This version of the form is not currently in use and is provided for reference only. Download this version of

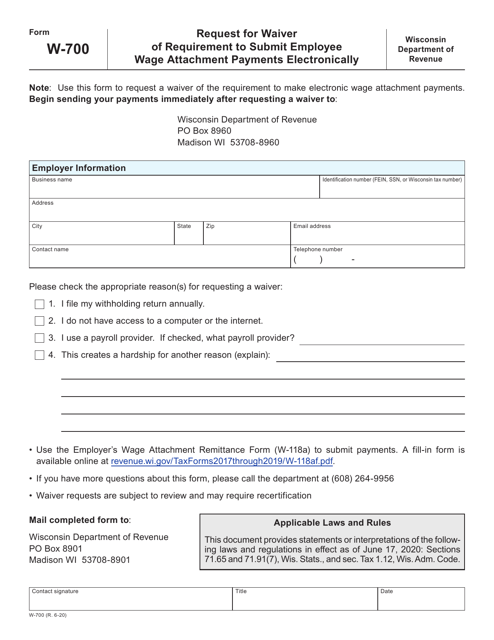

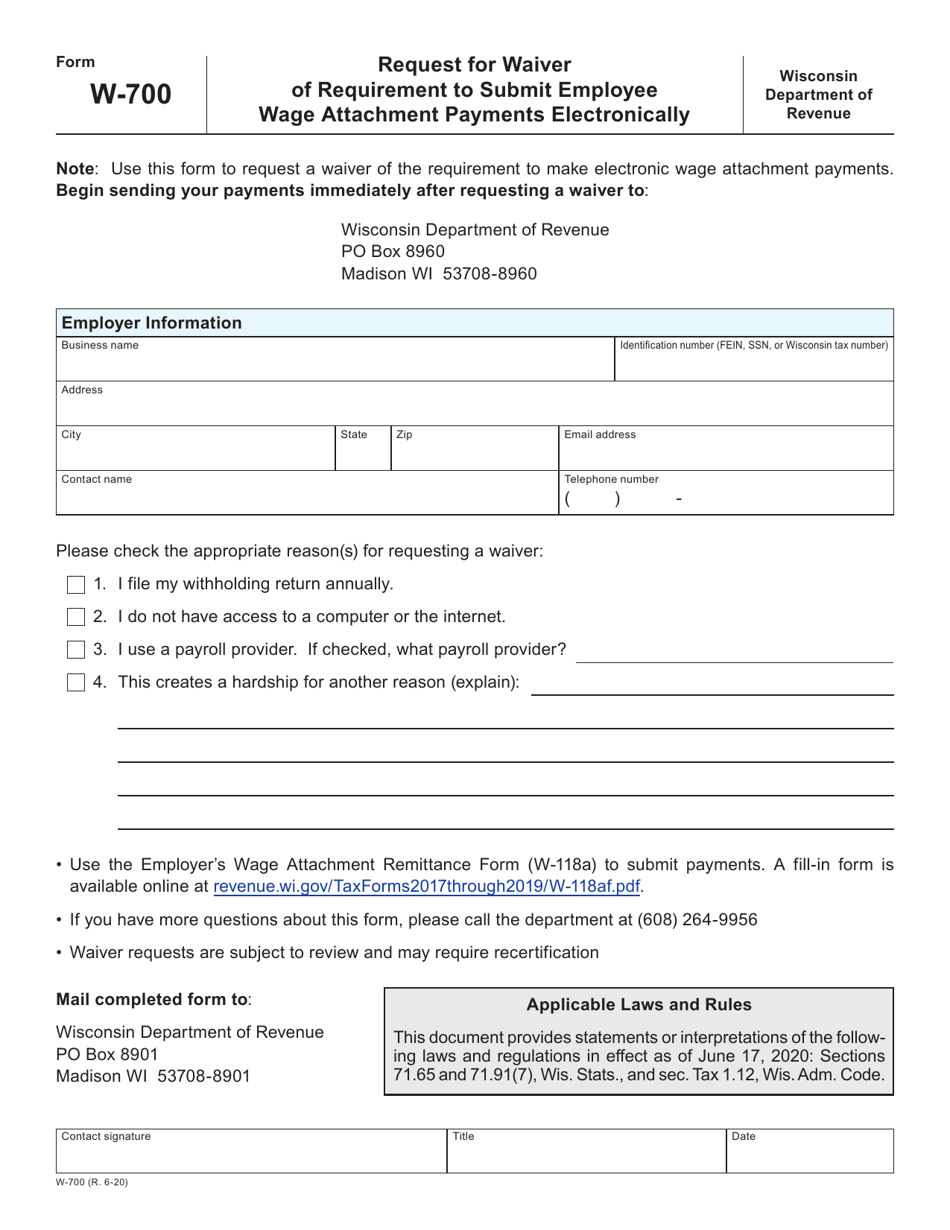

Form W-700

for the current year.

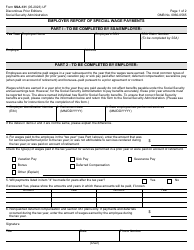

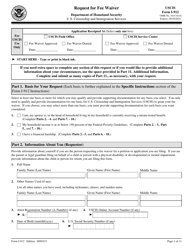

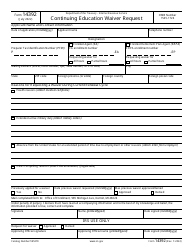

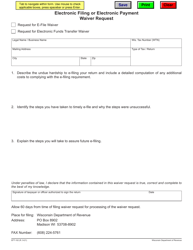

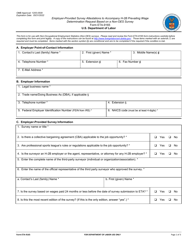

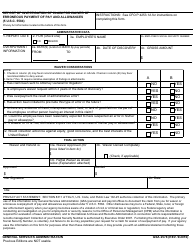

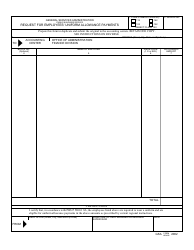

Form W-700 Request for Waiver of Requirement to Submit Employee Wage Attachment Payments Electronically - Wisconsin

What Is Form W-700?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W-700?

A: Form W-700 is a request for waiver of requirement to submit employee wage attachment payments electronically in Wisconsin.

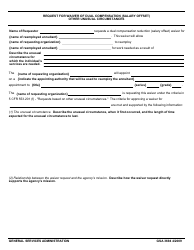

Q: Why would I need to request a waiver?

A: You would need to request a waiver from the requirement if you are unable to submit employee wage attachment payments electronically.

Q: Who can request a waiver?

A: Any employer who is unable to submit employee wage attachment payments electronically can request a waiver.

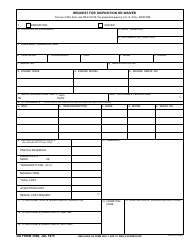

Q: How do I fill out Form W-700?

A: To fill out Form W-700, you need to provide your employer information, reason for the request, and signature.

Q: Is there a deadline to submit the form?

A: There is no specific deadline mentioned for submitting Form W-700. However, it is recommended to submit the waiver request as soon as possible.

Q: What happens after I submit the form?

A: Once you submit the form, the Wisconsin Department of Revenue will review your request and notify you of their decision.

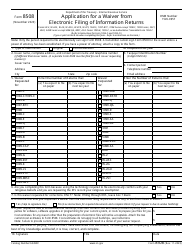

Q: Can I submit employee wage attachment payments electronically even if I requested a waiver?

A: No, if your waiver request is approved, you are not required to submit employee wage attachment payments electronically.

Q: What if my waiver request is denied?

A: If your waiver request is denied, you will need to make arrangements to comply with the requirement of submitting employee wage attachment payments electronically.

Q: Are there any penalties for not submitting employee wage attachment payments electronically?

A: Yes, there may be penalties for failure to comply with the requirement. It is important to follow the instructions provided by the Wisconsin Department of Revenue.

Form Details:

- Released on June 1, 2020;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form W-700 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.