This version of the form is not currently in use and is provided for reference only. Download this version of

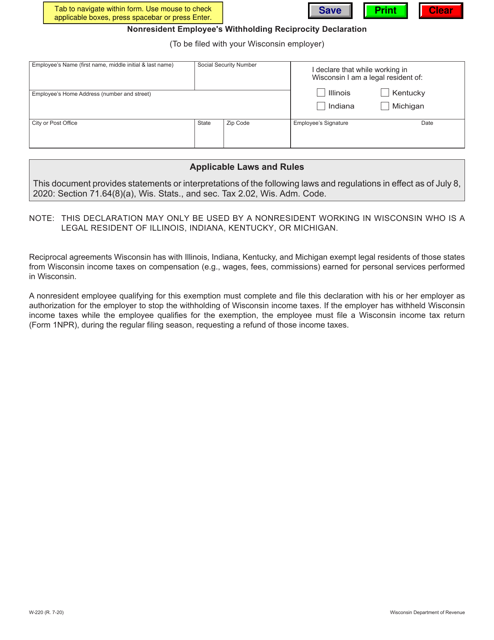

Form W-220

for the current year.

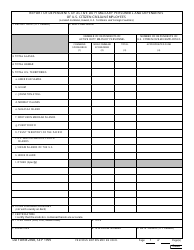

Form W-220 Nonresident Employee's Withholding Reciprocity Declaration - Wisconsin

What Is Form W-220?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W-220?

A: Form W-220 is the Nonresident Employee's Withholding Reciprocity Declaration for Wisconsin.

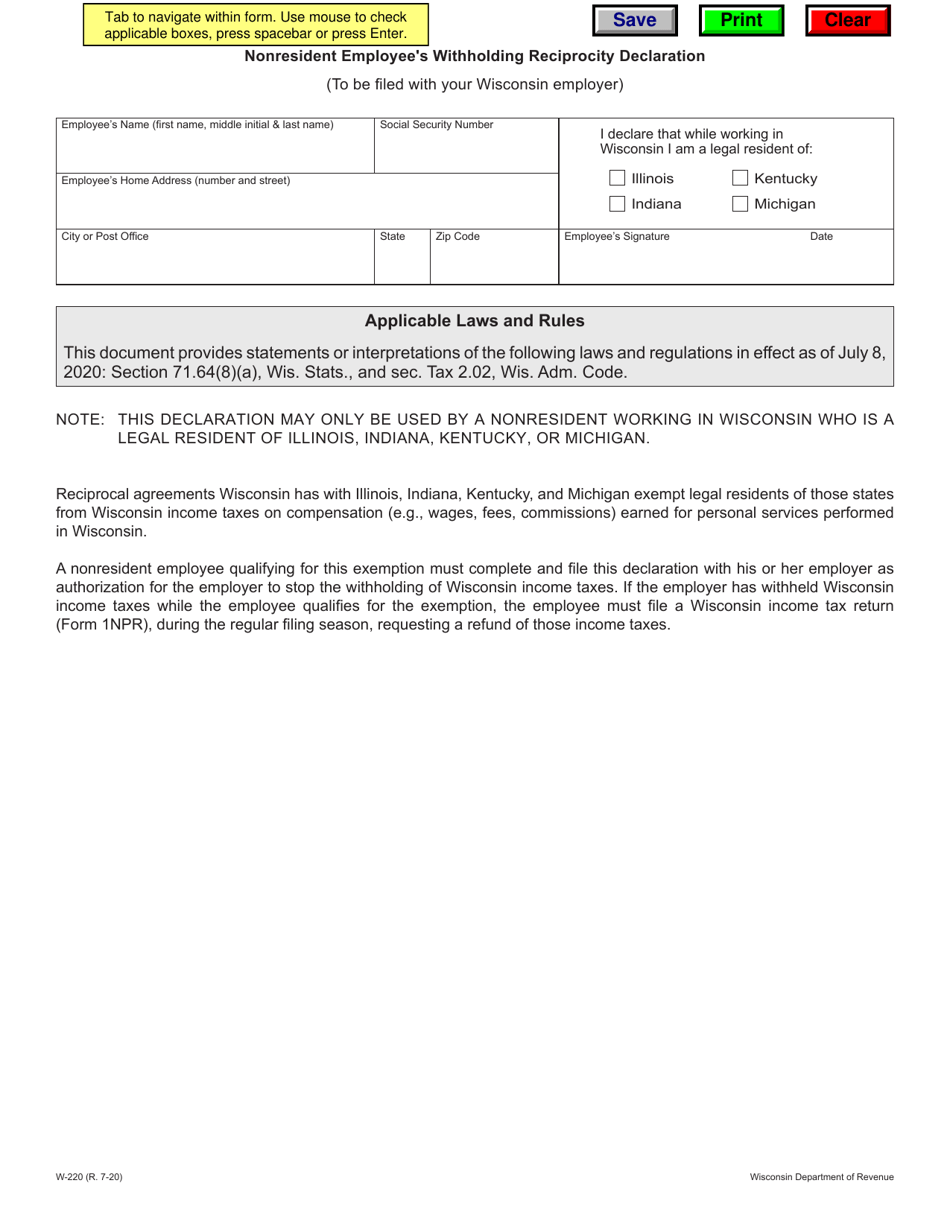

Q: Who should use Form W-220?

A: Nonresident employees who work in Wisconsin but live in a state that has a reciprocal agreement with Wisconsin should use Form W-220.

Q: What is a withholding reciprocity agreement?

A: A withholding reciprocity agreement is an agreement between two states that allows residents of one state to be exempt from withholding taxes in the other state.

Q: Which states have a withholding reciprocity agreement with Wisconsin?

A: As of 2021, the states that have a withholding reciprocity agreement with Wisconsin are Illinois, Indiana, Kentucky, and Michigan.

Q: What information is required on Form W-220?

A: Form W-220 requires information such as the employee's name, social security number, state of residence, and employer's information.

Q: How often should Form W-220 be filed?

A: Form W-220 should be filed once with the employer when the employee is first hired, and then updated if there are any changes in the employee's residency or employment.

Form Details:

- Released on July 1, 2020;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-220 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.