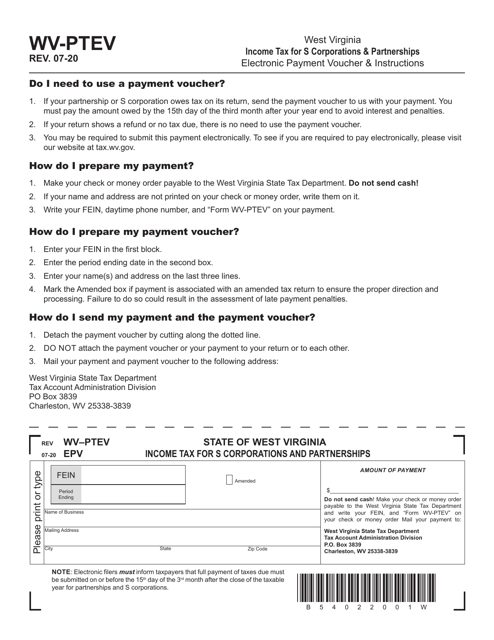

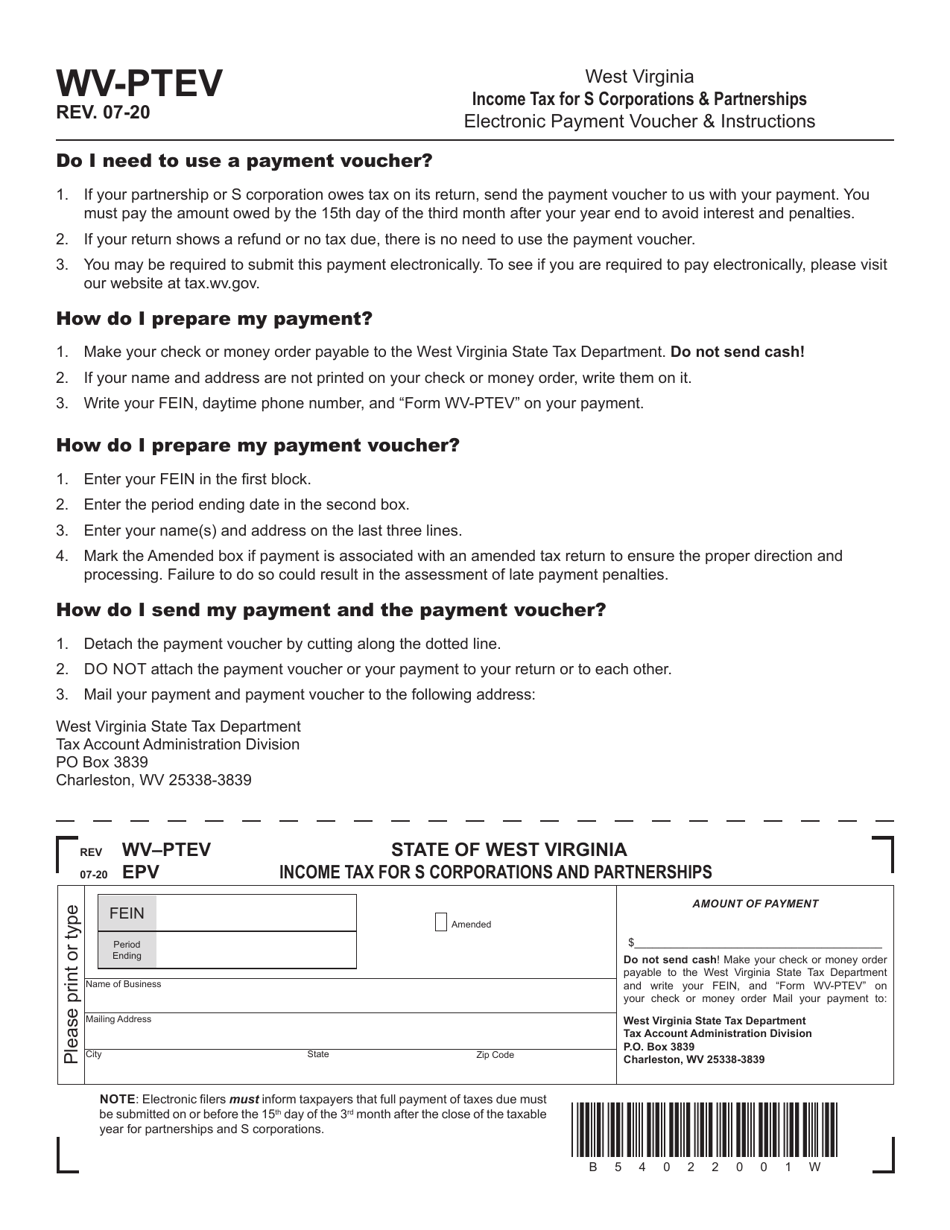

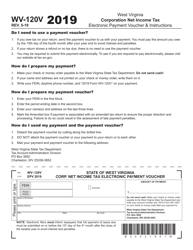

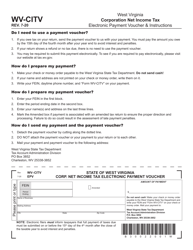

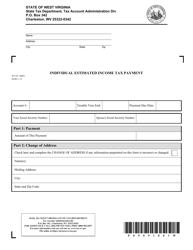

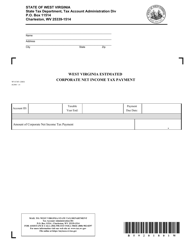

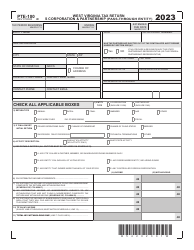

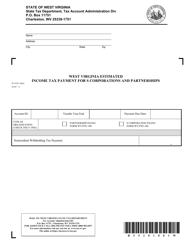

Form WV-PTEV West Virginia Income Tax for S Corporations and Partnerships Electronic Payment Voucher - West Virginia

What Is Form WV-PTEV?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form WV-PTEV?

A: Form WV-PTEV is a West Virginia Income Tax form for S Corporations and Partnerships Electronic Payment Voucher.

Q: Who needs to use form WV-PTEV?

A: S Corporations and Partnerships in West Virginia need to use form WV-PTEV.

Q: What is the purpose of form WV-PTEV?

A: The purpose of form WV-PTEV is to make electronic payments for West Virginia Income Tax for S Corporations and Partnerships.

Q: How do I use form WV-PTEV?

A: To use form WV-PTEV, you need to fill out the necessary information and make electronic payments for your West Virginia Income Tax.

Q: Are there any specific deadlines for using form WV-PTEV?

A: Yes, there are specific deadlines for using form WV-PTEV. Check the instructions provided with the form for more details.

Q: What should I do if I have questions about form WV-PTEV?

A: If you have questions about form WV-PTEV, you can contact the West Virginia Department of Revenue for assistance.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV-PTEV by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.