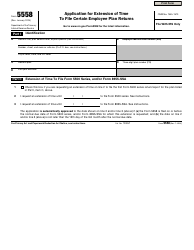

This version of the form is not currently in use and is provided for reference only. Download this version of

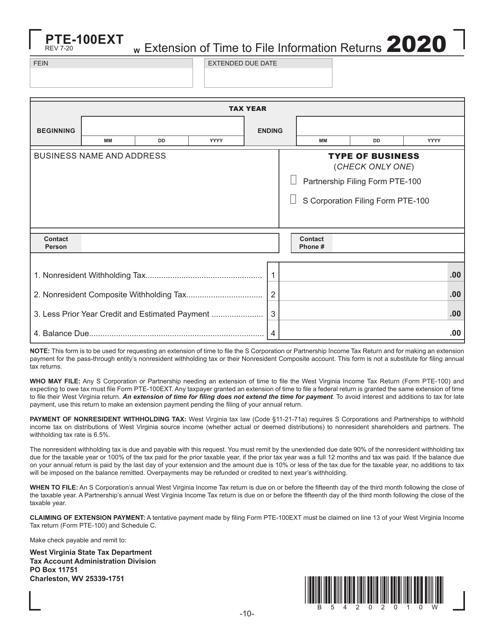

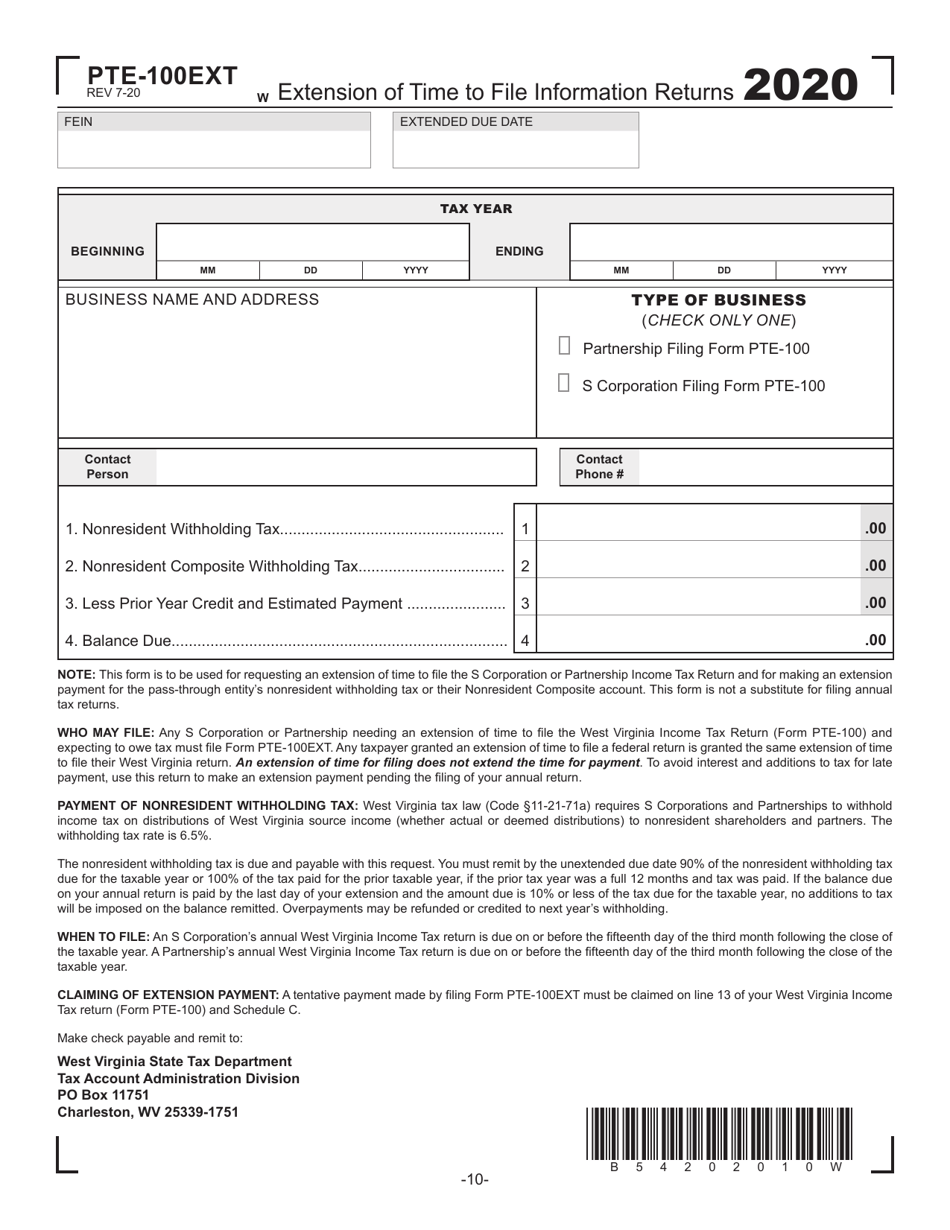

Form PTE-100EXT

for the current year.

Form PTE-100EXT Extension of Time to File Information Returns - West Virginia

What Is Form PTE-100EXT?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

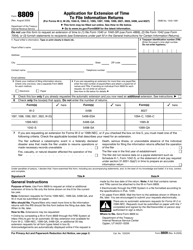

Q: What is Form PTE-100EXT?

A: Form PTE-100EXT is the Extension of Time to File Information Returns form for West Virginia.

Q: What is the purpose of Form PTE-100EXT?

A: The purpose of Form PTE-100EXT is to request an extension of time to file information returns for West Virginia.

Q: Who needs to file Form PTE-100EXT?

A: Individuals or businesses who are required to file information returns in West Virginia and need more time can file Form PTE-100EXT.

Q: When is Form PTE-100EXT due?

A: Form PTE-100EXT should be filed by the original due date of the information returns, which is usually January 31st.

Q: How long is the extension granted by Form PTE-100EXT?

A: The extension granted by Form PTE-100EXT is usually six months, extending the filing deadline to July 31st.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PTE-100EXT by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.