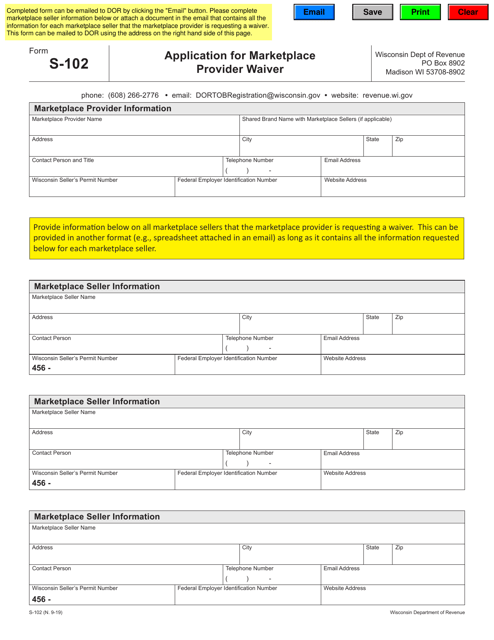

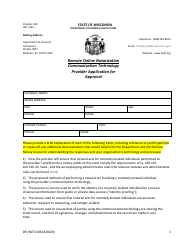

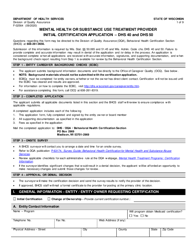

Form S-102 Application for Marketplace Provider Waiver - Wisconsin

What Is Form S-102?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form S-102?

A: Form S-102 is an application form for a waiver for marketplace providers in Wisconsin.

Q: Who should use Form S-102?

A: Marketplace providers in Wisconsin who are seeking a waiver should use Form S-102.

Q: Why would a marketplace provider need a waiver?

A: A waiver may be required for marketplace providers who are seeking relief from certain tax obligations in Wisconsin.

Q: What tax obligations can be waived with Form S-102?

A: The waiver may relieve marketplace providers from the obligation to collect and remit Wisconsin sales and use tax on certain transactions.

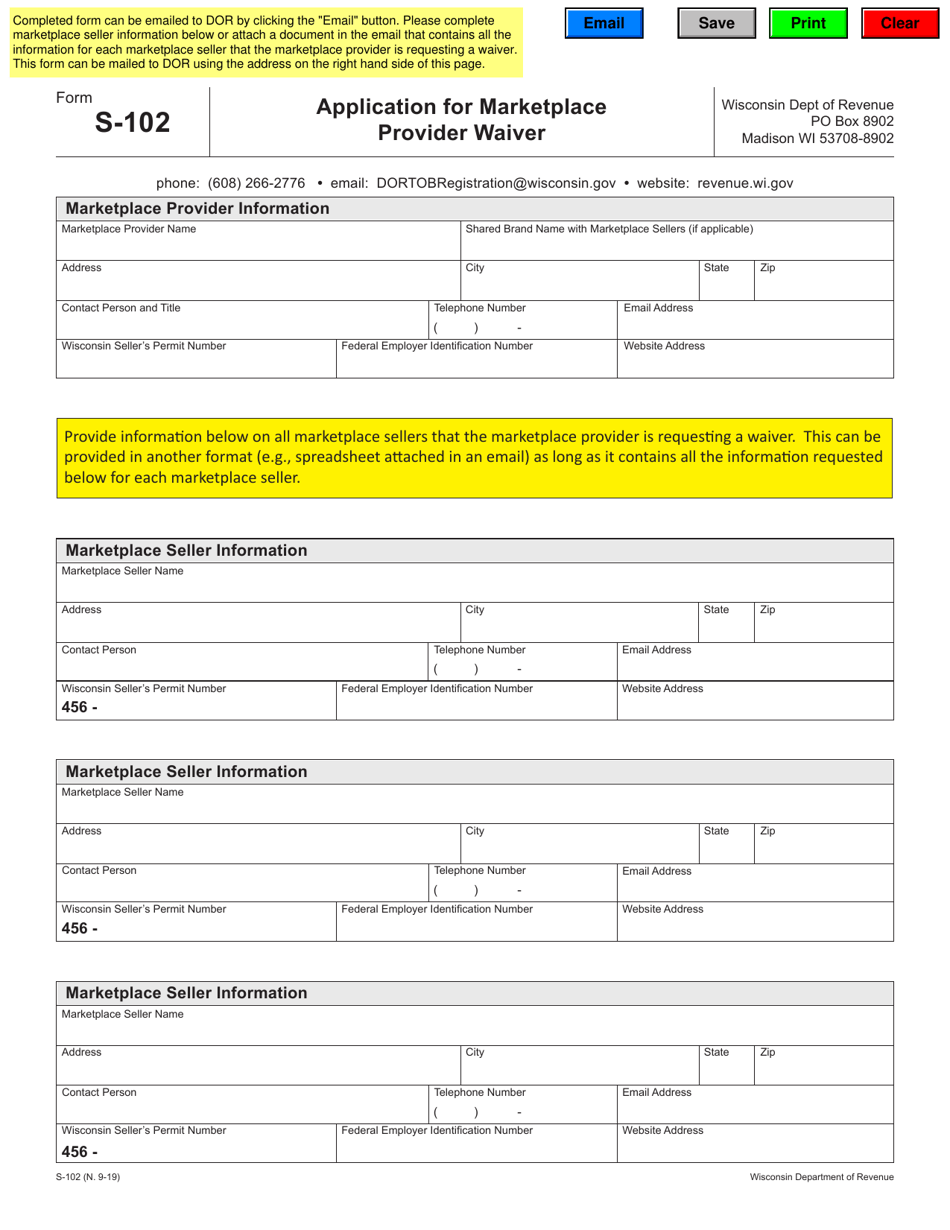

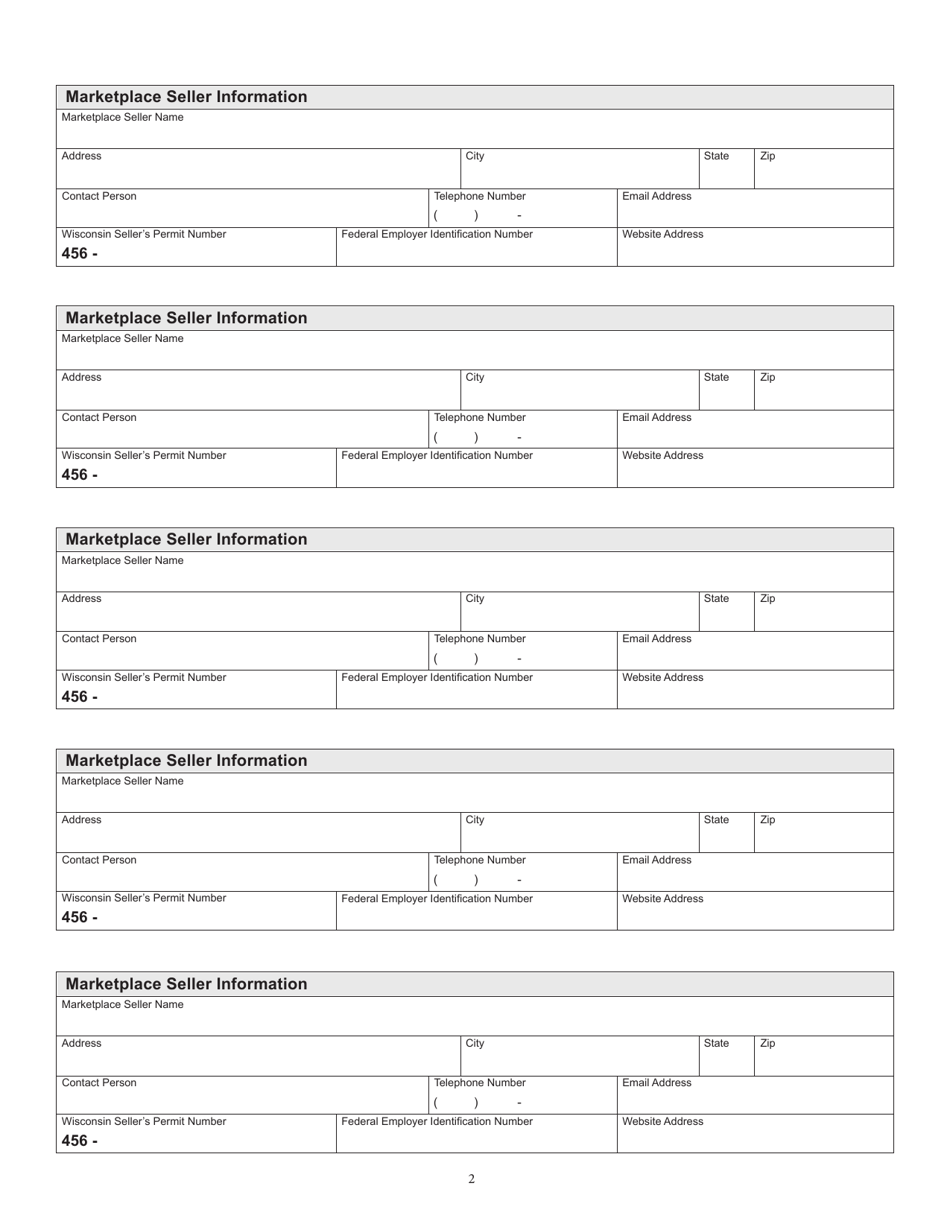

Q: What information is required on Form S-102?

A: The form requires information about the marketplace provider's business, transactions, and justification for the waiver request.

Q: Is there a fee for submitting Form S-102?

A: There is no fee associated with submitting Form S-102.

Q: How long does it take to receive a response to a Form S-102 application?

A: The Wisconsin Department of Revenue aims to respond to Form S-102 applications within 60 days.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form S-102 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.