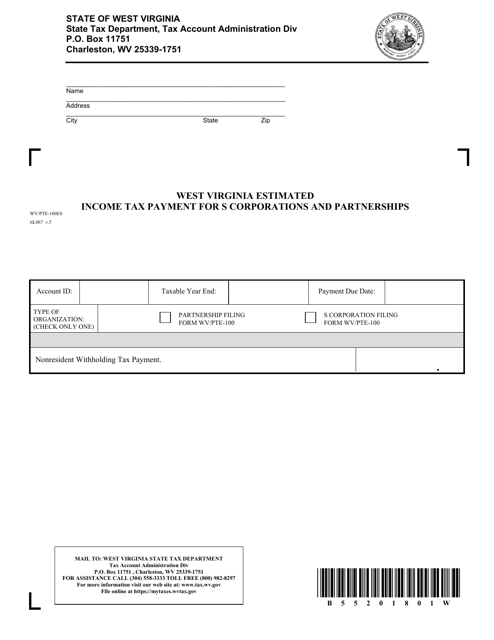

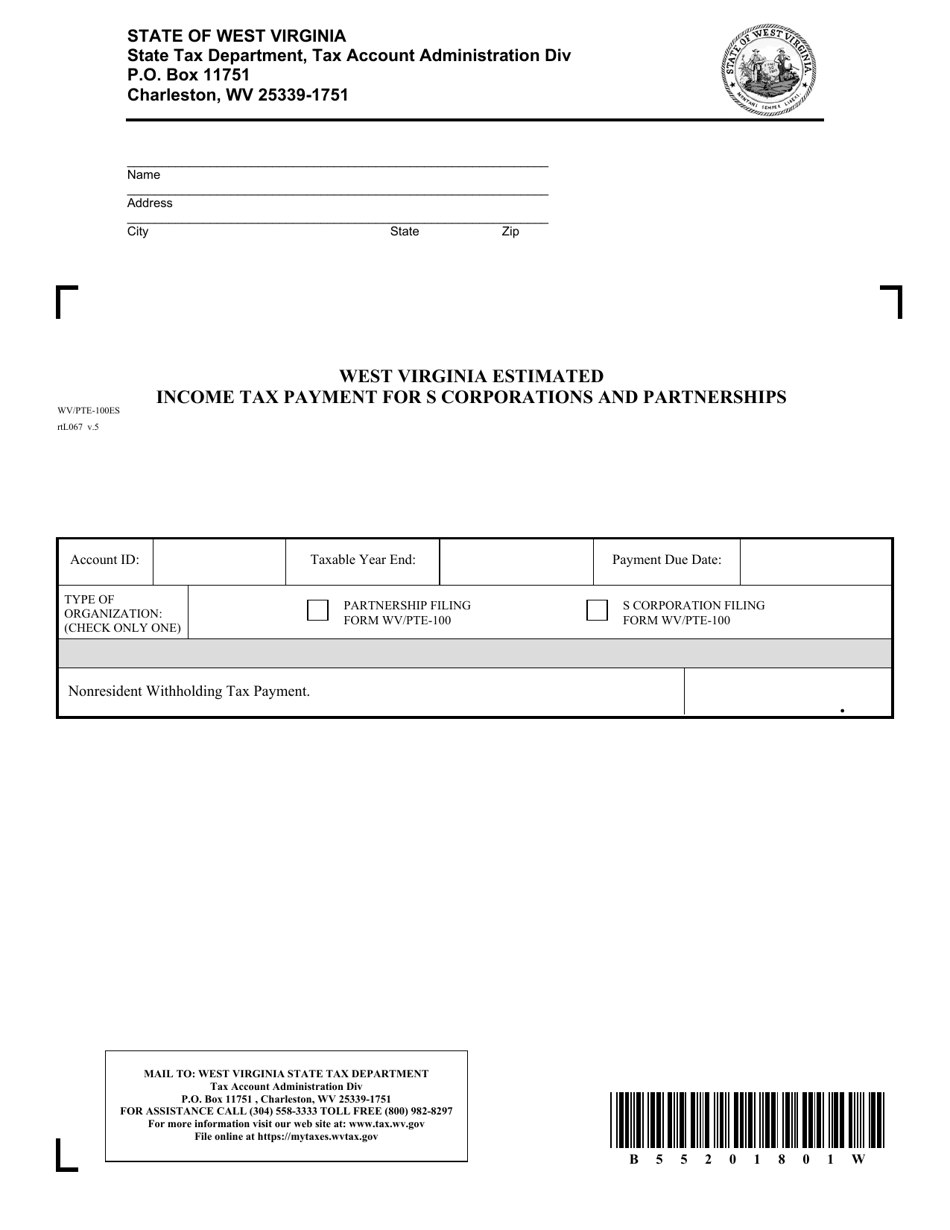

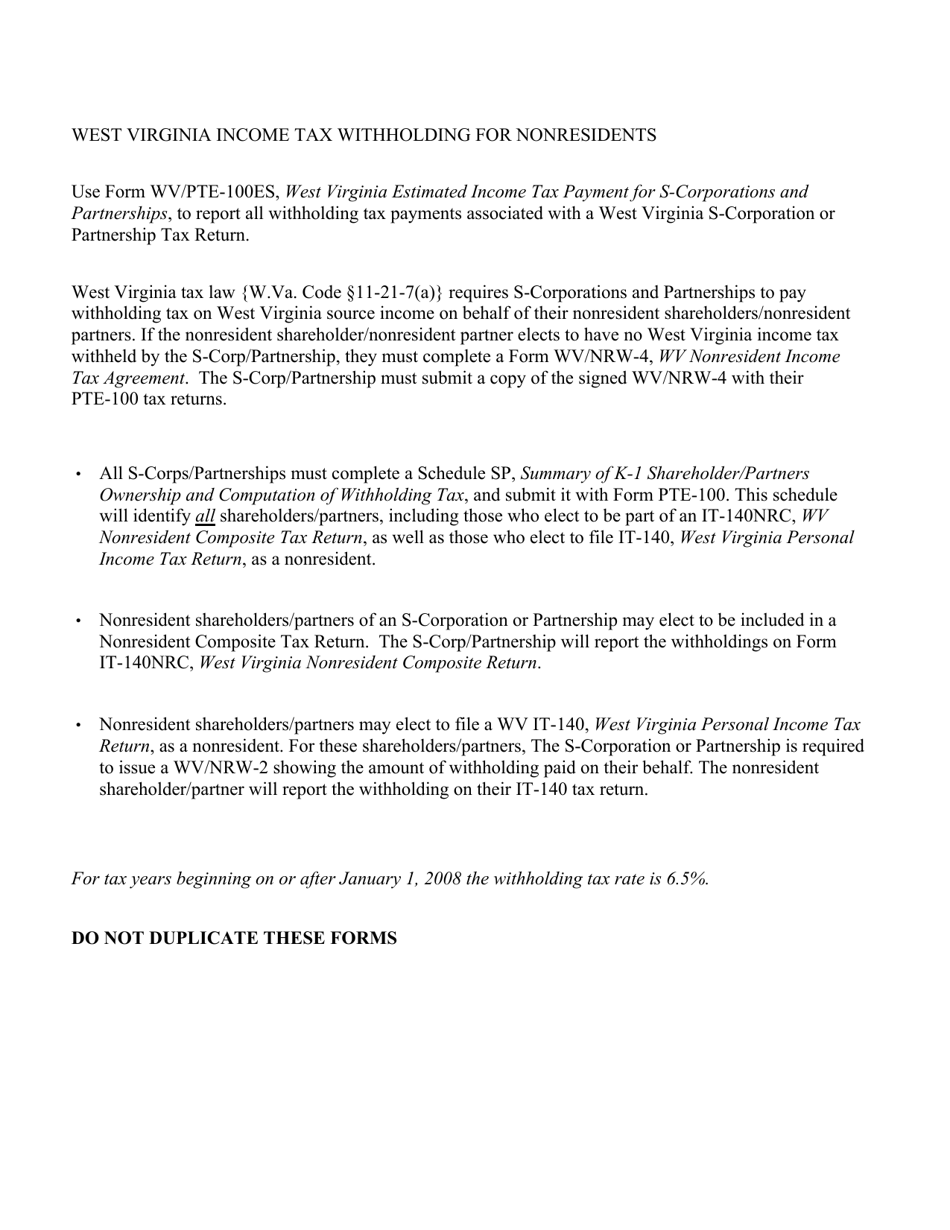

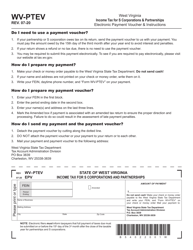

Form PTE-100ES West Virginia Estimated Income Tax Payment for S Corporations and Partnerships - West Virginia

What Is Form PTE-100ES?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PTE-100ES?

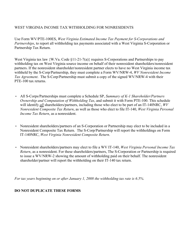

A: Form PTE-100ES is a tax form used by S Corporations and Partnerships in West Virginia to make estimated income tax payments.

Q: Who uses Form PTE-100ES?

A: S Corporations and Partnerships in West Virginia use Form PTE-100ES.

Q: What is the purpose of Form PTE-100ES?

A: The purpose of Form PTE-100ES is to make estimated income tax payments for S Corporations and Partnerships in West Virginia.

Q: When is Form PTE-100ES due?

A: Form PTE-100ES is due on or before the 15th day of the fourth month following the close of the taxable year.

Q: Are there any penalties for not filing Form PTE-100ES?

A: Yes, there may be penalties for not filing Form PTE-100ES or for underpayment of estimated tax.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PTE-100ES by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.