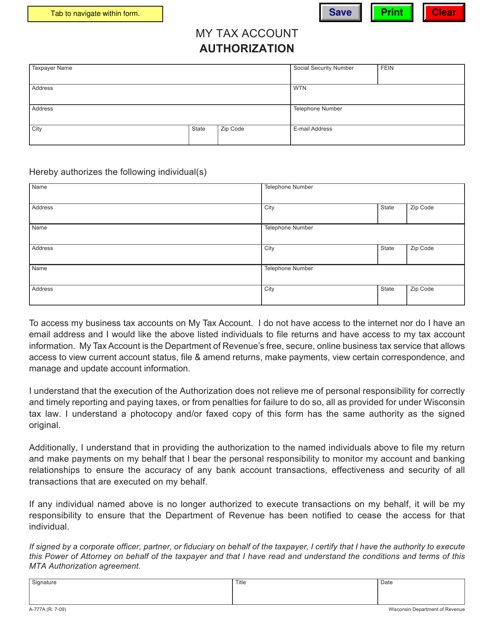

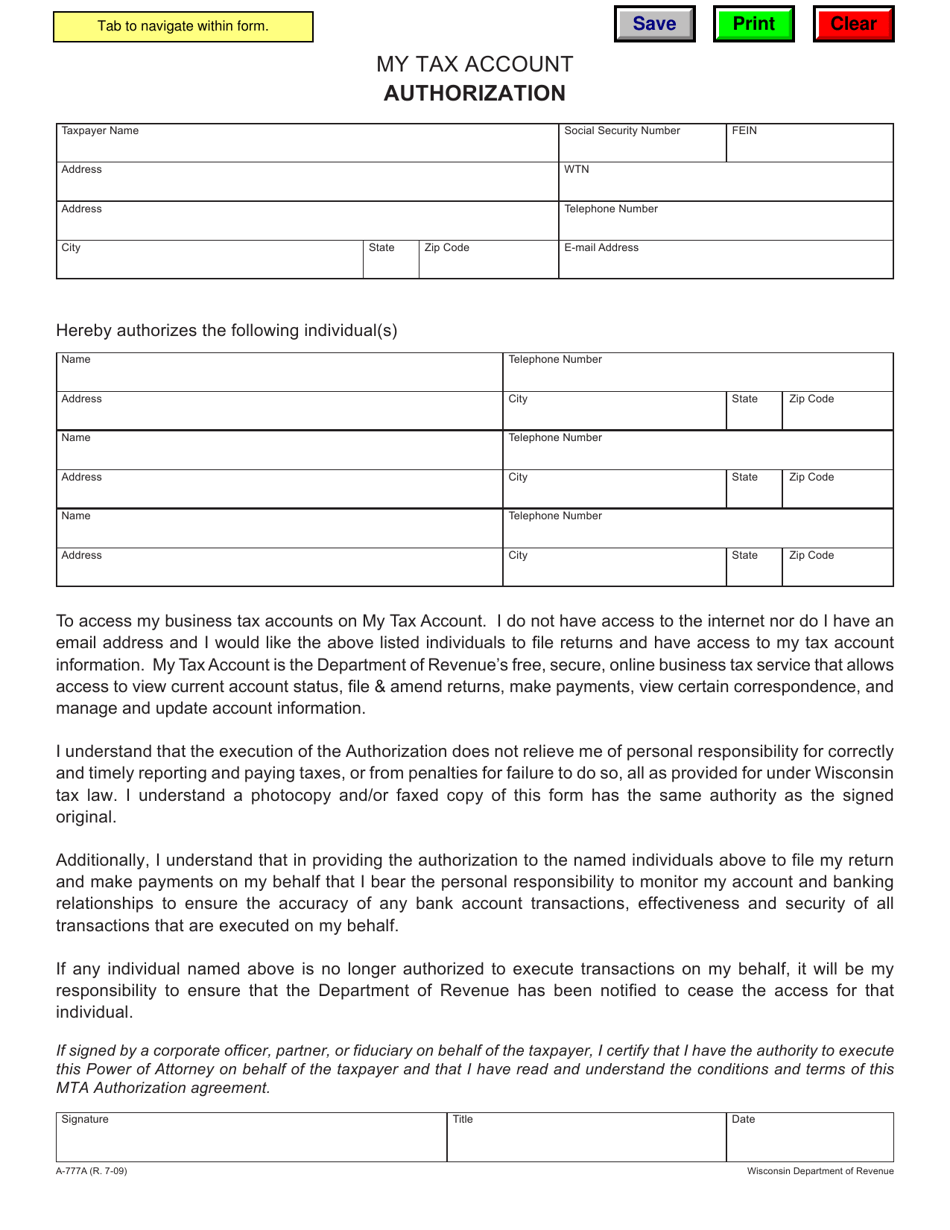

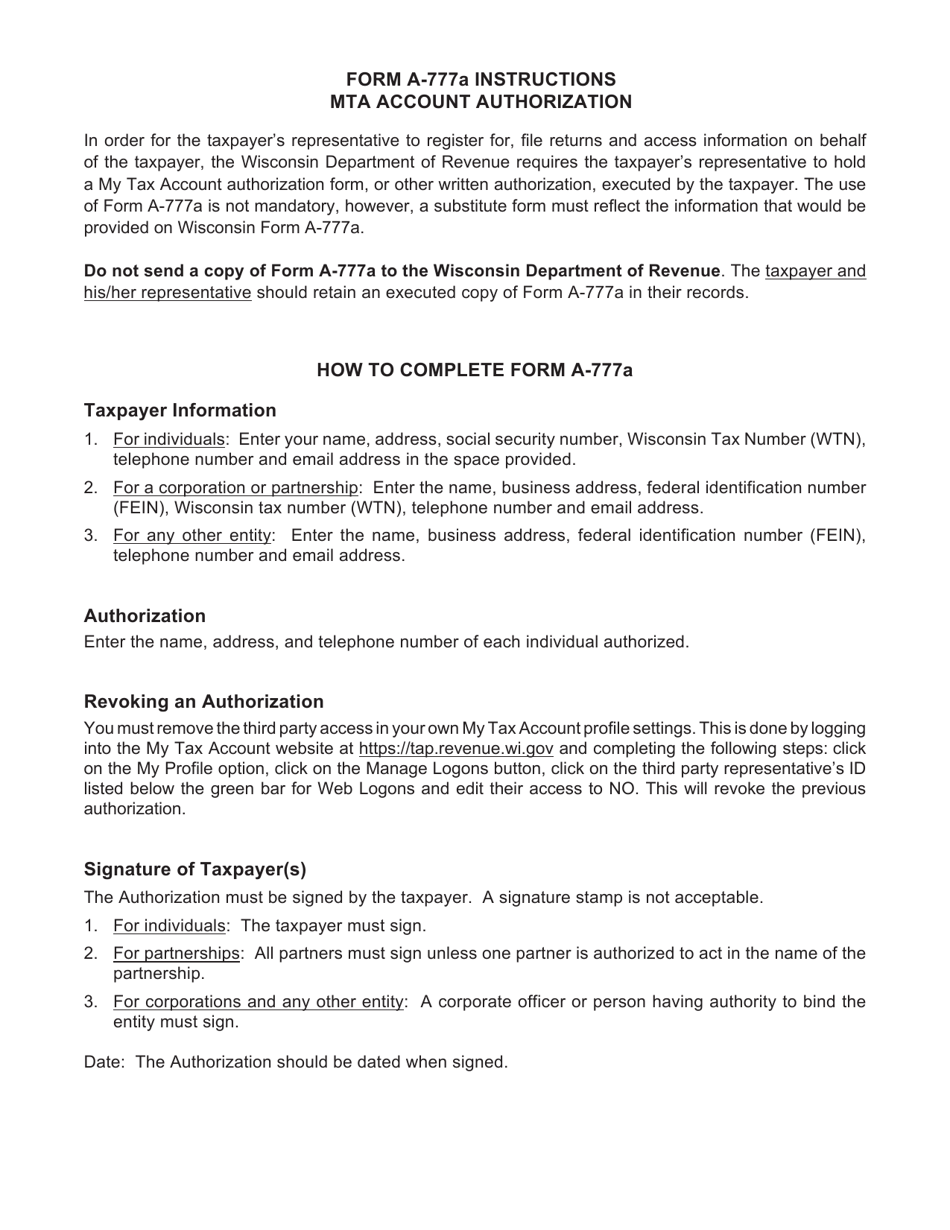

Form A-777A My Tax Account Authorization - Wisconsin

What Is Form A-777A?

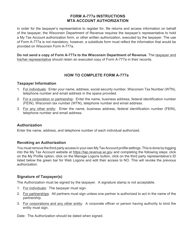

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form A-777A?

A: Form A-777A is the My Tax Account Authorization form for residents of Wisconsin.

Q: Who can use Form A-777A?

A: Residents of Wisconsin can use Form A-777A.

Q: What is the purpose of Form A-777A?

A: Form A-777A is used to authorize access to the My Tax Account system in Wisconsin.

Q: Is Form A-777A specific to individuals or businesses?

A: Form A-777A can be used by both individuals and businesses in Wisconsin.

Q: Are there any fees associated with submitting Form A-777A?

A: No, there are no fees associated with submitting Form A-777A.

Q: How long does it take to process Form A-777A?

A: Processing times for Form A-777A may vary, but it is typically processed within a few business days.

Q: Can I revoke or change my authorization on Form A-777A?

A: Yes, you can revoke or change your authorization on Form A-777A by submitting a new form with updated information.

Q: What information do I need to provide on Form A-777A?

A: You will need to provide your name, address, Social Security number or taxpayer identification number, and other relevant information on Form A-777A.

Form Details:

- Released on July 1, 2009;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A-777A by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.