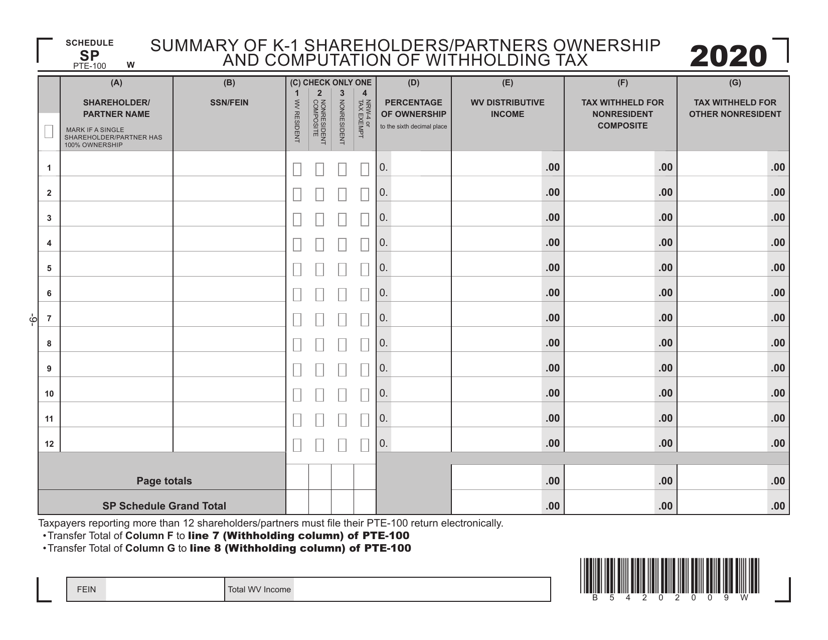

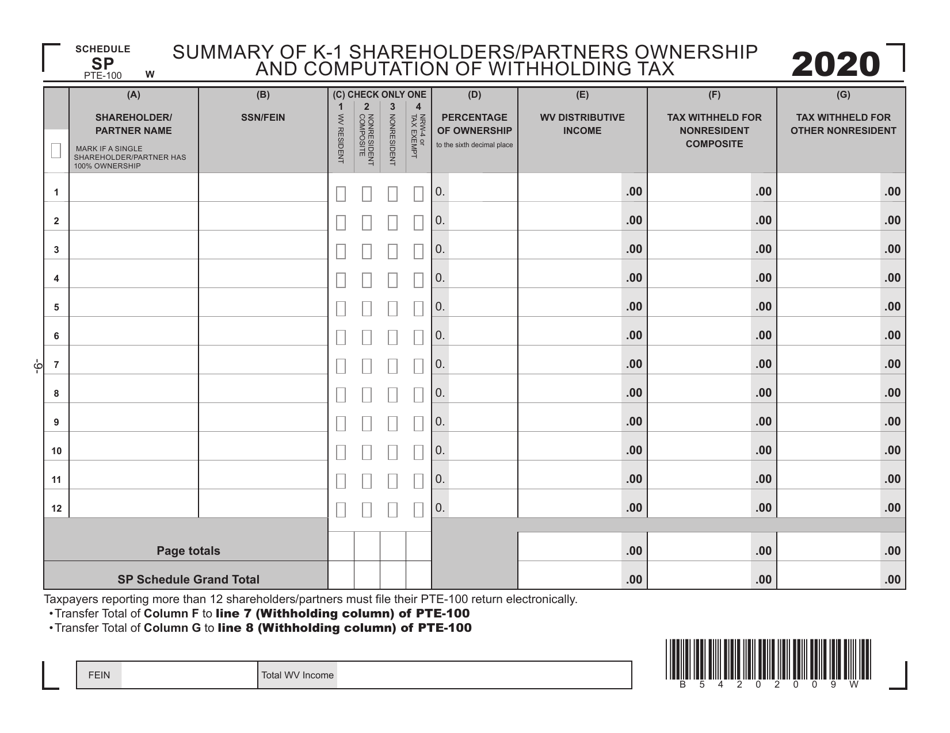

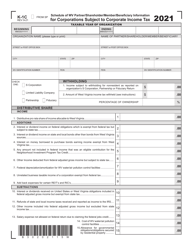

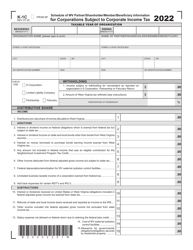

This version of the form is not currently in use and is provided for reference only. Download this version of

Form PTE-100 Schedule SP

for the current year.

Form PTE-100 Schedule SP Summary of K-1 Shareholders / Partners Ownership and Computation of Withholding Tax - West Virginia

What Is Form PTE-100 Schedule SP?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia.The document is a supplement to Form PTE-100, West Virginia Income Tax Return S Corporation & Partnership (Pass-Through Entity). As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PTE-100 Schedule SP?

A: Form PTE-100 Schedule SP is a document used in West Virginia to summarize the ownership and compute withholding tax for K-1 shareholders/partners.

Q: Who needs to file Form PTE-100 Schedule SP?

A: K-1 shareholders/partners in West Virginia who need to report their ownership and compute withholding tax must file Form PTE-100 Schedule SP.

Q: Why is Form PTE-100 Schedule SP important?

A: Form PTE-100 Schedule SP is important because it helps K-1 shareholders/partners in West Virginia accurately report their ownership and compute withholding tax.

Q: How do I complete Form PTE-100 Schedule SP?

A: To complete Form PTE-100 Schedule SP, you need to provide information about the K-1 shareholders/partners, their ownership percentages, and calculate the withholding tax.

Q: When is the deadline to file Form PTE-100 Schedule SP?

A: The deadline to file Form PTE-100 Schedule SP in West Virginia is usually the same as the deadline for the entity's annual tax return.

Q: Are there any penalties for not filing Form PTE-100 Schedule SP?

A: Yes, there may be penalties for not filing Form PTE-100 Schedule SP or filing it late in West Virginia, so it's important to submit it on time.

Q: Can I file Form PTE-100 Schedule SP electronically?

A: Yes, West Virginia allows electronic filing of Form PTE-100 Schedule SP.

Q: Is Form PTE-100 Schedule SP specific to West Virginia?

A: Yes, Form PTE-100 Schedule SP is specific to West Virginia and is used for reporting and computing withholding tax for K-1 shareholders/partners in the state.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PTE-100 Schedule SP by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.