This version of the form is not currently in use and is provided for reference only. Download this version of

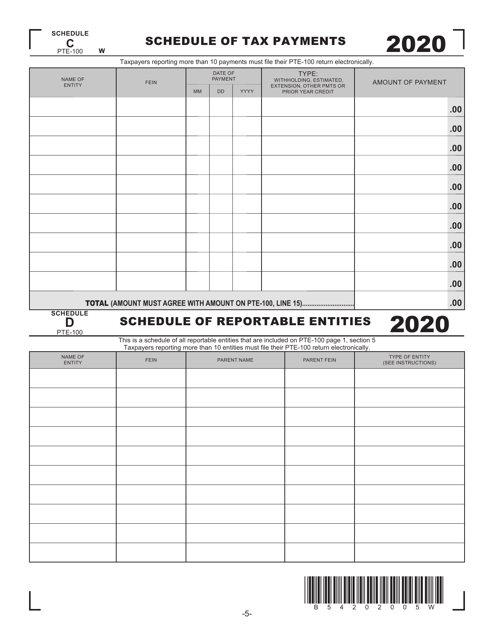

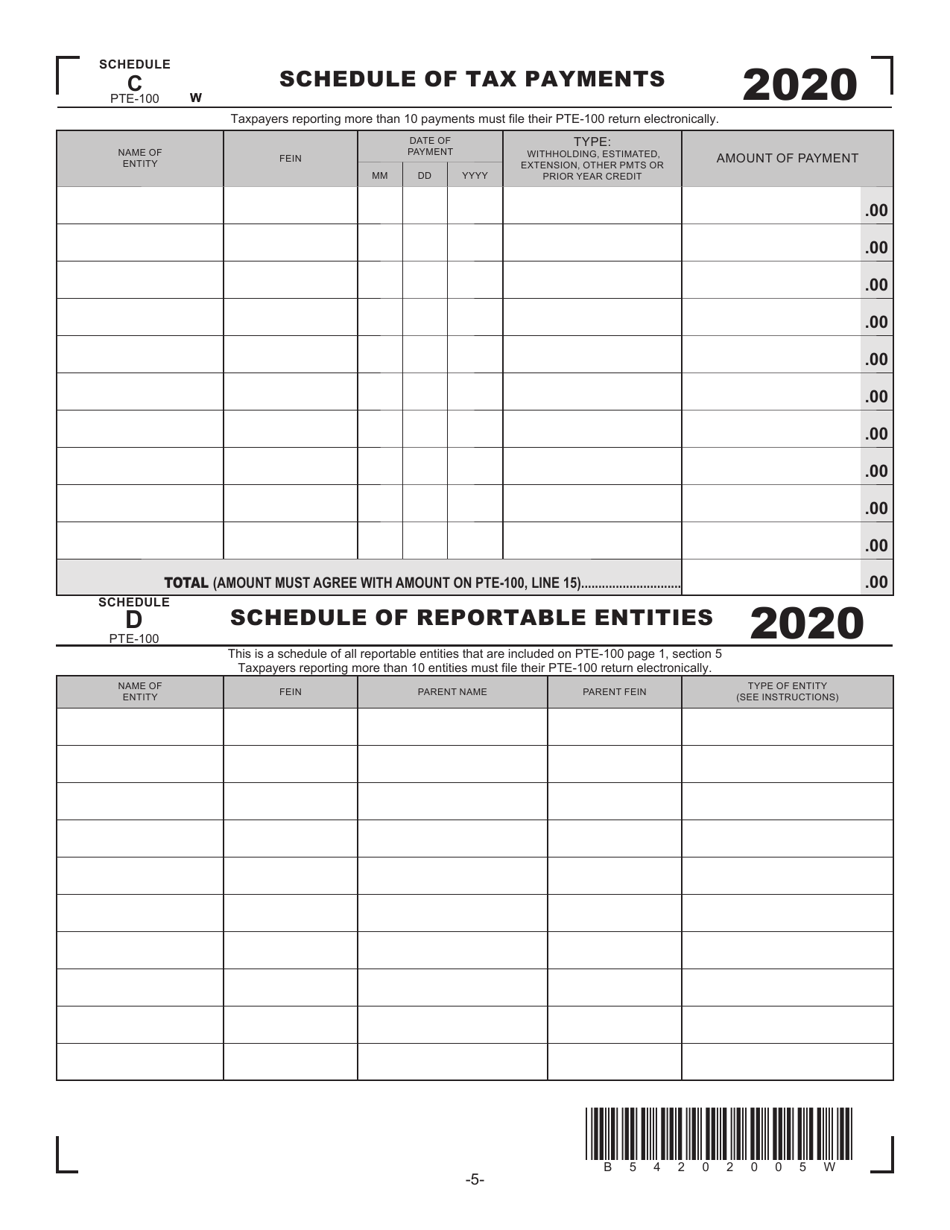

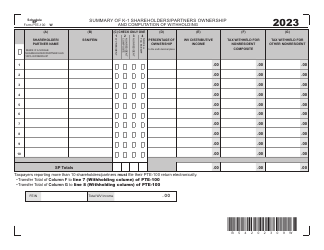

Form PTE-100 Schedule C, D

for the current year.

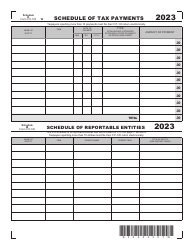

Form PTE-100 Schedule C, D Schedule of Tax Payments; Schedule of Reportable Entities - West Virginia

What Is Form PTE-100 Schedule C, D?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia.The document is a supplement to Form PTE-100, West Virginia Income Tax Return S Corporation & Partnership (Pass-Through Entity). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PTE-100?

A: Form PTE-100 is a tax form used in West Virginia for reporting income, deductions, and tax payments for pass-through entities.

Q: What is Schedule C?

A: Schedule C is a part of Form PTE-100 that is used to report tax payments made by the pass-through entity.

Q: What is Schedule D?

A: Schedule D is a part of Form PTE-100 that is used to report information about reportable entities.

Q: What are reportable entities?

A: Reportable entities are entities that have a nexus (connection) with West Virginia and meet certain criteria specified by the state.

Q: Why do I need to file Form PTE-100?

A: You need to file Form PTE-100 if you have a pass-through entity with income or activity in West Virginia.

Q: When is the deadline to file Form PTE-100?

A: The deadline to file Form PTE-100 in West Virginia is generally on or before April 15th of the following year.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing of Form PTE-100 in West Virginia. It is important to file the form by the deadline to avoid any penalties or interest charges.

Q: Is Form PTE-100 required for all pass-through entities in West Virginia?

A: Yes, Form PTE-100 is required for all pass-through entities that have income or activity in West Virginia, unless specifically exempted.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PTE-100 Schedule C, D by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.