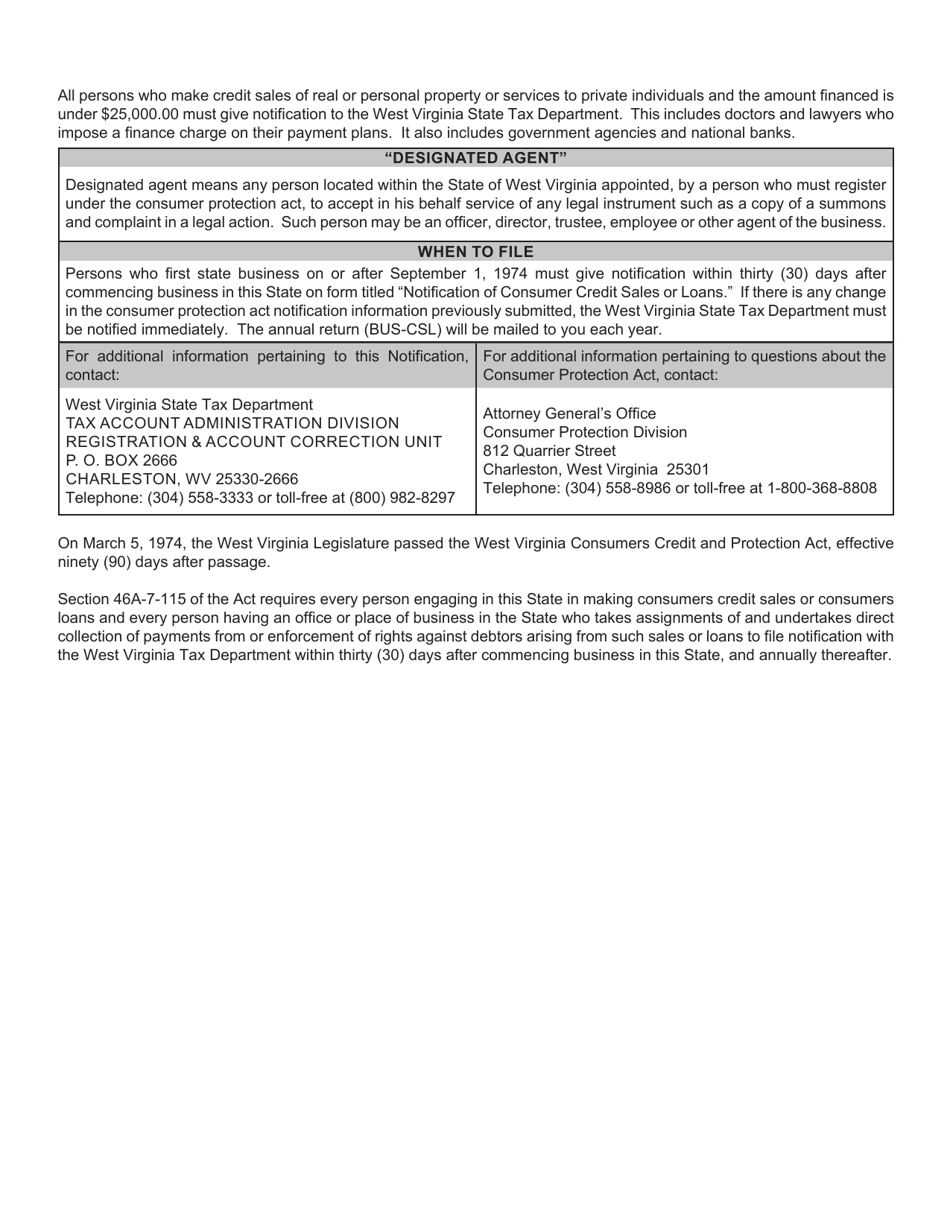

Q: What is the West Virginia Consumer Protection Act?

A: The West Virginia Consumer Protection Act is a law that protects consumers from unfair and deceptive practices.

Q: What does the West Virginia Consumer Protection Act cover?

A: The Act covers a wide range of industries and practices, including false advertising, fraud, and unfair debt collection practices.

Q: Who enforces the West Virginia Consumer Protection Act?

A: The West Virginia Attorney General's Office is responsible for enforcing the Act.

Q: What can I do if I believe I have been a victim of a consumer protection violation?

A: You can file a complaint with the West Virginia Attorney General's Office or seek legal advice from an attorney.

Q: What are the penalties for violating the West Virginia Consumer Protection Act?

A: Violators of the Act may be required to pay restitution to affected consumers and can face civil penalties and injunctive relief.

Q: Are there any exemptions to the West Virginia Consumer Protection Act?

A: There are some exemptions for certain types of transactions, such as transactions involving securities or insurance.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BUS-CSL by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.